Why do I have negative accounts receivable on a cash basis balance sheet in QuickBooks?

There are a few scenarios that will cause a negative accounts receivable on a cash basis balance sheet in QuickBooks. Let’s focus on the two most common: unapplied payments and timing differences.

Unapplied Payments –

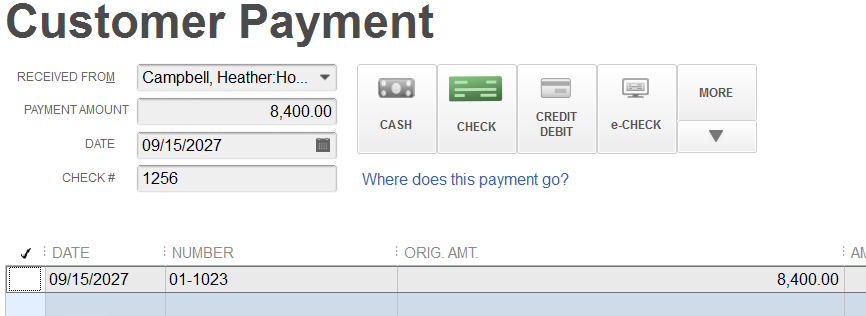

This occurs when a customer has paid you, you’ve received the payment, but you have not applied it to the invoice yet. As pictured below, a simple checkmark next to the invoice will resolve the negative accounts receivable on your balance sheet.

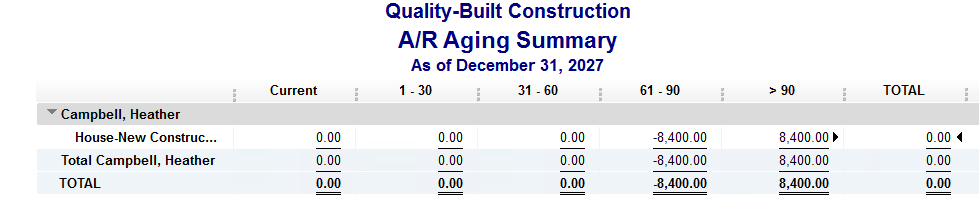

If you look at your accounts receivable aging report, you will see both the invoice and the payment for the customer – one positive, one negative and they wash to zero.

It’s important to clean up your accounts receivable aging summary report and fix unapplied payments by linking them before monthly reports are issued or year-end taxes are filed.

There are no journal entries required to correct this transaction; simply apply the payment to the invoice and re-run your reports.

Timing Differences –

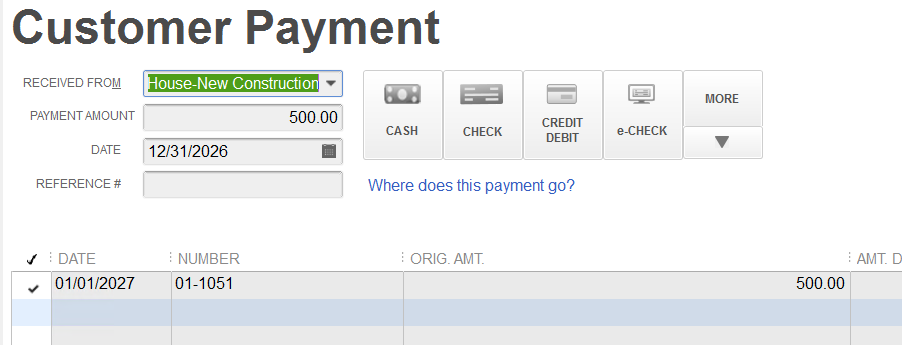

This occurs when a customer has paid you in advance; you’ve received the payment and applied it to an invoice that is dated in the future.

