If you have employees, you have the distinct honor once per year of being part of a worker’s compensation audit. You likely receive a form in the mail, an email request, or a phone call that will ask you about your payroll numbers and employees for the prior year.

Worker’s compensation is an insurance program that covers employees in the case they get hurt on the job. Each employee receives a classification code that describes the type of work they do, and a rate is figured based on the classification and its risk factors.

If you’ve hired anyone throughout the year, you might need to get a new classification by contacting your provider. If you have employees working in different locations (especially different states), that matters too.

The audit form will typically ask for gross payroll numbers by employee or by category or location of employee. That’s easy enough, but seldom does the policy run along your fiscal year, so the payroll figure needs to be prorated to match the policy period.

Your numbers need to tie back to the numbers reported on your quarterly payroll reports for both state and federal. The provider may also want copies of your 941s and your state payroll reports.

The auditor may also ask for subcontractor payments and certificates of expenses.

Once you’ve submitted your numbers, the insurance provider will calculate whether they owe you or you owe them additional fees.

You should do the math yourself to make sure their calculations are correct.

The worker’s compensation audit happens every year (even if you pay worker’s comp premiums each pay period, some companies still request an annual audit). It’s not difficult, but it is time-consuming. If this is something you’d like our help with, please feel free to reach out.

Would you call yourself a procrastinator? If so, you’re not alone, and with our to-do-lists growing daily, the percentage of people who procrastinate chronically has increased over the last few decades.

There’s a difference between procrastinating and prioritizing. Great entrepreneurs know how to put the most important tasks first. There’s also a difference between procrastinating and being overloaded with tasks; that’s another problem called delegation (or lack of it), and that’s a topic for a later article.

If you need a little motivation getting things done that you are procrastinating, here are five quick tips. Even if you aren’t a procrastinator, these tips may boost your productivity.

- Check your willpower.

Think of your willpower like a tank of gas that you use up every day. By the end of the day, it’s gone. If you leave tasks that you procrastinate until the end of the day when you have no willpower left, chances are they won’t get done. Instead, re-arrange your schedule so that the tasks you are procrastinating on get done on a full tank of willpower, usually in the morning.

- Set an internal deadline.

You might respond well to external deadlines when everyone is watching or there are consequences for missing them. If so, then make your internal deadlines external ones by announcing them to the world. Having friends ask you about the deadline will incent you to keep your promise.

- Treat your success.

If you completed the task you have been procrastinating, then stop and reward yourself. Your reward should be personal, something you enjoy. Perhaps it’s a spa day, a movie during the week, a long lunch with friends, or just a leisurely walk.

Hopefully, you will want more rewards, so you can set a new one for the next tasks you complete.

- Break it down.

Sometimes procrastination is the result of feeling like the project is just too big. If you have a large project looming ahead, break it down into smaller pieces that you feel are more manageable.

- Find your power hour.

Everyone has a time of day where they perform the best. For early risers, it’s the crack of dawn. For late night owls, it’s past sunset. Find the time of day where you have the most energy and motivation, and plan your difficult tasks accordingly.

Almost everyone procrastinates on their least favorite tasks. Let these tips help you boost your productivity and reduce your procrastination.

If you need guidance on how to stop procrastinating read “Eat that Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less Time” by Brian Tracy.

As business owners, we want to remain optimistic about our business’s future. But life can happen, and we need to be prepared. A good business owner thinks about all the risks to their business and has a plan in place to reduce or eliminate them. In 2017, we’ve already had floods in the Midwest and California, a healthy dose of tornadoes, and an ice storm earlier in the year. And those are just the weather disasters. Are you ready?

In 2015, Nationwide ran a survey that revealed that three out of four small business do not have a disaster plan. The same survey noted that 52 percent of small business owners thought it would take three months to recover from a disaster.

The most common solution is to create two plans:

- A disaster recovery plan, which details the steps needed to recover the business from a catastrophic loss

- A business continuity plan, which details the steps needed to keep the business running in case of a major loss, such as a loss of electricity, location, or key personnel

There’s a lot of help online to help you create your plan. A few of the major items that should be covered include:

- Employee safety: you’ll need an evacuation plan in case of a disaster that is life- or health-threatening.

