For small business owners, it can feel like there is never enough time to accomplish everything. If you’re feeling scattered in your day-to-day responsibilities, it may be time to implement a new approach to tackling your workload. One strategy that can help optimize your efforts is time batching (also called calendar blocking). If this is the first time you have heard of this, time batching can revolutionize the way you approach work.

What Is Time Batching?

Time batching is the act of grouping similar tasks together on your calendar to gain economies of scale. Almost everything can be batched: answering emails, running errands, customer calls or appointments, answering employees’ questions, and even meetings.

Here are a couple of examples. Instead of running to the office supply on Tuesday, going to the printer on Thursday, and visiting the warehouse on Friday, why not accomplish all your errands on Wednesday in one trip? Instead of answering emails as they appear in your inbox throughout the day, set aside designated time to answer them two to three times a day. If your calendar is overrun with meetings and appointments at all hours of the day, consider scheduling future appointments back-to-back, or designate one or more days a week as “no meetings” days by carving out time as “not available” in large chunks on your calendar.

The beauty of time batching is that your brain will be less exhausted at the end of the day. When your workday is spent jumping from one task to the next, the brain experiences greater fatigue, and productivity suffers. These dings to your output are called switching costs, because they describe the tax that results from switching tasks often.

Studies show that time costs are more significant when transitioning to more complex or unfamiliar tasks. Dr. David Myer, a psychologist who studies multitasking, determined that “even brief mental blocks created by shifting between tasks can cost as much as 40 percent of someone’s productive time,” according to an article by the American Psychological Association.

While switching tasks throughout the day is often necessary for most professionals, excessive switching can strain the brain. Time batching, on the other hand, helps reduce the number of times you switch tasks throughout the day, thus reducing mental fatigue and time costs that result from multitasking or frequent task switching.

Business vs Personal Time

You can apply time batching to more than just your work life. In fact, it’s likely that you’re already practicing it at home and don’t realize it. Common examples of time batching at home include prepping meals for the week on Sunday or washing several loads of laundry in a row.

While some things can’t be batched (like walking the dog), many more can. You just need to be open to the possibilities.

The Highest Payoff

The highest payoff with time batching comes when you can reduce your most common interruptions. For example, employee questions could be fielded more strategically by cross-training employees. Or, you could host recurring “office hours” for your team to address any questions or roadblocks with you, instead of stopping by throughout the day.

Emails, chat platforms, and texts are also a source of constant interruptions. If your role allows it, consider reducing your distractions by silencing one or more of these communication methods. If you set aside designated time throughout the day to answer these communications, they’ll never go more than a few hours without being addressed anyway, and your day will grow a little quieter.

Phone calls can be another source of interruption. When possible, encourage callers to schedule a time to call you or let them know how much more efficient email is, or silence your ringer and get back to them at a designated point in the day.

Getting It All Done

You can practice time batching for years and still get better at it. Try implementing just one element of time batching to start, like scheduling time to answer emails and then stay out of your inbox. Slowly transitioning to time batching will help you avoid change overwhelm. Then, every few months, look for more items to batch (no matter how long you’ve been practicing).

Time batching will not only help you get home to your personal life sooner; it will help you feel less drained and more energized at the end of the day, allowing you to actually enjoy your personal time. Try it and see what you think.

Remote work has exploded since the onset of the pandemic, especially in professional services. Now that companies have seen that remote work models are both productive and feasible, they’re realizing the benefits of an expanded pool of potential employees, too: some firms are hiring employees that live several states away from where the office is located. While this is an exciting opportunity for both employers and professionals, it comes with a few ramifications for employers. Below, we’ll walk you through what these could look like for your state.

Let’s say your business is based in Texas. Already, you file quarterly payroll reports and pay federal payroll taxes for your Texas-based employees. You also file all the required state payroll reports and have Texas workers’ compensation.

Now let’s imagine that in May, you hired an employee that lives in Cleveland, OH. And in June, you hired another that lives in San Francisco, CA. In both cases, you’re required to complete a few extra steps to run payroll for your new employees.

- You may need to get set up as a Foreign Corporation in these states (the exact paperwork depends on your type of entity as well as the state’s requirements and where your business originates). This means filing legal paperwork and complying with annual tax filings and information statements. You may also need to hire a firm that can be your registered agent and legal contact in that state.

- You must get workers’ compensation in those two states.

