QuickBooks® will be sun-setting the 2016 Pro, Premier and Enterprise versions of their software as of May 31, 2019.

What this means for you? No more software updates from Intuit, no more hosting and no more support on the 2016 and earlier versions.

In addition, certain features will no longer be available in your QuickBooks® 2016 after May 31st – payroll processing, bank or credit card download links or the ability to email reports from within the software.

Now is a good time to evaluate your software needs, and we’re here to help.

As the source for all of your Intuit needs, let us help you! As always, we’re here to help make sense of QuickBooks®.

Each January we rush around to gather tax information on the independent contractors we paid in the prior year in order to send them a 1099. Here are some basic tips for making it easier and less hurried in your year-end preparations.

A link to the IRS’s instructions for 2018 can be found here.

Form W-9

As a trade or business, you are required to obtain a Form W-9 from your independent contractors before you pay them, better yet – before they do any work for you. This is regardless of how much money you pay them. This form will give you the name, business name, address, entity type and taxpayer identification number.

Who Needs a 1099?

Service Providers – Anyone you pay in the course of your trade or business for services rendered. This includes Accountants, Consultants, Architects, Engineers, Designers, Contractors, Plumbers, Electricians, Installers, Landscapers, Snow Removal companies, Cleaning companies, the Auto Repair technician, Entertainers – anyone who performs a service or casual labor for your business who is not your employee.

Rents – If your business pays rent for office space or land or equipment, you are required to send the recipient a 1099 for the amount of rent you have paid them.

Exclusions – Sole proprietorships, partnerships and LLC’s that are taxed as sole proprietors and/or partnerships receive a 1099. You are not required to send 1099’s to a Corporation or a Tax Exempt entity. The Form W-9 will provide information regarding the entity type.

Threshold – Send to recipients to whom you have paid $600 or more during the calendar year.

Using the QuickBooks® 1099 Wizard

QuickBooks® has a 1099 Wizard to create accurate 1099 and 1096 forms. It allows you to review and edit  your vendors, set up account mapping preferences, run a summary report to review data, and print 1099 and 1096 forms.

your vendors, set up account mapping preferences, run a summary report to review data, and print 1099 and 1096 forms.

Note: QuickBooks® is only capable of preparing 1099-MISC. If you need to prepare other types of 1099’s (e.g. 1099-INT, 1099-DIV), you will need to do so outside of QuickBooks®.

Deadline

For 2018, if you are reporting Non Employee Compensation in Box 7, you are required to file on or before January 31, 2019 to both the recipients and to the Internal Revenue Service.

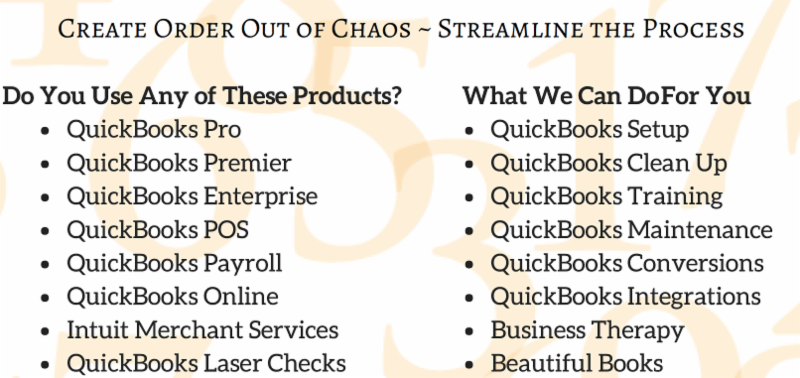

New Business Directions, LLC specializes in QuickBooks® set up, clean up, consulting and training services, coaching small business owners and providing innovative business solutions.

This article of QuickBooks Tips and Tricks was based on the 2018 version of QuickBooks®.

While “fetching” might be what some trained dogs can do, accounting systems are getting into the act too. This relatively new feature is called “receipt fetching,” and it’s when an app can retrieve documents directly from the vendors that you do business with so you don’t have to spend so much time on paperwork retrieval.

Apps that can perform receipt fetching can integrate with your accounts and pull invoices into their system. For example, if your business has an account with a utility or telecom company, the receipt fetching app can pull the electricity, water, or telephone bills into your receipt fetching app account and consolidate them.

The benefits are simple. You save time, certainly. But the bigger benefit is you no longer have a monthly deadline to get your documents to your accountant — at least for all the documents that can be automated in this way. This reduces stress and eliminates minutiae from your day.

Accountants benefit too. No accountant likes to spend their time asking clients for documents over and over again. We know you have better things to do with your time, and we know you probably hate doing the paperwork. Receipt fetching is an easy way to get the job done.

To take advantage of receipt fetching, the first step is to select a receipt-fetching app. A few of the apps to select from include LedgerDocs, ReceiptBank, HubDoc, and Greenback. Some of these apps do receipt fetching only, and others have many more functions.

