Learn how to Navigate the Homepage of QuickBooks with Rhonda Rosand CPA of New Business Directions LLC.

Each January we rush around to gather tax information on the independent contractors we paid in the prior year in order to send them a 1099. Here are some basic tips for making it easier and less hurried in your year-end preparations.

A link to the IRS’s instructions for 2018 can be found here.

Form W-9

As a trade or business, you are required to obtain a Form W-9 from your independent contractors before you pay them, better yet – before they do any work for you. This is regardless of how much money you pay them. This form will give you the name, business name, address, entity type and taxpayer identification number.

Who Needs a 1099?

Service Providers – Anyone you pay in the course of your trade or business for services rendered. This includes Accountants, Consultants, Architects, Engineers, Designers, Contractors, Plumbers, Electricians, Installers, Landscapers, Snow Removal companies, Cleaning companies, the Auto Repair technician, Entertainers – anyone who performs a service or casual labor for your business who is not your employee.

Rents – If your business pays rent for office space or land or equipment, you are required to send the recipient a 1099 for the amount of rent you have paid them.

Exclusions – Sole proprietorships, partnerships and LLC’s that are taxed as sole proprietors and/or partnerships receive a 1099. You are not required to send 1099’s to a Corporation or a Tax Exempt entity. The Form W-9 will provide information regarding the entity type.

Threshold – Send to recipients to whom you have paid $600 or more during the calendar year.

Using the QuickBooks® 1099 Wizard

QuickBooks® has a 1099 Wizard to create accurate 1099 and 1096 forms. It allows you to review and edit  your vendors, set up account mapping preferences, run a summary report to review data, and print 1099 and 1096 forms.

your vendors, set up account mapping preferences, run a summary report to review data, and print 1099 and 1096 forms.

Note: QuickBooks® is only capable of preparing 1099-MISC. If you need to prepare other types of 1099’s (e.g. 1099-INT, 1099-DIV), you will need to do so outside of QuickBooks®.

Deadline

For 2018, if you are reporting Non Employee Compensation in Box 7, you are required to file on or before January 31, 2019 to both the recipients and to the Internal Revenue Service.

New Business Directions, LLC specializes in QuickBooks® set up, clean up, consulting and training services, coaching small business owners and providing innovative business solutions.

This article of QuickBooks Tips and Tricks was based on the 2018 version of QuickBooks®.

Learn How To Write Off A Bad Debt In QuickBooks with Rhonda Rosand, CPA, Advanced Certified QuickBooks Proadvisor of New Business Directions, LLC.

Learn How Revenues Are Transactional with Rhonda Rosand, CPA and QuickBooks® Pro Advisor of New Business Directions, LLC. If you want to create more revenues within your business you just need to create more transactions! New Business Directions, LLC specializes in QuickBooks® set up, clean up, consulting and training services, coaching small…

This year’s theme was “epic” designed as the epic conference to empower small business advisors to develop and sustain the epic practice that distinguishes itself and embraces the key differences that separate ProAdvisors around the good, the great and the “epic.”

Sessions

The four-day conference kicked off each morning with Power Breakfast Sessions followed by main stage presentations with keynote speakers such as Daymond John of Shark Tank, Joe Buissink of Canon Explorer of Light, and author Mike Michalowicz of Profit First. In between general session, attendees dispersed around the conference center into rooms where cutting edge training sessions were being held. Training sessions were broken down into 5-tracks for Practice and Professional Development, Practice Growth, In-Depth QuickBooks Training, ProAdvisor Certification Training and QB Integrated Apps.

If you were fortunate enough to attend, Rhonda Rosand, CPA taught a 100-minute informative training session titled Successful Implementations from Initial Contact through Ongoing Support on Sunday, May 22nd. As the evenings came around, networking sessions were held consisting of ICB Bookkeeper’s Symposium, the Woodard Network Social hosted within Atlantis’ stunning marine life exhibit, The Dig and of course, the infamous TSheets dance Party on TSheets Tuesday.

taught a 100-minute informative training session titled Successful Implementations from Initial Contact through Ongoing Support on Sunday, May 22nd. As the evenings came around, networking sessions were held consisting of ICB Bookkeeper’s Symposium, the Woodard Network Social hosted within Atlantis’ stunning marine life exhibit, The Dig and of course, the infamous TSheets dance Party on TSheets Tuesday.

