Bad Debt on a Cash Basis QuickBooks Profit and Loss Report?

As an accountant, I know that there is no such thing as bad debt on a cash basis tax return.

Accrual basis taxpayers recognize revenue when they invoice for the services and are allowed to write off a bad debt if it is not collected.

Cash basis taxpayers only recognize revenue when they receive the money. If you never receive the money, there is nothing to write off.

Yet, I’ve seen it; I’ve seen a bad debt expense account on a cash basis profit and loss report in QuickBooks. How does that happen? And how does it get reported on your income tax return?

How a Bad Debt Expense Account Gets on a Cash Basis Profit and Loss Report

Bad Debt can wind up on a Cash Basis Profit and Loss Report when you invoice a customer in one tax year and write it off in another. This is just one more reason to clean up your accounts receivable at year-end, before filing your income taxes.

Let’s look at an example –

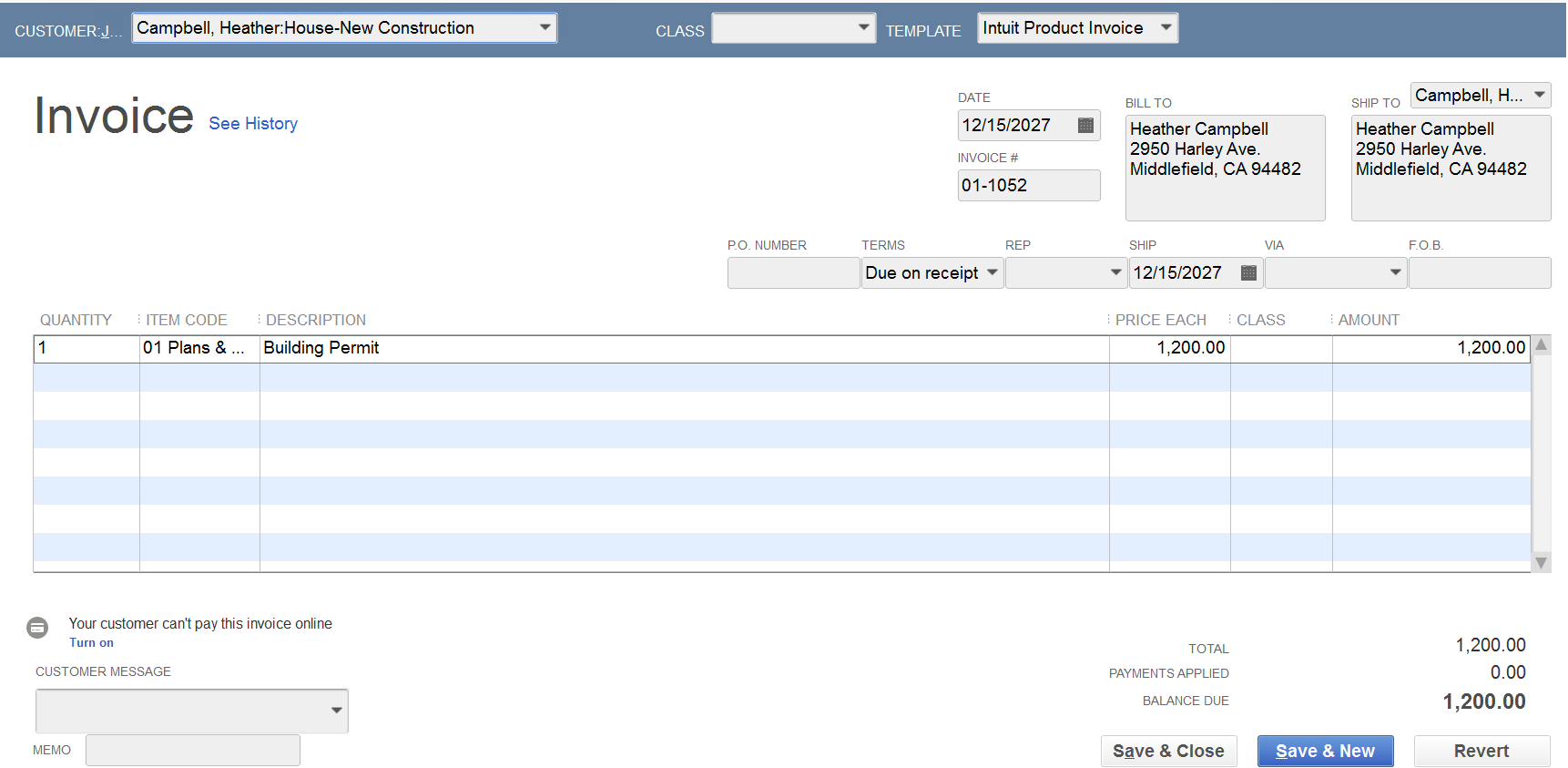

In a sample QuickBooks Enterprise data file, I have created an invoice dated 12/15/2027 to Heather Campbell for $1,200 for a building permit.

