Our “Comprehensive COVID-19 Sick Pay and Paid Leave” YouTube tutorial has helped thousands of people since it was released last year, teaching QuickBooks Desktop users how to set up COVID-19 Sick Pay, FMLA, and Health Premiums under the Families First Coronavirus Response Act (FFCRA).

Recently, the tutorial received some updates. Below, you’ll find helpful screen grabs and instructions with the most up-to-date information about the processes explained in this video. The times mentioned below are all hyperlinked to the video and will route you directly to the timestamp being mentioned for ease of access. For additional helpful information, make sure to view the comments section of the video.

The video can be viewed in its entirety here: https://www.youtube.com/watch?v=D8zIiPk3eNI&t=2s

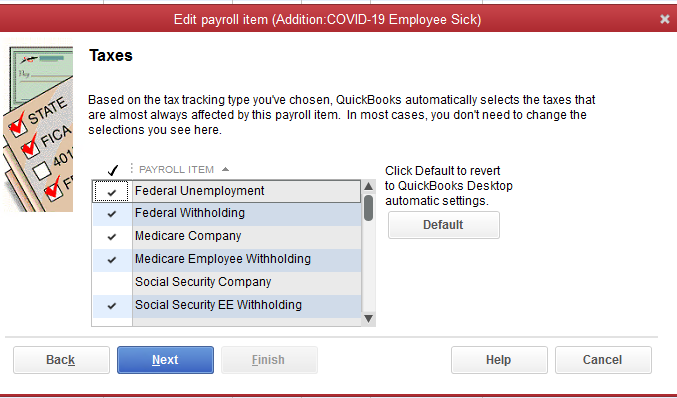

1. At 6:03, we discuss creating a COVID-19 employee sick pay item. The video shows that the social security company tax is checked, which is no longer correct. To revert back to the correct tax settings, select the “default” button. The screenshot below demonstrates the correct tax settings:

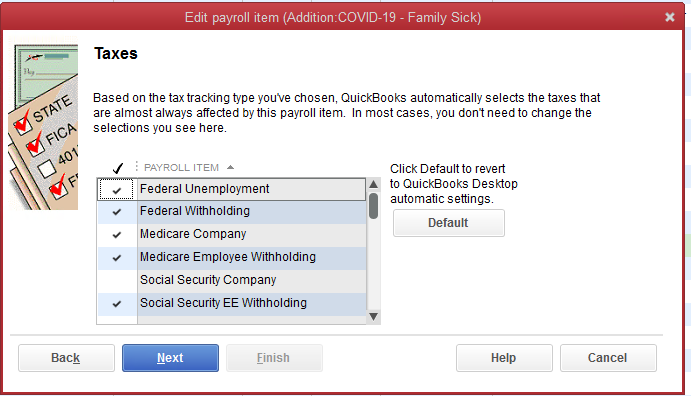

2. At 7:17, we discuss creating a family sick pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

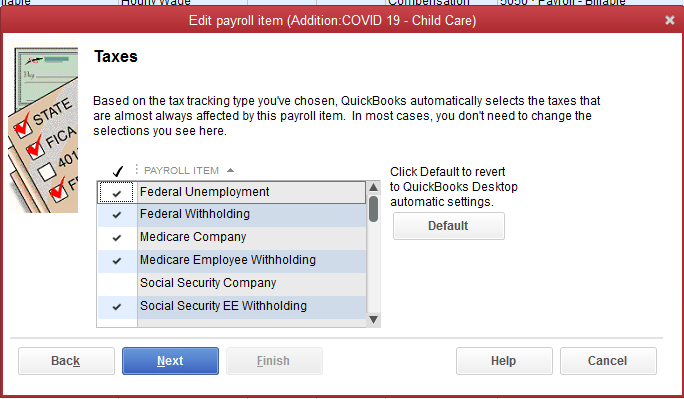

3. At 8:30, we discuss creating a child care pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

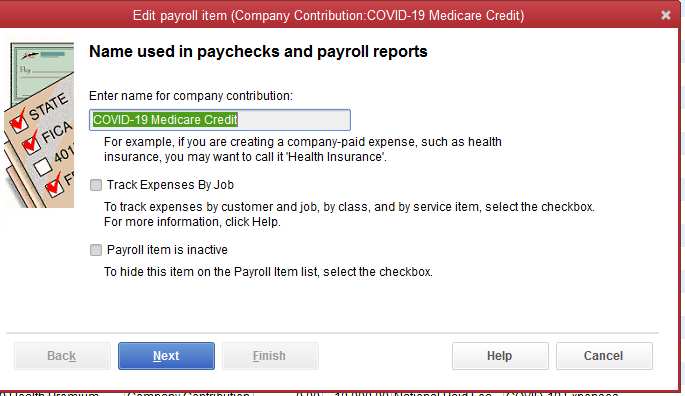

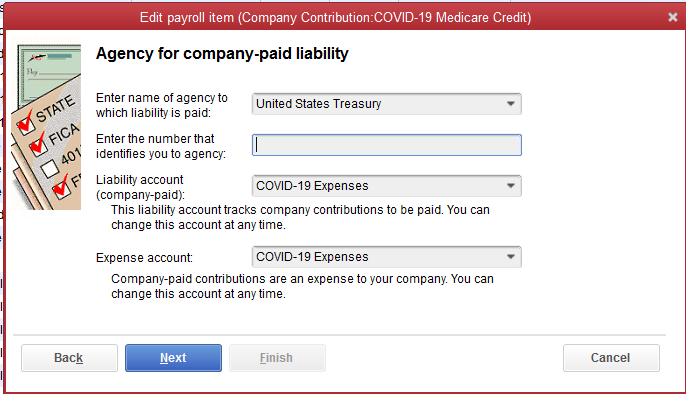

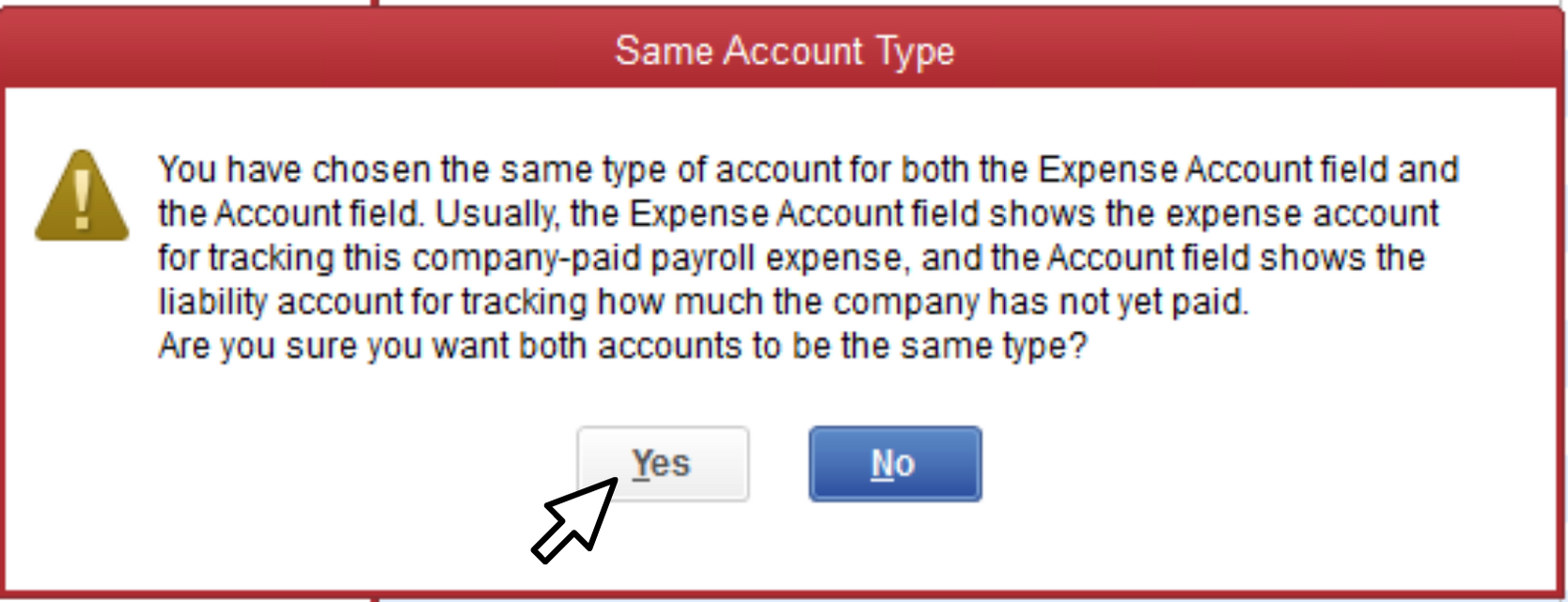

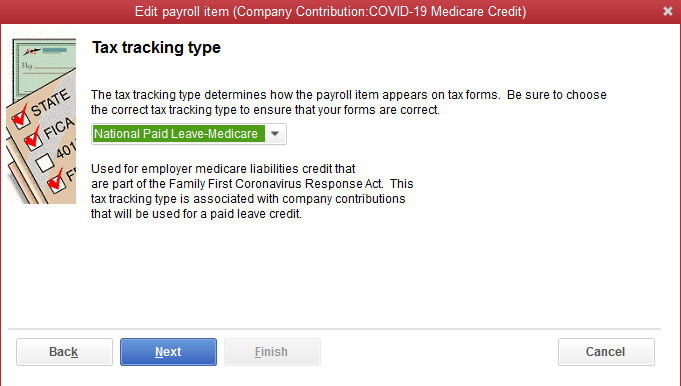

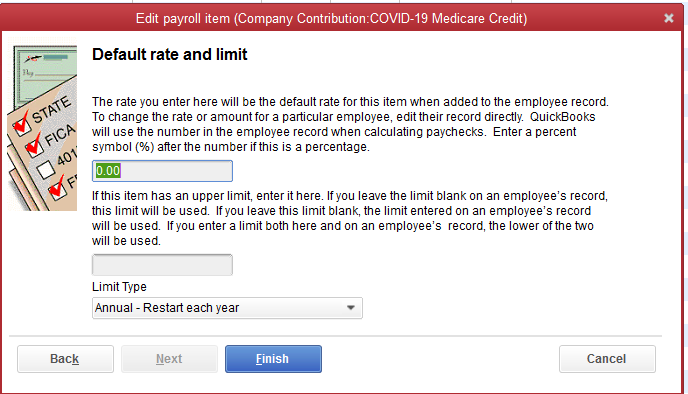

4. At 11:48, we discuss setting up a national paid leave credit. A second company contribution for the COVID-19 Medicare credit should have been created; Intuit later released information on this, and while the comments in the video contain this update, we wanted to ensure this information was easily accessible. The seven consecutive screenshots present the correct steps to take.

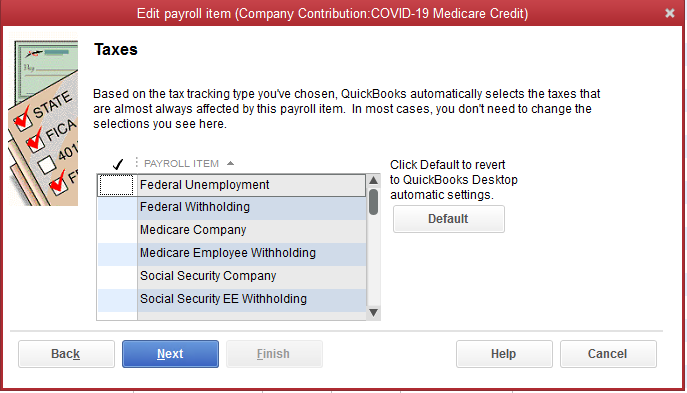

6. At 17:51, we discuss payroll liabilities. The video shows that the Medicare employee additional tax is checked, however, it should not be. Instead, the following items sh0uld be checked off:

- the federal withholding

- the Medicare company

- the Medicare employee withholding

- the social security company (this should be zero for COVID pay)

- social security employee withholding

At first glance, this article topic might seem too simple. After all, to get paid, don’t you just take money out of your business? Well, yes, but there is much more to it in the long run as well as from an accounting side. Let’s take a look.

The Traditional Paycheck

If you’ve ever worked for someone else, you probably received a paycheck every few weeks. It took care of three major things:

- Your regular pay that you live off from day to day

- Taxes you owe to the federal and state government

- Benefits. Depending on the employer, you might have received health care, retirement contributions, and vacation and holiday pay.

The employer took care of the needs you have today as well as some of your future needs.

Your Business Pay

Now that you’re the employer – of yourself, your business must cover all the items mentioned above. How it does that depends on the type of entity you chose when your business was formed.

Sole Proprietors

If you are doing business as a sole proprietor, you take draws from your business instead of paychecks. A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. The draws do not include any kind of taxes, including self-employment taxes; these need to be deposited separately, usually through quarterly estimated tax deposits to the IRS and to any relevant state agency.

