Ever wonder why you’re so busy this time of year? As you probably already know, there are a lot of extra tasks needed to be completed for year-end. While much of it is required by the government, clean-up and adjustments are vital to keeping your books accurate.

Here are just some of the items that are performed at year-end:

Books-related:

- Just about every asset on your balance sheet needs to be verified in some way or other:

- Petty cash accounts need to be reconciled and reimbursed as of year-end

- Bank accounts need to be reconciled with the bank statements. This includes PayPal.

- Accounts receivable balances and all other receivables need to be tied to each customer and any amounts determined to be uncollectible need to be written off.

- A physical inventory count needs to be taken and the inventory account should be adjusted accordingly.

- Fixed assets need to be reconciled to their fixed assets ledger and depreciation should be properly recorded.

- Goodwill accounts need to be checked and amortization adjusted.

- Prepaids, deposits, and all other asset accounts need to be adjusted if necessary.

- Liabilities and equity need to be adjusted too:

- Accounts payable balances and all other payables need to be tied to each vendor.

- Credit card accounts need to be tied to the statements and reconciled.

- Liabilities that haven’t been recorded need to be added to the books.

- Loans need to tie to lender statements, and interest paid on loans needs to be properly expensed.

- The Equity accounts need to be checked and tied out to prior year balances.

- Corrections and adjustments need to be made:

- Any misclassifications and corrections need to be made on the books with adjusting journal entries or other classification tools.

- If the client is a cash-basis taxpayer, a reversing journal entry needs to be made to get the correct tax numbers.

- A clean set of reports can now be run and used.

Tax-related:

- If you have payroll, employees need to be sent their W-2s before the end of January, and the federal and state government need a copy of the W-2s with a W-3 transmittal.

- For employees, you may also be required to have an up-to-date W-4 signed by them.

- For employers, your federal unemployment 940 return is due.

- If you have contractors, they need to be sent their 1099s before the end of January, and the IRS needs the 1099s and the 1096 transmittal.

- For contractors, you must also have an up-to-date W-9 form from them. You may also need to request an insurance certificate, or you may get a surprise at your workers compensation audit.

- For vendors who claim exemption from sales tax, you’ll need to be sure you have an exemption certificate in your files from them.

- If you pay sales tax annually, your return and payment are due.

- Your personal federal, state, and local income tax and returns are due in the spring, or they can be extended until later in the year.

- Depending on the type of entity your business is organized as, you may have franchise, federal and state tax returns to file. This deadline comes up sooner than the individual tax return due date.

Documents-related:

- This is a good time to file and store your receipts in case you are ever asked for them. For long-term storage, thermal receipts should be copied or scanned in before the ink fades.

- This may be the perfect time to start thinking about paperless document storage!

We are often so busy this time of year because of all the extra work we must do over and above the normal monthly load. If you have questions about any of this, please reach out anytime.

Here Rhonda’s latest video on how to add multiple users in you QuickBooks Desktop file:

Here is how to add users in your QuickBooks Online file:

Custom fields in your accounting software are data fields that you can define yourself. They are typically associated with customers, vendors, employees, and items, and they can help you store and categorize additional information about these stakeholders and your products and services in your business.

Custom fields in your accounting software are data fields that you can define yourself. They are typically associated with customers, vendors, employees, and items, and they can help you store and categorize additional information about these stakeholders and your products and services in your business.

