The Income Tracker is one of QuickBooks’ more innovative features. If you’re not using it, you should be.

One of the reasons that QuickBooks appeals to millions of small businesses is because it offers multiple ways to complete the same tasks, which accommodates different work styles. Say, for example, you wanted to look up a specific invoice. You could:

- Go to the Customer Center and select the customer, and then scan through the list of transactions,

- Use the Find feature (Edit | Find), or

- Create a report.

There’s also another way you can get there if you have a recent version of QuickBooks: the Income Tracker. (Note: Only the Administrator or a staff member with the correct permissions can access this feature. Talk to us about whether to allow other employees to use it, and how to set that up.)

|

| Figure 1: QuickBooks’ Income Tracker provides a visual overview of your company’s income. |

That’s the first thing you can do with QuickBooks’ Income Tracker. To get there, either click the link in the vertical navigation bar or go to Customers | Income Tracker.

Four colored bars across the top of the screen represent unbilled estimates, open invoices, overdue invoices, and invoices paid within the last 30 days. Each bar contains two numerical values: the number of transactions of that type and the dollar amount involved.

QuickBooks defaults to displaying all types of transactions, but when you click on a bar, the screen changes to show only that type of transaction.

You can also filter the table of transactions using the drop-down lists below the colored bars. Your choices here include Customer:Job, Type, Status (Open, Paid, etc.) and Date (range). Click the arrow to the right of each filter’s label to display your options.

The column labels below these lists will change depending on the transaction type that’s active.

|

More Functionality |

||

|

The Income Tracker is great for simply viewing groups of transactions; double-clicking on one will open the original form. You can also open them by selecting an action to take. For example, open your estimates list and click on a transaction to highlight it. Then click the arrow next to Select in the Action column at the far right end of the row.

If you choose the first option here, QuickBooks opens a small window that asks you whether you’d like to create an invoice for 100 percent of the estimate, a percentage of it, specific items, or percentages of each item. When you make your selection and click OK, a completed invoice form opens, which you can then check over and save.

As you can see above, you can also mark the estimate as inactive, print it, or email it.

Each transaction type supports a different set of actions. In the open invoice action column, as you’d expect, you can click the option to Receive Payment, which opens the Customer Payment window with the customer and amount due already filled in. This can be edited to reflect a different amount, or you can just accept it as is, then save it. |

|

Flexible Forms

|

||

|

You can even create a new transaction within the Income Tracker. Click on the arrow next to Manage Transactions in the lower left corner of the screen and select the form you want.

The Income Tracker also provides one of the fastest ways to print multiple forms. Just select the transactions you want to print by clicking in the box in front of them, and then click the arrow next to Batch Actions in the lower left corner.

Finally, you can edit transactions from here, too. Either double-click on one or select it and click Edit Highlighted Row in the Manage Transactions menu.

QuickBooks’ Income Tracker doesn’t do anything that can’t be done another way in the program. But it provides an excellent one-glance view of the current state of your receivables movement.

If you’re consistently seeing patterns that you don’t like, call us. We can evaluate your receivables process and suggest ways to accelerate it. Even if your sales aren’t increasing, getting that “PAID” stamp on invoices quickly will improve your cash flow and strengthen your confidence as a business manager. |

|

QuickBooks provides dozens of customizable report templates. You know when you need some of them, but which are musts?

You send invoices because you sold products and/or services. Purchase orders go out when you’re running low on inventory, and there are always bills to pay, it seems like. All of this activity is, of course, important in itself, but all of your conscientious bookkeeping culminates in what’s probably the most critical element of QuickBooks: your reports.

Reports can tell you how many navy blue sweatshirts you sold in March, what you paid for health insurance premiums in the first quarter, and how much you bought from your favorite vendor last month. They’re very good at drilling down to get the precise set of numbers you need.

