As a business coach and advisor, one of the most important conversations I have with restaurant customers revolves around understanding what it takes to make a profit and how to price their menu by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a busy restaurant, a construction company, or a retail shop, mastering this concept can be the difference between survival and sustainable success.

As a business coach and advisor, one of the most important conversations I have with restaurant customers revolves around understanding what it takes to make a profit and how to price their menu by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a busy restaurant, a construction company, or a retail shop, mastering this concept can be the difference between survival and sustainable success.

Let’s break this down with clarity and real-world examples.

What Are Fixed and Variable Expenses?

- Fixed Expenses are costs that remain constant regardless of your business activity level. They do not change with sales or production volume.

- Variable Expenses fluctuate in direct proportion to your revenue or output. More sales revenue or customers means more variable costs.

Understanding the balance between the two helps you:

- Plan more accurately

- Price your menu items effectively

- Make better staffing and purchasing decisions

- Know exactly what it takes to break even—that is, to cover your expenses without incurring a loss.

Restaurant Industry

Variable Expenses:

- Food and beverage costs

- Liquor costs

- Wages paid for servers, bartenders, chefs, dishwashers

- Cooking fuel (e.g. propane, fry-oil)

- Linen service and paper goods

- Packaging for take-out service

- Merchant account fees

Fixed Expenses:

- Lease on restaurant space

- Equipment lease (e.g. ovens, walk-ins)

- Business insurance premiums

- Manager’s salary

- Utility bills (e.g. telephone, electricity)

Breakeven Example: Let’s say your monthly fixed costs are $25,000/month or $300,000/year and your average meal ticket is $45 with a $20 variable cost leaving you with a margin of $25/cover (56%). You would need to serve 12,000 meals per year, average 1,000 meals per month or 231 per week. If your restaurant is open five days/week, that’s 46 covers per day. If you have 20 seats in your restaurant, you will need to turn your tables 2.3 times.

Breakeven Revenue Formula

The breakeven point in terms of revenue is calculated as follows:

Breakeven Revenue = Fixed Costs / Contribution Margin

$300,000 / .5556 = $539,956

You will need to generate $539,956 in revenue to break even and anything beyond that is profit.

Here’s the breakeven analysis in graph format:

- The blue dashed line shows your fixed overhead.

- The red line is your total cost (fixed + variable).

- The green line is your revenue.

- The gray dashed line marks the breakeven point, which is $539,956 in revenue.

This chart helps visualize exactly how much you need to bring in before turning a profit.

Why This Matters

When you clearly define your fixed and variable expenses, you’re better positioned to:

- Adjust menu pricing intelligently

- Manage payroll strategically

- Negotiate purchasing

- Scale your business with intention

Breakeven analysis isn’t just a math exercise—it’s a decision-making compass. When you know your breakeven point, you know exactly what you need to sell, build, or serve each month just to stay afloat—and how much more to hit your profit targets.

Final Thought

Every dollar you bring in above your breakeven point contributes directly to your profit—but only if you manage your variable costs wisely. Understanding this relationship helps you shift from reactive to strategic business operations.

If you’re unsure how to calculate your breakeven point or how your cost structure stacks up, let’s talk. I help construction, retail, and restaurant owners like you take control of their numbers so they can focus on growth with confidence.

QuickBooks® Desktop 2022 software will be discontinued after May 31, 2025. This affects all 2022 versions. Starting from June 1, 2025, you will not have access to technical support and will not receive the latest security patches.

In addition, certain features will no longer be available in your QuickBooks® 2022 after May 31st – QuickBooks® payroll processing, workers’ comp payment service, QuickBooks® workforce, payment processing, merchant service deposit (reconciliation), recurring payments, eInvoice, accountant copy transfer service, contributed reports, multi-currency/exchange rate, online banking, emailing reports from within the software.

Intuit is encouraging all Desktop 2022 users to upgrade to QuickBooks® Enterprise 24.0 or QuickBooks® Online. However, a version of QuickBooks Desktop Plus 2024 is also available at no

additional charge to existing QuickBooks Desktop Plus subscribers.

New Business Directions recommends that if you have an existing QuickBooks® Desktop Plus subscription that you upgrade to the 2024 version. If you do not have an existing subscription, we recommend upgrading to QuickBooks® Desktop Enterprise Solutions 24.0.

This is a friendly reminder that all eligible entities registered in the state of New Hampshire are required to file their annual report with the Secretary of State by April 1st of each year.

Entities that are required to file include:

- Corporations

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- Limited Liability Partnerships (LLPs)

Filing your annual report is crucial for maintaining your entity’s good standing. Failure to file can result in penalties, loss of privileges, and even dissolution of your business entity. You will have received an email with your business registration number and/or a paper mailing from the state with details regarding filing of this annual report.

Please ensure timely submission to avoid any complications. For assistance or more information, feel free to reach out to us or visit the Secretary of State’s website at https://sos.nh.gov

As the year wraps up, it’s time to start preparing your IRS 1099 forms. As a business owner, filing 1099s correctly and on time is a critical part of year-end compliance for your company. Here’s what you need to know to navigate the requirements for Forms 1099-NEC, 1099-MISC, and 1099-K this filing season.

Form 1099-NEC

Form 1099-NEC (Nonemployee Compensation) is used to report payments of $600 or more made to nonemployees such as independent contractors, freelancers, and vendors.

Who needs a 1099-NEC?

You’ll need to file Form 1099-NEC for any contractor or service provider, including attorneys, to whom you paid $600 or more in 2024, unless the service provider is a corporation. An LLC is not necessarily a corporation. Be sure to collect a Form W-9 from each service provider, regardless of their entity structure, to ensure you have their tax information. You are required to have a W-9 on file for all service providers.

What’s the filing deadline for 1099-NECs in 2025?

- Recipient copies must be sent by January 31, 2025.

- IRS filing must also be submitted by January 31, 2025.

Here are some helpful links for 1099-NECs:

Form 1099-MISC

Form 1099-MISC is used to report miscellaneous income such as rent, prizes and awards, and other types of payments not reported on Form 1099-NEC.

Who needs a 1099-MISC?

File Form 1099-MISC if you’ve paid:

- $600 or more in rent, prizes, or awards.

- Royalties of $10 or more.

What’s the filing deadline for 1099-MISC forms in 2025?

- Recipient copies must be sent by January 31, 2025.

- IRS filing deadlines:

- Paper filing: February 28, 2025.

- Electronic filing: March 31, 2025.

Here are some helpful links for 1099-MISC Forms:

Form 1099-K

Form 1099-K is used to report payment transactions made through third-party settlement organizations like PayPal, Venmo, or Square. For tax year 2024, the IRS requires a Form 1099-K to be issued if:

- Gross payments exceed $600, regardless of the number of transactions.