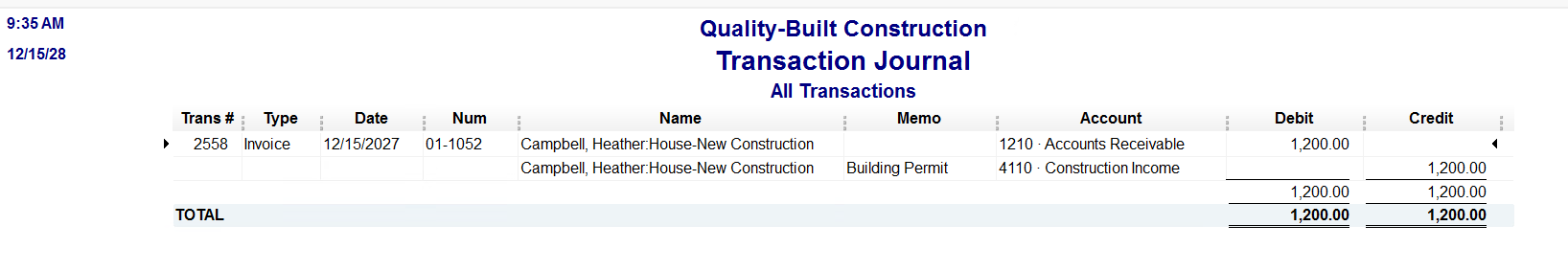

Behind the scenes, the transaction journal debits Accounts Receivable and credits Income.