But reports – carefully customized and properly analyzed – can do more than tell you how many golf clubs to order and when it’s time to switch phone services. They can help you make the business decisions that will help you take your growing company to the next level. There are several that you should be looking at regularly, some of which you can interpret easily and use in your daily workflow. We’ll help you with the interpretation of the more complex financial reports. |

|

Who Owes Money? |

|

That’s probably a question you ask yourself every day. You don’t necessarily have to run the A/R Aging Detail report every day, but you’ll want to run it frequently. It tells you who owes you money and whether they’ve missed the due date (and by how many days).

Figure 1: By running the A/R Aging Detail report, you can see whether you need to follow up with customers who have past due invoices.

As with any report, you can modify it to include the columns, data set and date range you want by clicking the Customize button. When you create a report in a format that you think you might want to run again, click the Memorize button. Enter a name that you’ll remember, and assign it to a Memorized Report Group.

|

|

Getting There

|

|

There are two ways to find the reports you want to see. You can open the Reports menu and move your cursor down to the category you want, like Customers & Receivables, which will open a slide-out menu of options there.

Or you can open the Report Center, which lets you explore reports in more depth. Each is represented by a small graphic with four icons under it. You can:

Figure 2: If you access QuickBooks reports through the Report Center, you’ll have several related options.

Other accounts receivable reports that you should consult periodically include Open Invoices and Average Days to Pay. |

|

Tracking What You Owe

|

|

Reports can also keep you up-to-date on money that you owe to other people and companies. An important one is Unpaid Bills Detail, accessible through the Vendors & Payables menu item. Though you can modify its columns, this report basically tells you who is expecting money from you, the date the bill was issued and its due date, any number assigned to it, the balance due, and relevant aging information.

Vendor Balance Detail is critical, too. This report displays every transaction (invoices, payments, etc.) that contribute to the balance you have with each vendor.

|

|

Standard Financial Reports

|

||

QuickBooks report categories include one labeled Company & Financial. These are reports that you can run yourself, but they’re critical for understanding your company’s financial status. We can customize and analyze these for you on a regular basis so you’ll know where you stand. They include:

Reports can only generate information about what you’ve entered in QuickBooks and exactly where it’s been entered. So it’s crucial that you follow standard accounting practice as you proceed through your daily workflow. We’re always available to answer questions you have about QuickBooks’ structure and your activity there. Your reports – and your critical business decisions – depend on it. |

There are a lot of clues that indicate trouble with your QuickBooks company file. Is it time for a check-up and tune-up?

After this ridiculously long winter, you’ll probably hear few complaints about things like puddles in the street, summer heat and spring cleaning. Most people are eager to throw open the doors and windows, and attack the dirt that the season left behind, both inside and outside of the house.

It’s not hard to see when your home is dirty. QuickBooks company file errors are harder to detect, but they’re there, including:

- Performance problems

- Inability to execute specific processes, like upgrading

- Occasional program crashes

- Missing data (accounts, names, etc.)

- Refusal to complete transactions, and

- Mistakes in reports.

Figure 1: If some transactions won’t go through when you click one of the Save buttons – or worse, QuickBooks shuts down — you may have a corrupted company file.

Figure 1: If some transactions won’t go through when you click one of the Save buttons – or worse, QuickBooks shuts down — you may have a corrupted company file.Call for Help

The best thing you can do if you notice problems like this cropping up in QuickBooks – especially if you’re experiencing multiple ones – is to contact us. We understand the file structure of QuickBooks company data, and we have access to tools that you don’t. We can analyze your file and take steps to correct the problem(s).

One of the reasons QuickBooks files get corrupt is simply because they grow too big. That’s either a sign of your company’s success or of a lack of periodic maintenance that you can do yourself. QuickBooks contains some built-in tools that you can run occasionally to minimize your file size.

One thing you can do on your own is to rid QuickBooks of old, unneeded data. The software contains a Condense Data utility that can do this automatically. But just because QuickBooks offers a tool doesn’t mean that you should use it on your own.