Who issues Form 1099-K?

Third-party settlement organizations are responsible for filing Form 1099-K and sending copies to payees. However, ensure you cross-check your records with any 1099-K forms received to verify reported amounts.

What’s the filing deadline for Form 1099-K?

- Recipient copies must be sent by January 31, 2025.

- IRS filing deadlines mirror those for Form 1099-MISC.

Helpful Links for Form 1099-K:

Pro Tips for Smooth 1099 Filing

- Collect W-9s now. Ensure you have accurate information for all contractors and vendors.

- Double-check tax identification numbers (TINs). This prevents filing errors that could result in penalties.

- Use accounting software. Most platforms have tools to simplify 1099 preparation and electronic filing.

- File electronically if possible. E-filing is faster and ensures timely submission to the IRS.

Need Help? We’re Here for You!

We’re happy to guide our customers through the process, from verifying vendor details to ensuring accurate filings. Let us take the stress out of 1099 compliance so you can focus on your business as we head into the new year.

As we prepare to wrap up 2024, there’s no better way to set the stage for a successful new year than by finishing strong. A smooth year-end close not only gives you peace of mind but also sets you up to hit the ground running in 2025.

Here’s a comprehensive checklist to help you organize and streamline your year-end close. And remember, if any of these tasks seem daunting, we’re just an email away to assist!

Financial Tasks

- Catch up on your bookkeeping. If you’ve been putting this off, now’s the time to get your books in order to avoid the rush of tax season.

- Reconcile all bank accounts. Include savings accounts, PayPal, credit cards, and cash equivalents. Review old uncleared checks, void or re-issue, as necessary.

- Review and address unpaid invoices. Collect outstanding invoices from customers and clean up any errors in accounts receivable.

- Write off uncollectible invoices. Prepare your books for a realistic reflection of revenue.

- Record all bills due through year-end. Reconcile your accounts payable and ensure balances are accurate.

Payroll and Contractor Preparations

- Update employee and vendor addresses. Ensure accurate W-2s and 1099s by confirming everyone’s information is up to date.

- Gather W-9s from contractors. This simplifies your 1099 filing process.

- Request proof of workers’ compensation insurance. Avoid extra charges by collecting certificates from applicable contractors.

- Decide on year-end employee bonuses. Remember, these payments are subject to withholding taxes.

- Review PTO balances. Adjust or roll over unused days in your payroll system.

Inventory Management

- Schedule and take inventory. Make necessary adjustments to your books after counting.

- Write off unsellable inventory. If possible, sell scrap inventory or waste to recover costs.

Assets and Liabilities

- Update your fixed assets register. Confirm that you still own all of the assets listed on your depreciation schedule.

- Calculate and record depreciation as needed.

- Adjust loans for interest and principal allocations. (Need help accurately recording business loans? Check out this tutorial from our team.)

- Analyze all balance sheet accounts. Ensure all balances are current and accurate.

Tax Preparation and Strategy

- Plan your deductions. Decide whether to maximize deductions or defer income for optimal tax impact.

- Prepare for tax adjustments. Work with your accountant to ensure all entries and reconciliations are complete.

Recordkeeping and Organization

- Ensure a complete paper trail. Match transactions with receipts, invoices, and other documents.

- Digitize and store records. Scan and securely save important documents like bank statements, payroll reports, and contracts. (If you’re still operating your business using a local server to store your data, we wrote a think piece about why you should consider switching to cloud-based storage)

Strategic Planning for 2025

- Create a revenue and profit plan. Enter your 2025 goals into your accounting system. (Need help determining where your revenue should come from in 2025? Check out our article about three different sources of cashflow. Need to find out if your growth strategy actually optimizes your profits? Check out this tutorial we wrote.)

- Review holiday closures. Share your 2025 holiday schedule with your team.

- Update pricing. Adjust product and service prices if this is your annual review period.

- Review key metrics. Decide which performance indicators will guide your success in 2025.

Celebrate and Reflect

As you complete this checklist, take time to celebrate your accomplishments from 2024. Reflect on what went well and set your sights on an even better 2025. If you need help with any of these tasks, we’re here to make the process easier. Let’s close the year with confidence and start the new one with excitement!

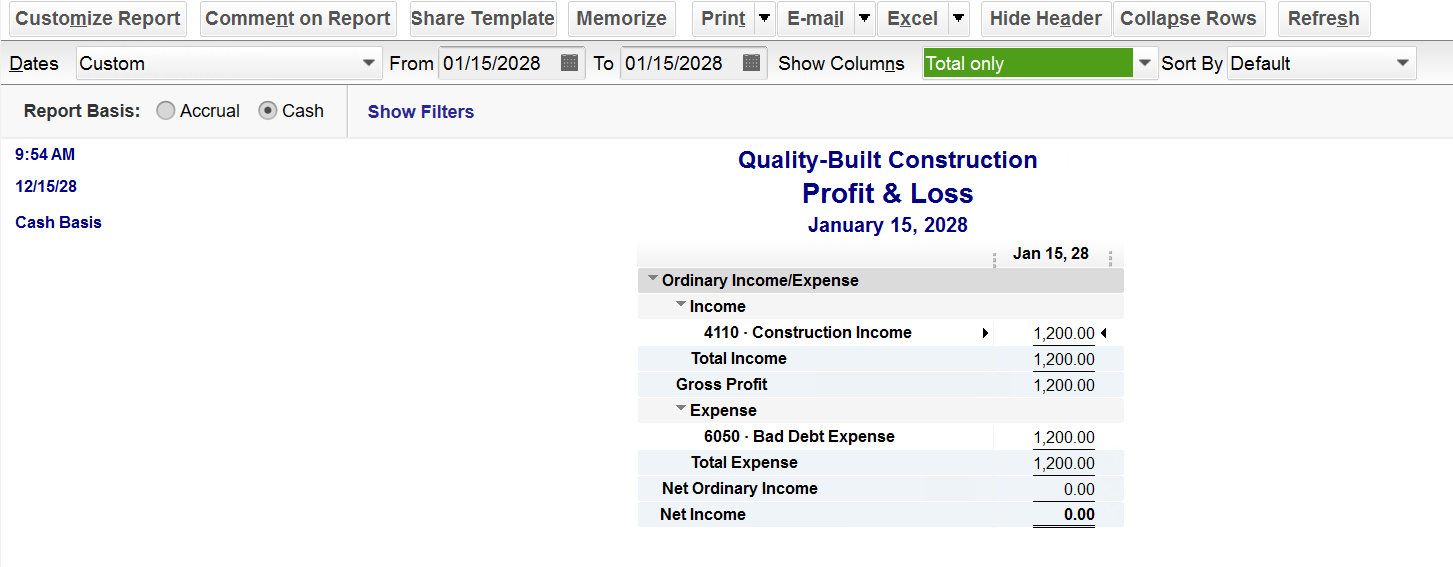

As an accountant, I know that there is no such thing as bad debt on a cash basis tax return.

