Nobody likes, them, but sometimes it happens. This is how you record it in QuickBooks if this happens to you.

Learn How to Record a Bounced Check From a Customer in QuickBooks® with Rhonda Rosand, CPA and QuickBooks® ProAdvisor from New Business Directions, LLC

If you want to swap services with a vendor or customer, great! But did you know barter transactions are taxable, and they need to be recorded on your books. Here’s a video from Rhonda on exactly how to record barter transactions: https://www.youtube.com/watch?v=iOAaOrojGhI

Learn How to Use the Same Name on Different Lists in QuickBooks with Rhonda Rosand, CPA of New Business Directions, LLC.

Learn How To Add & Edit Multiple List Entries in QuickBooks with Rhonda Rosand CPA and Advanced Certified QuickBooks ProAdvisor

Learn how to back up your QuickBooks file with Rhonda Rosand, CPA of New Business Directions, LLC.

Have a receivable you can’t collect on? Learn how to write off a bad debt in QuickBooks with Rhonda Rosand, CPA, Advanced Certified QuickBooks Proadvisor of New Business Directions, LLC.

QuickBooks is made up of Lists. The most important list in QuickBooks is the Chart of Accounts; it creates the framework for your financial reports from your Balance Sheet to your Profit and Loss statement and your statement of cash flows. It also creates the infrastructure for your budgets or revenue plan.

Learn about the Chart of Accounts in QuickBooks with Rhonda Rosand, CPA or New Business Directions, LLC.

Learn how to Navigate the Homepage of QuickBooks with Rhonda Rosand CPA of New Business Directions LLC.

QuickBooks® will be sun-setting the 2016 Pro, Premier and Enterprise versions of their software as of May 31, 2019.

What this means for you? No more software updates from Intuit, no more hosting and no more support on the 2016 and earlier versions.

In addition, certain features will no longer be available in your QuickBooks® 2016 after May 31st – payroll processing, bank or credit card download links or the ability to email reports from within the software.

Now is a good time to evaluate your software needs, and we’re here to help.

As the source for all of your Intuit needs, let us help you! As always, we’re here to help make sense of QuickBooks®.

Each January we rush around to gather tax information on the independent contractors we paid in the prior year in order to send them a 1099. Here are some basic tips for making it easier and less hurried in your year-end preparations.

A link to the IRS’s instructions for 2018 can be found here.

Form W-9

As a trade or business, you are required to obtain a Form W-9 from your independent contractors before you pay them, better yet – before they do any work for you. This is regardless of how much money you pay them. This form will give you the name, business name, address, entity type and taxpayer identification number.

Who Needs a 1099?

Service Providers – Anyone you pay in the course of your trade or business for services rendered. This includes Accountants, Consultants, Architects, Engineers, Designers, Contractors, Plumbers, Electricians, Installers, Landscapers, Snow Removal companies, Cleaning companies, the Auto Repair technician, Entertainers – anyone who performs a service or casual labor for your business who is not your employee.

Rents – If your business pays rent for office space or land or equipment, you are required to send the recipient a 1099 for the amount of rent you have paid them.

Exclusions – Sole proprietorships, partnerships and LLC’s that are taxed as sole proprietors and/or partnerships receive a 1099. You are not required to send 1099’s to a Corporation or a Tax Exempt entity. The Form W-9 will provide information regarding the entity type.

Threshold – Send to recipients to whom you have paid $600 or more during the calendar year.

Using the QuickBooks® 1099 Wizard

QuickBooks® has a 1099 Wizard to create accurate 1099 and 1096 forms. It allows you to review and edit  your vendors, set up account mapping preferences, run a summary report to review data, and print 1099 and 1096 forms.

your vendors, set up account mapping preferences, run a summary report to review data, and print 1099 and 1096 forms.

Note: QuickBooks® is only capable of preparing 1099-MISC. If you need to prepare other types of 1099’s (e.g. 1099-INT, 1099-DIV), you will need to do so outside of QuickBooks®.

Deadline

For 2018, if you are reporting Non Employee Compensation in Box 7, you are required to file on or before January 31, 2019 to both the recipients and to the Internal Revenue Service.

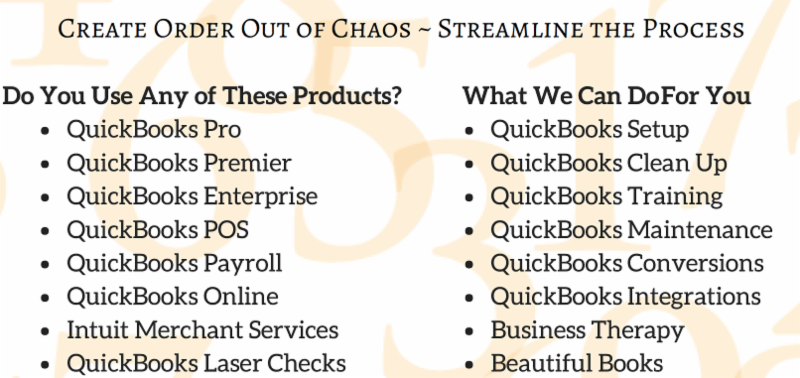

New Business Directions, LLC specializes in QuickBooks® set up, clean up, consulting and training services, coaching small business owners and providing innovative business solutions.

This article of QuickBooks Tips and Tricks was based on the 2018 version of QuickBooks®.

New Business Direction LLC

New Business Direction LLC