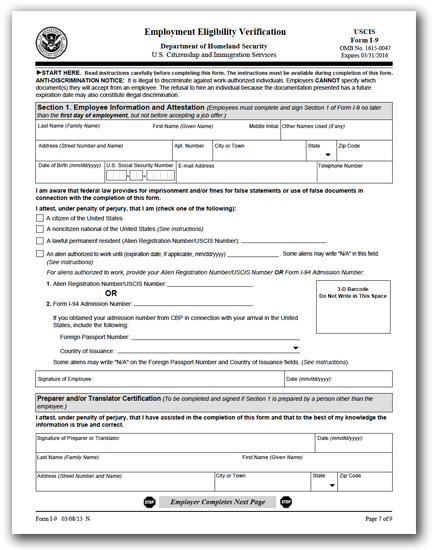

New I-9 Form Mandated After January 22, 2017

- Section 1 asks for “other last names used” rather than “other names used,” and streamlines certification for certain foreign nationals.

- The addition of prompts to ensure information is entered correctly.

- The ability to enter multiple preparers and translators.

- A dedicated area for including additional information rather than having to add it in the margins.

- A supplemental page for the preparer/translator.

Are you ready for next year to be even better than this year? If so, take a few minutes to reflect on the questions below and take action to set your profit plan for the next year.

Question 1: What were the three best business things about this year?

No need to re-invent the wheel. If you knocked it out of the park this year, can you wash, rinse and repeat these tasks in the next?

If you’re having trouble thinking of three things, here are some hints:

- What apps saved you time and money?

- Did you make some good hires?

- Did you let go of a bad hire or two?

- Was there a marketing campaign that really worked?

- Were there any events you went to that generated great ideas?

- Did you add or remove products and/or services?

- Did you buy new equipment or open a new location?

Summarize the three best things that happened in your business for the last year and think about how you can repeat them to enhance your next year in business.

Question 2: What were the three worst business things about this most recent year?

While we don’t want to dwell too much on our failures, we do want to learn from them. Think about the three things that are causing you to lose time, money or gain stress, and decide if you can make changes for the next 12 months.

Question 3: What vision do you have for your business in the coming year?

At the end of next year, what has to have happened in order for you to have a successful year? Think in terms of metrics as well as intangibles, such as peace of mind and happiness.

Once you know your destination, the fun is in creating a roadmap to get you there.

Your Profit Plan for Next Year

If your vision includes financial goals, then creating a profit plan is one way to measure your progress throughout the upcoming year. Start by deciding how much profit you want to make. From there, you can compute your revenue goal and make a plan. Then you can add expenses to complete the budget. Here’s an example:

Let’s say you want to make $50,000 in profit for next year. You can do that in a number of ways:

- Generate $500,000 in revenue and $450,000 in expenses.

- Generate $2 million in revenue and $1,950,000 in expenses.

- Generate $150,000 in revenue and $100,000 in expenses.

- And so forth.

From your profit number, you can create a revenue plan. A revenue should include how many items you need to sell. Like this:

| No. of units | Price | Revenue | |

| Widget A | 3,000 | $200 | $600,000 |

| Part B | 100 | $2,000 | $200,000 |

| Service C | 700 | $1,000 | $700,000 |

| Total | $1,500,000 |

Once you have your revenue plan, you can fill in your estimated expenses.

You might be thinking that this sure sounds a lot like making a budget. And it is. But it’s far more fun to work on something called a profit plan than it is a budget. And if you need us to do the number-crunching part, please feel free to reach out any time.

Here’s to a very happy and prosperous next year in business for you.

Tim Ferriss made the 4-hour workweek a popular concept in his 2007 book. But is there such a thing, and more importantly, can business owners like you and me cash in on it? As the last of the Baby Boomers approach retirement, the topic of working less while making the same or more income is popular.

Here are five ideas to help you work fewer hours while making the same or more income.

Active vs. Automatic Revenue

Some business models allow you to generate automatic revenue. Automatic revenue is revenue you can earn and leverage over time by doing something only once and not over and over again. Active revenue is earned while doing something over and over again. Showing up for a teaching job with a live audience is active revenue while producing and selling video recordings of the same teaching is automatic revenue.

A goal of a 4-hour workweek concept is to increase automatic revenue while reducing active revenue. You may have to think out of the box to do this in your industry, but the payoff can be huge.