- You must sign up with the unemployment agency in those states. For California, it’s the EDD (Employee Development Department), and for Ohio, it’s the Ohio Department of Job and Family Services.

- You’ll need to work with your payroll provider (think: QuickBooks Payroll or ADP) so they can accurately create paychecks for your new team members with the appropriate state withholdings.

- You’ll need to file the correct quarterly payroll reports (in addition to your federal ones) for both states.

It’s important to note that each state has its own forms and requirements with precise filing requirements. Some states that are smaller and closer together may have exceptions you can follow to save time, since it’s more likely that workers crossed state lines for work before the pandemic, but this is not often the case.

Nexus

Nexus is the connection between a company and a state that requires the company to register and then collect and remit sales tax in that state. Having an employee in another state establishes nexus for your organization, which means that you may have additional tax and legal requirements beyond payroll taxes. For example:

- If you have sales in these states, you may also need to collect and remit sales tax on those sales and file sales tax returns, where you otherwise might not have unless you met certain sales thresholds. Your first step is to register with the sales tax agency in the state where your new employee resides.

- As the business owner, you may even need to file a state income tax return and pay state income taxes as an individual, even if you’ve never set foot in that state!

Making the job offer to a remote worker may seem easy, but the paperwork that follows will be anything but. Ensure you comply with all tax and legal requirements brought on by hiring an out-of-state worker. You may need some lead time in getting all this setup, so be sure to consider this in establishing your new employee’s start date.

As always, if you need help with any of these tasks, please feel free to reach out to us any time.

When starting a business, most entrepreneurs excel at the specific technical skills they need in order to deliver their services and products to customers. It may seem like an obvious example, but a bike shop owner probably opened their store because they had an expertise in bicycles. If you own a law firm, you are probably good at practicing law (or at least smart enough to pass the bar exam). In either case, your core skill is closely aligned with the services your business provides.

When starting a business, most entrepreneurs excel at the specific technical skills they need in order to deliver their services and products to customers. It may seem like an obvious example, but a bike shop owner probably opened their store because they had an expertise in bicycles. If you own a law firm, you are probably good at practicing law (or at least smart enough to pass the bar exam). In either case, your core skill is closely aligned with the services your business provides.

But starting a business means putting on hats you wouldn’t normally wear at first, like marketer, bookkeeper, or administrator. And while you might outsource these tasks to new team members as your business grows, you’ll also need to develop new skills beyond your core strengths in order to thrive. That new skill depends on the type of business model you want to succeed at. Below, we’ll discuss the biggest strengths you’ll need to master in order to continue your business’s growth and become outrageously successful.

People-Based Business Model = Leadership

If your business is one of the 25 percent of small businesses that have employees and you have a team that serves customers, then you most likely have a people-based business model. The revenue you earn is dependent on how your people perform and serve customers.

Some examples would be a mid-sized law firm, a nail salon, a marketing agency, and a mid-sized plumbing company. Each one has a team of people that generate revenue.

These people need to be hired, trained, and motivated, and that is where the skill comes in. If you have a business model like this, you need to excel at leadership, which includes managing people as well as hiring and firing. You need to be great at developing a productive, happy team in order to reach your highest pinnacle of success. Your core skill is still needed, but without leadership skills, you won’t grow as much as you could.

Acquisition-Based Business Model = Negotiation

Some companies grow through the acquisition of other companies. In this case, your top skill should be negotiation; you will need to execute great deals to keep your business growing.

Project-Based Business Model = Project Management

If your job revolves around delivering large projects, such as construction, then your business model might be project-based. While knowing how to be a general contractor might be your core skill, your top skill should become project management.

How well you manage the project timeline, delivery of materials, and oversee the management of the right number of people with the right skill at the right time are all factors required to complete the project as quickly and profitably as possible, with the quality needed so you can move to the next one.

Volume-Based Business Model = Merchandising

If moving high quantities of products or services is your business model (think: grocery store, software company, certain retailers and wholesalers), then your revenue depends on volume and how much you can sell. How you display and market your products will affect how many customers you can get in the door and how fast you can sell. Your top skill should become merchandising and all things marketing.

Your Top Skill Is No Longer Your Core Skill

These four types of business models serve as a sampling to show that once you achieve some level of success, your core skill may no longer be the keystone to further success. Developing professional skills beyond your core skill will take you farther than you ever imagined you could go with your business.