The second step is to detemine which vendor accounts are supported, and to connect with them. Generally speaking, the connection is based on your account credentials, so if those change, the connection will need to be updated. When many of your documents can be pulled into one place, you don’t have to spend time logging into each vendor portal to pull receipts.

If you’re curious about how to benefit from receipt fetching in your business, please feel free to reach out.

Internal control is a very special phrase in the accounting profession. Tactically, it’s the set of processes that help a company produce accurate data throughout the organization, follow reporting requirements and laws, and maintain consistency and accuracy in its operations. Strategically, it’s an entirely new way of thinking and doing business.

Internal control helps to reduce organizational risk. A blunt way of putting it is internal control is what you put in place to avoid mistakes, intentional or accidental, and to control accuracy and quality. It impacts every aspect of an organization.

As a small business, you’ll want to be familiar with the concept because it can help you reduce risks you might not realize you have. Here are some practical examples of good ideas that support internal control:

- When data is private and secure, provide access only to employees who need to know the data and restrict access of others.

- Have someone check that your bank balance matches the reconciled amount in your books, and that someone should be different from the person who does the reconciliation. This is an example of what’s called segregation of duties.

- Lock up paper checks and use the missing check number report to make sure none of the stock could be used for nefarious purposes.

- Have employees sign in and out equipment that they take home. This is part of asset management.

- Write and enforce a hardware and software use policy that includes items like employees should make sure their anti-virus software is active at all times, they should not bring in disks or CDs, and they should not download games or other unauthorized programs. This protects from computer viruses and helps to avoid catastrophic network failures.

There are literally hundreds of internal control procedures that should be implemented in small businesses as they grow into larger businesses.

Internal control is typically a big part of an audit or an attest function in accounting; it determines how many additional procedures an auditor needs to do in order to provide assurances about the reliability of the financial reports. But it’s also just good plain common business sense to implement as many internal control processes as are cost-effective for your business to protect it at the level of risk you’re comfortable with.

If you’d like to discuss the idea of internal control further, please feel free to reach out any time.

The Mt. Washington Valley Economic Council

FALL 2018

QuickBooks® Desktop Boot Camps

with Rhonda Rosand, CPA – Advanced Certified QuickBooks® ProAdvisor

Session #1 QuickBooks® Set Up – Do It Right the First Time

Tuesday, October 2nd, 2018, 9 AM -11 AM

Whether you are starting from scratch or starting over, there is a right way and several wrong ways to set up a QuickBooks® file. Learn how to do it right the first time.

Avoid some of the common mistakes we see people make.

QuickBooks® Solutions

Accounts and Items

Users and Permissions

Customers/Jobs/Vendors

Class Tracking

Common Pitfalls

Session #2 Customizing Forms and Templates and QuickBooks® Reports

Tuesday, October 16th, 2018, 9 AM – 11 AM

Learn how to customize forms and templates and create QuickBooks® reports that are useful management tools for your business. Understand the difference between profits and cash.

Customize Forms and Templates

QuickBooks Reports

Revenue Planning

Cash Flow Management

Tuesday, October 23rd, 2018, 9 AM-NOON

This is a session designed exclusively for tax preparers, enrolled agents and accountants. We will cover advanced level topics to help you streamline the process and best practices for troubleshooting your client QuickBooks® file during this busy tax season.

What’s New in QuickBooks® 2019

In Product Demonstration of Features

Client Data Review and Accountant Toolbox

Common Issues and Troubleshooting

Hosting Platforms

3rd Applications

Courses are $35 each and held in the Community Room at Granite State College-Conway.

To register please call Susie at (603) 447-6622, email susie@mwvec.com, or register online.

A quick glance is all you need to check your fuel gauge, speed limit, engine temperature, and RPM when you’re driving down the road. Your car’s dashboard is designed to focus you on what’s important and what you need to know to have a safe trip.

Your car’s dashboard items, if they applied to business, would be called key performance indicators or KPIs. Unlike a car’s, the KPIs of your business vary depending on your business goals and what’s important to you. Common ones might include your cash balance, how fast you get paid, how much revenue is coming in, and whether you’re making plan. There are literally hundreds of them to choose from, and many of them are not derivable from your financial statements, such as number of orders, client satisfaction levels, and employee turnover.

Would it be useful to have a dashboard of KPIs for your business so you can know what’s working and get alerted to what needs focus? Here are the steps to creating a dashboard for your business:

- Decide on the KPIs you want to track. Selecting 6-10 to create and track is a good place to start.

- Select a tool that will provide you with the KPIs in the format you desire. There are many great add-ons to your accounting software that will instantly crunch the financial KPIs for you and present them in insightful formats, including charts, graphs, dashboards, and reports.

- Create any new processes to calculate the new KPIs and get them entered into the dashboard app.

- Hold a review meeting to go over the KPIs and determine any action based on the review.

There are many great KPIs available right in your accounting system, which might be plenty to get started with. And there are some real gems outside your accounting system that will take a bit of work to calculate. In any case, we can help you through this process. Feel free to reach out to us any time to discuss the possibilities of having a dashboard in your business.