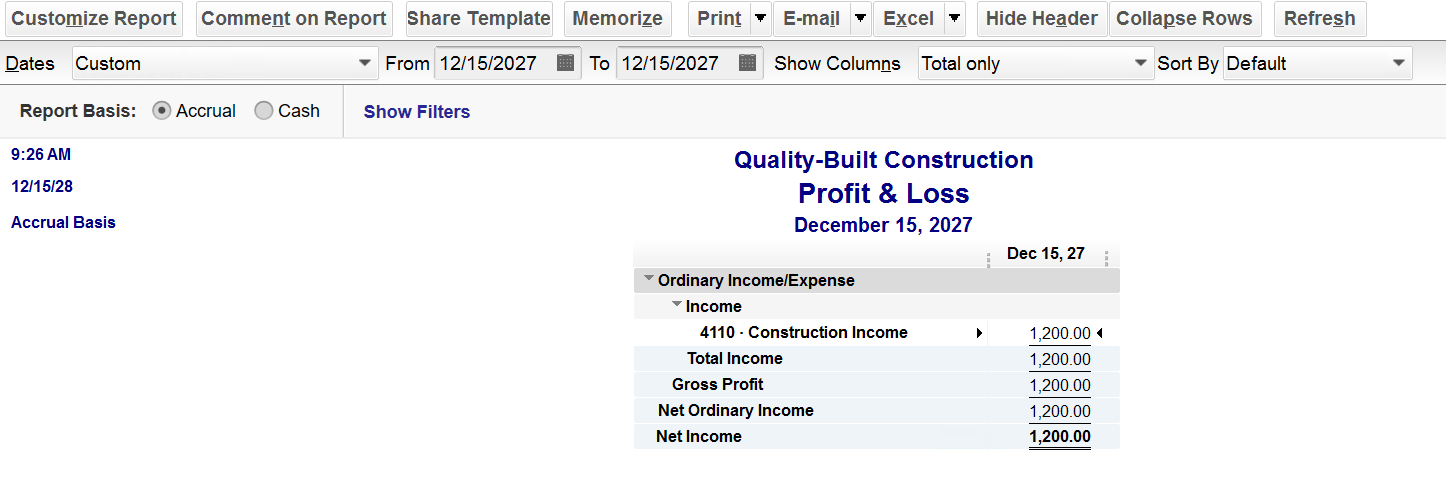

The accrual basis profit and loss will report this as Construction Income…

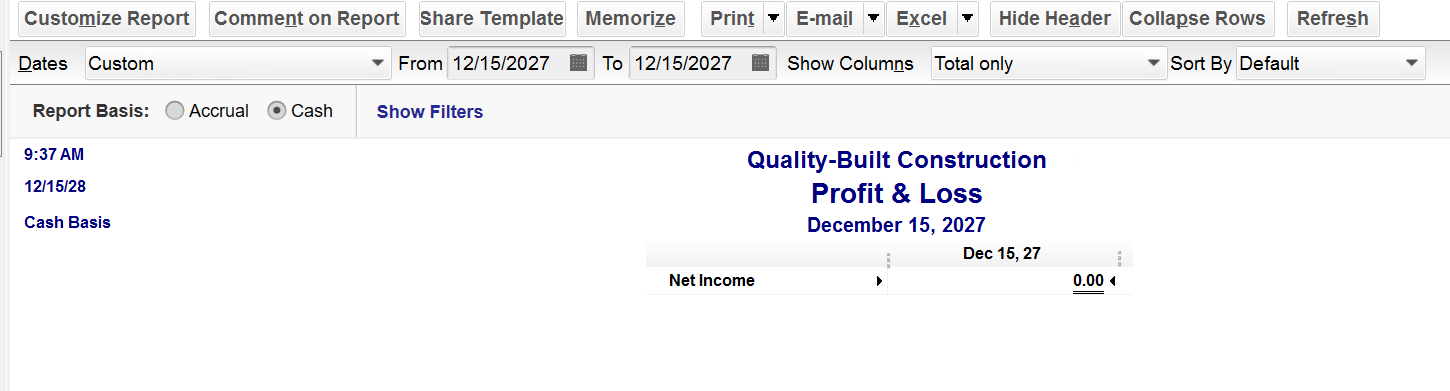

…but the cash basis profit and loss will not.

