The New Business Directions Team is bringing the #1 employee-rated and requested Time Tracking Software to you. Sondra Love, Wayne Kukuruza, and Rhonda Rosand, CPA have recently joined the 6000+ TSheets PRO community by participating in an exclusive TSheets PRO certification course accredited by CPAacademy.org.So what exactly is TSheets? TSheets is a time tracking and scheduling software designed for businesses that track, manage, and report time. TSheets provides the alternative to paper timesheets and/or punch cards to simplify human resource and data processing roles for companies of all sizes.

But here’s the best part, TSheets fully integrates with QuickBooks by syncing accurate timesheets to your QuickBooks file and eliminating manual, duplicate time entries. Tracked and approved time can now be easily exported to either QuickBooks® Online or Desktop with just one click. Management can then use their favorite tools within QuickBooks to process payroll, calculate job costing, and create invoices in a more simplified work flow.

TSheets is also a scheduling software making it faster and easier to build and share schedules with employees, assign jobs, and alert shifts while increasing profitability and improving communication. In other words, we want to keep your workforce running like a well-oiled machine.

Oh, and have I mentioned their amazing customer service department? The TSheets team who’s behind the product is just as amazing as the software itself. Customer service team is passionate about their customers and provides exceptional support in times of need. They make your entire TSheets experience FUN and might even give you a smile or two.

The best cakes have layers and layers of different delicious flavors to enjoy. Stacked on top of one another, each layer is baked separately and becomes part of the whole. Like a layer cake, your business expenses have layers of meaning to them. When you can understand how expenses play a part in profit, you can manage them better.

Here’s how to make a layer cake of your business expenses. Let’s start with the most direct expenses.

Direct Costs

If you have inventory you will have a balance in the Cost of Goods Sold account. It should represent how much you paid for product or inventory that you are selling. It is the most direct expense of all the expenses; if you don’t spend this money, you would not have a product.

If you sell services, you should not have a balance in Cost of Goods Sold, but you will have direct expenses that are tied to performing your services. These might include labor from wages of the employees who carry out the services for clients. Any supplies directly involved with delivering services should be included as well.

You may also have other direct costs related to selling specific products or to servicing specific accounts.

Indirect Costs

The next layer includes indirect expenses. These expenses do not make up your product directly and might contribute to several different lines of products. Indirect costs might be attributable to a group of products or projects and can be apportioned accordingly.

Overhead

Although overhead is technically a form of indirect cost, it’s good to create a separate layer for it. It includes management salaries, rent, utilities, and other fixed costs that cannot be directly allocated to a product or service.

Assembling the Layers

A wonderful exercise is to classify each of your expense accounts in your Chart of Accounts as direct, indirect, or overhead. In that way, you can see how each account contributes to the costs of running your business. Some questions to ask yourself:

- What is my gross margin before indirect costs and overhead?

- What is my gross profit after indirect costs and before overhead costs?

- How can I cut down on any of these categories of expense?

- What is my breakeven volume in sales before overhead is factored in?

- Can my profit margin be changed if I spent less in a certain area?

This layered view is just another way to view the financial aspects of your business and can help you make better decisions down the road.

You can also break the layers down even further by classifying the expenses as critical and non-critical. This will help you determine where best to invest while maintaining the level of profit you desire.

You can’t manage what you don’t measure. Layering your expenses will help you have your cake and eat it too. And if we can help, just reach out as always.

This year’s theme was “epic” designed as the epic conference to empower small business advisors to develop and sustain the epic practice that distinguishes itself and embraces the key differences that separate ProAdvisors around the good, the great and the “epic.”

Sessions

The four-day conference kicked off each morning with Power Breakfast Sessions followed by main stage presentations with keynote speakers such as Daymond John of Shark Tank, Joe Buissink of Canon Explorer of Light, and author Mike Michalowicz of Profit First. In between general session, attendees dispersed around the conference center into rooms where cutting edge training sessions were being held. Training sessions were broken down into 5-tracks for Practice and Professional Development, Practice Growth, In-Depth QuickBooks Training, ProAdvisor Certification Training and QB Integrated Apps.