Accrual basis taxpayers recognize revenue when they invoice for the services and are allowed to write off a bad debt if it is not collected.

Cash basis taxpayers only recognize revenue when they receive the money. If you never receive the money, there is nothing to write off.

Yet, I’ve seen it; I’ve seen a bad debt expense account on a cash basis profit and loss report in QuickBooks. How does that happen? And how does it get reported on your income tax return?

How a Bad Debt Expense Account Gets on a Cash Basis Profit and Loss Report

Bad Debt can wind up on a Cash Basis Profit and Loss Report when you invoice a customer in one tax year and write it off in another. This is just one more reason to clean up your accounts receivable at year-end, before filing your income taxes.

Let’s look at an example –

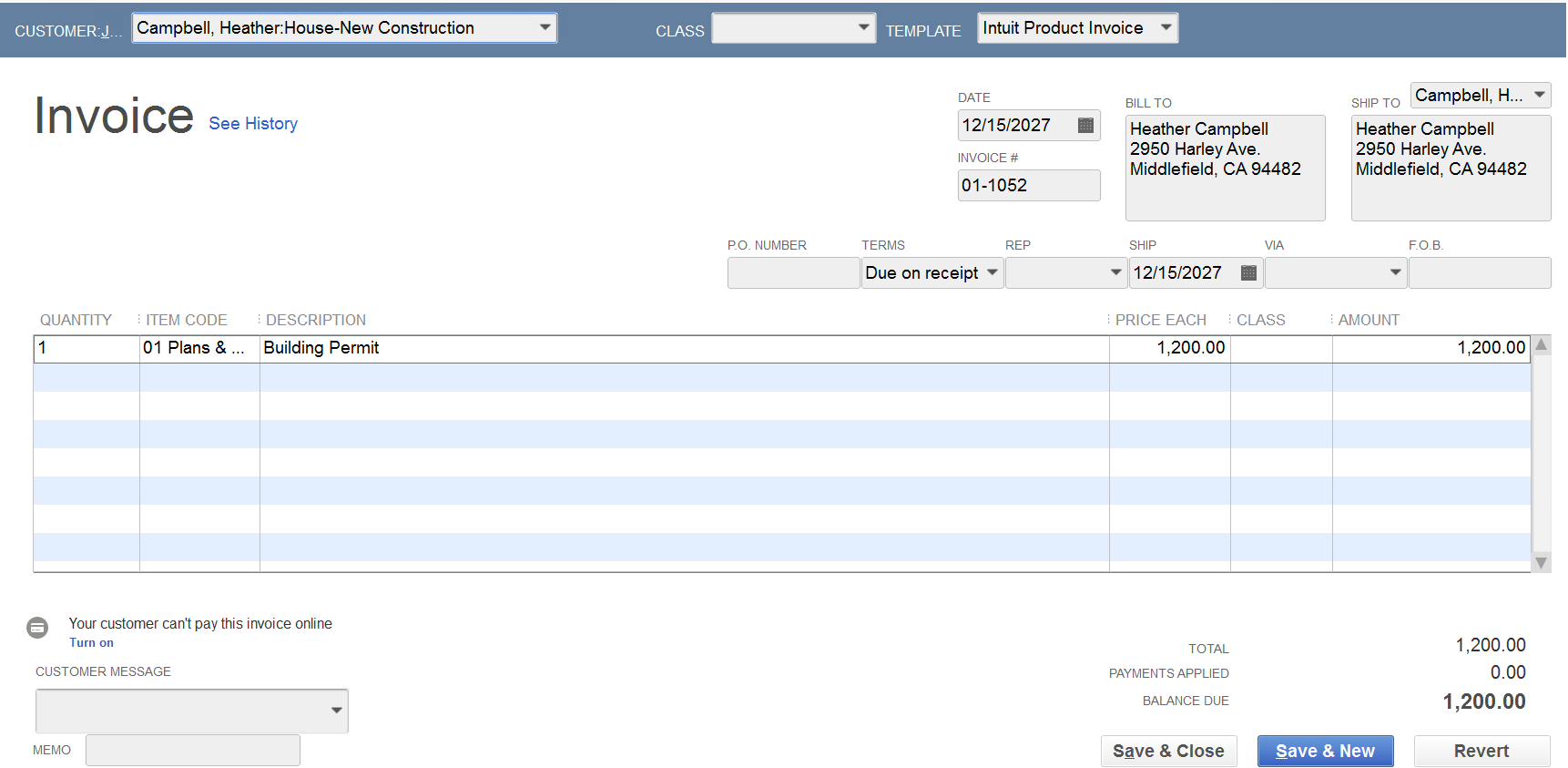

In a sample QuickBooks Enterprise data file, I have created an invoice dated 12/15/2027 to Heather Campbell for $1,200 for a building permit.

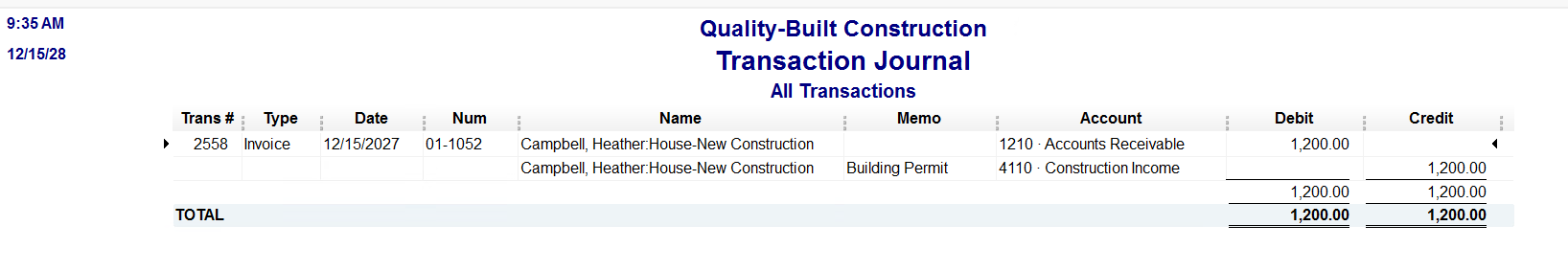

Behind the scenes, the transaction journal debits Accounts Receivable and credits Income.