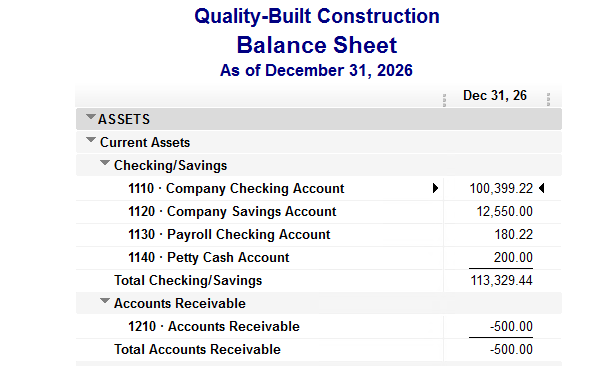

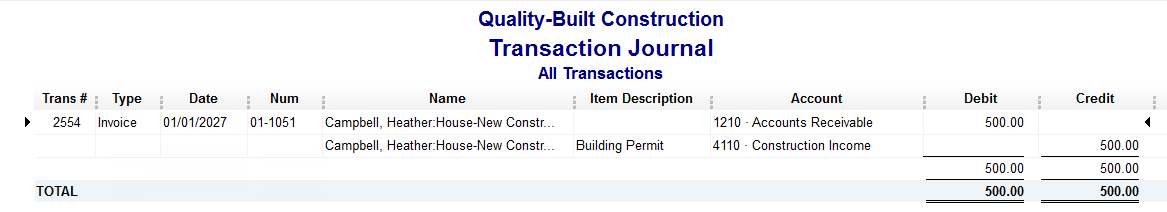

In the image above, you’ll notice that the date of the payment receipt is the day before the date of the invoice. This is an advance payment from the customer on a future invoice resulting in a negative accounts receivable on the balance sheet dated as of the date of the payment. It will not wash to zero on the accounts receivable aging report until the next day–in this case, it will be in the next calendar year.

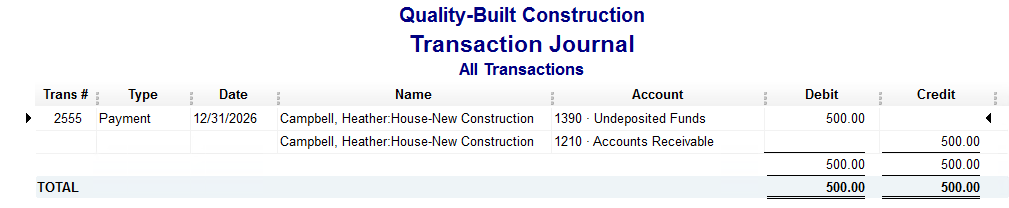

Please note that you will have a negative accounts receivable on both the cash and the accrual basis balance sheets for this transaction. Below is the transaction detail for the payment dated 12/31/2026 and the invoice dated 1/1/2027, behind the scenes in QuickBooks.

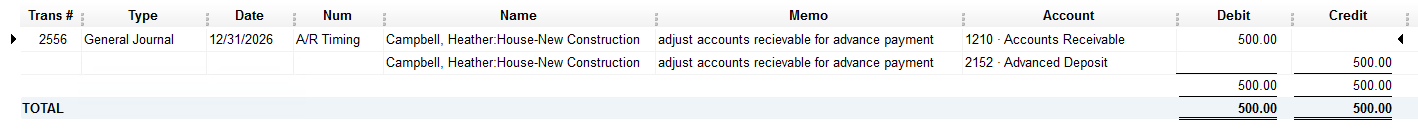

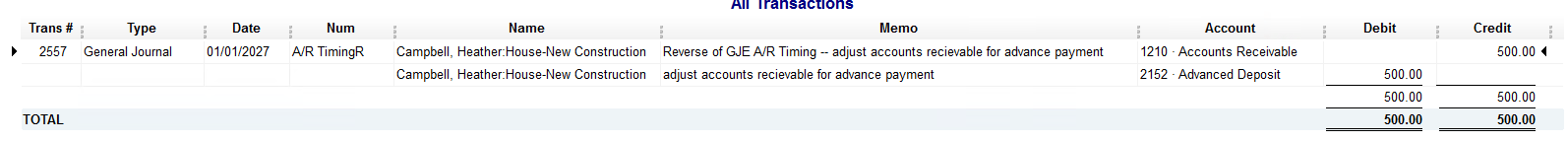

If you find yourself in a situation where you have negative accounts receivable due to a timing difference at a month-end reporting period (or at year-end for tax filing), you will need to make two journal entries – one regular and one reversing, to move the negative accounts receivable to an other current liability account for advanced deposits, as follows:

These are the two most common reasons why you would see a negative accounts receivable on a cash basis balance sheet in QuickBooks.

This holds true for negative accounts payable on a cash basis balance sheet as well and the process to fix/link or adjust is the same.

New Business Direction LLC

New Business Direction LLC