If you were fortunate enough to attend, Rhonda Rosand, CPA taught a 100-minute informative training session titled Successful Implementations from Initial Contact through Ongoing Support on Sunday, May 22nd. As the evenings came around, networking sessions were held consisting of ICB Bookkeeper’s Symposium, the Woodard Network Social hosted within Atlantis’ stunning marine life exhibit, The Dig and of course, the infamous TSheets dance Party on TSheets Tuesday.

taught a 100-minute informative training session titled Successful Implementations from Initial Contact through Ongoing Support on Sunday, May 22nd. As the evenings came around, networking sessions were held consisting of ICB Bookkeeper’s Symposium, the Woodard Network Social hosted within Atlantis’ stunning marine life exhibit, The Dig and of course, the infamous TSheets dance Party on TSheets Tuesday.

Sondra’s Take on Vendors

In between training, I was able to visit the exhibit ballroom which held over 90 vendors, some of which were very familiar. I came across software I use everyday to make my work flow run smoothly and now I am able to put a face to the product. For example, SmartVault allows me to access files anywhere, anytime and from any device. I also have the capability to securely share files with clients and our team.

In between training, I was able to visit the exhibit ballroom which held over 90 vendors, some of which were very familiar. I came across software I use everyday to make my work flow run smoothly and now I am able to put a face to the product. For example, SmartVault allows me to access files anywhere, anytime and from any device. I also have the capability to securely share files with clients and our team.While at Scaling New Heights, I learned the importance of technology and how it relates to strengthening our firm and supporting our clients.

Running a small business is often about taking and managing risks. Market risks are normal but business and tax risks are another thing altogether. Most business and tax-related risks can be managed as long you know about them. Here are seven small business risks you will want to make sure are covered.

1. Best Choice of Entity

Are you operating as a corporation, limited liability company, partnership, or sole proprietor? More importantly, is the entity you are operating under providing you with the greatest tax benefits and separation from personal liability? If not, you might want to explore the alternatives to make sure you’re taking the amount of risk that’s right for you.

2. Employees or Contractors

Are your team members properly categorized when it comes to the IRS’s rules about employees versus contractors? Unfortunately, it’s not about what you and your team member decide you want. If you decide to hire contractors and the IRS determines they are employees, you could owe back payroll taxes that can cripple a small business. So you’ll want to do the right thing up front and make sure you and the IRS are in agreement, or be willing to take a future risk.

3. Insurance

If you’d like to protect yourself from possible losses through a disaster, theft, or other incident, insurance can help. There are a lot of kinds to choose from, and you’ll likely need more than one. At the minimum, make sure you’re covered by:

- Business property insurance, renters insurance, or a homeowners rider to protect your physical assets.

- Professional liability or malpractice insurance, if applicable, to protect you from professional mistakes including ones made by employees.

- Workers compensation insurance, to cover employee accidents on the job.

- Auto insurance or a non-owned policy if employees drive their car for work errands.

You may also want personal umbrella insurance, life insurance, and health insurance. Check with an insurance agent to get a comprehensive list of options.

4. Sales Tax Liability

Are you sure you’re collecting sales tax where you should be? As the states get greedier, they invent new rules for liability. For example, if one of your contractors lives in another state, you may owe sales tax on sales to customers who live there even if you don’t live there or have an office there.

Nexus is a term that describes whether you have a presence in a state for tax purposes. Having an office, an employee or contractor, or a warehouse can extend nexus so that you’d need to collect and file sales tax for those states. If you’re in doubt, check with a professional, and let us know how we can help.

5. Underpricing

Most small businesses make the mistake of underpricing their services, especially when they start out. If you started out that way, it’s awfully hard to catch up your pricing to a reasonable level. Knowing the right price to charge can make the difference between whether the company last six months or six years. You can mitigate this risk by getting cost accounting help from your accountants who can help you calculate your margins and determine if you’re covering your overhead and making a profit.

6. Legal Services

Legal services can be expensive for a small business, so sometimes owners cut corners and take risks. Attorneys are needed most when it comes to setting up your entity, reviewing contractual agreements such as leases and loan agreements, settling conflicts, advising on trademark protection, and creating documents such as terms of service, employment agreements, and privacy policies. Just one mistake on any of these documents can cost a lot, so be sure it’s worth the risk.

7. Accounting Services

Doing your own accounting and taxes can be risky if they’re done wrong or incomplete. You could end up paying more than you should if you leave out deductions you’re entitled to. Worse, if you do your books wrong, you could end up overpaying taxes without realizing it. A common bookkeeping error results in doubling sales, and while it might look good, you certainly don’t want to pay more than what’s been truly received.

How did you do with these seven risks? If you need to reduce your risks in any of the areas, feel free to reach out for our help.

Most small businesses need help with cash during certain stages of their growth. If you find that you have more plans than cash to do them with, then it might be time for a loan. Here are five steps you can take to make the loan process go smoother.