A Risky Utility

The program’s documentation for this utility contains a list of warnings and preparation steps a mile long.

We recommend that you do not use this tool. Same goes for Verify Data and Rebuild Data in the Utilities menu. If you lose a significant amount of company data, you can also lose your company file. It’s happened to numerous businesses.

Be Proactive

Instead, start practicing good preventive medicine to keep your QuickBooks company file healthy. Once a month or so, perhaps at the same time you reconcile your bank accounts, do a manual check of your major Lists.

Run the Account Listing report (Lists | Chart of Accounts | Reports | Account Listing). Are all of your bank accounts still active? Do you see accounts that you no longer used or which duplicate each other? Don’t try to “fix” the Chart of Accounts on your own. Let us help.

Figure 3: You might run this report periodically to see if it can be abbreviated.

Be very careful here, but if there are Customers and Vendors that have been off your radar for a long time, consider removing them – once you’re sure your interaction with them is history. Same goes for Items and Jobs. Go through the other lists in this menu with a critical but conservative eye. If there’s any doubt, leave them there.

A Few Alternatives

There are other options. Your copy of QuickBooks may be misbehaving because it’s unable to handle the depth and complexity of your company. It may be time to upgrade. If you’re using QuickBooks Pro, consider a move up to Premier. And if Premier isn’t cutting it anymore, consider QuickBooks Enterprise Solutions.

There’s cost involved, of course, but you may already be losing money by losing time because of your version’s limitations. All editions of QuickBooks look and work similarly, so your learning curve will be minimal.

Also, try to minimize the number of open windows that are active in QuickBooks. That will improve your performance. And what about your hardware? Is it getting a little long in the tooth? At least consider adding memory, but PCs are cheap these days. If you’re having problems with many of your applications, it may be time for an upgrade.

A Stitch in Time…

We’ve suggested many times here that you contact us for help with your spring cleanup. While that may seem self-serving, remember that it takes us a lot less time and money to take preventive steps with your QuickBooks company file than to troubleshoot a broken one.

Increasing your income is good. But even if you can’t, you can still take steps to collect the money you’re already owed faster. Here are five ways.

If you asked five small business owners to name the top three roadblocks they face in their quest for ongoing profitability, it’s likely that all five would point to slow payments.

It’s everyone’s problem. Accounts receivable requires constant monitoring. As satisfying as it can be to dispatch a group of invoices, you know that it’s going to take some work to bring in payment for at least some of them.

By using QuickBooks’ tools and complying with accounting best practices, you’ll be more confident during the invoicing stage that what you’re owed will actually be in your bank account in a reasonable amount of time. Here are five things that we suggest.

Let Customers Pay Invoices Electronically

A few years ago, this was a good idea. In 2014, when people have stopped carrying checkbooks and are accustomed to using their mobile devices to pay for merchandise, it’s become almost required. Whether or not you know it, you’re probably losing some business if you don’t have a merchant account that supports credit and debit card payments, and possibly e-checks.

If you have an online storefront, you’ve undoubtedly been accepting plastic for a long time now. Not many shoppers want to place an order on a website and hunt for envelopes and stamps and blank checks to complete it. If you invoice customers, it’s just as critical that you allow them to remit payment as soon as possible.

Not set up with a merchant account yet? We can help you get started with the Intuit Payment Network.

Keep a Close Watch on your A/R Reports

Part of being proactive with your accounts receivable is being vigilant and informed. Create and customize A/R reports regularly. When you customize your A/R Aging Detail report, for example, in addition to the other columns that you include, be sure that Terms, Due Date, Bill Date, Aging and Open Balance are turned on (click Customize Report | Display and click in front of each column label).

You should also be looking at Open Invoices and Collections Report frequently, or assigning someone else to monitor them closely. We can help here by creating more complex financial reports periodically, like Statement of Cash Flows.