Delegation and Outsourcing

One traditional way to move to a 4-hour workweek is to have others do the work. Hiring staff frees up your time and allows your business to become scalable. When it runs without you, it’s more salable too.

Time Batching

If you have a lot of distractions in your day, you can easily double your productivity by learning time batching, which is grouping like tasks together in a block or batch of time and getting them done. For example, if an employee interrupts you with questions multiple times a day, train them to come to you only once a day to get all their questions handled at one time. Take your calls one after the other in a group, and then stay off the phone the rest of the day. Do the same with email, social media, running errands, and all of your other tasks.

Automation and Procedures

New apps save an amazing amount of time. List all of your time-consuming chores and then find an app that helps you get them done faster. For example, a scheduling app can reduce countless emails back and forth when setting meetings and appointments. To-do list or project management software can cut down on emails among you and your staff. And apps like Zapier can connect two apps that need to share data, reducing data entry.

Leverage

The key to working less is to embrace the concept of leverage. How can you leverage the business resources around you to save time, increase staff productivity, and improve profits? It takes discipline and change, two difficult goals to accomplish. But when you do, you will be rewarded.

An interesting way to fund your dream project, whether you are a startup or a more established business, is to consider crowdfunding. Crowdfunding is when many people provide the money in small amounts for a project.

Although crowdfunding is not new, it became much more popular when organizations like Kickstarter, Indiegogo, RocketHub, and GoFundMe created web platforms to enable this method of raising funds. The 2015 crowdfunding market is estimated at $34 billion and is growing exponentially.

In crowdfunding, the person who initiates the project receives the money that the people contribute. The web platform that supports the project usually gets a percentage of what’s raised. It varies as to what the people who contribute to the project receive in return. It can be the payback of a loan with interest, shares of stock, rewards, or a possible tax write-off in the case of a donation.

You probably hear about companies that get funded overnight, making it look easy to create a successful crowdfunding campaign. There is a lot that goes into the launch of a successful campaign. Here are some steps:

- Design your project and research how much money you need

- Choose your platform (Kickstarter, Indiegogo, etc.). This requires careful research about which platform is best for your type of project as well as a complete understanding of the rules and limitations of that platform. For example, on Kickstarter, if you don’t reach your goal, you don’t get any money, including what you have partially raised.

- Create a video that tells your story and makes the pitch. You must not only grab attention but appeal to both the rational and emotional sides of your followers. You must also provide an enticing reward for your followers.

- Count your followers. Do you have enough to raise the capital you need? If not, create the marketing you need to build your followers and make your numbers.

- Gain some big name backers if you possibly can.

- Develop a carefully orchestrated launch using multiple marketing channels, including social media and press.

With the explosive growth in crowdfunding, it’s here to stay. Consider how it may help your business grow.

If it’s been a while since you’ve adopted new marketing methods, it might be time, especially if you want to attract younger customers. Here are five ideas to do just that.

1. Video

With YouTube as the second largest search engine, using video in your marketing is a slam-dunk return on investment. If there is an educational aspect to your sales cycle, a video is perfect to get the message across.

Even better news is that many companies still haven’t caught on to how powerful video can be in marketing, so you will have an advantage. There is no longer a financial barrier to entry as most videos are no longer professionally made.

There are so many ways to create video: using a webcam, capturing your screen with webinar software or TechSmith’s Camtasia®, or even using your cell phone. If you have a gmail address, you already have a YouTube account, and you can easily crate and customize your own YouTube channel.

The hardest part of adding video to your marketing is to simply take the leap.

2. Social Media

Social media is now one of the best places for a business to expand brand awareness. LinkedIn provides customers with a way to discover your background. It’s also a good source of new employees. Facebook and Google+ enable you to build community and learn more about the interests of your customers.

Twitter is perfect for announcing sales and boosting event excitement. YouTube enhances education and motivation. Pinterest for Business and Instagram are perfect for retail to showcase new products. Tumblr is a must if you market to teens.

If you’re new to social media, choose one or two sites and set up your profile. If you already have some social media profiles, consider expanding or increasing your activity.