1. Make a plan.

Questions like how much you need and how much you will benefit from the cash infusion are ones you should consider. If you don’t already have some version of a budget and business plan, experts recommend you spend a bit of time drafting those items. There’s nothing worse than getting a loan and finding out you needed twice the cash to do what you wanted to accomplish.

2. Know your credit-related numbers.

Do you know your credit score? Is there anything in your credit history that needs cleaning up before it slows down the loan approval process?

Take a look also at your standard financial ratios. These are ratios like your current ratio (current assets / current liabilities) and debt-to-equity ratio. If these are in line with what your lender is expecting, then you are in good shape to proceed.

3. Research your options.

Luckily, there are many more options for financing your business today than there have been in the past. Traditional options, such as banks, still exist, but it can be difficult to get a bank loan for a small business.

Here are some online loan sources where investors are matched with borrowers via an online transaction:

- Kabbage

- OnDeck

- LendingClub

- FundBox

- BlueVine

Or you can go to Fundera and compare which loan is the most economical.

There is also crowdfunding, which is very different from a loan. Crowdfunding is a way to raise cash from many people who invest a small amount. Top sites include GoFundMe and KickStarter, where you can find out more about how it works.

Other ways to get cash include tapping into your personal assets: using credits cards, refinancing a house, and borrowing money from family and friends.

4. Create your loan package.

Most lenders will want to know your story, and a loan package can provide the information they need to decide whether they want to loan you money or not. A good loan package includes the following:

- A narrative that includes why you need the loan, how much you want, and how you will pay it back. A good narrative will also list sources of collateral and a willingness to make a personal guarantee.

- Current financial statements and supporting credit documentation, such as bank statements and credit history.

- A business plan and budget, or portions of it, that cover your business overview, vision, products and services, and market.

- A resume or biography of the business owners and a description of the organization structure and management.

While it takes time to put together a great loan package, it’s also a great learning experience to go through the exercise of pulling all of the information together.

5. Execute!

You’re now ready to get your loan. Or not. Going through these five steps helps you discover more about your business and helps you make an informed decision about whether a loan is still what you want and need.

Throughout the process, you may have learned new information that tells you you’re not quite ready for a loan, or that in fact, you are. At any rate, preparing for a loan is a great learning process, and the good news is there are lots of avenues for small businesses to get the cash they need to grow.

Two very important skills for entrepreneurs to master are marketing and finances. Combine them by understanding the numbers behind marketing, and you have an even more powerful understanding of exactly what makes your business tick.

Key Numbers – Cost Per Client Acquisition

Do you know how much it costs your business to bring in one client? The technical term is “Cost per customer acquisition,” and it’s computed by adding the total marketing and sales costs excluding retention costs and dividing them by the total number of clients acquired during a period of time.

Cost per customer acquisition is important to know because then you can compute how long it takes before your business begins to make a profit on any one customer. In software application services with a monthly fee, the breakeven for a client can be around ten months.

It’s essential to understand this dynamic for pricing and volume planning purposes. If your services or products are priced too low so that your acquisition costs are not recouped in a reasonable period of time, it can play havoc with your cash flow as well as your profits. If you don’t have enough volume to cover overhead and acquisition costs, then your company will be in trouble in the long term.

Customer Lifetime Value

There is a simple and an academic formula for customer lifetime value. You can estimate it by multiplying the average sale of a customer by the average number of visits per year by the number of years they remain a customer. That’s the easy version.

The more difficult version of this formula takes into account retention rates and gross profit margins. The formula is: Average customer sales for life times the gross profit margin divided by the annual churn rate.

Once you know and track these numbers in your business, you’ll be better able to make smart decisions about your marketing investments and your pricing. And if we can help you, please reach out as always.

Spring denotes new growth, fresh starts, and spring cleaning. Why not apply these ideas to your sales so they can blossom along with spring flowers? Here are six ideas to put the spring into your sales.

1. Spring Cleaning Sales

Get rid of old inventory by having a spring sale that will clean out your closets and put some money in your account. Look through your items for sale and find the ones that haven’t moved like you expected. Mark them down and move them out.

2. New Items and Services from Customer Ideas

Now that you’ve gotten rid of the old stuff, you have room for new. If you’re not sure what your clients want or need, ask. Use Survey Monkey to find out what your clients can use. If you don’t have what they want, make it, buy it, or partner with someone who does. Then let everyone know, “based on popular demand” of course, that you have new items for sale just in time for spring.