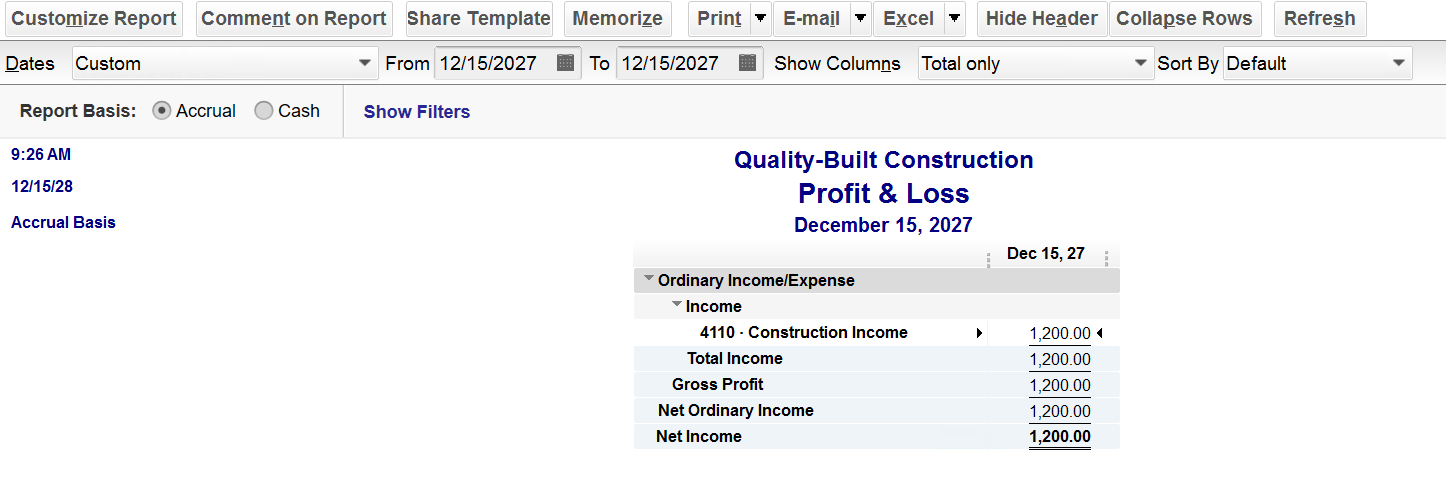

The accrual basis profit and loss will report this as Construction Income…

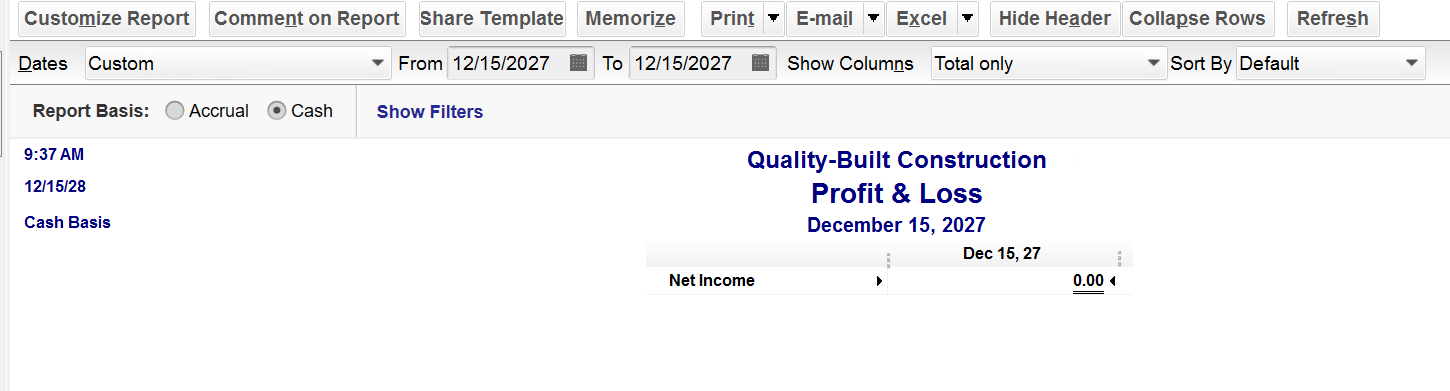

…but the cash basis profit and loss will not.

