As a business coach and advisor, one of the most important conversations I have with restaurant customers revolves around understanding what it takes to make a profit and how to price their menu by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a busy restaurant, a construction company, or a retail shop, mastering this concept can be the difference between survival and sustainable success.

As a business coach and advisor, one of the most important conversations I have with restaurant customers revolves around understanding what it takes to make a profit and how to price their menu by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a busy restaurant, a construction company, or a retail shop, mastering this concept can be the difference between survival and sustainable success.

Let’s break this down with clarity and real-world examples.

What Are Fixed and Variable Expenses?

- Fixed Expenses are costs that remain constant regardless of your business activity level. They do not change with sales or production volume.

- Variable Expenses fluctuate in direct proportion to your revenue or output. More sales revenue or customers means more variable costs.

Understanding the balance between the two helps you:

- Plan more accurately

- Price your menu items effectively

- Make better staffing and purchasing decisions

- Know exactly what it takes to break even—that is, to cover your expenses without incurring a loss.

Restaurant Industry

Variable Expenses:

- Food and beverage costs

- Liquor costs

- Wages paid for servers, bartenders, chefs, dishwashers

- Cooking fuel (e.g. propane, fry-oil)

- Linen service and paper goods

- Packaging for take-out service

- Merchant account fees

Fixed Expenses:

- Lease on restaurant space

- Equipment lease (e.g. ovens, walk-ins)

- Business insurance premiums

- Manager’s salary

- Utility bills (e.g. telephone, electricity)

Breakeven Example: Let’s say your monthly fixed costs are $25,000/month or $300,000/year and your average meal ticket is $45 with a $20 variable cost leaving you with a margin of $25/cover (56%). You would need to serve 12,000 meals per year, average 1,000 meals per month or 231 per week. If your restaurant is open five days/week, that’s 46 covers per day. If you have 20 seats in your restaurant, you will need to turn your tables 2.3 times.

Breakeven Revenue Formula

The breakeven point in terms of revenue is calculated as follows:

Breakeven Revenue = Fixed Costs / Contribution Margin

$300,000 / .5556 = $539,956

You will need to generate $539,956 in revenue to break even and anything beyond that is profit.

Here’s the breakeven analysis in graph format:

- The blue dashed line shows your fixed overhead.

- The red line is your total cost (fixed + variable).

- The green line is your revenue.

- The gray dashed line marks the breakeven point, which is $539,956 in revenue.

This chart helps visualize exactly how much you need to bring in before turning a profit.

Why This Matters

When you clearly define your fixed and variable expenses, you’re better positioned to:

- Adjust menu pricing intelligently

- Manage payroll strategically

- Negotiate purchasing

- Scale your business with intention

Breakeven analysis isn’t just a math exercise—it’s a decision-making compass. When you know your breakeven point, you know exactly what you need to sell, build, or serve each month just to stay afloat—and how much more to hit your profit targets.

Final Thought

Every dollar you bring in above your breakeven point contributes directly to your profit—but only if you manage your variable costs wisely. Understanding this relationship helps you shift from reactive to strategic business operations.

If you’re unsure how to calculate your breakeven point or how your cost structure stacks up, let’s talk. I help construction, retail, and restaurant owners like you take control of their numbers so they can focus on growth with confidence.

As a business coach and advisor, one of the most impactful conversations I have with customers revolves around understanding what it takes to make a profit by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a construction company, a retail shop, or a bustling restaurant, mastering this concept can be the difference between survival and sustainable success.

Let’s break this down with clarity and real-world examples.

What Are Fixed and Variable Expenses?

- Fixed Expenses are costs that remain constant regardless of your business activity level. They do not change with sales or production volume.

- Variable Expenses fluctuate in direct proportion to your revenue or output. More sales revenue or projects means more variable costs.

Understanding the balance between the two helps you:

- Plan more accurately

- Price your services and/or products effectively

- Make better hiring and investment decisions

- Know exactly what it takes to break even—that is, to cover your expenses without incurring a loss.