If you have employees, you have the distinct honor once per year of being part of a worker’s compensation audit. You likely receive a form in the mail, an email request, or a phone call that will ask you about your payroll numbers and employees for the prior year.

Worker’s compensation is an insurance program that covers employees in the case they get hurt on the job. Each employee receives a classification code that describes the type of work they do, and a rate is figured based on the classification and its risk factors.

If you’ve hired anyone throughout the year, you might need to get a new classification by contacting your provider. If you have employees working in different locations (especially different states), that matters too.

The audit form will typically ask for gross payroll numbers by employee or by category or location of employee. That’s easy enough, but seldom does the policy run along your fiscal year, so the payroll figure needs to be prorated to match the policy period.

Your numbers need to tie back to the numbers reported on your quarterly payroll reports for both state and federal. The provider may also want copies of your 941s and your state payroll reports.

The auditor may also ask for subcontractor payments and certificates of expenses.

Once you’ve submitted your numbers, the insurance provider will calculate whether they owe you or you owe them additional fees.

You should do the math yourself to make sure their calculations are correct.

The worker’s compensation audit happens every year (even if you pay worker’s comp premiums each pay period, some companies still request an annual audit). It’s not difficult, but it is time-consuming. If this is something you’d like our help with, please feel free to reach out.

Fixed assets are special kind of assets in your business. They include land, buildings, equipment, furniture, and vehicles that your company owns. While we frequently look at expenses to cut costs, fixed asset management is another place we can look to find ways to better utilize our resources and, in some cases, improve our profits.

Fixed asset management is a discipline that requires keeping good records of the assets a company owns. In the case of furniture and equipment, many businesses place an asset tag on the item and assign it a number that goes in a spreadsheet where data is kept about the item. There are also software apps more sophisticated than spreadsheets that track all of the fixed assets for a company, including original cost, depreciation method and history, and tax treatment.

You never know how many of an item you might have until you record and count them. How many computers (and computer parts) do you have lying around your office? Extra desks and chairs? Maybe you even have extra office space or extra land.

Part of being a great entrepreneur is fully utilizing all the resources you have at your disposal. Where can you put to better use the extra assets you have? Could you sell the surplus items? Or donate them for a write-off? Do you have extra room to rent out to a tenant, earning rent?

Sometimes we’re so focused on operating the core of our business that we don’t see what else is a money maker right in front of us. In addition to focusing on income and expenses from operations, consider the resources you have in your fixed assets.

At the very least, consider developing a spreadsheet that tracks the major items your business owns. Or reach out to us, and we’ll help you develop a fixed assets schedule and tracking process for your business.

And if you do sell some of your fixed assets, be sure to reach out to us so we can help you record the transactions properly.

Social security is one of those topics that seems to be minimized by statements like, “You can’t count on it,” and “By the time you reach retirement age, it won’t matter.” Those statements are not only incorrect; they contribute toward a lack of education on what’s possible.

Social security is still a large part of how most seniors will be able to fund their final 20 to 30 years of life. The options we take toward claiming the benefits that are rightly ours are often permanent and can affect our lives and our finances significantly, often by tens of thousands of dollars.

No matter your age today, here are three things you’ll want to dive deeper into when the time is right for you.

Claim date

For retirement purposes, most people will claim their social security payouts any time from age 62 to age 70. It’s your choice to decide when you make the claim and start your benefits. But, and it’s a very big but, the amount you get each month will vary depending on your claim date. Generally, the later you wait, the higher your payout will be.

The federal retirement age for social security purposes depends on when you were born and creeps up a little each year. If you were born in 1954, your retirement age is 66 years old. If you file your social security claim on your retirement age, you’ll get 100 percent of your benefit. If you claim at 70, you’ll get 132 percent of your benefit, which can make a huge difference in payout over your lifetime: tens of thousands of dollars of difference. If you claim early at age 62, you’ll get far less.

Taxability

Your social security income may be taxable if you earn income in the same years you are collecting social security and if you surpass an earnings threshold. This takes many seniors by surprise. There are ways to plan for this, and they are so specific to each family circumstance and often so complicated that software has been developed to calculate all of the situations.

Eligibility

The amount of your social security payment is affected by dozens of factors, including family members’ ages, how much they paid into social security, pensions, previous marriages, and disabilities, to name a few. If any of your family members are disabled, there are payments for that in some cases.

If you are divorced and were married for more than 10 years, you are eligible for spousal benefits. And if you are married, you are also eligible for spousal benefits. If your spouse has passed away, you are eligible for survival benefits, which could increase an existing payment if your spouse earned more than you did.

Social security is clearly a topic where you don’t know what you don’t know. It’s so complex at this point that most people should work with an advisor who has software that can show multiple claiming options that optimize their lifetime payout or meet their financial retirement goals. If we can help, please reach out.

Learn How To Add & Edit Multiple List Entries in QuickBooks with Rhonda Rosand CPA and Advanced Certified QuickBooks ProAdvisor!

New Business Direction LLC

New Business Direction LLC