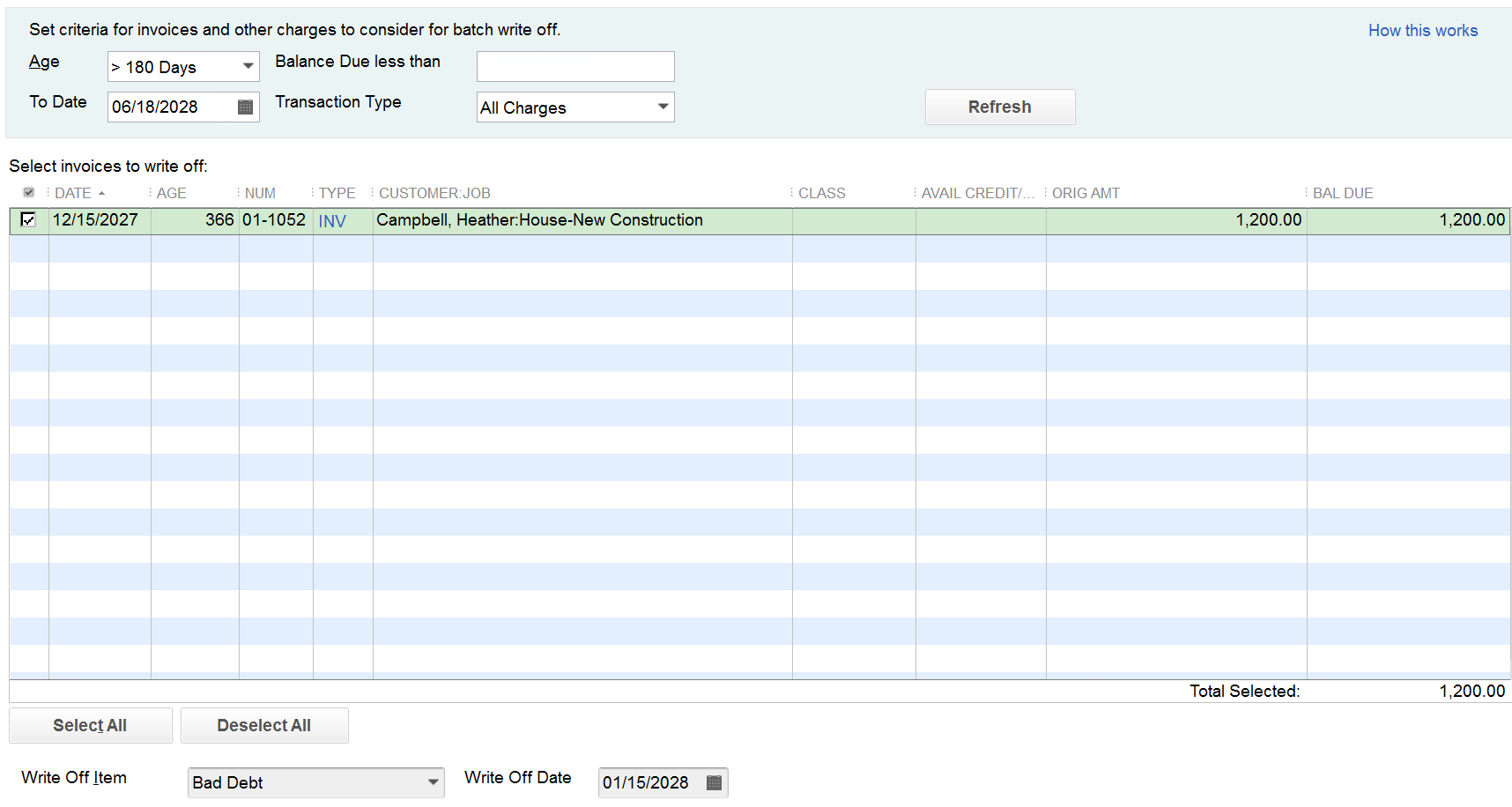

Now, let’s say I write off that invoice in the next tax year using the QuickBooks Enterprise tool –

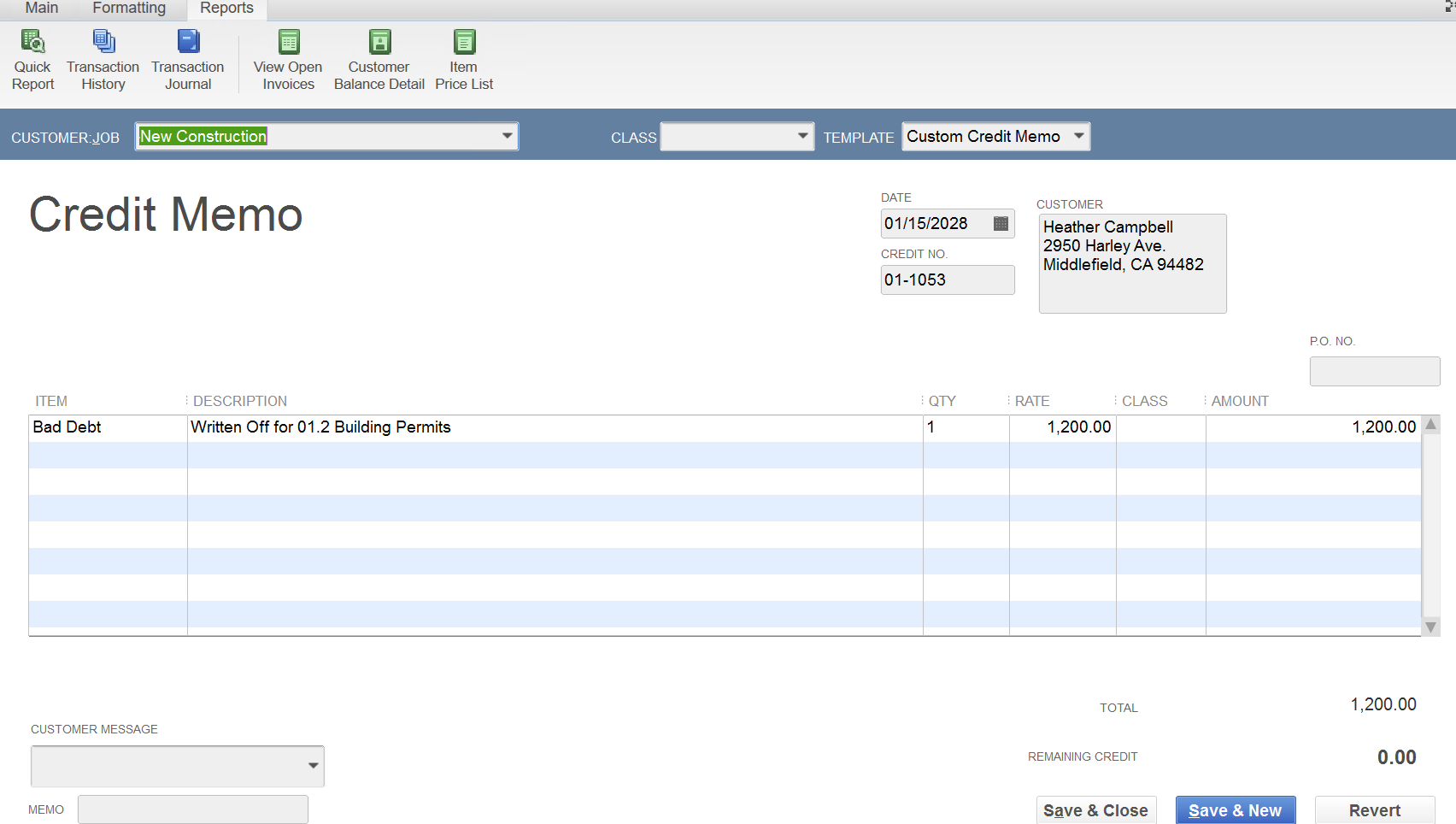

QuickBooks creates a credit memo for the write-off –

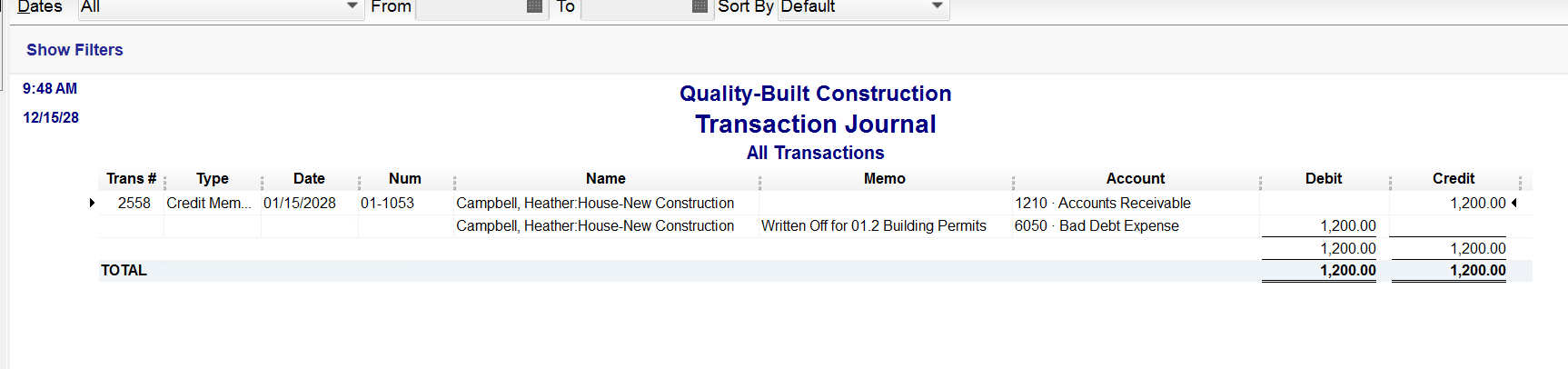

The transaction journal behind the scenes debits Bad Debt Expense and credits Accounts Receivable –