- Communication plan: how will you reach employees in an emergency?

- Electricity contingency: will you need to access a generator?

- Internet contingency: can your business survive without the internet for long periods of time, or will you need to find a way to get connected?

- Location contingency: if your worksite is inoperable, do employees have another place to report to?

- Employee roles: who will carry out the plan?

- Private data: how will you safeguard private company and customer data?

- Systems: do you have an inventory of hardware and software, including vendor technical support contacts? How will you prioritize which system to get back up first? Do you have agreements with vendors who can come to your aid quickly?

Creating a disaster recovery plan can be the lowest priority item on your to-do list as a business owner – until it isn’t. If you have a lot to lose, then consider spending some time on a plan to give you peace of mind.

An after-action review (AAR) is a fantastic process to help you look back at a project or period of your business to see what, why, and how things occurred and how they can be improved for the future. Taking a profit-focused view will help you get the most out of the idea.

- What was supposed to happen?

- What did happen?

- What worked? What should we keep doing?

- What didn’t work? What are some improvements?

- What advice would you give yourself at the beginning of the year? (Or project?)

- What personal lessons did you learn?

- Technology changes / additions or training

- Staffing changes

- Hiring process changes

- Marketing changes / additions or training

- Operations changes / additions or training

- New service or product development / new niches

- Changes in your existing services or products

- Customer retention

- Sales cycle changes or development

- Pricing evaluations

- Client surveys / communications / service level changes

Accounting automation has come a long way in the last few years, and the process of handling invoices and receipts is included in those changes. No longer is there a mountain of paperwork to deal with. In this article, we’ll explain some of the changes in this area.

Vendor Invoices

Most invoices are now sent electronically, often through email or from accounting system to accounting system. Some accounting systems allow the invoice document, usually in PDF format, to be attached to the transaction in the accounting system. This feature makes it easy for vendor support questions as well as any audit that may come up.

Some systems are smart enough to “read” the invoice and prepare a check with little or no data entry. Others are able to automate three-way matching – this is when you match a purchase order, packing slip, and invoice together – so that time is saved in the accounts payable function.

Receipts

Today’s systems allow you or your bookkeeper to scan in or take cell phone photos of receipts – whether cash or credit card – and then “read” them and record the transaction. This type of system cuts way down on data entry and allows the accountants to focus on more consultative work rather than administrative work.

Some vendors will email you receipts so all you have to do is use a special email address where your accountant is copied or forward the receipt as you receive it.

The biggest challenge for business owners is getting into the habit of photographing the receipt and sending it to the accountant. The days of shoebox receipts are not completely over, but cloud-savvy business owners are definitely enjoying the alternative options of today’s paperless world.

Approvals

Some systems automate bill approval. This is especially handy for nonprofits or companies with a multi-person approval process. It cuts down on approval time and the time it takes to pay the bill.

New Systems

There are many 3rd party applications that automate a part of the vendor payment or receipt management system. All of them have different features, platforms, software requirements, integration options, and pricing. Many of them integrate with Quickbooks, some with the desktop version, some with Quickbooks online and some integrate with both platforms.

- BILL

- Hubdoc

- Receipt Bank

- Expensify

- SmartVault

- Doc.it

- Tallie

- Concur

- LedgerSync

- ShoeBoxed

- ShareFile

If you are interested in finding out more about automating your accounts payable invoices or receipts, please reach out anytime. We have partnerships with many of these 3rd parties for preferred pricing and in most cases we have certified in their products.

Most small businesses need help with cash during certain stages of their growth. If you find that you have more plans than cash to do them with, then it might be time for a loan. Here are five steps you can take to make the loan process go smoother.

1. Make a plan.

Questions like how much you need and how much you will benefit from the cash infusion are ones you should consider. If you don’t already have some version of a budget and business plan, experts recommend you spend a bit of time drafting those items. There’s nothing worse than getting a loan and finding out you needed twice the cash to do what you wanted to accomplish.