Construction Industry

Variable Expenses:

- Job materials (e.g., concrete, lumber, flooring)

- Subcontractor fees (e.g., electricians, plumbers)

- Equipment rental (e.g., excavators, lifts, scaffolding)

- Direct labor on job sites (typically paid hourly)

- Direct labor burden (payroll taxes, workers compensation, benefits)

- Fuel and transportation related to specific projects

Fixed Expenses:

- Office rent or warehouse lease

- Business insurance premiums

- Salaried administrative staff

- Utility bills for a permanent office location

Breakeven Example: Let’s say your annual fixed costs are $600,000 and that you markup your variable costs to arrive at an average 35% contribution margin, that’s how much your projects contribute to covering the overhead.

Breakeven Revenue Formula

The breakeven point in terms of revenue is calculated as follows:

Breakeven Revenue = Fixed Costs / Contribution Margin

$600,000 / .35 = $1,714,285.71

You will need to generate $1,714,286 in revenue to break even and anything beyond that is profit.

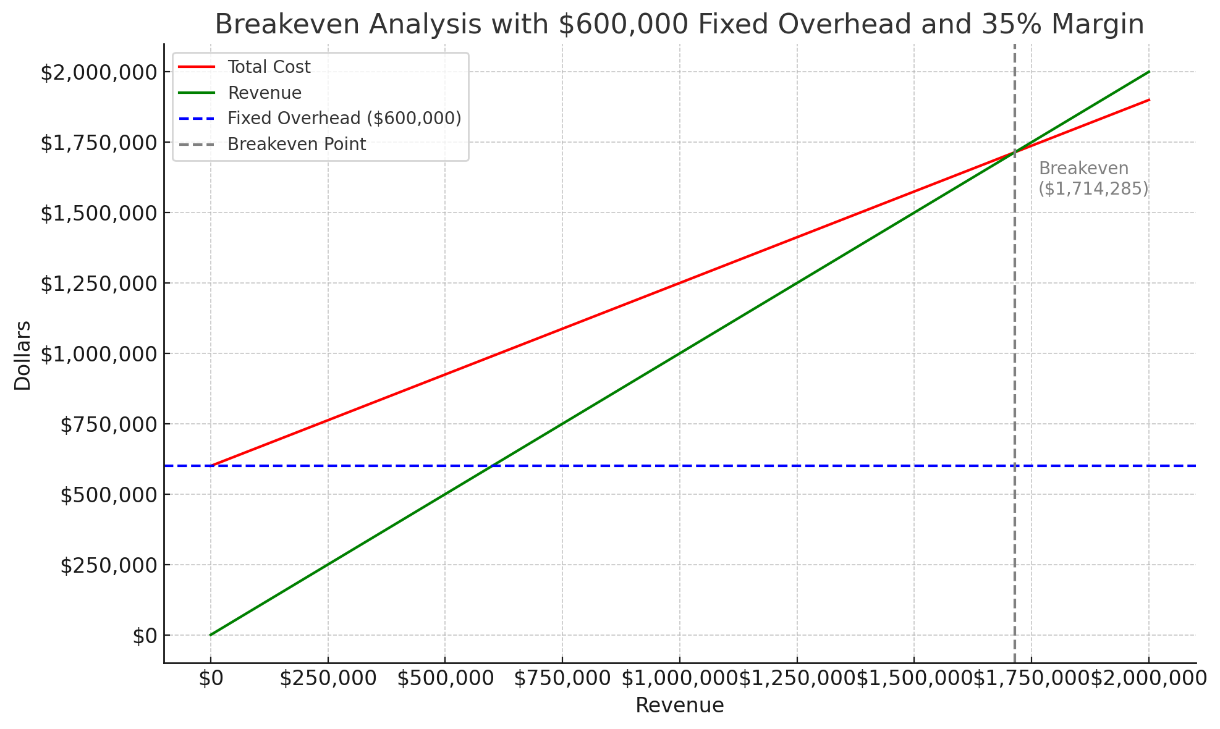

Here’s the breakeven analysis in graph format:

- The blue dashed line shows your fixed overhead.

- The red line is your total cost (fixed + variable).

- The green line is your revenue.

- The gray dashed line marks the breakeven point, which is $1,714,286 in revenue.