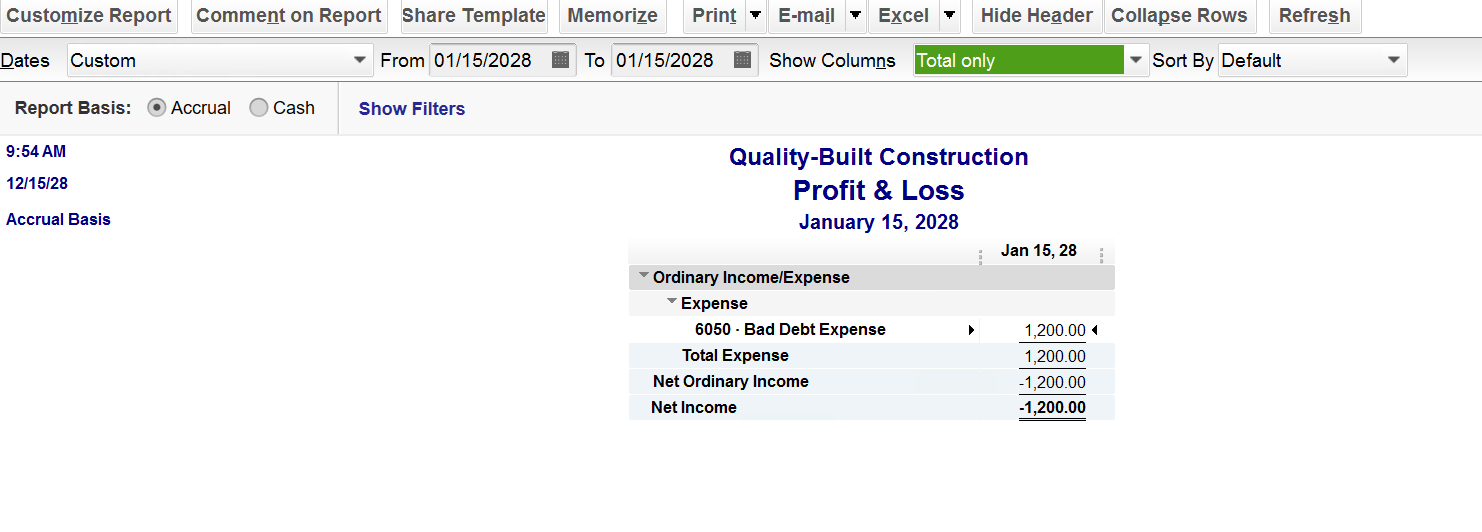

On the accrual basis profit and loss, we see Bad Debt Expense – this is correct – it’s writing off the income that was reported in the prior year.

On the cash basis profit and loss report, we see both Construction Income and Bad Debt Expense – this is also correct – it’s a wash – since it reports the income and writes off the bad debt.

How a Bad Debt Expense Gets Reported on Your Income Tax Return

Now, let’s discuss what’s supposed to happen on your cash basis tax return. Nothing; technically, it’s a wash, as the Bad Debt Expense on a cash basis profit and loss is simply a reduction of revenue. If I were preparing your income tax return*, I would reduce the Construction Income by the Bad Debt Expense and report the net revenue. For more information on this topic, check out this helpful tutorial our team prepared: https://newbusinessdirections.com/how-to-write-off-a-bad-debt-in-quickbooks-3/

*Note: New Business Directions does not prepare income tax returns.

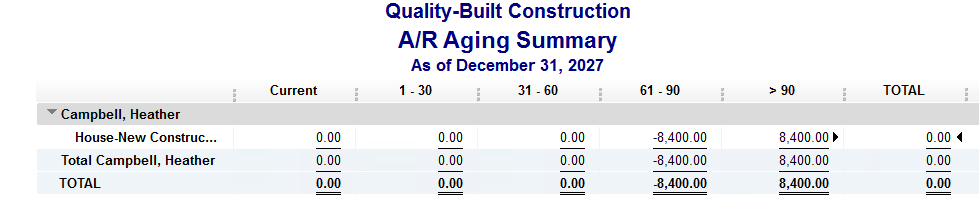

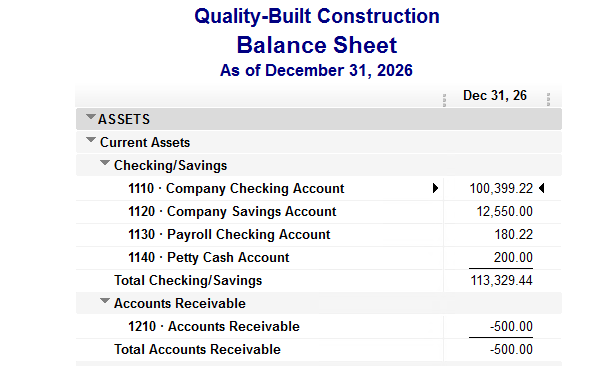

There are a few scenarios that will cause a negative accounts receivable on a cash basis balance sheet in QuickBooks. Let’s focus on the two most common: unapplied payments and timing differences.

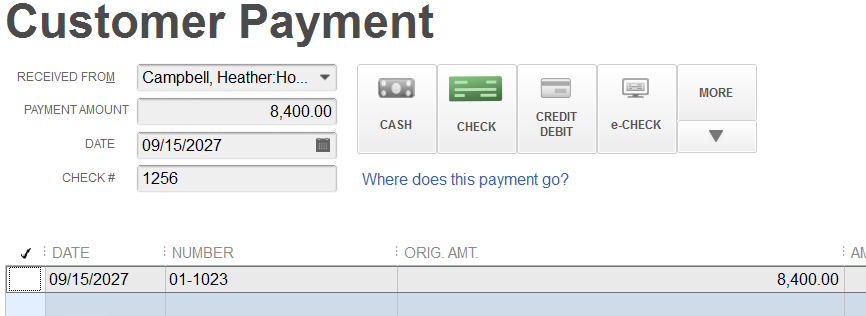

Unapplied Payments –

This occurs when a customer has paid you, you’ve received the payment, but you have not applied it to the invoice yet. As pictured below, a simple checkmark next to the invoice will resolve the negative accounts receivable on your balance sheet.

If you look at your accounts receivable aging report, you will see both the invoice and the payment for the customer – one positive, one negative and they wash to zero.

It’s important to clean up your accounts receivable aging summary report and fix unapplied payments by linking them before monthly reports are issued or year-end taxes are filed.

