Before we get too far into 2017, let’s take a look back at 2016 results and five meaningful numbers you may want to discover about your business’s performance. To start, grab your 2016 income statement, or better yet, give us a call to help you compute and interpret your results.

Revenue per Employee

This number measures a company’s productivity with regard to its employees and is relevant and meaningful for all industries. If you have part-time employees, compute a full time equivalent total and use that as your denominator.

Compare this number to prior years to see if your company is getting more or less productive. Also compare this number to businesses in your same industry to see how your company compares to peer companies.

You may also want to compute other revenue calculations, such as revenue by geography, revenue by product line, or average sale: revenue by customer, if you feel these may be meaningful to your business.

Customer Acquisition Cost (CAC)

How much does it cost your business to acquire a new customer? That is the customer acquisition cost and is made up of marketing and selling costs, including marketing and selling labor. You’ll need the number of new customers acquired during 2016 in order to calculate this number.

Compare this number to prior years as well as industry peers. You can potentially do a lot to lower this number by boosting your marketing skills and implementing lower cost marketing channels.

Overhead Costs

Overhead costs are costs that are not directly attributable to producing or selling your products and services. They include items such as rent, telephone, insurance, legal expenses, and executive salaries. Although it’s not standard practice to break out overhead expenses from other expenses on an income statement, it’s valuable to know the numbers for performance purposes.

Compare your overhead costs to prior years and industry averages. You can actively manage your overhead cost by re-negotiating with vendors on a regular basis and trimming where it makes sense.

Profit Margins

Your profit margin can help you determine which division of your business is most profitable. If you sell more than one product or service, you can compute a gross or net margin by product or service. You can also compute margins by geography, sales rep, employee, customer, or any other meaningful segment of your business.

Your accounting system may be able to generate an income statement by division if everything has been coded correctly and overhead has been allocated appropriately. Reach out if you’d like us to help you with this.

Seeing which service or product is most profitable can help you decide if you want to try to refocus marketing efforts, change prices, discontinue items, fire employees, attract a different type of customer, or any number of other important decisions for your business.

Breakeven Point

Do you know how many units you need to sell in order to start generating a profit? If not, the breakeven calculation can help you learn this information. The formula is Fixed Costs / (Sales Price per Unit – Variable Costs per Unit) which results in the number of units you need to sell in order to “break even” or cover your overhead costs.

The breakeven point helps you plan the amount of volume you need in order to ensure that you have healthy profits and plenty of cash flow in your business.

These five numbers can help you interpret your business performance on a deeper level so you can make better decisions that will lead to increased success in your business. If we can help with any of them, please give us a call any time.

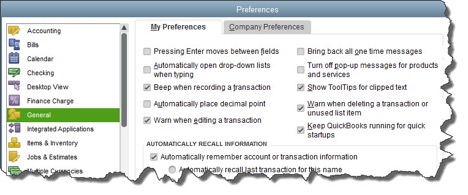

- Accounting. Do you want to use account numbers & classes?

- Checking. Which accounts should QuickBooks automatically use for tasks like Open the Pay Bills, Open the Make Deposits, and Open the Create Paychecks?

- Finance Charge. Will you be assessing finance charges on late payments from customers? What’s the interest rate, minimum finance charge, and grace period?

- Items & Inventory. Do you want inventory and purchase orders to be active?

- Multiple Currencies. Does your company do business using other currencies? This preference is NOT reversible, it cannot be turned off once it is turn on – be sure that you know this!

- Payments. Can customers pay you online? What methods can they use?

- Payroll & Employees. Will you be processing payroll using QuickBooks?

- Sales & Customers. Do you want to use sales orders? How should QuickBooks handle invoices when there are time and costs that need to be added?

- Reminders. Ask QuickBooks to track critical dates and tasks and remind you of them.