As a sole proprietor, you’ll likely need to find your own health insurance. And the most important thing you’ll need to do is plan for your retirement by investing in IRAs or otherwise saving money that is earmarked for your retirement.

From an accounting standpoint, owner’s draws are shown in the equity portion of the balance sheet as a reduction to the owner’s capital account.

Corporations

If your business is formed as a C Corporation or an S Corporation, you will most likely receive a paycheck just like you did when you were employed by someone else. You will also be responsible for making the payroll tax deposit, funding the retirement plan, and paying for health care insurance.

From an accounting standpoint, corporate payroll, taxes, and benefits are all considered expenses and are shown on the income statement. Any money taken out additionally is a reduction to the owner’s capital account, and this is shown in the equity section of the balance sheet.

Rules for Shareholder benefits and additional distributions are complex, so please reach out to your tax professional for guidance.

Partnerships

If your business is formed as a partnership, each partner will be paid distributions based on the partnership agreement. Typically, that means receiving a base salary and a portion of the profits. You can also take money out of the partnership. Taxes are not included; you are responsible for making your quarterly estimated payments. Plus, you will also be responsible for paying self-employment taxes.

For benefits like retirement plans, partners can be eligible, but the tax treatment of these and other benefits is not necessarily the same as it is for a W-2 employee. Again, the rules are complex for deductibility, so it’s best to contact a tax professional to find out more.

Evaluating Company Profits

It’s critical to understand where your wages show up on your books so that you can truly understand your business’s profitability. With corporations, the salaries are included in the expenses, so net income is after, or net of, salaries and payroll taxes.

With sole proprietors and partnerships, the net income figure on the income statement does not include owner salaries because there aren’t any. Instead, only the equity section is impacted. Net income for partnerships and sole proprietors should always be high enough to at least “cover” an amount equivalent to a “so-called salary” for all of the active, participating owners.

If you have questions or need help understanding how business owners get paid, please feel free to reach out any time.

Join Rhonda Rosand, CPA and Advanced Certified QuickBooks ProAdvisor of New Business Directions LLC, to set up your COVID-19 Expense account, payroll liabilities account, payroll items and tax credit in QuickBooks Desktop. See what it looks like when you process a payroll and where to go to find the remaining balance of your tax credit.

Abandoned Property – What Is It? How Do We Account For It?

How many times have you written a check to someone, who either loses it or forgets to cash the check? After a certain amount of time, that check is considered stale and can no longer be presented to be cashed. It sits in your QuickBooks file uncleared on the bank statement reconciliation, now what?

You call the person, ask them to cash it. You may even re-issue the check so they have another chance to get paid, but then you find out they moved away and you don’t have their address, now what?

Uncashed checks to vendors, payroll checks to employees, contractors, dividends, and distributions to stockholders all are potential unclaimed or abandoned property. Every state has their own escheatment laws that require businesses and organizations to hand over to the state, the abandoned property that has been in their possession for a certain period of time. If a check goes uncashed, that does not mean the property no longer belongs to that individual and the obligation that the employer has to compensate the employee does not go away.

In the state of New Hampshire, you are required to notify the owner of the abandoned property. No more than 120 days prior to filing, all holders must send a written notice to the owner of the property having a value of $50.00 or more. In this notice you must verify the nature of the property and how to retrieve it and avoid abandonment to the state. If this attempt at notifying the owner is unsuccessful, you will then move forward to reporting the abandoned property to the state.

How to Report Abandoned Property in New Hampshire

To begin the process of reporting abandoned property, you must fill out the State of New Hampshire form for abandoned property which is Form T-1. Below is a link for your convenience to click on and review this form and/or print it.

https://www.nh.gov/treasury/documents/abandonded-propert-t1-form.pdf

For detailed instructions on how to fill out this form, we have also provided you the necessary link that will walk you through, step-by-step for filling out NH Form T-1.

https://www.nh.gov/treasury/documents/abandonded-property-t1-instructions.pdf

The first column on the form asks for the correct code for the property type. Here is a link that will show you which code is appropriate for your abandoned property.

https://www.nh.gov/treasury/documents/property-type-codes-t1-a.pdf

How to handle Abandoned Property in QuickBooks

It is important to remember that abandoned property does not belong to the company. That property is either owed to the state or owner. Uncashed checks should never be voided. Making sure your bank accounts are reconciled on a monthly basis will help you monitor uncashed checks. Once that property amount is sent to the state or given to the property owner, it can then be cleared from your bank reconciliation.