There are no journal entries required to correct this transaction; simply apply the payment to the invoice and re-run your reports.

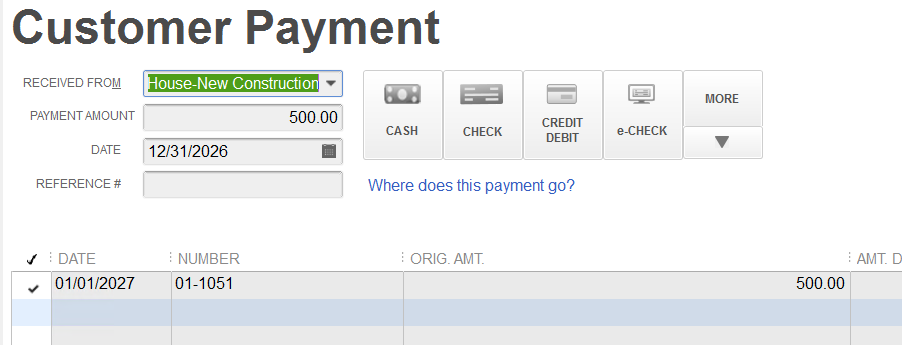

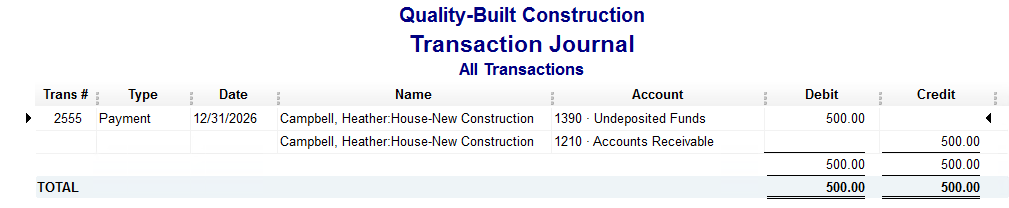

Timing Differences –

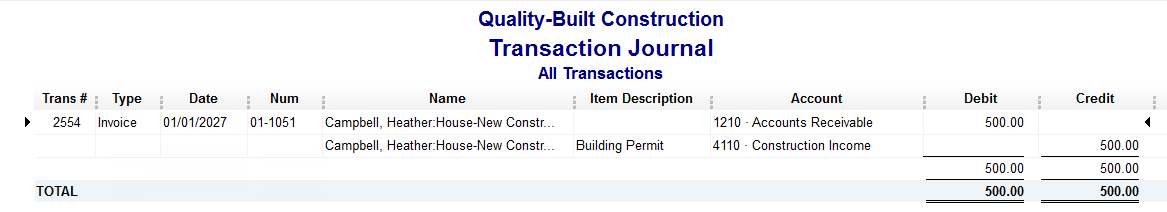

This occurs when a customer has paid you in advance; you’ve received the payment and applied it to an invoice that is dated in the future.

In the image above, you’ll notice that the date of the payment receipt is the day before the date of the invoice. This is an advance payment from the customer on a future invoice resulting in a negative accounts receivable on the balance sheet dated as of the date of the payment. It will not wash to zero on the accounts receivable aging report until the next day–in this case, it will be in the next calendar year.

Please note that you will have a negative accounts receivable on both the cash and the accrual basis balance sheets for this transaction. Below is the transaction detail for the payment dated 12/31/2026 and the invoice dated 1/1/2027, behind the scenes in QuickBooks.

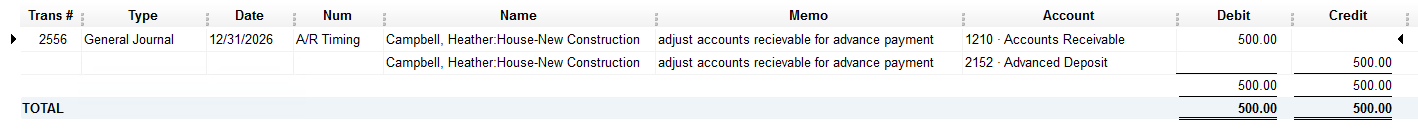

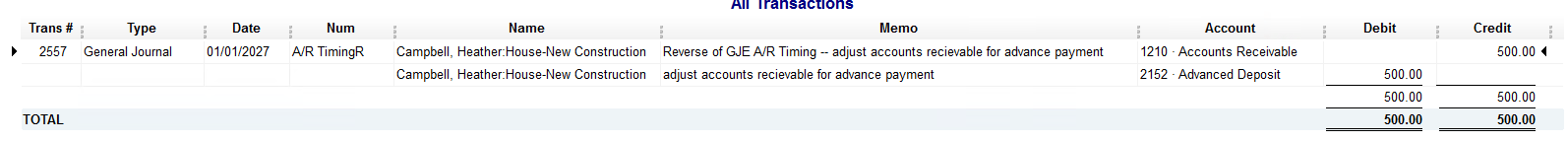

If you find yourself in a situation where you have negative accounts receivable due to a timing difference at a month-end reporting period (or at year-end for tax filing), you will need to make two journal entries – one regular and one reversing, to move the negative accounts receivable to an other current liability account for advanced deposits, as follows:

These are the two most common reasons why you would see a negative accounts receivable on a cash basis balance sheet in QuickBooks.

This holds true for negative accounts payable on a cash basis balance sheet as well and the process to fix/link or adjust is the same.

You may have heard reports over the past couple of years regarding the demise of QuickBooks Desktop.

Actually, if you search the web to purchase QuickBooks Desktop, you’ll be hard-pressed to find it.

Now that we’ve passed the May 31st, 2024 sunset date of the 2021 versions of QuickBooks Desktop – Pro, Premier, Mac and Enterprise Solutions v21, there is no more Intuit support for those 2021 versions and any integrations for connected services such as payroll and merchant services will no longer link.

There is a New Date on the Horizon

Intuit will stop selling new subscriptions of Desktop Pro, Premier and Mac as well as Enhanced Payroll to new US users on September 30, 2024. This is not a sunset or discontinuation; it’s a stop-sell.

If you don’t have a current subscription of the 2024 QuickBooks Desktop Pro, Premier or Mac or Enhanced Payroll on or before July 31, 2024 – you will not be able to purchase it.

Existing customers with 2024 Pro, Premier, Mac or Enhanced Payroll will not be affected and they will still be able to renew their software annually – this is only for new customers. Existing customers will be able to add seats, additional licenses, to their existing licenses.

QuickBooks Enterprise Solutions is Alive and Well

This stop-sell order does not affect QuickBooks Enterprise Solutions. Think of the Enterprise version of QuickBooks as the Pro/Premier software on steroids. It’s the same product, just more robust, with increased capacity and additional features.