Sondra’s Take on Vendors

In between training, I was able to visit the exhibit ballroom which held over 90 vendors, some of which were very familiar. I came across software I use everyday to make my work flow run smoothly and now I am able to put a face to the product. For example, SmartVault allows me to access files anywhere, anytime and from any device. I also have the capability to securely share files with clients and our team.

In between training, I was able to visit the exhibit ballroom which held over 90 vendors, some of which were very familiar. I came across software I use everyday to make my work flow run smoothly and now I am able to put a face to the product. For example, SmartVault allows me to access files anywhere, anytime and from any device. I also have the capability to securely share files with clients and our team.While at Scaling New Heights, I learned the importance of technology and how it relates to strengthening our firm and supporting our clients.

New Business Directions, LLC is pleased to announce the recognition of Rhonda Rosand, CPA as an Insightful Accountant Top 100 ProAdvisor for 2016. This will be Rosand’s third consecutive year receiving the award out of tens of thousands of ProAdvisors in the country.

Leading Top 100 ProAdvisors leverage the ProAdvisor Program to better serve their clients, grow their own business, deliver great client service, and increase their knowledge and understanding of the Intuit ecosystem. This years award ceremony will take place at the Scaling New Heights 2016 conference at Atlantis Paradise Island Resort in the Bahamas.

This years award ceremony will take place at the Scaling New Heights 2016 conference at Atlantis Paradise Island Resort in the Bahamas.

Congratulations Rhonda!

It’s not hard to see when your home needs a good cleaning but QuickBooks company file errors are harder to recognize so here are a few errors to watch for:

- Performance problems

- Inability to execute specific processes

- Occasional program crashes

- Missing data (accounts, names, dates)

- Refusal to complete transactions

- Mistakes in reports

One thing you can do on your own is to start practicing good preventive medicine to keep your QuickBooks company file healthy. Once a month or so, perhaps at the same time you reconcile your bank accounts, do a manual check of your major Lists.

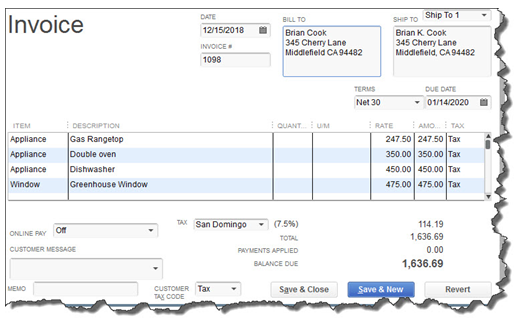

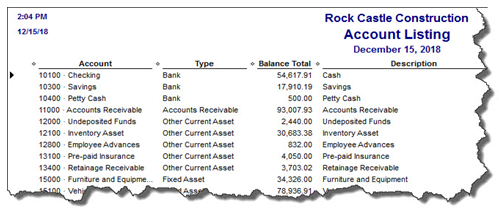

Run the Account Listing report (Lists, Chart of Accounts, and Reports). Ask yourself: Are all of your bank accounts still active? Do you see accounts that you no longer use or which duplicate each other? You may be able to make them inactive or merge duplicates. Be very careful here. If there’s any doubt, leave them there. Do not try to fix the Chart of Accounts on your own. Let us help or speak with your tax preparer. Do not make accounts with balances inactive.

Figure 2: You might run this report periodically to see if it can be abbreviated.

A Risky Utility

The program’s documentation for this utility contains a list of warnings and preparation steps a mile long. We recommend that you do not use this tool. Same goes for Verify Data and Rebuild Data in the Utilities menu. If you lose a significant amount of company data, you can also lose your company file. It’s happened to numerous businesses.