Send Statements

Invoices are generally the preferred way to bill your customers, but you should consider sending statements when customers have outstanding balances past a certain date. QuickBooks sometimes calls these reminder statements. You’re not providing the recipients with any new information; you’re simply sending a kind of report that lists all invoices sent, credit memos and payment received.

To generate statements, click Customers | Create Statements. You’ll see the window pictured above. You can send statements to everyone, a defined group or one customer, and you can define the past-due status that you want to target in addition to other options.

Send Accurate Invoices the First Time

Few things will slow down your accounts receivable more than incorrect invoices. The customer can wait until payment is almost due to dispute the charges, which means that they’ll probably get another 15 or 30 days (or whatever their terms are) to pay the amended bill.

So whoever is responsible for creating invoices needs to be checking and re-checking them. If it’s logistically possible, and depending on your workflow, have them verified by a second employee.

Offer Discounts for Early Payment and Assess Finance Charges

Offering discounts is a balancing act. You’ll be getting less money for your sale – even 5 percent multiplied by many customers can add up – but it may make sense financially for you to take a small hit in return for being able to deposit the payment sooner. We can help you do the math here.

To offer this, you’ll have to set up your discount scenario as a Term option (Lists | Customer & Vendor Profile Lists | Terms List), as seen here:

To make a customer eligible for the discount, open the Customer Center and double-click on a customer, then on Payment Settings| Payment Terms.

You might also want to be assessing finance charges. The revenue you bring in from finance charges will probably be negligible. But sometimes, just knowing that a late payment will be more costly may prompt your customers to settle up in a timely fashion.

Whatever approaches you choose to accelerate your receivables, be consistent. If any of your customers should compare notes, you want to be regarded as being firm but fair.

You may not have even completed your 2013 taxes yet. But now is an ideal time to start getting ready for your 2014 returns.

We know that you’re in some stage of preparation for your 2013 income taxes. It may seem odd to start thinking about 2014 taxes just now, but actually, this is the ideal time to start planning and making business decisions with their tax implications always in the back of your mind.

As you look at the data that will be entered in your 2013 tax forms, you’re likely to come across some expenses that you might have handled differently, or some income that should have been deferred. If you begin your planning process for 2014 while 2013 is still in the works, you can start making smarter, more tax-advantageous business decisions now, instead of late in the year when everyone is rushing to take actions necessary to lower their tax obligation.

Here’s how QuickBooks can help you with this new approach.

Overhaul your Chart of Accounts

The mechanics of doing this in QuickBooks are fairly uncomplicated, but changing this critical list – the backbone of your company file – requires solid knowledge of which accounts should be added, deleted or changed. You also need to know which accounts and subaccounts will have impact on your income taxes. They must be structured accordingly.

Figure 1: QuickBooks’ default Chart of Accounts can be easily modified to meet your company’s unique needs. But let us help you with this task.

For these reasons, we ask that you consult with us if you think your Chart of Accounts could use an overhaul. Our early involvement will be much more economical for you than if we have to come in down the road when your accounts have become dangerously tangled.

Devise an Effective System for Estimated Taxes

As you well know, there’s no magical formula for estimating how much income tax you’ll owe when all of your income and expenses have been tallied. We can make this an ongoing task by creating monthly or quarterly financial reports for your business and working from those.

If you’re self-employed, you might want to open a low-fee checking account that will serve solely as your tax fund. Because you have no employer to pay a portion of your Social Security and Medicare obligations, it’s critical that you’re putting enough away. Consider putting one-third of your taxable income into that account and see how it goes. You may get a pleasant surprise at tax prep time, or you may have to dip into other savings to be compliant.

Figure 2: You may want to set up a separate bank account to park estimated tax funds, so you know they’re committed. Ask us about numbering new accounts.

You can submit federal payments online on the Electronic Federal Tax Payment System site. Check with us to see if your state has an electronic system. Of course, the IRS will accept a check.