Your favorite number on the balance sheet might just be Cash. It’s easy to understand and something every business has. But there is a more meaningful number, at least in the long-term sense, and that’s equity. Below, we’ll dive deeper into this part of the balance sheet.

Your favorite number on the balance sheet might just be Cash. It’s easy to understand and something every business has. But there is a more meaningful number, at least in the long-term sense, and that’s equity. Below, we’ll dive deeper into this part of the balance sheet.

The Equity Section

As a reminder, the balance sheet has three major sections: assets, liabilities, and equity. When it comes to equity, the accounts displayed depend on the type of entity of your business. Your business could be a sole proprietorship, a partnership, a corporation, or something else. In this article, we’ll focus on the example of equity in a corporation.

Every corporation should have at least three equity accounts:

- Stock.

This account should reflect the amount of stock issued by the corporation. The amount and price of each share are usually detailed in the Articles of Incorporation, which is the initial legal document of the corporation. For example, if the amount of shares the corporation can issue is 100,000, and they have a par value of $.01, then your stock account balance should be $1,000, which was paid in by cash by the corporation’s owner(s).

This account might also be named Capital Stock, Common Stock, or something similar. This account’s balance typically doesn’t change much over time for a small business. It’s only when new stock is purchased (issued), sold, retired or repurchased by the corporation that the account will see changes.

2. Additional Paid in Capital (APIC)

Additional Paid in Capital occurs when investors and business owners pay in more than the par value price of the stock. The balance represents the difference between what owners/investors paid into the company and the par value of the company stock.

3. Retained Earnings

Retained Earnings is where the action is and it is an important number to understand. It’s the accumulated earnings of the company less any dividends paid to shareholders over all time that the business has been in existence.

For a small business, retained earnings will change once a year at the end of the fiscal year when net profit (or loss) from the current year is rolled into the retained earnings account. At this time, all of the income and expense accounts are zeroed out to start over for the new year, and the balance (which is profit or loss) is added (or subtracted, in the case of loss) to retained earnings. Your accounting system automatically does this for you, and you can check it out by running a balance sheet as of the last day of your fiscal year, then running a balance sheet on the following day – the first day on the next fiscal year and comparing what changed.

You can reconcile retained earnings by adding up all of your profits and losses for each year you are in business. Then subtract any dividends paid throughout the years, and you should come out with your retained earnings balance. You can have a negative retained earnings balance.

The retained earnings number is a measure of the long-term value of the business. It also plays a large role in determining your basis, or investment, so to speak, in the company, which is used for tax purposes.

An S Corporation will have an additional fourth account in its Equity section.

4. Distributions

Distributions represent the money that the S Corporation owner has taken out of the business. This money is over and above the salary that is paid to the owner. It must be tracked for tax purposes, which is why it has a separate account on the balance sheet. In simple terms, distributions are generally not taxable as long as the owner has enough basis to cover them. In this way, distributions are different from dividends that are issued in C Corporations, since they are taxable.

Last, if you run a balance sheet report in your accounting system on any date during the year, you may see an additional account:

5. Current Year Earnings

This is the sum of all of your income and expense accounts. It should be the same number as net profit or loss on your income statement from the beginning of the year to your balance sheet date. On a formal balance sheet for external purposes, this number is rolled into the retained earnings account.

The equity section can be the most difficult section to understand on the balance sheet. Hopefully, the explanation above will provide a bit more clarity as well as shine a light on the significance of the retained earnings balance.

Every business has competitors of some kind, and in most industries, it’s crucial to know what your competition is up to in order to ensure your own products sell. A great deal of information can be gleaned from researching your competition’s online presence, but there’s another tool you might consider adding to your marketing toolbox: a mystery shopper.

A mystery shopper is a trained observer with significant customer service experience who is hired to shop your competitors. Their sole purpose is to share information with you about their shopping experience. While most of this article will focus on the example of mystery shopping at brick-and-mortar retailers, the tactic can be useful beyond this specific industry from professional services to health care, real estate, restaurants, and beyond. You can also adapt the idea to industries such as construction and manufacturing.

Mystery shoppers provide value by helping you collect intel you can’t determine from an internet query, like the shopping experience, quality of products offered, or accessibility. This data will help you perform a Competitive Analysis – a report on who your competitors are and what they are doing, informing your business of where it can (or already does) stand out. A competitive analysis report should be part of your marketing plan, as it can help you optimally spend your marketing dollars.