Figure 3: Yes, QuickBooks allows you to use this tool on your own. But if you really want to preserve the integrity of your data, let us help.

The best thing you can do if you notice problems like this cropping up in QuickBooks – especially if you’re experiencing multiple ones – is to contact us. We understand the file structure of QuickBooks company data, and we have access to tools that you don’t. We can analyze your file and take steps to correct the problem(s).

Your copy of QuickBooks may be misbehaving because it’s unable to handle the depth and complexity of your company. It may be time to upgrade. If you’re using QuickBooks Pro, consider a move up to Premier. And if Premier isn’t cutting it anymore, consider QuickBooks Enterprise Solutions.

There’s cost involved, of course, but you may already be losing money by losing time because of your version’s limitations. All editions of QuickBooks look and work similarly, so your learning curve will be minimal.

We Are Here for You

We’ve suggested many times that you should contact us for help with your spring cleanup. While that may seem self-serving, remember that it takes us a lot less time and money to take preventive steps with your QuickBooks company file than to troubleshoot a broken one.

On November 2nd– 4th, Intuit will be hosting the 2nd annual QuickBooks Connect Conference in San Jose. The conference brings together thousands of entrepreneurs, small business owners, accounting professionals and developers  under one roof.

under one roof.

There are three different tracks on the agenda as follows:

Accountant – QuickBooks Connect will help your firm get future ready by challenging you to go further, think differently, and embrace the cloud to properly value the services you provide, grow your firm, and better support your clients. *

Small Business – Whether you’re a company of one or one hundred, come to make your business dream a reality: network with fellow small business owners, entrepreneurs, self employed individuals, startup founders, and Venture Capital leaders to receive personalized advice on maximizing your success. *

Developer – Engage Intuit Developer experts to speed your QuickBooks app integration and successful launch to the QuickBooks ecosystem. Take advantage of the unique opportunity to meet and network with other developers, accountants and small business owners. *

The mission is to connect, learn and grow throughout a dynamic agenda of main stage and intimate sessions. Key speakers  include Oprah Winfrey, Jessica Alba, Brian Lee and Robert Herjavec. Sessions topics include: Here to There: The Accountant’s Journey toward Professional Greatness, Work/Life Harmony, 10 Barriers to Service Excellence and How to Overcome Them, and Cash is King: Tips to Increase Your Cash Flow Today. There will also be speed mentoring sessions and an entire series of QuickBooks Online training topics.

include Oprah Winfrey, Jessica Alba, Brian Lee and Robert Herjavec. Sessions topics include: Here to There: The Accountant’s Journey toward Professional Greatness, Work/Life Harmony, 10 Barriers to Service Excellence and How to Overcome Them, and Cash is King: Tips to Increase Your Cash Flow Today. There will also be speed mentoring sessions and an entire series of QuickBooks Online training topics.

Rhonda Rosand states, “This will be my second year attending the Intuit conference and I look forward to seeing many familiar faces at the event and I invite you to join me in California for this spectacular training opportunity.”

* – content is taken directly from the QuickBooks Connect Website

As we move into the fall season and the final quarter of the year, it’s a perfect time to commit to a project in your business that will help you reach the year’s end in better shape. Here are five ideas:

1. Back-to-School Time

If payroll expenses are one of the higher costs in your business, then it makes sense to boost your team’s productivity and maybe also your own. Fall is back-to-school time anyway, so it’s a natural time of the year to take on a course, read a business book, or hire an organizer to help you get more from your workspace.

If you spend a lot of time doing email, consider taking a course on Microsoft Outlook® or even Windows; learning a few new keystrokes could save you tons of time. If you need more time, look for a book or course on time management. Look for classes at your local community college or adult education center.

2. A Garage Sale for Your Business

Do you have inventory in your business? If so, take a look at which items are slower-moving and clear them out in a big sale. We can help you figure out what’s moving slowly, and you might even save on taxes too.