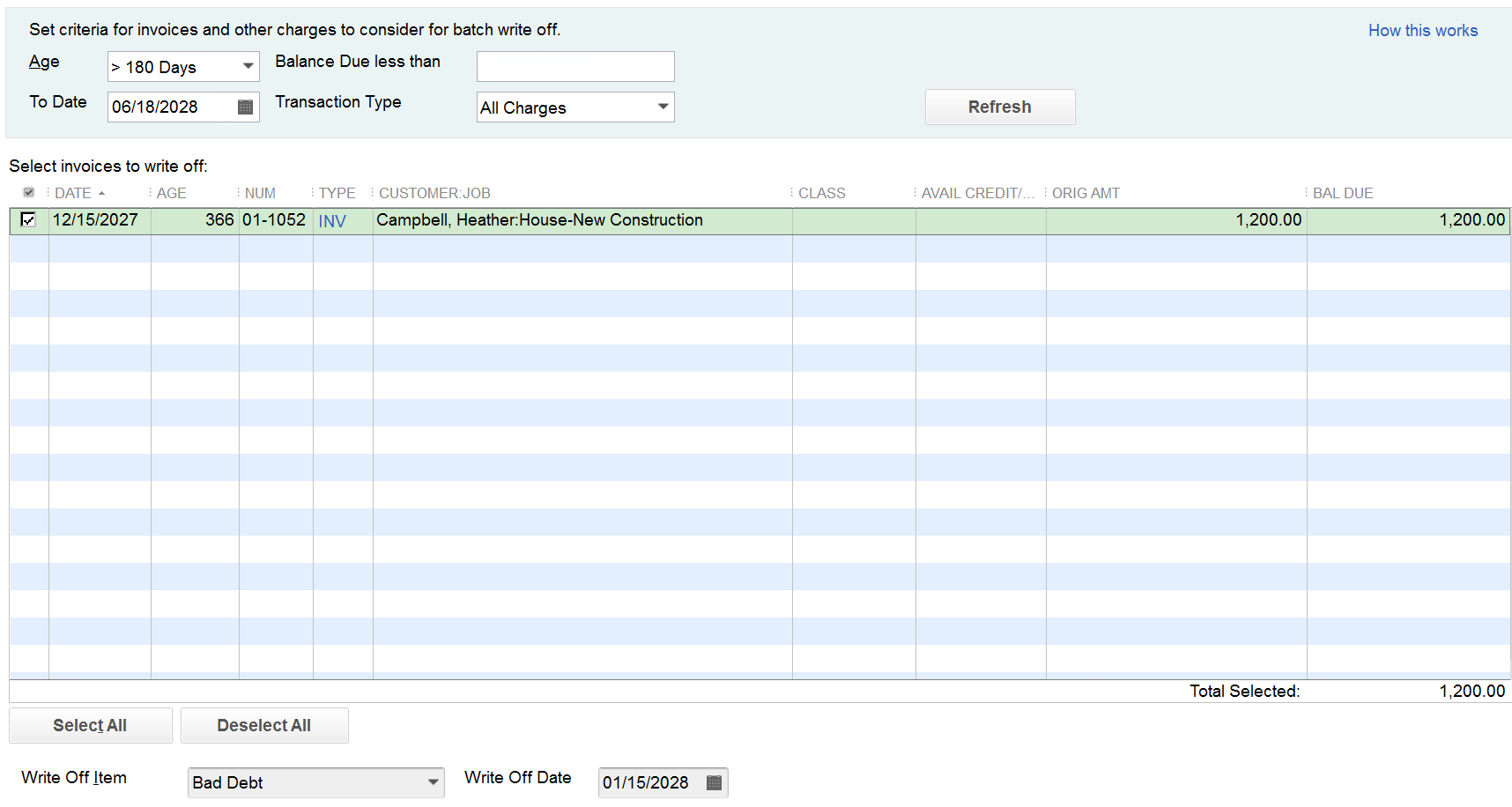

Now, let’s say I write off that invoice in the next tax year using the QuickBooks Enterprise tool –