What questions should you ask in your survey? Try questions like these to draw out your customers’ needs and wishes and to discover any shortcomings you might have not known about:

- What items/services are on your wish list that you’d like us to stock/provide?

- How do you currently use our services/products?

- What do you wish our items accomplished that they don’t now?

- How would you recommend we expand our selections?

- What do you wish we did better?

3. The Old “Fries with Your Burger” Upsell

Waitpersons offer desserts and appetizers, office supply staff offer cables and accessories with hardware purchases, and software vendors offer the next level package. Almost every business practices a form of upsell these days, so if you don’t, you’ve got a new opportunity right here.

Dust off your old upsell procedures and try these ideas to rejuvenate your upsells:

- Re-visit your inventory to pair complementary items for upsell potential.

- Retrain your staff for upsell language at the time of sale.

- Re-package like items to offer more bundles and groups.

4. New Prices

When is the last time you’ve raised your prices? If it’s been a while, then it’s a great opportunity to increase revenue with little additional effort.

5. Spread the Word with Spring Samples

Samples can help get your product or service into the hands of many potential buyers. Buyers can better experience your product and reduce their perceived risk.

Not all businesses can provide samples, but there is always the next best thing. Where your product is not consumable, you can sometimes provide a portion of the product, such as a carpet sample, wallpaper swatch, or floor tile. With retail clothing, pictures will have to do. With books or courses, you can provide a sample chapter or a demo video. And with services, case studies or proof of concept will suffice.

6. Offer a Customer Reward Program

Put together a program to reward your most loyal clients and to make them even more loyal to you. Some of the perks could include monthly gifts, priority service, an exclusive event, and/or discounts. The price can be structured as a membership fee, retainer, or package price. Increasing contact, benefits, and communication with these clients is always a good investment.

Try one of these six ideas to put the spring in your sales this season.

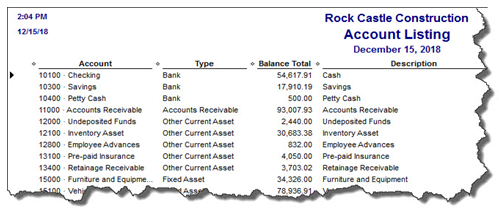

It’s not hard to see when your home needs a good cleaning but QuickBooks company file errors are harder to recognize so here are a few errors to watch for:

- Performance problems

- Inability to execute specific processes

- Occasional program crashes

- Missing data (accounts, names, dates)

- Refusal to complete transactions

- Mistakes in reports

One thing you can do on your own is to start practicing good preventive medicine to keep your QuickBooks company file healthy. Once a month or so, perhaps at the same time you reconcile your bank accounts, do a manual check of your major Lists.

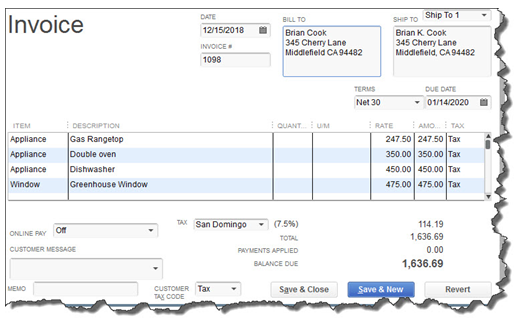

Run the Account Listing report (Lists, Chart of Accounts, and Reports). Ask yourself: Are all of your bank accounts still active? Do you see accounts that you no longer use or which duplicate each other? You may be able to make them inactive or merge duplicates. Be very careful here. If there’s any doubt, leave them there. Do not try to fix the Chart of Accounts on your own. Let us help or speak with your tax preparer. Do not make accounts with balances inactive.

Figure 2: You might run this report periodically to see if it can be abbreviated.

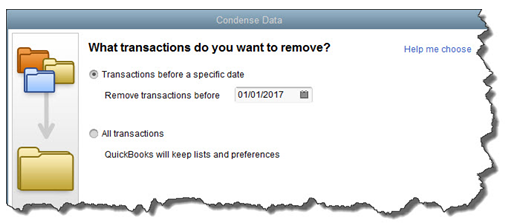

A Risky Utility

The program’s documentation for this utility contains a list of warnings and preparation steps a mile long. We recommend that you do not use this tool. Same goes for Verify Data and Rebuild Data in the Utilities menu. If you lose a significant amount of company data, you can also lose your company file. It’s happened to numerous businesses.

Figure 3: Yes, QuickBooks allows you to use this tool on your own. But if you really want to preserve the integrity of your data, let us help.