Let’s say you own a fabric store and want to know what other stores in your area are doing. You can make a list of a few fabric retailers in the three zip codes around you, providing that list to your mystery shopper, who would visit each of the stores. You could also provide your mystery shopper with a list of questions or a checklist of what to observe and/or purchase. The mystery shopper will take detailed notes about their experiences at each retailer and report their findings back to you.

From your mystery shopper’s notes, you can determine a variety of things, like:

- how their storefront looks and what their curb appeal is.

- if it was easy or not to find parking.

- what their opening hours are and do they open on time? Is there a queue of shoppers waiting to get into the store? Are you required to schedule an appointment to use their services?

- Did employees provide a greeting when entering the business? How friendly or approachable are the employees?

- How does the store look? Is it crammed full of items or sparse?

- What kind of displays do they have and how attractive are they?

- Is their inventory broad, deep, or both? What type of items and brands do they carry compared to your store? Are there brands, items, or product lines your company should be carrying?

- Were there a lot of customers in the store? How long were the checkout lines?

- How clean is the store? Do you feel comfortable with the level of cleanliness?

- Taking a sample of items and comparing pricing, how does your company’s selection stack up?

- What was the purchase experience like? Were you offered an upsell or a coupon? What does the checkout area look like? Were customers offered a bag for their items?

- What was it like to return an item? How strict is the return policy, and was the service friendly or hesitant?

- For service providers, does their waiting area look inviting and professional? What do their service areas look like?

- Was there any follow-up, such as an email promotion or thank-you note?

Once you have compiled the information on your competitors, you can look for ideas to improve your business that align with your brand and culture. These improvements are often in the area of customer service, but can also include adding inventory, updating hours and availability, adding store features or sales events, and more. You may even be able to find ideas to implement at a lower cost than your competitors, giving you an edge on profits.

Now, where can you find a mystery shopper? You can hire individuals or a company that specializes in providing this service. While many business owners might consider asking a friend to mystery shop in an effort to save money, a friend might not be able to articulate their experience with the detail you need, or they could fail to observe important aspects of the shopping experience.

So, consider recruiting a professional for the job. You’ll need a budget to pay the shopper(s) for their time, plus funds to make any purchases on your behalf. But hiring a mystery shopper can be well worth the investment, as it provides valuable access to your competition.

Whether we’re headed for a recession or not, it’s always a good time to squeak out more profits from your business books. We’re not talking about drastically slashing expenses or spending a lot to raise revenue; the tips in this article are long-term ideas to lift up your profits gently.

Timing on Capital Purchases

The timing of asset purchases, such as equipment, a truck, or even a PC, can be tricky. Understanding the best timing for asset purchases and replacements can make a difference in your profits.

When purchasing a new asset, gain a good understanding of the return on investment so that you’re prepared from a cash flow standpoint. With more complex businesses, it’s a good idea to hire an accountant who knows your industry and has capital expenditure experience.

When replacing an asset, it should be timed so that the asset is replaced before you have to begin spending a lot on repairs, but not so soon that you maximize your use of the current asset.

Rent and Utility Contracts

When rent and utility contracts come up for renewal, it’s time to negotiate. If your landlord hasn’t fixed something, you can at least use this as an opportunity to have the discussion and hopefully accelerate the repairs.

For certain utility contracts, like internet and phone, the price will often increase when your contract runs out. However, it can also be the best time to ask for a better deal, or even a new customer deal. The adage “it’s always easier to keep a customer than find a new one,” can apply to new carriers, too. Communications companies are constantly creating new deals and packages, so try to jump into one of those to keep your costs from going up.

Profit in Leftovers

What assets do you have that aren’t working for you? Put them to work!

Here are some examples:

- Cash – make sure your excess cash is safely invested or at least in an interest-bearing checking or savings account.

- Extra space – rent out space that you are not using or only using some days. This solution can have many different looks to it beyond the monthly renter. As an example, virtual workers looking for a conference room for a day could be a money-maker for you.

- Manufacturing firms can sell the scrap from their assembly lines as well as their obsolete inventory.

- Excess construction materials can be sold, donated, stored for the next job, used on a new small project, or used as firewood.

- If the inventory on your shelf needs to be dusted, you’ve had it too long. Find a way to move it now, and replace it with something that sells faster.