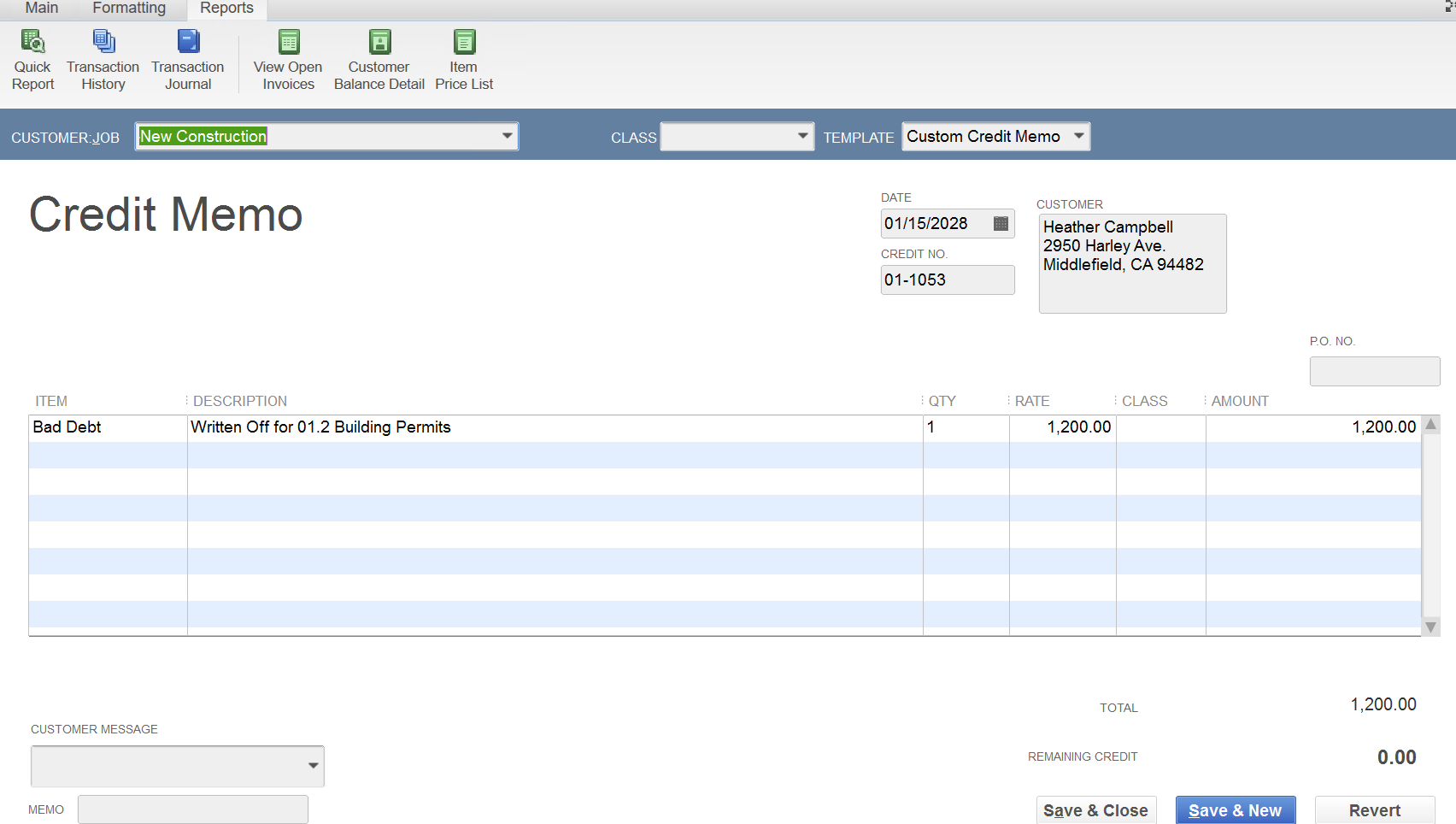

QuickBooks creates a credit memo for the write-off –

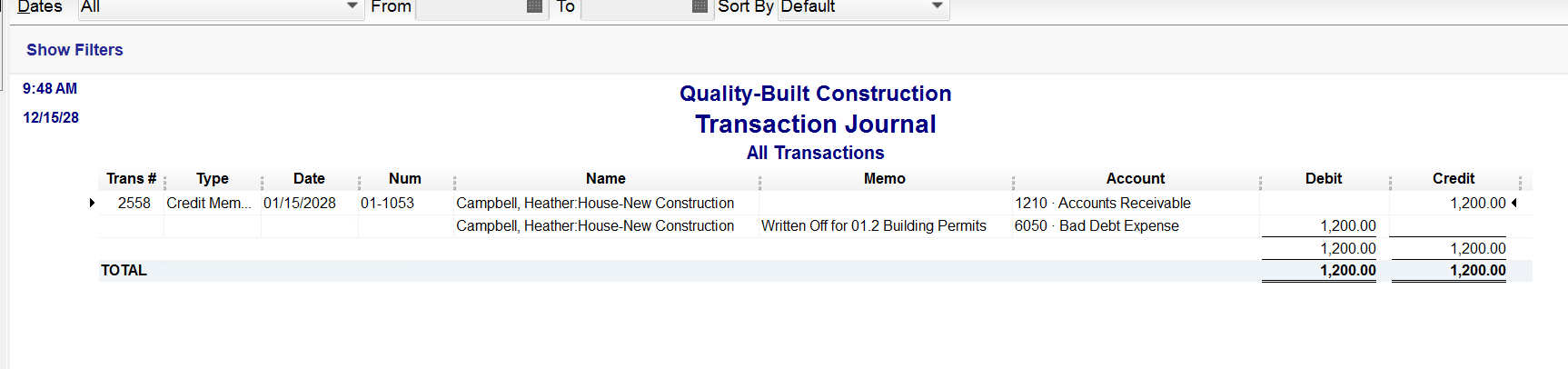

The transaction journal behind the scenes debits Bad Debt Expense and credits Accounts Receivable –