3. Celebrate Your Results

Take a checkpoint to see how your revenue and income are running compared to last year at this time. Is it time for a celebration, or is it time to hunker down and bring in some more sales before winter? With one more quarter to go, you have time to make any strategy corrections you need to at this time. Let us know if we can pull a report that shows your year-on-year financial comparison.

4. Get Ready for Year’s End

Avoid the time pressure of year’s end by getting ready early. Review your balance sheet to make sure your account balances are correct for all transactions entered to date. You will be ahead of the game by getting the bulk of the year reviewed and out of the way early.

Also make sure you have the required documentation you need from vendors and customers. One example is contract labor that you will need to issue a 1099 for; make sure you have a W-9 on file for them. If we can help you get ready for year-end, let us know.

5. Margin Mastery

If your business has multiple products and services, there may be some that are far more profitable than others. Breaking these numbers out to calculate your profit margins or contribution margins by product or service line can help you see the areas that are adding the most income to your bottom line. Correspondingly, you can determine if you have any items that are losing money; knowing will help you take the right action in your business. Refresh your financials this fall with your favorite idea of these five, or come up with your own fall project to rejuvenate your business.

contribution margins by product or service line can help you see the areas that are adding the most income to your bottom line. Correspondingly, you can determine if you have any items that are losing money; knowing will help you take the right action in your business. Refresh your financials this fall with your favorite idea of these five, or come up with your own fall project to rejuvenate your business.

If you need cash fast, there’s nothing like having a sale to increase your bank account quickly. Here are ten excuses you can use to tell your customers you’re having a sale.

1. It’s Your Birthday (or Your Business’s Birthday)

We all feel generous on our birthday, so why not have a sale on your special day. You can even tie to discount amount to your day of birth. For example, if you were born on the 14th, then you can offer customers 14% off.

Similarly, you can hold an anniversary sale on your business’s anniversary date. It’s a good way to let customers know how long you’ve been in business.

2. Your Partner Is on Vacation

If you have a business partner, you can use the excuse, “When the cat’s away, the mice will play.” You can pretend that your partner knows nothing about the sale, but has left you in charge and you’re going to have this sale. The customers will enjoy the reason and feel like they are getting away with something fun.

3. Holidays

Most stores have holiday sales, and you can too. There are so many unusual holidays that you can tap into just in case the holidays are at an inconvenient time. Here’s a website that will give you a list of special days, weeks, and holidays: http://www.holidayinsights.com/moreholidays/

4. The Full Moon

Why not? It might be the best sale you’ve ever had. The next full moon is June 2, 2015, and July has a blue moon (when two full moons occur in one month) on July 31, 2015.

5. Small Business Saturday

November 28, 2015 is Small Business Saturday. It’s one day after Black Friday and the Saturday before Cyber Monday. Small Business Saturday is relatively new, but has been gaining momentum in the past few years.

6. Tax Holidays

In some states the sales tax authority provides exemptions for a few days on selected categories of items. For example, in August, Texas allows one weekend where sales tax does not have to be paid or collected on school supplies. You may not even have to mark down your items to generate a crowd for sales tax holidays. Unfortunately, this does not apply here in New Hampshire. For more information, here’s a Wikipedia page on it: http://en.wikipedia.org/wiki/Tax_holiday

7. Old Inventory Items or Overstock Condition

A great reason to have a sale is when you have old inventory items you need to clear out. Similarly, if you’re overstocked on certain items, a sale will help them move.

8. Your Kid’s College Tuition Is Due

You can have a lot of fun by advertising that you simply need to make your tuition payments. Customers will get a smile out of helping you out and relating to a familiar need.

9. The Stock Market

If the stock market goes up or down, you can have a sale based on its performance.

10. Seasonal Dates

Dates such as the first day of summer, Spring Equinox, or even April 15th, tax day (in the U.S.) can be potential sales days for your business. Think about seasonal dates related to your industry.

Try these ten ideas to get your sale noticed.

New Business Direction LLC

New Business Direction LLC