2. Know your credit-related numbers.

Do you know your credit score? Is there anything in your credit history that needs cleaning up before it slows down the loan approval process?

Take a look also at your standard financial ratios. These are ratios like your current ratio (current assets / current liabilities) and debt-to-equity ratio. If these are in line with what your lender is expecting, then you are in good shape to proceed.

3. Research your options.

Luckily, there are many more options for financing your business today than there have been in the past. Traditional options, such as banks, still exist, but it can be difficult to get a bank loan for a small business.

Here are some online loan sources where investors are matched with borrowers via an online transaction:

- Kabbage

- OnDeck

- LendingClub

- FundBox

- BlueVine

Or you can go to Fundera and compare which loan is the most economical.

There is also crowdfunding, which is very different from a loan. Crowdfunding is a way to raise cash from many people who invest a small amount. Top sites include GoFundMe and KickStarter, where you can find out more about how it works.

Other ways to get cash include tapping into your personal assets: using credits cards, refinancing a house, and borrowing money from family and friends.

4. Create your loan package.

Most lenders will want to know your story, and a loan package can provide the information they need to decide whether they want to loan you money or not. A good loan package includes the following:

- A narrative that includes why you need the loan, how much you want, and how you will pay it back. A good narrative will also list sources of collateral and a willingness to make a personal guarantee.

- Current financial statements and supporting credit documentation, such as bank statements and credit history.

- A business plan and budget, or portions of it, that cover your business overview, vision, products and services, and market.

- A resume or biography of the business owners and a description of the organization structure and management.

While it takes time to put together a great loan package, it’s also a great learning experience to go through the exercise of pulling all of the information together.

5. Execute!

You’re now ready to get your loan. Or not. Going through these five steps helps you discover more about your business and helps you make an informed decision about whether a loan is still what you want and need.

Throughout the process, you may have learned new information that tells you you’re not quite ready for a loan, or that in fact, you are. At any rate, preparing for a loan is a great learning process, and the good news is there are lots of avenues for small businesses to get the cash they need to grow.

It’s not hard to see when your home needs a good cleaning but QuickBooks company file errors are harder to recognize so here are a few errors to watch for:

- Performance problems

- Inability to execute specific processes

- Occasional program crashes

- Missing data (accounts, names, dates)

- Refusal to complete transactions

- Mistakes in reports

One thing you can do on your own is to start practicing good preventive medicine to keep your QuickBooks company file healthy. Once a month or so, perhaps at the same time you reconcile your bank accounts, do a manual check of your major Lists.

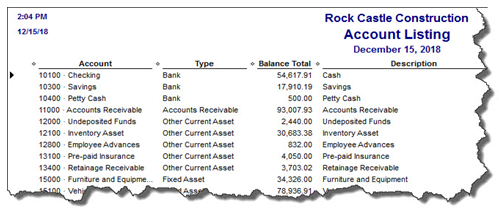

Run the Account Listing report (Lists, Chart of Accounts, and Reports). Ask yourself: Are all of your bank accounts still active? Do you see accounts that you no longer use or which duplicate each other? You may be able to make them inactive or merge duplicates. Be very careful here. If there’s any doubt, leave them there. Do not try to fix the Chart of Accounts on your own. Let us help or speak with your tax preparer. Do not make accounts with balances inactive.

Figure 2: You might run this report periodically to see if it can be abbreviated.

A Risky Utility

The program’s documentation for this utility contains a list of warnings and preparation steps a mile long. We recommend that you do not use this tool. Same goes for Verify Data and Rebuild Data in the Utilities menu. If you lose a significant amount of company data, you can also lose your company file. It’s happened to numerous businesses.

Figure 3: Yes, QuickBooks allows you to use this tool on your own. But if you really want to preserve the integrity of your data, let us help.

The best thing you can do if you notice problems like this cropping up in QuickBooks – especially if you’re experiencing multiple ones – is to contact us. We understand the file structure of QuickBooks company data, and we have access to tools that you don’t. We can analyze your file and take steps to correct the problem(s).