Run Reports on Everything. And Keep Running Them.

We already mentioned that we’re happy to create and analyze your most critical financial reports on a regular basis. You may have tried to understand the Trial Balance, Statement of Cash Flows, etc. in QuickBooks and been puzzled. Don’t feel incompetent because of that: It often takes an accountant-level individual to understand what they mean for your business.

You can define and build your own reports using QuickBooks’ customization tools. If you have employees who travel, consider bringing in an automated expense report application (we can help you find one and implement it). Stress the importance of adhering to IRS rules about travel. Same goes for your local salesforce, off-site technicians and other service providers, etc.

For employees who come into the office every day or are telecommuting, you can give them some ownership of their contribution to expenses by bringing them into the budget process and/or requesting that they submit their own monthly mini-reports on any company funds they spend. The more employees are aware of and accountable for expenses, the easier it will be for you to work toward minimizing your tax obligation. And having some information about the considerable sum you pay in taxes may help staff understand your tightening of the purse strings.

Consider Retraining Bookkeeping Staff if Necessary

You may be paying a portion of your taxes unnecessarily, simply because your company’s bookkeeping is less-than-precise. Nip that in the bud.

The more you manage your reporting, stay aware of the consequences of every expenditure and bring employees into the process, the more prepared you’ll be for 2014 taxes.

QuickBooks can be used as is, or you can customize many elements to improve your workflow, your form output and your business insight.

While many of the things you purchase and use in your daily work and professional lives don’t come with options, many do. Think about the last time you bought a car, for example. Did you request additional features for safety or convenience or aesthetic value?

You can’t buy “extras” with your copy of QuickBooks. You can select from the different versions (Pro, Premier, etc.) and extend the software’s functionality by installing integrated add-ons from the Intuit App Center. But if you install QuickBooks on two machines from the same DVD or download, they’ll look and work the same.

Figure 1: Need more functionality in areas like CRM or receivables? Talk to us about adding an integrated app.

That is, until you start customizing the product, which you should do. The customization options in QuickBooks let you:

- Change the appearance of your desktop

- Modify forms to include only needed content and to make them look professional and uniform, and

- Drill down deeply on your company data to isolate only the information that you want.

The benefits of customization are obvious. You’ll accelerate your workflow, polish your image and get insight that helps you make critical business decisions.

Your Desktop View

QuickBooks has always made your most commonly-used tools available on the home page. Intuit revamped this screen very skillfully starting with the 2013 versions, so it’s much cleaner and less cramped. But if you don’t use all of the functions represented by icons, you don’t have to even see them.

Figure 2: You can remove icons from the home page, but not if related features are enabled.

You can remove icons like Estimates and Time Tracking if you’re not planning to use those functions, but some icons must remain if specific features are active. For example, if sales orders and estimates are enabled, invoices are automatically turned on. Likewise, if you’ve enabled Inventory, Enter Bills and Pay Bills are locked in, too.

There’s an option to either limit the QuickBooks display to one window or let multiple windows open simultaneously. When you open QuickBooks, you can choose to have a specific set of windows open, the window or windows that were open when you shut down, or no windows.

Your Forms

QuickBooks comes with pre-defined forms for transactions like purchase orders, invoices and sales receipts. If you don’t like the look of one of these default templates, you can download one from the dozens of alternatives that QuickBooks supplies. You can alter these to better meet your needs – even creating multiple versions of the same type of form to use in different situations.

Columns and fields can be added, deleted, renamed and repositioned so that your forms contain only the information that your business requires. You can add your logo and change fonts and colors. Once you’ve settled on a design, you can apply it to multiple forms to present a unified image to your customers and vendors.

Figure 3: You can specify which fields will appear – both onscreen and in print — in your templates’ headers, footers and columns. QuickBooks provides the tools to do all of this, but let us help you if you plan to do much modification. It can be challenging, especially if you have to use the Layout Designer.