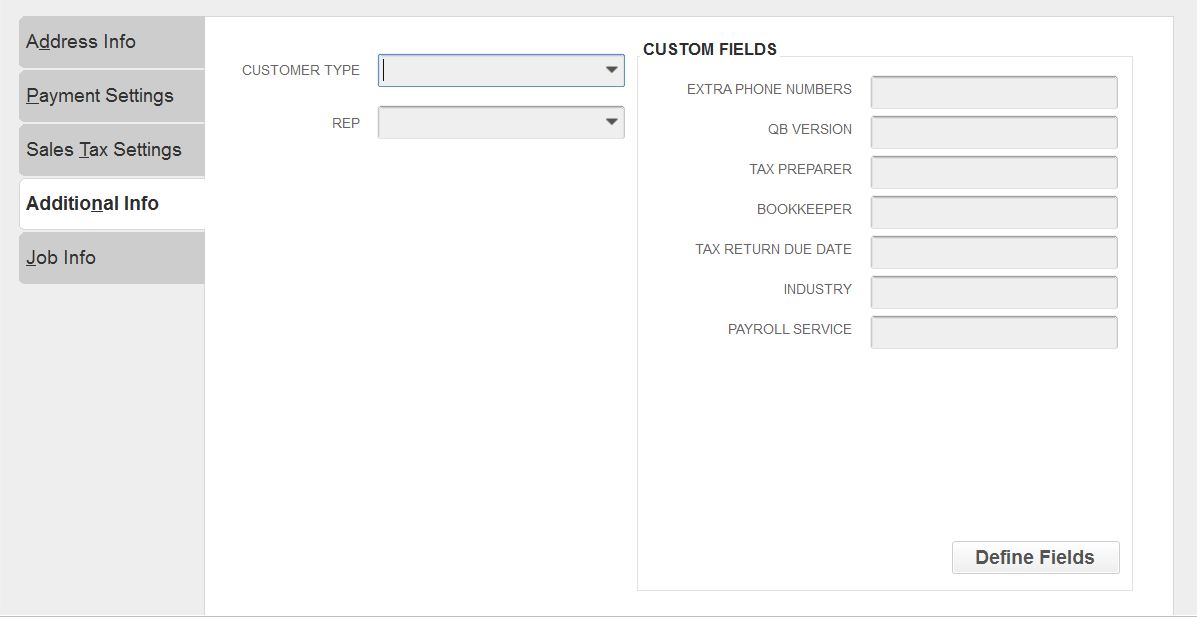

Custom Fields in QuickBooks Desktop

An example custom field that can be associated with customers is their anniversary date with you. You could also decide to store their birthday, their spouse’s name, their favorite color, or their shoe size.

Custom fields add functionality to your accounting system. Here are a few examples of practical uses for custom fields:

- Contact for customer – if customers are assigned a particular team member, you can add their name in a custom field

- Frequency of service – daily, weekly, monthly

- Warehouse location

- Type of customer; for example, non-profit, construction, retail, restaurant

- Referral Source

- Preferred method of contact: email, phone, fax, text, chat

- License number

Our customer custom fields track which version of QuickBooks you use, what payroll service is active, who your tax preparer is, etc. Then we can sort on any one of these fields.

Some software allows you to choose the type of custom field you want to add. In some cases, this allows for cleaner data as the data can be limited to a certain type or certain values upon entry. Here are the most common types:

- Free form text – this is the default type; it can come as a single line or paragraph

- Check box – choose one or more values from a limited number of choices

- Radio button – choose only one value from a limited number of choices

- Drop down – choose a value from a dropdown list

- File upload – add an attachment

- Image upload – upload an image that will be displayed

- Date/time – enter a date or time

- Number – enter a number; it can be currency, integer, or another mathematical type of number

Custom fields allow you to meet your company’s unique needs over and above what the software provides by default. It’s a great way to make your data more meaningful. If you have some ideas for custom fields in your accounting software and want help setting them up, feel free to give us a call anytime.

Nobody likes, them, but sometimes it happens. This is how you record it in QuickBooks if this happens to you.

Learn How to Record a Bounced Check From a Customer in QuickBooks® with Rhonda Rosand, CPA and QuickBooks® ProAdvisor from New Business Directions, LLC

If you want to swap services with a vendor or customer, great! But did you know barter transactions are taxable, and they need to be recorded on your books. Here’s a video from Rhonda on exactly how to record barter transactions: https://www.youtube.com/watch?v=iOAaOrojGhI

Learn How to Use the Same Name on Different Lists in QuickBooks with Rhonda Rosand, CPA of New Business Directions, LLC.

A great way to make a wonderful start to 2020 is to wrap up 2019 feeling organized and on top of the world. Here’s a checklist of items that you can start on now to make your year-end close go smoother than ever before. And don’t worry if you don’t know how to do some of these tasks – that’s what we’re here for.

A great way to make a wonderful start to 2020 is to wrap up 2019 feeling organized and on top of the world. Here’s a checklist of items that you can start on now to make your year-end close go smoother than ever before. And don’t worry if you don’t know how to do some of these tasks – that’s what we’re here for.

- Catch up on your books, especially if you do them only once a year. By doing it now, you’ll be

able to get into your accountant faster this time of year and they will appreciate getting the work done ahead of their crunch time.

able to get into your accountant faster this time of year and they will appreciate getting the work done ahead of their crunch time. - Catch up on bank reconciliations in case they are not up to date. Don’t forget your savings accounts, PayPal, and any other cash equivalents. Void any old uncleared checks if needed.

- Review unpaid invoices in accounts receivable and get aggressive about collecting them, especially if you are a cash basis tax payer. Clean up any items that are incorrect so that the account reconciles.

- Write off any invoices that are no longer collectible.

- Ask employees and vendors to update their addresses in your payroll system so that W-2s and 1099s will reflect the correct addresses.

- Collect any W-9s that you don’t already have on file for contractors that will receive a 1099 form from you.

- Collect workers compensation proof of insurance certificates from contractors so you won’t have to pay workers comp on payments you have made to them.

- Collect sales tax exemption certificates from any vendor who has not paid sales tax.

- Decide if you’ll pay employee bonuses prior to year-end. Reminder: This payroll is subject to withholding taxes.

- Review employee PTO and vacation time and reset or rollover the days in your payroll system.

- After the final payroll runs, contact your payroll software company to make any W-2 adjustments necessary for things like health insurance.

- Set the date to take inventory, and once you have, make adjustments to your books as necessary.