3. Content Marketing

Content marketing is another way to educate your customers before and during the sales cycle. With content marketing, you creates a report, white paper, or educational video that describes a topic congruent with your services. The content is typically “gated,” meaning the prospect needs to provide email address or phone number or both, so that you can follow up on the lead. The content should be enticing and educational and should also introduce the prospect to your brands and services without being heavy handed about it.

Content marketing is a great lead generator, especially if you have a sales staff that can deliver scripted follow-up calls.

4. Mobile and Wearables

Over a year ago, Google proclaimed there are now more mobile searches than desktop searches. For the last few years, it’s been increasingly important to make sure your website delivers a great experience via mobile technology.

Wearables are growing as fast as mobile did. Innovative companies are providing a rich customer experience through wearables. It’s now common to see wearables in health, sports, household automation, and virtual reality entertainment. But others are having fun with creative solutions, such as British Airways blankets that turn a color based on a passenger’s mood and Nivea’s children’s sunblock that comes with a GPS bracelet tracker so the kid doesn’t stray too far away.

5. Marketing Automation and Integration

Today, the entire marketing funnel can pretty much be automated, from SEO-enhanced social media posts to landing pages using content marketing to follow up emails, videos, and shopping cart links. Almost every business needs a website, list management system, shopping cart, social media automation app, and a CRM, Customer Relationship Manager. With this automation, you may be able to reduce sales labor as well as customer support expenses.

Integration of multiple marketing channels and methods is essential as the buying decision has become more complex and trust is built slowly over time. Successful marketers are integrating SEO (search engine optimization) with social media, video with content marketing, and email marketing with landing pages, to name a few.

Try any of these five trends to give your marketing a future-focused boost.

Accounting automation has come a long way in the last few years, and the process of handling invoices and receipts is included in those changes. No longer is there a mountain of paperwork to deal with. In this article, we’ll explain some of the changes in this area.

Vendor Invoices

Most invoices are now sent electronically, often through email or from accounting system to accounting system. Some accounting systems allow the invoice document, usually in PDF format, to be attached to the transaction in the accounting system. This feature makes it easy for vendor support questions as well as any audit that may come up.

Some systems are smart enough to “read” the invoice and prepare a check with little or no data entry. Others are able to automate three-way matching – this is when you match a purchase order, packing slip, and invoice together – so that time is saved in the accounts payable function.

Receipts

Today’s systems allow you or your bookkeeper to scan in or take cell phone photos of receipts – whether cash or credit card – and then “read” them and record the transaction. This type of system cuts way down on data entry and allows the accountants to focus on more consultative work rather than administrative work.

Some vendors will email you receipts so all you have to do is use a special email address where your accountant is copied or forward the receipt as you receive it.

The biggest challenge for business owners is getting into the habit of photographing the receipt and sending it to the accountant. The days of shoebox receipts are not completely over, but cloud-savvy business owners are definitely enjoying the alternative options of today’s paperless world.

Approvals

Some systems automate bill approval. This is especially handy for nonprofits or companies with a multi-person approval process. It cuts down on approval time and the time it takes to pay the bill.

New Systems

There are many 3rd party applications that automate a part of the vendor payment or receipt management system. All of them have different features, platforms, software requirements, integration options, and pricing. Many of them integrate with Quickbooks, some with the desktop version, some with Quickbooks online and some integrate with both platforms.

- BILL

- Hubdoc

- Receipt Bank

- Expensify

- SmartVault

- Doc.it

- Tallie

- Concur

- LedgerSync

- ShoeBoxed

- ShareFile

If you are interested in finding out more about automating your accounts payable invoices or receipts, please reach out anytime. We have partnerships with many of these 3rd parties for preferred pricing and in most cases we have certified in their products.

If you’re looking for more ways to bring in additional revenue, then a VIP revenue stream is one option for many businesses. Here are a couple of examples:

A plastic surgeon has a long waiting line of patients. The surgeon sets up a special membership fee of $3,000 per year for patients who wish to work with her. These patients get first access to her appointment schedule. They get priority surgery dates and personal care. Her other patients that do not pay are able to see her physician assistant. She earns an extra $300K — insurance-hassle-free — for the hundred patients who join her VIP group.

A pizza restaurant always has long lines during rush hours. The owner sets up a VIP membership of $75 per year for customers who want to bypass the long lines. He dedicates one of his cash registers to the VIP line and staffs it accordingly during rush hour. He sends specials by email and a birthday coupon to the VIP members. Five hundred customers sign up, grossing an extra $37,500 with little or no additional expenses.