For business owners with employers, payroll is a necessary task that can slow your day and tie you down if you let it. If you’re looking for a way to make payroll less time-consuming, here are five ideas you can put to good use:

- Employee Onboarding

If you hire a lot, empower your new hires by letting them do their paperwork for you. A good payroll system allows employees to “onboard” themselves, completing the I-9, W-4, and direct deposit authorizations electronically, even before they show up for their first day. You’ll still need to ask for ID on their first working day, but at least you won’t have to do their paperwork for them.

- Integrate Employee Benefits

Rather than hire several separate companies to handle benefits, some payroll systems allow you to integrate benefits solutions right in their dashboard. That way, you won’t have to re-enter employee data in multiple systems, which often gets out of sync. Deductions and payments can also be integrated to save accounting time.

- Delegate Timesheet Entry

Require non-exempt employees to enter their own time; all you should have to do is approve it. The right timesheet application can take care of that, and a great timesheet application will allow employees to enter time from multiple options, including timecard, cell phone, and others.

- Eliminate the Annual Worker’s Compensation Audit

Tie your worker’s compensation vendor to your accounting system, and you’ll be able to avoid that time-consuming annual reconciliation report required by your worker’s compensation insurance company. You can also avoid the large annual payment because the insurance will be taken out each payroll cycle.

- Reduce the Frequency of Payroll

It’s not always possible, but if you can pay employees less frequently, you might be able to cut your payroll time in half. Pay weekly employees every two weeks or pay bi-weekly employees monthly. Reducing payroll frequency boosts cash flow as well.

Try one of these five ideas to streamline your payroll time and costs in your business. And as always, let us know if we can help.

Effective December 1, 2016, federal overtime regulations will change and may affect how you are paying your employees. These overtime updates will affect 4.2 million workers across the country.

The new rules will raise the salary overtime-eligibility threshold from $455/week to $913 ($47,476 per year). This new threshold will increase every three years. Salaried workers already entitled to overtime will get increased protection.

Employers have a choice of three actions they can take to employees who become eligible for overtime that weren’t before.

- Pay time-and-a-half for overtime work.

- Raise worker’s salaries above the new threshold.

- Limit worker’s hours to 40 per week.

Let’s say you have an employee that earns $500 per week and works 50 hours a week. Previously, you didn’t pay overtime, but beginning December 1, 2016, you will need to. At $12.50 per hour, you would owe them the regular $500 plus 10 hours of overtime at $187.50.

Let’s say you have an employee earning $800 per week and they work 50 hours. Previously, you didn’t pay overtime, but now you will need to consider it. You could pay them overtime, which works out to a weekly pay of $1100. Or you can choose to give them a raise to $913 per week – the new threshold – and continue to exempt them from overtime. The latter is the lowest cost alternative.

In both cases above, it may be cheaper to hire an additional part-time worker to work the 10 extra hours per week.

You can find more about the new overtime law here:

https://www.dol.gov/featured/overtime/

And if you have any questions about your payroll, feel free to reach out anytime.

The New Business Directions Team is bringing the #1 employee-rated and requested Time Tracking Software to you. Sondra Love, Wayne Kukuruza, and Rhonda Rosand, CPA have recently joined the 6000+ TSheets PRO community by participating in an exclusive TSheets PRO certification course accredited by CPAacademy.org.So what exactly is TSheets? TSheets is a time tracking and scheduling software designed for businesses that track, manage, and report time. TSheets provides the alternative to paper timesheets and/or punch cards to simplify human resource and data processing roles for companies of all sizes.

But here’s the best part, TSheets fully integrates with QuickBooks by syncing accurate timesheets to your QuickBooks file and eliminating manual, duplicate time entries. Tracked and approved time can now be easily exported to either QuickBooks® Online or Desktop with just one click. Management can then use their favorite tools within QuickBooks to process payroll, calculate job costing, and create invoices in a more simplified work flow.

TSheets is also a scheduling software making it faster and easier to build and share schedules with employees, assign jobs, and alert shifts while increasing profitability and improving communication. In other words, we want to keep your workforce running like a well-oiled machine.

Oh, and have I mentioned their amazing customer service department? The TSheets team who’s behind the product is just as amazing as the software itself. Customer service team is passionate about their customers and provides exceptional support in times of need. They make your entire TSheets experience FUN and might even give you a smile or two.

New Business Direction LLC

New Business Direction LLC