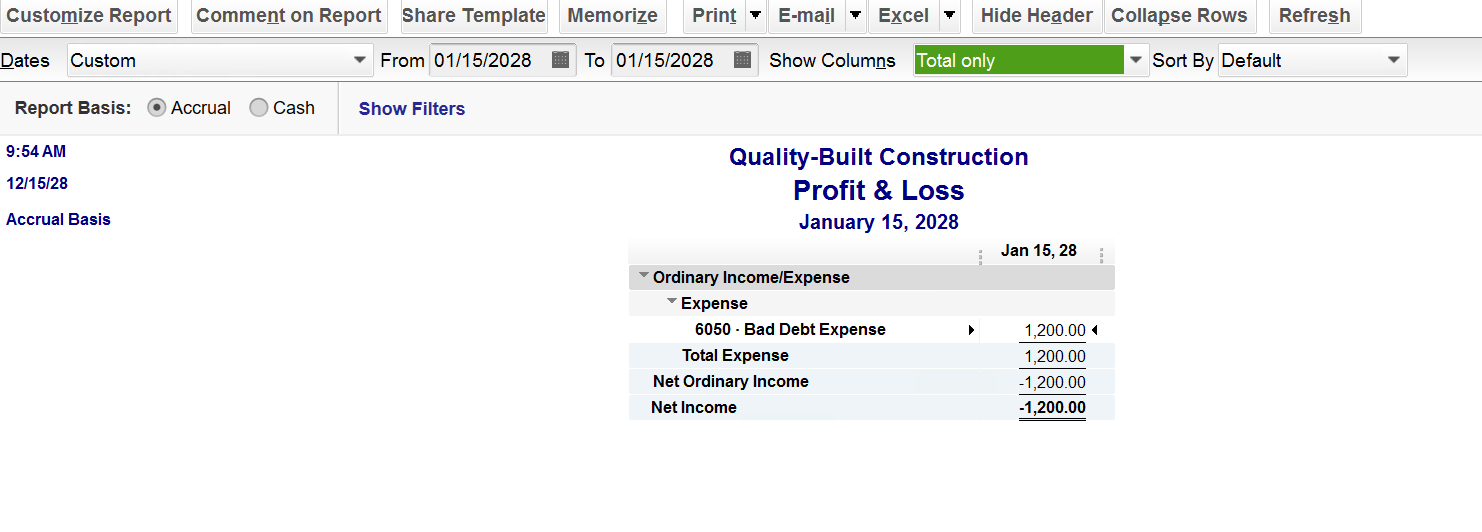

On the accrual basis profit and loss, we see Bad Debt Expense – this is correct – it’s writing off the income that was reported in the prior year.

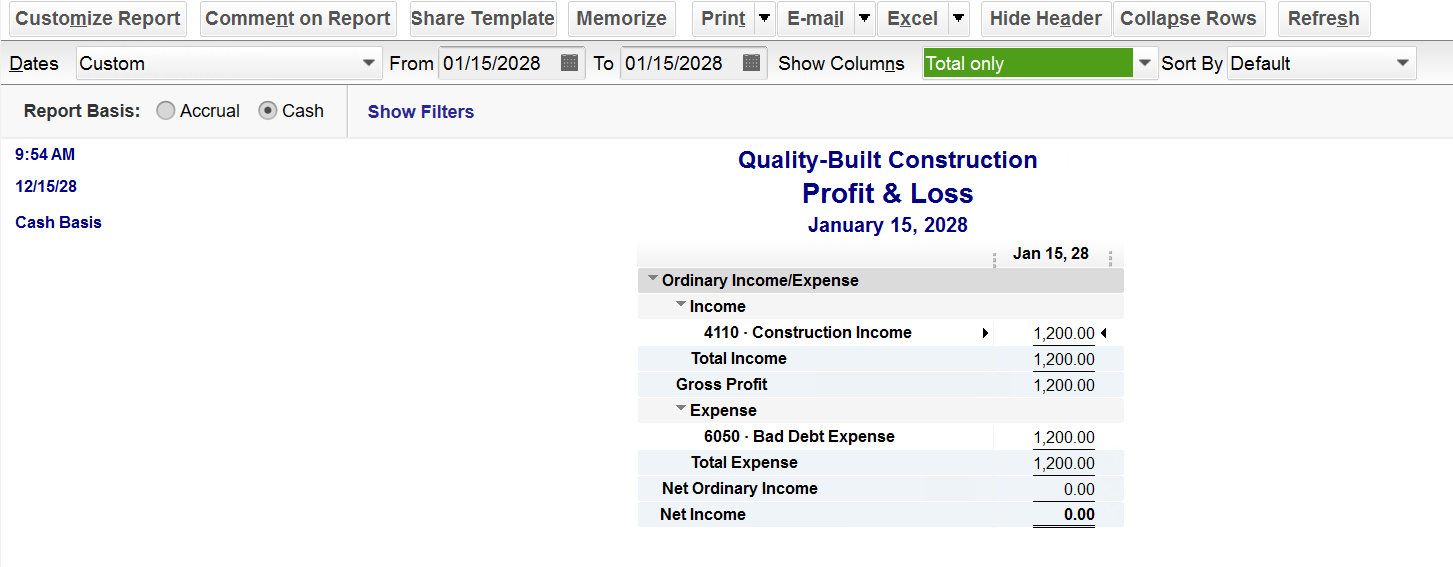

On the cash basis profit and loss report, we see both Construction Income and Bad Debt Expense – this is also correct – it’s a wash – since it reports the income and writes off the bad debt.

How a Bad Debt Expense Gets Reported on Your Income Tax Return

Now, let’s discuss what’s supposed to happen on your cash basis tax return. Nothing; technically, it’s a wash, as the Bad Debt Expense on a cash basis profit and loss is simply a reduction of revenue. If I were preparing your income tax return*, I would reduce the Construction Income by the Bad Debt Expense and report the net revenue. For more information on this topic, check out this helpful tutorial our team prepared: https://newbusinessdirections.com/how-to-write-off-a-bad-debt-in-quickbooks-3/

*Note: New Business Directions does not prepare income tax returns.

New Business Direction LLC

New Business Direction LLC