Training

If employees are wasting time, they are wasting money–yours, to be exact. There are three good solutions:

- Offer training – perhaps they haven’t been shown what to do correctly or how to do it efficiently. Or maybe they need to break bad habits.

- Re-energize employees with incentives, new benefits, or motivational training and events.

- Redesign your processes and automation, then retrain – it could be your workflow needs revamping to make it more efficient. For accounting processes, New Business Directions can help with this!

If these options don’t work, it may be time to face the reality that your employee could be a bad fit. You know what you have to do in that case.

Stop the Subscriptions

Those recurring monthly charges just keep adding up. The average small business uses dozens of apps, meaning they also likely have dozens of $20 to $50 automatic monthly charges going on a credit card somewhere in your business. This includes magazines, memberships, dues, conferences, newsletters, gadgets, and software.

If you’re making a lot of money, you may have trouble finding the time to research what subscriptions you really need versus what you don’t. But in the long run, you will retain more revenue sooner if you sit down and examine this area of spending. Stop the $20 to $50 madness by reassessing what subscriptions you really need and then either opting for the annual subscription discount or canceling the apps that aren’t essential.

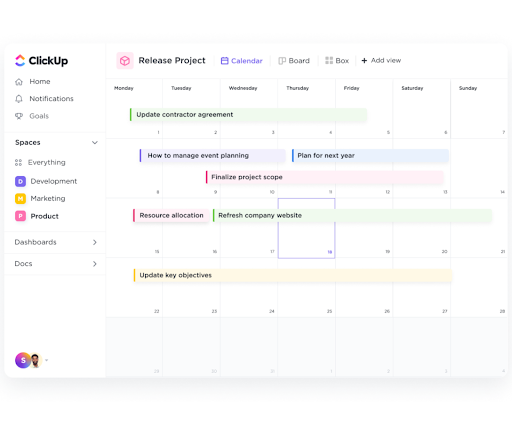

ClickUp™ is a versatile new web application that functions primarily as a project management tool, and serves multiple other functions for small businesses and is adaptable across several industries.

ClickUp’s goal for its users is to save time and reduce redundancy by tying everything together in one app. Its integrations, which are called ClickApps, are truly its strength. The 1,000+ integrations set ClickUp apart from other offerings, and for this reason, ClickUp excels at automating processes that use multiple apps, including hard-to-automate processes like customer onboarding.

Some of the functions people use ClickUp for include reminders, goals, whiteboards, templates, calendars, document flow, task management, dashboards, marketing processes, and team collaboration and communication.

One feature frequently mentioned is the ability to create custom views exactly the way you want them. Views provide a summary of your work and come in many flavors. You can create task views, list views, boards, calendars, Gantt views, workload views, and box views.

If ClickUp has any weakness, it could be the fact that it’s a blank slate. Because the platform is so versatile, it can be used across many different industries. However, users should really spend some time considering their hierarchy of workspaces, folders, and list. You may need to be somewhat tech-savvy to get everything set up. The learning curve can be intimidating, but once you get through it, there is so much power in having everything customized and on one platform.

ClickUp does have a following of power users, and a certification of sorts is offered. Becoming ClickUp Verified means that you’ve earned expertise in the product. If the learning curve is too much for you or your team members, you can hire one of these ClickUp consultants to do the setup for you, or head to YouTube for comprehensive tutorials.

As of this writing, ClickUp hosts 4,000,000 users, including those using the free version available for personal use. Monthly pricing for business users ranges from $5 to $19 per user, depending on the features you need. Enterprise options are also available.

ClickUp was founded in 2017, is headquartered in San Diego, CA, and has raised three rounds of funding as of this writing. New Business Directions recently implemented ClickUp within our own company, so if you’d like to learn more about why we chose this software, send us an email or learn more at clickup.com.

Entrepreneurs often excel at running their day-to-day businesses and swiftly meeting their customers’ needs. But often, those same business owners who are great at meeting their clients’ needs have a hard time meeting internal deadlines and achieving long-term goals, despite their best intentions. Enter: self-accountability, or the act of maintaining commitments you make to yourself and accepting responsibility for the outcomes of your actions. It’s the difference between getting something done and a wistful, “I’ll get to that next week” mindset.

