Updating our “Comprehensive COVID-19 Sick Pay and Paid Leave” YouTube Training

Our “Comprehensive COVID-19 Sick Pay and Paid Leave” YouTube tutorial has helped thousands of people since it was released last year, teaching QuickBooks Desktop users how to set up COVID-19 Sick Pay, FMLA, and Health Premiums under the Families First Coronavirus Response Act (FFCRA).

Recently, the tutorial received some updates. Below, you’ll find helpful screen grabs and instructions with the most up-to-date information about the processes explained in this video. The times mentioned below are all hyperlinked to the video and will route you directly to the timestamp being mentioned for ease of access. For additional helpful information, make sure to view the comments section of the video.

The video can be viewed in its entirety here: https://www.youtube.com/watch?v=D8zIiPk3eNI&t=2s

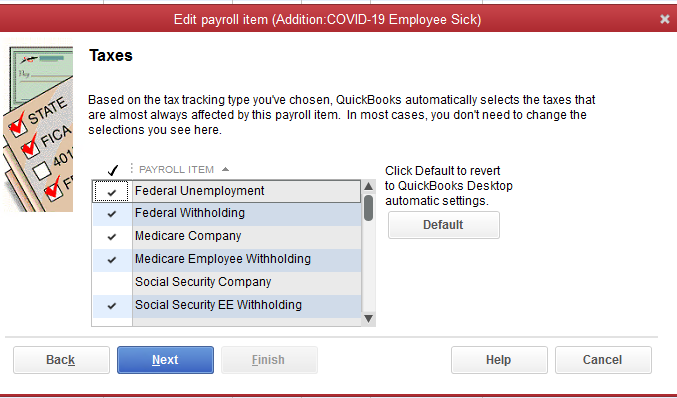

1. At 6:03, we discuss creating a COVID-19 employee sick pay item. The video shows that the social security company tax is checked, which is no longer correct. To revert back to the correct tax settings, select the “default” button. The screenshot below demonstrates the correct tax settings:

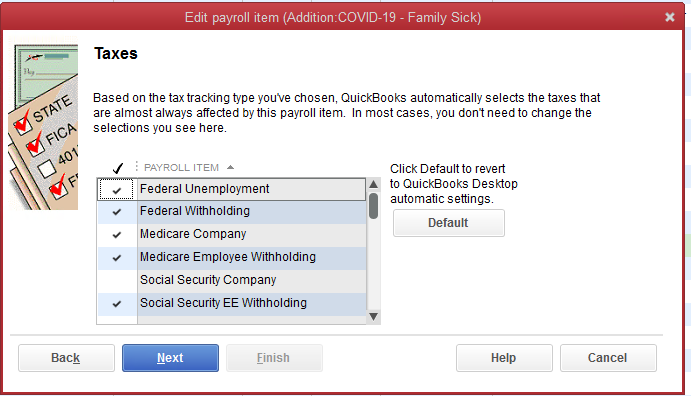

2. At 7:17, we discuss creating a family sick pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

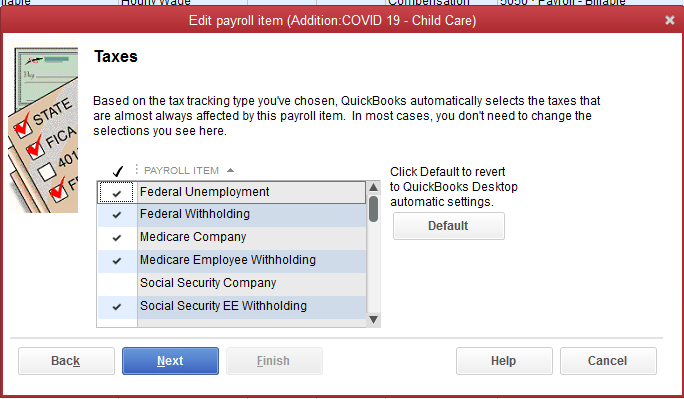

3. At 8:30, we discuss creating a child care pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

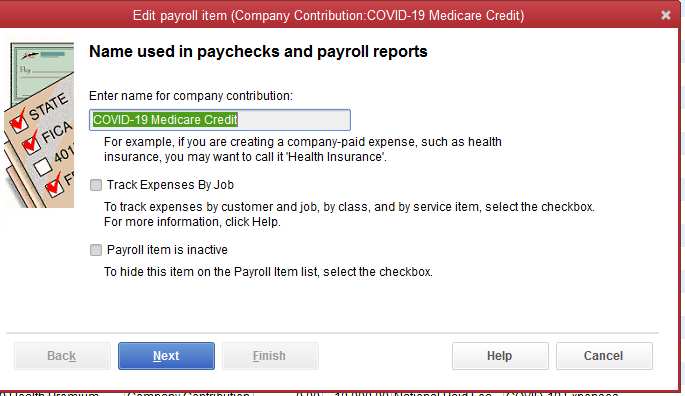

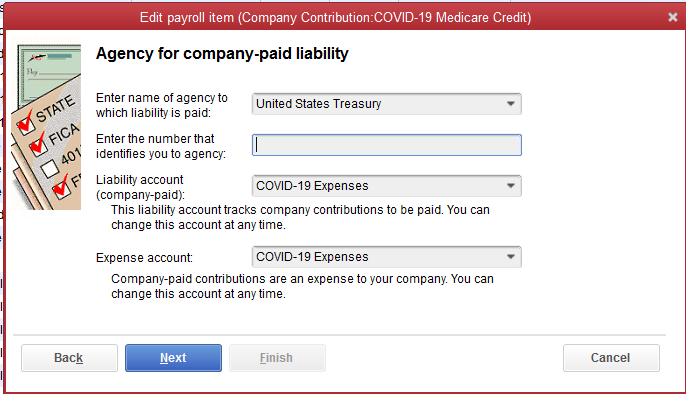

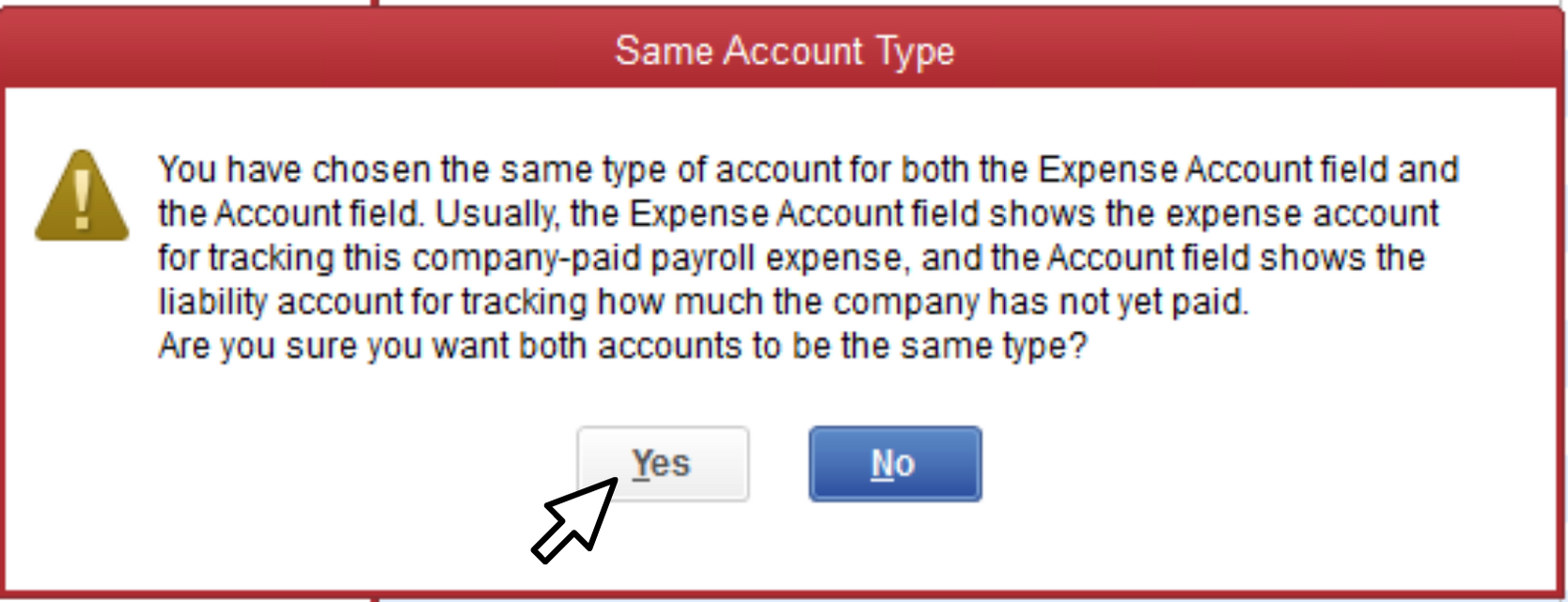

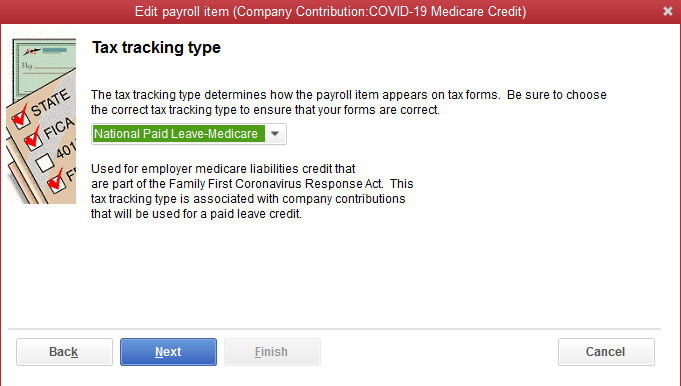

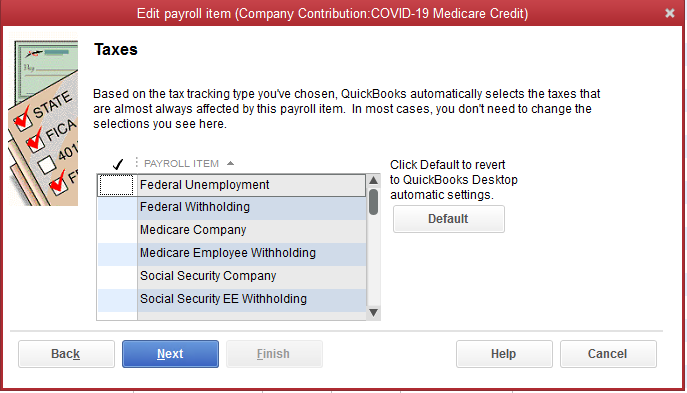

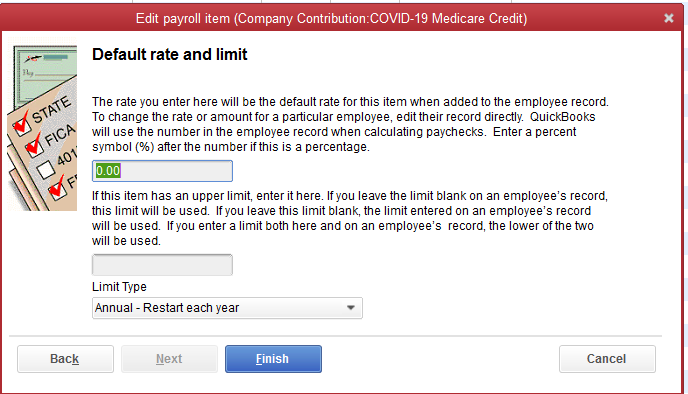

4. At 11:48, we discuss setting up a national paid leave credit. A second company contribution for the COVID-19 Medicare credit should have been created; Intuit later released information on this, and while the comments in the video contain this update, we wanted to ensure this information was easily accessible. The seven consecutive screenshots present the correct steps to take.

6. At 17:51, we discuss payroll liabilities. The video shows that the Medicare employee additional tax is checked, however, it should not be. Instead, the following items sh0uld be checked off:

- the federal withholding

- the Medicare company

- the Medicare employee withholding

- the social security company (this should be zero for COVID pay)

- social security employee withholding

New Business Direction LLC

New Business Direction LLC