The best thing you can do if you notice problems like this cropping up in QuickBooks – especially if you’re experiencing multiple ones – is to contact us. We understand the file structure of QuickBooks company data, and we have access to tools that you don’t. We can analyze your file and take steps to correct the problem(s).

Your copy of QuickBooks may be misbehaving because it’s unable to handle the depth and complexity of your company. It may be time to upgrade. If you’re using QuickBooks Pro, consider a move up to Premier. And if Premier isn’t cutting it anymore, consider QuickBooks Enterprise Solutions.

There’s cost involved, of course, but you may already be losing money by losing time because of your version’s limitations. All editions of QuickBooks look and work similarly, so your learning curve will be minimal.

We Are Here for You

We’ve suggested many times that you should contact us for help with your spring cleanup. While that may seem self-serving, remember that it takes us a lot less time and money to take preventive steps with your QuickBooks company file than to troubleshoot a broken one.

Do you love using Facebook with your friends but know you’re missing out by not using it in business? Do you feel guilty when you post a business promotion and would prefer not to bug your friends? The good news is there’s an easy way to separate Facebook personal use from business within your personal account.

The answer is to group your friends by lists. Once you do that, you can selectively post to the appropriate list(s). Here’s how to do it, step by step.

Log into Facebook and go to your Home page. From the left column, locate the section on Friends and click on More, which is just to the right. At the top right of this Friends page, you’ll see a button called Create List.

Create two lists: one labeled Business and one labeled Personal. You can create far more than two if you want, but for now, start with two. Click the Create button and it will then ask you if you want to add friends. Click that button and select the friends you want to add to each list. In some cases, you’ll want a friend to be on both lists, and that’s fine. Once you’re done, you’ll have a list of business friends and a list of personal friends.

When you post an item, you can select which list you want to see your post. If you’re showing private events like birthdays, weddings, drunk parties, and grandbabies, you may only want friends to see those posts. If you’re pitching a new product, your business list should see that post, but you might not want to bug your friends.

Enter your post as usual and locate the Custom button to the left of the blue Post button. Select the list of friends that you wish to see this post. Then click Post. You’ve now successfully separated your personal and business friends and posts on Facebook.

Almost every social media account has a way for you to separate business from personal, so don’t let this excuse be a reason to miss out on some great marketing opportunities for your business.

A 2014 Global Fraud Study conducted by the Association of Certified Fraud Examiners (ACFE) estimates that the average business loses five percent of their revenues to fraud. The global total of fraud losses is $3.7 trillion. The median fraud case goes 18 months before detection and results in a $145,000 loss. How can you avoid being a fraud victim?

The first step is to become more aware of the conditions that make fraud possible. The fraud triangle is a model that describes three components that need to be present in order for fraud to occur:

- Motivation (or Need)

- Rationalization

- Opportunity

When fewer than three legs of the triangle are present, we can deter fraud. When all three are present, fraud could occur.

Motivation

Financial pressure at home is an example of when motivation to commit fraud is present. The fraud perpetrator finds themselves in need of large amounts of cash due to any number of reasons: poor investments, gambling, a flamboyant lifestyle, need for health care funds, family requirements, or social pressure. In short, the person needs money and lots of it fast.

Rationalization

The person who commits fraud rationalizes the act in their minds:

- I’m too smart to get caught.

- I’ll put it back when my luck changes.

- The big company won’t miss it.

- I don’t like the person I’m stealing from.

- I’m entitled to it.

At some point in the process, the person who commits fraud loses their sense of right and wrong and their fear of any consequences.

Opportunity

Here’s where you as a business owner come in. If there’s a leak in your control processes, then you have created an opportunity for fraud to occur. People who handle cash, signatory authority on a bank account, or financial records with poor oversight could notice that there is an opportunity for fraud to occur with the ability to cover the act up for some time.

Seventy-seven percent of all frauds occur in one of these departments: accounting, operations, sales, executive/upper management, customer service, purchasing and finance. The banking and financial services, government and public administration, and manufacturing industries are at the highest risk for fraud cases. (Source: ACFE)

Prevention

Once you understand a little about fraud, prevention is the next step. To some degree, all three points on the triangle can be controlled; however, most fraud prevention programs focus on the third area the most: Opportunity. When you can shut down the opportunity for fraud, then you’ve gone a long way to prevent it.

While we hope fraud never happens to you, it makes good sense to take preventative steps to avoid it. Please give us a call if we can help you in any way.

New Business Direction LLC

New Business Direction LLC