Next Steps – What You Need to Do

Confirm that you have the 2024 version of QuickBooks Desktop and that your payment method on file with Intuit is current with the correct card number and expiration date. Do not let your subscription for Desktop Pro, Premier, Mac or Enhanced Payroll lapse.

If you need assistance with the renewal process or upgrading the file from an older version, please reach out.

As a business coach, one of the fundamental lessons I impart to my customers is the vital importance of cash flow management. Cash flow is the lifeblood of any business, and understanding the primary avenues through which cash is generated can make the difference between thriving and merely surviving. There are essentially three ways to generate cash for your business: through operations, financing, and investing. Let’s delve into each of these in more detail.

1. Cash from Operations: Doing What You Do Best

Generating cash from operations is the most sustainable and preferable method for a business. It involves the day-to-day activities that your business engages in to generate revenue. Your operations cash flow is like the engine room of your enterprise, where the core products or services are created, marketed, and sold.

The key business priorities for generating cash from your operations include the following:

- Generating revenue: This includes sales of goods or services. Consistently increasing sales while managing expenses effectively is crucial.

- Managing expenses: Controlling operating expenses ensures that more of your revenue is converted into profit.

- Improving efficiency: Streamlining operations can reduce costs and improve productivity, in turn boosting cash flow.

Prioritizing operational cash flow is vital to a successful business because it indicates a healthy, self-sustaining enterprise. Managing the above priorities while enhancing customer experience, optimizing pricing strategies, and continuously improving product or service quality will drive your operational cash flow.

2. Cash from Financing: Leveraging Debt and Equity

The second avenue of generating cash flow is financing, which involves borrowing money or raising funds from investors. While less ideal than generating cash from operations, financing is sometimes necessary to support growth, manage working capital, or navigate challenging times.

There are two primary types of financing:

- Debt Financing: This includes taking out loans or issuing bonds. While debt must be repaid with interest, it can provide immediate funds for expansion at a critical time for growth (or other needs).

- Equity Financing: Selling shares of your company to investors in exchange for capital. This doesn’t require repayment but does dilute ownership.

Financing can be a double-edged sword; it can provide the necessary capital to seize growth opportunities, but it also comes with risks, such as interest obligations and potential loss of control. A sound financing strategy should balance these risks, ensuring that debt levels remain manageable and that equity is only diluted when it aligns with long-term goals.

2. Cash from Investments: Selling Assets

The third method is generating cash by liquidating investments you’ve made for your business. This strategy can include selling off assets, such as equipment, real estate, or even entire business units that are no longer core to your business strategy.

Below are three critical considerations for your investing activities:

- Asset Management: Regularly review your asset portfolio to identify non-essential or underperforming assets.

- Strategic Sales: Consider selling non-core assets to free up capital, which can be reinvested in higher-return areas of your business.

- Investment Income: Earning returns from financial investments can also contribute to cash flow.

This method can provide a significant influx of cash but should be approached cautiously. It’s essential to ensure that selling assets aligns with your long-term strategic goals and doesn’t undermine your operational capabilities.

Balancing your Cash Flow Sources

Each of these three sources of revenue has its place in a comprehensive cash flow strategy. Remember, cash from operations is most reliable, and wisely leveraging financing can support growth and stability. At the same time, strategic asset sales can optimize resource allocation. All three avenues can help your business grow and remain stable. Strategically integrating these three methods of generating cash could look like this:

- Optimizing your operations to boost cash flow by improving efficiency and controlling costs.

- Seeking financing to invest in new technology to expand your capacity to produce

- Selling outdated equipment to raise additional funds.

As your business coach, my goal is to help you navigate these avenues effectively, ensuring your business can not only survive but thrive in any economic climate. As always, if you have any questions or want to learn more about cash flow management services for your business, please feel free to contact us anytime.

Implementing a new accounting system is no small feat. It requires careful planning, coordination, and commitment from every team member. We’re always excited to help a business with a new accounting infrastructure implementation because we know the positive impact it can have on a business.

We also understand that, as a business owner, transitioning to a new software solution can be both exciting and daunting. You’re taking a giant leap in a positive direction to increase your efficiency, enhance the functionality of your accounting system, and optimize your processes.

But great reward doesn’t come without some risk: you’ve likely already considered employee learning curves, potential technical challenges during the transition period, and how a new implementation could disrupt daily operations. These concerns are valid, and with the right expectations, the journey can be smoother and more rewarding for everyone involved.

Hard Work Ahead: Embracing the Challenge

Let’s be honest: implementing a new accounting system isn’t a walk in the park. It requires time, effort, and resources to ensure a successful transition. From data migration to process reengineering, numerous tasks need to be completed with precision and attention to detail. It’s a journey that will test the resilience and determination of the entire team.

Rowing in the Same Direction: Unity in Purpose

Implementing a new accounting system requires a collective effort from your entire team. Everyone on board must be rowing in the same direction; if you notice team members resisting the change, it’s best to address the issue head-on. Ultimately, the goal is not to make their jobs harder; it’s to improve their workflows and processes in the future by putting in the hard work now. And for your implementation to be as successful and pain-free as possible, every team member must be ready to embrace change, adapt to new processes, and support one another throughout the transition. With a company culture of collaboration and communication, we can overcome any challenges that come our way while implementing your new accounting infrastructure.

Charting the Course: Milestones and Deadlines

Like any major project, implementing a new accounting system involves setting milestones and deadlines to keep the team on track. These milestones serve as checkpoints to assess progress and make necessary adjustments along the way. Whether we’re completing data migration or conducting one-on-one training with your team, each milestone brings us one step closer to our ultimate goal: to give you a beautiful accounting infrastructure that meets your current business needs and still leaves room for growth.

Bringing It All Together: The “Go Live” Date

The “go live” date is the culmination of your months of hard work and preparation. It’s the moment when the new accounting system officially replaces the old one, and all systems are a go! Reaching this milestone involves coordinating a multitude of moving parts, from finalizing configurations to conducting system testing. Everyone needs to be aligned and working together towards this common goal.

Embracing Differences

Transitioning to a new accounting system inevitably brings about comparisons between the old and the new. From software functionalities to workflow processes, there will be changes that require adjustment and adaptation. It’s important to acknowledge these differences and approach them with an open mind and a willingness to learn. We wouldn’t be guiding you through an implementation if we didn’t already understand your business’s unique needs and believe we were charting the best path forward for you. With the right mindset, we can turn the differences between your former and future accounting systems into opportunities for growth and improvement.

Implementing a new accounting system is a significant undertaking that requires dedication, perseverance, and teamwork. By setting clear expectations and rallying the team around a common goal, we can confidently navigate this journey and achieve success. You can learn more about our implementation services here.

New Business Direction LLC

New Business Direction LLC