If there is a period of time between when your customers receive your goods or services and when they pay for them, then several things are true:

- You have a balance in Accounts Receivable on your balance sheet that represents how much customers owe you

- You have an invoice process that you follow

- You have granted credit to customers

- You may have some that don’t pay as quickly as you’d like them to

Each invoice you send should have payment terms listed. A payment term is the period of time you expect the invoice to be paid by the customer. Your payment terms should be set by you, not your customers!

Payment terms are always measured from the invoice date and define when the payment should be received. Here are some common payment terms in accounting terminology, and then in English.

Net 30

Payment is due 30 days from the invoice date.

2/10 Net 30

Payment is due 30 days from the invoice date. If you pay the invoice in 10 days, you can take a 2% discount off the total amount of the invoice as an early pay discount incentive.

Due Upon Receipt

Payment is due immediately

If you use Net 30 or Due Upon Receipt, then you may want to change your terms to get paid faster. When people see Due Upon Receipt, sometimes they translate it into “I can take my time.” A more specific term spelled out such as Net 7 or Net 10 will actually get you your money faster than Due Upon Receipt.

Do you have issues with people paying you late? If so, you might want to set consequences. Consider adding a line on your invoice that provides interest charges if the payment is late. Utility companies do it, and so do many businesses. A common percentage to charge is 1% – 2%, however, some states have laws that limit you to 10% or another percentage.

The wording would be something like this:

“Accounts not paid within __ days of the date of the invoice are subject to a __% monthly finance charge.”

You will also need to make sure your accounting system can automatically compute these fees.

If you have questions about payment terms, your invoicing process, or your accounts receivable, please reach out.

Tim Ferriss made the 4-hour workweek a popular concept in his 2007 book. But is there such a thing, and more importantly, can business owners like you and me cash in on it? As the last of the Baby Boomers approach retirement, the topic of working less while making the same or more income is popular.

Here are five ideas to help you work fewer hours while making the same or more income.

Active vs. Automatic Revenue

Some business models allow you to generate automatic revenue. Automatic revenue is revenue you can earn and leverage over time by doing something only once and not over and over again. Active revenue is earned while doing something over and over again. Showing up for a teaching job with a live audience is active revenue while producing and selling video recordings of the same teaching is automatic revenue.

A goal of a 4-hour workweek concept is to increase automatic revenue while reducing active revenue. You may have to think out of the box to do this in your industry, but the payoff can be huge.

Delegation and Outsourcing

One traditional way to move to a 4-hour workweek is to have others do the work. Hiring staff frees up your time and allows your business to become scalable. When it runs without you, it’s more salable too.

Time Batching

If you have a lot of distractions in your day, you can easily double your productivity by learning time batching, which is grouping like tasks together in a block or batch of time and getting them done. For example, if an employee interrupts you with questions multiple times a day, train them to come to you only once a day to get all their questions handled at one time. Take your calls one after the other in a group, and then stay off the phone the rest of the day. Do the same with email, social media, running errands, and all of your other tasks.

Automation and Procedures

New apps save an amazing amount of time. List all of your time-consuming chores and then find an app that helps you get them done faster. For example, a scheduling app can reduce countless emails back and forth when setting meetings and appointments. To-do list or project management software can cut down on emails among you and your staff. And apps like Zapier can connect two apps that need to share data, reducing data entry.

Leverage

The key to working less is to embrace the concept of leverage. How can you leverage the business resources around you to save time, increase staff productivity, and improve profits? It takes discipline and change, two difficult goals to accomplish. But when you do, you will be rewarded.

Accounting automation has come a long way in the last few years, and the process of handling invoices and receipts is included in those changes. No longer is there a mountain of paperwork to deal with. In this article, we’ll explain some of the changes in this area.

Vendor Invoices

Most invoices are now sent electronically, often through email or from accounting system to accounting system. Some accounting systems allow the invoice document, usually in PDF format, to be attached to the transaction in the accounting system. This feature makes it easy for vendor support questions as well as any audit that may come up.

Some systems are smart enough to “read” the invoice and prepare a check with little or no data entry. Others are able to automate three-way matching – this is when you match a purchase order, packing slip, and invoice together – so that time is saved in the accounts payable function.