Entrepreneurs often excel at running their day-to-day businesses and swiftly meeting their customers’ needs. But often, those same business owners who are great at meeting their clients’ needs have a hard time meeting internal deadlines and achieving long-term goals, despite their best intentions. Enter: self-accountability, or the act of maintaining commitments you make to yourself and accepting responsibility for the outcomes of your actions. It’s the difference between getting something done and a wistful, “I’ll get to that next week” mindset.

This article will outline a few ways you can stretch your self-accountability muscle.

Setting Goals and Deadlines

We all have projects we’d like to work on but haven’t gotten around to for various reasons. The issue could be that your goal isn’t SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) enough, causing uncertainty about how to start. Eliminating ambiguity around your goals can often unveil the path to achieving them.

Once your goal is SMART, start by making a timeline of tasks and milestones that you would like to be held accountable for, marking your calendar for each milestone and the project’s end date. By displaying your list of milestone dates prominently, you might find that carving out time to work toward them becomes a more practical and intentional process.

Connect with Your Purpose

Take some time to analyze why completing a project is important to you. How would completing it connect with your business purpose, mission, vision, and values? Document your “why” and display it prominently next to your milestone list to help you stay focused.

State Your Goals Publicly

Communicate your goals publicly with peers, friends, or co-workers. For many entrepreneurs, this is when their commitment to achieving their goals feels real. “There’s no turning back now,” you might find yourself thinking.

It’s a big step to put yourself out there, and as we’ve mentioned, many entrepreneurs find it easier to be accountable to others than to themselves. If this is something you experience, announcing your commitment can be a great way to establish self-accountability. By making your intentions public, you’re taking responsibility for the results of your actions (or inactions). It may feel scary to do so, but it works!

Consider an Accountability Partner

Some people do very well by partnering with a peer or trusted business person. This could be a mentor, a paid coach, an advisory board, a mastermind group of people, a nonprofit group, a co-working group, a peer, a vendor, an incubator, or an investor. While a friend might seem like the best place to start, consider going further outside your comfort zone.

Tell your accountability partner to push you and to be candid. They may need your explicit permission if it’s an informal arrangement. Set regular meetings to help you maintain your progress and report on your milestones. Allow your partner to point out mistakes or opportunities for improvement, and acknowledge them yourself. Make course corrections as soon as they’re necessary and use your partner as a sounding board.

Remember, this process won’t work if you aren’t honest with both yourself and your partner. Notice when you’re procrastinating and dig deep to discover why. Often, it can be a lack of resources or time, but this cause is usually coupled with a mindset issue, like uncertainty about where to start or a fear of failure that needs to be illuminated.

Celebrate

Celebrate every milestone you achieve, big and small. Reward yourself appropriately! Even if a project seems small, if it’s one you’ve put off for months or even years, completing it is worth celebrating, and you shouldn’t feel ashamed of the time it took you to reach completion. A celebratory mindset reinforces positive behavior and creates enthusiasm and momentum.

Self-accountability makes the functions of your business run better, plain simple. You can apply these ideas to projects, entire departments, and even your personal life goals.

Accountability can make a tremendous difference in achieving the success you want, so try out one of the approaches we outlined above, and know that we’re cheering you on every step of the way.

Securing a business loan can be an exciting step in the growth of your business. But did you know that loans typically require a specific process to be properly recorded in your accounting system? Not to worry; your loan statement will provide the information needed by your accountant to get the loan booked properly.

Securing a business loan can be an exciting step in the growth of your business. But did you know that loans typically require a specific process to be properly recorded in your accounting system? Not to worry; your loan statement will provide the information needed by your accountant to get the loan booked properly.

To start, you’ll need to locate the following pieces of information about your loan:

- Total amount borrowed

- Date of loan

- Date of the first payment

- Payment amount

- Term of loan

- Number of payments

- Interest rate

The full amount of your loan should be recorded as a liability on your business’s balance sheet. The offset is either an increase to cash or the recording of new assets like a car, truck, or building.

Each payment you make contains two components: interest and principal. Interest is an expense and is recorded in the Other Expenses section of your profit and loss statement. It will reduce your profit. Principal is the amount you pay toward paying off the loan. It reduces the liability account where the loan is recorded. While Principal does not affect your profit, it does improve your liquidity with each payment you make.