This chart helps visualize exactly how much you need to bring in before turning a profit.

Why This Matters

When you clearly define your fixed and variable expenses, you’re better positioned to:

- Adjust pricing intelligently

- Manage payroll strategically during slow seasons

- Negotiate vendor contracts

- Scale your business with intention

Breakeven analysis isn’t just a math exercise—it’s a decision-making compass. When you know your breakeven point, you know exactly what you need to sell, build, or serve just to stay afloat—and how much more to hit your profit targets.

Final Thought

Every dollar you bring in above your breakeven point contributes directly to your profit—but only if you manage your variable costs wisely. Understanding this relationship helps you shift from reactive to strategic business operations.

If you’re unsure how to calculate your breakeven point or how your cost structure stacks up, let’s talk. We help construction, retail, and restaurant owners like you take control of their numbers so they can focus on growth with confidence.

Stay tuned for our next issue of Fun With Finance where we break this down for the retail and restaurant industries.

Welcome to the first edition of Fun With Financials! Managing finances doesn’t have to be overwhelming or boring—we’re here to break it down into simple, actionable steps. This month, we’re diving into squeezing the balance sheet: what that means and how to do it.

The balance sheet report shows what your business owns (assets) vs. what it owes (liabilities). “Squeezing the balance sheet” (proving or cleaning up the balance sheet) means ensuring that all asset and liability account balances are complete and accurate, which proves that all transactions have been captured, which in turn forces the profit and loss statement to reflect the correct bottom line.

This process is critical in financial reporting because any missing or incorrect entries in the balance sheet directly impact a company’s financial performance on the profit and loss report. It’s especially important at the end of your fiscal year to have all of these balances accurate for financial and tax filing purposes.

How to Squeeze the Balance Sheet Effectively:

Bank accounts – Checking, savings, money market, CDs, petty cash, drawer cash – reconcile these accounts – ensure that the balances in your books reconcile with the balances on your bank statements or physical counts of the petty cash bag or cash register drawers.

Accounts receivable – Review the outstanding invoices that you’ve sent to customers and confirm the balances of who owes you money and how much – if someone is not going to pay, write it off – get it off the receivables list before year-end.

Inventory – Do a physical count to confirm what you have, remove obsolete or damaged items, and ensure that the value on your books matches what you actually have in stock.

Prepaid Insurances/Expenses – If you have paid your insurance premiums or any other business expense in advance, an adjustment needs to be made to record the expenses in the proper accounting period to avoid distorting financial results.

Fixed Assets/Depreciation – Review the depreciation schedule from the prior year’s tax return – do you still own those assets? Are they damaged or obsolete? Did you scrap them? Did you trade them in? Have you purchased a new building, vehicle, or equipment for your business – has the purchase transaction been recorded in your books? Has depreciation been calculated and adjusted on the assets you own?

Accounts Payable – Review the bills you owe to vendors and suppliers as of year end – many times you’ll receive a bill after year-end that is for a service or material provided in the prior year – it’s a payable when the service or material is received – make sure all outstanding bills are recorded in the proper accounting period.

Gift Cards/Certificates – If your business sells/redeems gift certificates or gift cards, it’s important to tie out the amount on your books to the amount that the gift card company shows as outstanding – many times, gift cards will be sold for zero dollars in your point of sale system, i.e. when a donated gift card is provided to a nonprofit organization – it may be zero dollars on your books, yet it has a balance on the street.

Credit Cards – Confirm that all credit card transactions have been entered and each credit card statement has been reconciled to your books, even if you have not paid the balance due yet – it’s a liability until you pay it, yet it’s an expense when you incur the charge – transaction dates matter.

Long-Term Debt – Did you buy an asset with payment installments over a period of time? Is the asset reflected in your books at the principal amount with interest recorded separately?

By tightening up these balance sheet areas, your business can ensure that the profit and loss statement accurately reflects net income, leading to better financial decision-making in the future. Would you like a checklist for squeezing the balance sheet for your business? Contact us at info@newbusinessdirections.com!

New Business Direction LLC

New Business Direction LLC