Figure 3: You can specify which fields will appear – both onscreen and in print — in your templates’ headers, footers and columns. QuickBooks provides the tools to do all of this, but let us help you if you plan to do much modification. It can be challenging, especially if you have to use the Layout Designer.

Your Reports

You already know that you can do simple modification of your reports, like changing the date range. You may even have clicked on Customize Report and altered the column structure of a report and its sort order.

But do you regularly click on the Filters tab in the Modify Report dialog box? If you’re often frustrated because your reports cover too much ground or an inadequate, unfocused level of detail, you should be exploring the options offered here regularly. Filters restrict the data in a given report to a smaller, more targeted group of records or transactions, based on your needs.

For example, you might want to find out which customers in your New Construction class have outstanding balances (based on invoices) of more than $500 that are more than 60 days old. You’d set up Filters to create this screen:

Figure 4: You’ll learn far more about your company’s financial status if you use Filters in reports. We can help you set up the most effective ones for your business.

Figure 4: You’ll learn far more about your company’s financial status if you use Filters in reports. We can help you set up the most effective ones for your business.

Why not resolve to make your copy of QuickBooks your copy of QuickBooks in 2014? Some customization processes will require some upfront time, but once you get going, you’ll wish you’d done this sooner.

Depending on the situation, there’s more than one way to record a customer payment in QuickBooks. Here are your options.

There are undoubtedly some QuickBooks tasks that are more enjoyable than others. It’s no fun paying bills, for example, and making collection calls on unpaid invoices can be downright unpleasant.

But you probably don’t mind recording customer payments, sending invoices or statements, and generating reports to make sure you’re on top of it all.

QuickBooks offers more than one way to document customer remittances, and it’s important that you use the right one for the right situation.

Defining the Destination

Figure 1: Uncheck the box on the farthest right if you think you may want to direct payments to other accounts sometimes.

Before you begin receiving payments, you need to make sure they’ll end up in the correct account. The default is an account called Undeposited Funds. To make sure that this setting is correct, open the Edit menu and select Preferences, click Payments and select the Company Preferences tab. Use Undeposited Funds as a default deposit to account should have a check mark in the box next to it.

If you think you’ll sometimes want to deposit to a different account, leave the box unchecked. Then every time you record a payment, there’ll be a Deposit to field on the form. Talk to us if you’re planning to use any account other than Undeposited Funds, as you can run into serious problems down the road if payments are earmarked for the wrong account.

The Right Tools for the Right Job

Probably the most common type of payment that you’ll process will come in to pay all or part of an invoice or statement that you sent previously.

To do this, open the Customers menu and select Receive Payments. In the window that opens, click on the arrow in the field next to RECEIVED FROM to display the drop-down list, and choose the correct customer. You’ll see the outstanding balance. Enter the amount of the payment you received in the AMOUNT field and change the date if necessary. Click the arrow in the field next to PMT METHOD, and then select the type of payment.

If you established a credit card as the default payment method in the customer record, the card number and expiration date will be filled in. If not, or if a check was submitted, enter the information requested.

Any outstanding invoices will appear in a table. Make sure that there’s a check mark in front of the correct one(s). If the customer only made a partial payment, you’ll have to indicate how you want to handle the underpayment. Here are your options:

Figure 3: You can select how to handle partially-paid invoices here.

When you’re done, save the payment.

Instant Income

There may be times when you receive payment immediately, at the time your products or services change hands. In these cases, you’ll want to use a sales receipt. Open the Customers menu again and click Enter Sales Receipts.

Select a customer from the drop-down list or add a new one, then fill out the rest of the form like you would an invoice, selecting the items and quantities sold, and indicating the type of payment made (cash, check, credit).

Other Scenarios

These are the most common methods of receiving payments from customers, and you may never have to do anything other than simple payment-recording and sales receipts.