- Write off any inventory that is unsalable. If possible, sell scrap inventory or other waste components.

- Prepare a fixed assets register, calculate depreciation, and make book adjustments as needed. Leave the calculations and adjustments to us or your tax preparer.

- Record all bills due through year-end, and reconcile your accounts payable balance to these open bills.

- Make loan adjustments to reflect interest and principal allocations.

- Perform account analysis on all other balance sheet accounts to make sure all balances are correct and current.

- Make any additional accrual entries needed, or if you’re a cash basis taxpayer, make those adjustments as needed. You can leave these entries to your tax preparer.

- Get an idea of what your profit number will be. Choose whether you want to maximize deductions to save on taxes or whether to want to reflect more income. Decide what you can defer into 2020 or what you want to have as part of your 2019 results.

- Match all transactions with their corresponding documents – receipts, bills, packing slips, etc. – to make sure you have the paper trail you need. Go paperless – digitize these documents!

- Download your bank statements and store them in a safe place.

- Download any payroll reports and store them in a safe place.

- Scan in paper documents so that they’re stored electronically.

- File any important papers such as new leases, asset purchases, employee hiring contracts and other business contracts.

- Prepare a revenue and profit plan for 2020 and enter it into your accounting system.

- Take a look at the 2020 calendar to determine which holidays you’ll close and you’re your employees a copy of the schedule.

- Review your product and service prices if this is the time of year you do that and make any changes you decide on.

- Update your payroll system for any new unemployment insurance percentages received in a letter each year.

- Update the mileage deduction rate if that rate has changed at the beginning of the year.

- Set a time with your accountant to go over 2019 results and get ideas on how to meet your financial goals in 2020.

- Review the metrics you’ve been using in 2019 and decide on the list of metrics and corresponding values that will take you through 2020.

- Celebrate the new year; it’s a wonderful time to gain perspective and be hopeful about the upcoming year.

Start 2020 with a bang and this year-end checklist, and feel free to reach out if we can help with anything.

Learn How To Add & Edit Multiple List Entries in QuickBooks with Rhonda Rosand CPA and Advanced Certified QuickBooks ProAdvisor

Learn how to back up your QuickBooks file with Rhonda Rosand, CPA of New Business Directions, LLC.

When you pay a bill in your business, are you 100 percent comfortable that the bill payment is correct and justified? Is there ever a chance that that bill is fake or fraudulent? What about duplicates? With so many fake bills being mailed to businesses these days, it makes sense to think about controls you can put into place to reduce the risk that you might write a check out of your hard-earned profits that should never be written.

When you pay a bill in your business, are you 100 percent comfortable that the bill payment is correct and justified? Is there ever a chance that that bill is fake or fraudulent? What about duplicates? With so many fake bills being mailed to businesses these days, it makes sense to think about controls you can put into place to reduce the risk that you might write a check out of your hard-earned profits that should never be written.

Accounts Payable Controls

In the accounting profession, the term “internal controls” refers to processes, procedures, and automations you can put into place to reduce errors. In accounts payable, there is a specific subset of rules and controls you can put into place to reduce risk in this area. Here are just a few ideas.

1. Approvals

All bills should be approved by the appropriate level of employee in your business. Sometimes a bill gets approved that is fake or shouldn’t be approved, especially in areas where the approver doesn’t have technical knowledge of what they are buying. Be sure to read the fine print on the bill and make sure you know what you are paying for. There are ways to streamline the approvals process.

2. Segregation of duties

The person who pays the bill should be different from the person who submitted the bill. These people should be different from the one who signs the check. This reduces employee fraud.

3. Receipt confirmation

A packing slip or other confirmation of receipt of the goods or services should be matched to the bill, line item by line item.

4. Math check

A prudent step is to check a bill’s math, at least for reasonableness.

5. Duplicate payments

If a vendor emails their bill as well as mails a hard copy, controls should be put in place (usually automated) to avoid duplicate payments on the same bill.

6. Reconciliation

If there are a significant number of transactions between you and a vendor, an accounts payable reconciliation should be performed each month via a statement.

7. Missing check numbers

7. Missing check numbers

Most systems provide a missing check numbers report that you can use to make sure all checks are accounted for.

8. Bank reconciliation

A bank reconciliation is a sure way to see exactly what checks cleared your bank account.

9. Coding

Coding each transaction to the correct expense account, inventory, asset, or cost of goods sold account is an essential part of the process.

10. Income statement review

Each month, a review of the balances in your expense accounts as well as a disbursements ledger review for reasonableness can provide added peace of mind.

11. Purchase order

Requiring purchase orders is another control you can add to your process. Purchase orders should be matched to packing slips and bills before payment or approvals are made.

12. In-depth knowledge of your business’s numbers

The more you get to know the numbers in your business, the greater chance you’ll have of accurate accounts payable handling.

If you’d like to discuss your accounts payable function with us and how it can be improved and streamlined, we’re happy for you to reach out any time.

New Business Direction LLC

New Business Direction LLC