The interest and principal amounts won’t be the same for each payment. Earlier loan payments consist of higher interest and lower principal amounts. As you reach the end of paying off your loan, the interest portion becomes smaller and the principal larger. An amortization schedule shows you the exact amount of interest and principal for each payment. You or your accountant can create a loan amortization schedule in Excel.

Each time you make a payment, cash is reduced for the entire payment amount. The offset is split between interest expense and your loan liability, using the amounts in the amortization schedule. When you code your loan payment, you can use the amortization schedule to get the correct amounts for both of those accounts.

In a simple service business with no assets except cash, your cash balance can mimic your profit level. However, when you introduce loans and new, non-cash assets with depreciation expenses, that won’t be the case. You might wonder why you have no cash and more profits, or vice versa. This is why it’s a good idea to understand how these transactions affect your Balance Sheet and Income Statement as well as your business’s overall financial health.

At year-end, your accountant can make correcting entries if needed between the loan balance and interest expense.

If you failed to make payments or made them late, your accountant can make those allocations as well using manual journal entries.

Often, when you get a loan, you’re also acquiring some type of asset, such as a car or land and building. This asset should be recorded on your books correctly as well. You should have some type of closing statement or purchase contract that has the details for your accountant. Your Accountant will also compute and record the correct amount of depreciation for the asset type.

Your accountant can speak with you in more detail about your specific situation and better explain the interplay between cash and profits. We use the Statement of Cash Flows to reconcile profits to cash. Want to learn more about that financial report? Reach out to New Business Directions.

Incidents of cybercrime have been problematic for a long time, but since the onset of the pandemic, we’ve seen these incidents increase not only in frequency but in elaboration, too. Unfortunately, phishers and hackers have become more adept at successfully targeting small and midsize businesses with their efforts.

Previously, we’ve addressed how you can improve the security of your online accounts. However, if your organization’s reputation depends on maintaining the security and privacy of customer records, then this insurance is a must. In today’s climate, it’s no longer a matter of “if” but “when” your private business information could be breached, and to what extent. However, with the right precautions in place, you could reduce–and possibly even eliminate–such risk.

Finding the Right Insurance

The best place to start is your current insurance agent or a general insurance broker that you trust. Cybercrime policies are separate policies that cover specific acts, and you will need to read the policy carefully to determine exactly what you are protected from. You should also distinguish between personal and business policies; you may want both.

In a business policy, some of the items you’ll want to consider protection against include:

- Data breach

- Ransomware attack

- Spoofing and identity theft

- Wire fraud

- Civil fines

- Lawsuits

- Costs of notification, reputation repair, forensics and data restoration, credit monitoring, and other potential damages

A good policy will cover some or all of these costs:

- Business interruption costs

- Data breach costs

- Extortion costs

- Crisis management and public relations costs

- Data recovery costs

- Computer replacement costs

- The cost of reputational harm

Like any other insurance, you will need to complete an application to obtain a quote. Some of the standard questions you’ll be required to answer include:

- Type of products and services sold in the business

- Type of electronic data stored on your computer systems

- Whether laptops are password-protected

- Whether you have written network security and privacy policies in place

- Whether you have physical security procedures in place

- Whether you have the most current software and processes to keep it upgraded

- Whether you have backups

- Whether you monitor unauthorized attempts to access systems

- Whether you are in compliance with PCI DSS (Payment Card Industry Data Security Standard), HIPAA (Health Insurance Portability & Accountability Act), and GLBA (Gramm-Leach-Bliley Act)

- Whether you have a written document retention and destruction plan in place

- Whether you have encryption enabled

- Whether third parties are involved in data handling

- Whether you have a process to check copyrights of materials you use

- Whether you have a risk management education program for employees

- Your current insurance policies

- Whether you’ve had a breach in recent years

- Whether you’ve had any lawsuits or claims in this area

- Whether you use a firewall

- Whether you use anti-virus protection

- Whether you have an employee/third party off-boarding process that terminates access to computers and data

As you can see, the application process itself is an excellent way to “cross your Ts and dot your Is” when it comes to putting safeguards in place for your business. And, of course, your premium will likely be less expensive when you have these precautions and systems in place. It goes without saying that your premium will be less expensive if you get insurance before you are attacked so that you have a clean application.

A key aspect of owning a business is managing enterprise risk effectively. A cybercrime policy will go a long way toward protecting your hard-earned investment and offer you peace of mind, knowing that your business is protected.

New Business Direction LLC

New Business Direction LLC