Your copy of QuickBooks may be misbehaving because it’s unable to handle the depth and complexity of your company. It may be time to upgrade. If you’re using QuickBooks Pro, consider a move up to Premier. And if Premier isn’t cutting it anymore, consider QuickBooks Enterprise Solutions.

There’s cost involved, of course, but you may already be losing money by losing time because of your version’s limitations. All editions of QuickBooks look and work similarly, so your learning curve will be minimal.

We Are Here for You

We’ve suggested many times that you should contact us for help with your spring cleanup. While that may seem self-serving, remember that it takes us a lot less time and money to take preventive steps with your QuickBooks company file than to troubleshoot a broken one.

A 2014 Global Fraud Study conducted by the Association of Certified Fraud Examiners (ACFE) estimates that the average business loses five percent of their revenues to fraud. The global total of fraud losses is $3.7 trillion. The median fraud case goes 18 months before detection and results in a $145,000 loss. How can you avoid being a fraud victim?

The first step is to become more aware of the conditions that make fraud possible. The fraud triangle is a model that describes three components that need to be present in order for fraud to occur:

- Motivation (or Need)

- Rationalization

- Opportunity

When fewer than three legs of the triangle are present, we can deter fraud. When all three are present, fraud could occur.

Motivation

Financial pressure at home is an example of when motivation to commit fraud is present. The fraud perpetrator finds themselves in need of large amounts of cash due to any number of reasons: poor investments, gambling, a flamboyant lifestyle, need for health care funds, family requirements, or social pressure. In short, the person needs money and lots of it fast.

Rationalization

The person who commits fraud rationalizes the act in their minds:

- I’m too smart to get caught.

- I’ll put it back when my luck changes.

- The big company won’t miss it.

- I don’t like the person I’m stealing from.

- I’m entitled to it.

At some point in the process, the person who commits fraud loses their sense of right and wrong and their fear of any consequences.

Opportunity

Here’s where you as a business owner come in. If there’s a leak in your control processes, then you have created an opportunity for fraud to occur. People who handle cash, signatory authority on a bank account, or financial records with poor oversight could notice that there is an opportunity for fraud to occur with the ability to cover the act up for some time.

Seventy-seven percent of all frauds occur in one of these departments: accounting, operations, sales, executive/upper management, customer service, purchasing and finance. The banking and financial services, government and public administration, and manufacturing industries are at the highest risk for fraud cases. (Source: ACFE)

Prevention

Once you understand a little about fraud, prevention is the next step. To some degree, all three points on the triangle can be controlled; however, most fraud prevention programs focus on the third area the most: Opportunity. When you can shut down the opportunity for fraud, then you’ve gone a long way to prevent it.

While we hope fraud never happens to you, it makes good sense to take preventative steps to avoid it. Please give us a call if we can help you in any way.

Keeping a to-do list is a great way to be productive, avoid having things fall through the crack, and unclutter your brain. How you maintain your to-do list varies: some people use pen and paper because they love the feeling of crossing tasks off, others use Excel or Google documents. Still others might try Evernote.

If all of those still have you feeling unorganized, then you’re in luck. There’s a whole new genre of apps to automate your to-do list. Here is a list of things to consider:

- Would it be great to access your to-do list from any device?

- Do you need subtasks?

- Would you like to set priorities and due dates?

- Do you want notifications or reminders?

- Do you want to share tasks with others?

- Do you have repeating tasks that need to be handled differently?

- Do you need to be able to make comments or notes for each task?

- Would it be nice to forward an email to your to-do list and just have it logged?

- Do you want to be able to print your to-do list?

- Do you want to be able to set hash tags, filters, and labels for each task?

Once you’ve thought about your requirements, now you can look for an app that meets it. Here are two to get you started:

- ToDoist.com

- Wunderlist.com

If those don’t work out, Google “to-do list apps” and you’ll have a bevy of selections to choose from. These to-do lists will work for not only business projects but also major life projects like weddings, vacations, and more.

Try these new to-do list apps and let us know what you think.

New Business Direction LLC

New Business Direction LLC