But unusual situations may arise that leave you stumped. For example, a customer may want to make a partial, advance payment before you’ve created an invoice or at the same time you’re entering it. In a case like this, you’ll have to create a payment item so that the money you’ve just received is reflected on the invoice. Or you may get a down payment on a product or service, or even an overpayment.

Let us help you when such situations occur. It’s much easier -and more economical for you – to spend some time with us before you record a puzzling payment than to have us track it down later on. We’ll help ensure that your money makes it to the right destination.

This article of QuickBooks Tips and Tricks was based on the 2013 version of QuickBooks.

With the holiday season just around the corner, it’s a perfect time to get your financial records in order. Tax moves you make now can mean finding more “green” to spend on family gifts and festivities. Here are five quick tips for you to feel more prepared about your financial status as you go into year-end.

1. Avoid Penalties

This time of year is ideal to double-check your tax payments, both federal and state, to make sure enough has been paid in, and even more important, to avoid overpaying so your money is not tied up unnecessarily. If you’re not sure of your 2013 tax liability, check with your tax preparer.

This time of year is ideal to double-check your tax payments, both federal and state, to make sure enough has been paid in, and even more important, to avoid overpaying so your money is not tied up unnecessarily. If you’re not sure of your 2013 tax liability, check with your tax preparer.

2. Balanced Books

Rather than wait until the busiest time of year for accountants and bookkeepers, you can get a head start now on catching up your books. You’ll have more of their attention and you may even avoid a rate increase if you get your books done early. Completed bank reconciliations are a very important part of catching up.

Rather than wait until the busiest time of year for accountants and bookkeepers, you can get a head start now on catching up your books. You’ll have more of their attention and you may even avoid a rate increase if you get your books done early. Completed bank reconciliations are a very important part of catching up.

3. Forms

It’s not too early to get your orders in for the forms you need at year-end like your W-2s, W-3s, 1099s, and 1096s. That way, your forms will be onsite when you’re ready. If we do not process your year-end forms, you can order the forms you need online and save 20% using code PAPWBKC.

It’s not too early to get your orders in for the forms you need at year-end like your W-2s, W-3s, 1099s, and 1096s. That way, your forms will be onsite when you’re ready. If we do not process your year-end forms, you can order the forms you need online and save 20% using code PAPWBKC.

4. Records

Information that’s missing at the last minute can take up extra time and be costly. It’s a great idea to do an audit now of W-9s to grab missing addresses and tax ID numbers of your sub-contractors. Also do a scrub of your employee payroll records so that your W-2s will be complete and accurate.

5. New Tax Changes

Be sure to check with your advisors on new laws affecting individuals and businesses next year. One of the biggest ones making news is avoiding the fine involved regarding the new health care requirements for individuals. And there are many more you’ll want to get up to speed on so that you’ll know how they affect your situation.

We know it’s early to be talking about taxes, but we’re also all about saving you money and time. Try these five tips so you’ll have better peace of mind and be more prepared for year-end.

Kristen has earned her designation as a QuickBooks Certified User on November 4, 2013. Kristen has attended extensive training courses on QuickBooks and has been with New Business Directions since December of 2011.

Kristen has earned her designation as a QuickBooks Certified User on November 4, 2013. Kristen has attended extensive training courses on QuickBooks and has been with New Business Directions since December of 2011.

In addition to being a Level One Bookkeeper for New Business Directions, Kristen is also our in-house Marketing Coordinator, and has recently created a blog on our website which features helpful Tips and Tricks in QuickBooks. If you would like to submit a QuickBooks related topic to be covered in our blog, email Kristen at Kristenp@newbusinessdirections.com.

At New Business directions we help small business owners streamline the process of making money. If you would like to create order out of chaos and improve your bottom line, call us at 603-356-2914 or visit our website at www.newbusinessdirections.com.

New version of desktop QuickBooks accomplishes goal of speeding up, refining your workflow.