Receipts

Today’s systems allow you or your bookkeeper to scan in or take cell phone photos of receipts – whether cash or credit card – and then “read” them and record the transaction. This type of system cuts way down on data entry and allows the accountants to focus on more consultative work rather than administrative work.

Some vendors will email you receipts so all you have to do is use a special email address where your accountant is copied or forward the receipt as you receive it.

The biggest challenge for business owners is getting into the habit of photographing the receipt and sending it to the accountant. The days of shoebox receipts are not completely over, but cloud-savvy business owners are definitely enjoying the alternative options of today’s paperless world.

Approvals

Some systems automate bill approval. This is especially handy for nonprofits or companies with a multi-person approval process. It cuts down on approval time and the time it takes to pay the bill.

New Systems

There are many 3rd party applications that automate a part of the vendor payment or receipt management system. All of them have different features, platforms, software requirements, integration options, and pricing. Many of them integrate with Quickbooks, some with the desktop version, some with Quickbooks online and some integrate with both platforms.

- BILL

- Hubdoc

- Receipt Bank

- Expensify

- SmartVault

- Doc.it

- Tallie

- Concur

- LedgerSync

- ShoeBoxed

- ShareFile

If you are interested in finding out more about automating your accounts payable invoices or receipts, please reach out anytime. We have partnerships with many of these 3rd parties for preferred pricing and in most cases we have certified in their products.

If you grant credit to customers, then you have a balance in accounts receivable. DSO stands for Days Sales Outstanding, and this helps you measure how fast your receivables are being converted to cash.

Here’s how to calculate it:

DSO = Accounts receivable balance / Annual net credit sales * 365.

DSO is measured in days and it represents how many days it takes to collect the customer invoice balance and convert it to cash.

Whether the DSO measure is “good” or not varies by industry as well as the terms you’ve set for your clients. If you’ve set your invoices to be due in 30 days and your DSO is 45 days or less, that’s pretty good. If you’ve set your invoices to be due in 10 days and your DSO is 60 days, then you might want to consider a more aggressive collection policy to speed up your cash flow.

Here are some tips to reduce DSO:

1. Invoice clarity.

Make sure your invoices are accurate and clear. Make it clear whom to make the check out to, where to mail it, the due date, and the amount due. All of these features should be easy to find on the invoice.

2. Consider discounts.

A common discount term is 2/10, net 30. This means the customer can take two percent off their invoice if they pay in 10 days; otherwise they owe the whole amount in 30 days. If you have customers from large companies, discounts are often required by policy to be taken and this can speed up your payments from them.

3. Consider electronic payments.

Going paperless with your invoicing as well as your payment process can speed up the entire billing cycle. Customers getting their bills earlier will also pay earlier.

What’s your DSO? If you need help calculating it, give us a call.

I know that many of you are wondering if you should upgrade to the new Windows 10 operating system. It has been hard to ignore the constant reminders of this FREE upgrade. Every time we turn on our computers, there it is, asking us to Upgrade Now. Some of us have even had a surprise automatic installation of the newest operating system while we were sleeping!

Microsoft is offering this software for free until the end of July 2016, after which they are going to charge a fee – currently starting at $149 per system for the Home Edition – they have not yet released any pricing for the Professional versions of the software. If you are currently running Windows 8/8.1, then you may wish to consider the update to Windows 10, but please read further.

At New Business Directions, LLC, we have decided to stay with the Windows 7 platform and not to upgrade to Windows 10. Microsoft will still be issuing updates for Windows 7 until 2021 but will not offer any phone or online support for the product.

There have been many issues with the installation of Windows 10 especially in a networked environment and the software needs a lot of tweaking to network correctly and play with other devices – such as printers. We see no real advantage to updating to Windows 10 and we have found it to actually hinder some programs from running properly, specifically QuickBooks and Point of Sale.

New Business Direction LLC

New Business Direction LLC