A consultant has a couple of clients that want to have access to her 24/7. She sets up a special retainer of $1,500 per month for these clients and provides her cell number. Since they are busy CEOs, they only call a few times a year, but when they do, she drops everything to be of service. With four clients on retainer, it’s an extra $72K per year for a few days of work.

No matter who your clientele is, there are always a few who demand extraordinary service and are willing to pay extra for it. Capitalize on this by adding a VIP revenue stream to your offerings.

What you include in your VIP package will vary by industry, but here are a few thoughts:

- Increased access to you

- Special service, perhaps via another phone line or checkout lane

- Invitation to exclusive events or sales or previews

- Free gift wrapping

- Free shipping

- Special gifts

- Friends are free

- A richer experience

- Birthday acknowledgement

A VIP offering is not the same as a points program. A points program encourages volume sales, while a VIP program is all about special perks, exclusivity, and a higher level of service.

Does your business lend itself to a VIP offering? If so, give it a try.

Sometimes, the most telling numbers in your business are not necessarily on the monthly reports. Although the foundation of your finances revolves around the balance sheet and income statement, there are a few numbers that, when known and tracked, can make a huge impact on your business decision-making. Here are five:

1. Revenue per employee.

Even if you are a solo business owner, revenue per employee can be an interesting number. It’s easy to compute: take total revenue for the year and divide by the number of employees you had during the year. You may need to average the number in case you had turnover or adjust it for part-time employees.

Whether your number is good or bad depends on the industry you’re in as well as a host of other factors. Compare it to prior years; is the number increasing (good) or decreasing (not so good)? If it’s decreasing you might want to investigate why. It could be you have many new employees who need training so that your productivity has slipped. It could also be that revenue has declined.

2. Customer acquisition cost.

If you’ve ever watched Shark Tank®, you know that CAC is one of the most important numbers for investors. This is how much it costs you in marketing and selling costs to acquire a new client. Factors such as annual revenue, or even lifetime value of a client will affect how low or high you can allow this number to go.

3. Cash burn rate.

How fast do you go through cash? The cash burn rate calculates this for you. Compute the difference between your starting and ending cash balances and divide that number by the number of months it covers. The result is a monthly value. This is especially important for startups that have not shown a profit yet so they can figure out how much cash they need to borrow or raise to fund their venture.

4. Revenue per client.

Revenue per client is a good measure to compare from year to year. Are clients spending more or less with you, on average, than last year?

5. Customer retention.

If you are curious as to how many customers return year after year, you can compute your client retention percentage. Make a list of all the customers who paid you money last year. Then create a list of customers who have paid you this year. (You’ll need to two full years to be accurate). Merge the two lists. Count how many customers you had in the first year. Then count the customers who paid you money in both years. The formula is:

Number of customer who paid you in both years / Number of customers in the first or prior year * 100 = Customer retention rate as a percentage

New customers don’t count in this formula. You’ll be able to see what percentage of customers came back in a year. You can also modify this formula for any length of time you wish to measure.

Try any of these five metrics so you’ll gain richer financial information about your business’s performance. And as always, if we can help, be sure to reach out.

I know that many of you are wondering if you should upgrade to the new Windows 10 operating system. It has been hard to ignore the constant reminders of this FREE upgrade. Every time we turn on our computers, there it is, asking us to Upgrade Now. Some of us have even had a surprise automatic installation of the newest operating system while we were sleeping!

Microsoft is offering this software for free until the end of July 2016, after which they are going to charge a fee – currently starting at $149 per system for the Home Edition – they have not yet released any pricing for the Professional versions of the software. If you are currently running Windows 8/8.1, then you may wish to consider the update to Windows 10, but please read further.

At New Business Directions, LLC, we have decided to stay with the Windows 7 platform and not to upgrade to Windows 10. Microsoft will still be issuing updates for Windows 7 until 2021 but will not offer any phone or online support for the product.

There have been many issues with the installation of Windows 10 especially in a networked environment and the software needs a lot of tweaking to network correctly and play with other devices – such as printers. We see no real advantage to updating to Windows 10 and we have found it to actually hinder some programs from running properly, specifically QuickBooks and Point of Sale.

New Business Direction LLC

New Business Direction LLC