If Intuit named its desktop versions of QuickBooks by the version number rather than the year, we’d be in version 20-something by now. QuickBooks, still the preferred software for small businesses, keeps getting smarter in its annual upgrades. Rather than pile on tons of new features in its upgrades, Intuit – for many years – has concentrated on making it easier for you to access the tools and data that are already there.

QuickBooks 2014 is no exception. Its combination of small-but-effective changes makes it easier to get in and do what needs to be done quickly, and then get out and move on to activities that will help build your business.

A Superior View

If you do upgrade to QuickBooks 2014, head first to the new Income Tracker (Customers | Income Tracker). QuickBooks offers numerous reports and other tools for following the progress of your incoming revenue, but this new feature provides the best we’ve seen in the software.

Figure 1: QuickBooks 2014’s new Income Tracker gives you real-time access to the status of your receivables.

You may find yourself spending a lot of time on this screen because it gives you a birds-eye view of your receivables that isn’t available anywhere else in the program. You can click on any of the four colored bars that run across the top of the screen – Estimates, Open Invoices, Overdue and Paid Last 30 Days — to change the data that appears below. Within each bar is the number of related transactions and their total dollar amount.

You’ll use the drop-down lists directly below these navigational bars to set filters that define a subset of transactions. These are CUSTOMER:JOB, TYPE, STATUS and DATE.

The last column in the table is labeled ACTION. Once you’ve earmarked a transaction or transactions that you want to work with by checking the box in front of each name, you can select an action you want to take. If OPEN INVOICES is active, for example, you can receive payment for the transaction(s), print or email them. Where applicable, you can open a drop-down menu in the lower left of the screen and batch-produce invoices, sales receipts and credit memos/refunds.

More Descriptive Email

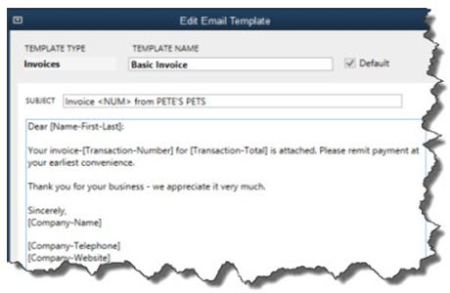

If you regularly send invoices through email, you may have wondered how many of them actually get opened by your customers in a timely fashion. QuickBooks 2014 contains a new tool that makes the details of each invoice available within the body of the email itself.

Figure 2: You can modify this template or leave it as is: QuickBooks 2014 will fill in the relevant details for each customer.

To access this template, open the Edit menu and select Preferences. Click on the Send Forms tab, then Company Preferences. Open the drop-down list to select the type of form you want to view or modify (pay stub, sales receipt, credit memo, etc.). Click the Edit button to see the actual template, and open the Insert Field drop-down menu to see your options. When you email a form, QuickBooks will replace the text and numbers in brackets with the correct details for each recipient.

This is what’s called a mail merge. They’re fairly simple to use, but one error will throw your message off. We can help you get set up with these.

Smaller Changes

Intuit has made many small-but-useful features to QuickBooks 2014, all designed to help you work faster and smarter, and simply to support more convenient operations. For example, the Ribbon toolbars on transactions now include a tab or menu that lets you open related reports.

Figure 3: You can now access reports directly from the Ribbon toolbar on transaction screens.

In addition:

- QuickBooks’ color scheme has been changed.

- The program runs faster.

- You can now copy and paste lines within forms.

- We can communicate with you (and vice versa) via an email window that’s been embedded into the software. This tool even auto-pastes the transaction in question into the email window.

- There’s been some retooling of online banking (now called “Bank Feeds”), making it more accessible and understandable.

Upgrading to a new version of QuickBooks can be challenging, so we encourage you to let us know if you’d like to explore the process. New functionality and usability that improves your workflow and your understanding of your finances can be worth the time and trouble.

New Business Direction LLC

New Business Direction LLC