As a business coach and advisor, one of the most important conversations I have with restaurant customers revolves around understanding what it takes to make a profit and how to price their menu by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a busy restaurant, a construction company, or a retail shop, mastering this concept can be the difference between survival and sustainable success.

As a business coach and advisor, one of the most important conversations I have with restaurant customers revolves around understanding what it takes to make a profit and how to price their menu by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a busy restaurant, a construction company, or a retail shop, mastering this concept can be the difference between survival and sustainable success.

Let’s break this down with clarity and real-world examples.

What Are Fixed and Variable Expenses?

- Fixed Expenses are costs that remain constant regardless of your business activity level. They do not change with sales or production volume.

- Variable Expenses fluctuate in direct proportion to your revenue or output. More sales revenue or customers means more variable costs.

Understanding the balance between the two helps you:

- Plan more accurately

- Price your menu items effectively

- Make better staffing and purchasing decisions

- Know exactly what it takes to break even—that is, to cover your expenses without incurring a loss.

Restaurant Industry

Variable Expenses:

- Food and beverage costs

- Liquor costs

- Wages paid for servers, bartenders, chefs, dishwashers

- Cooking fuel (e.g. propane, fry-oil)

- Linen service and paper goods

- Packaging for take-out service

- Merchant account fees

Fixed Expenses:

- Lease on restaurant space

- Equipment lease (e.g. ovens, walk-ins)

- Business insurance premiums

- Manager’s salary

- Utility bills (e.g. telephone, electricity)

Breakeven Example: Let’s say your monthly fixed costs are $25,000/month or $300,000/year and your average meal ticket is $45 with a $20 variable cost leaving you with a margin of $25/cover (56%). You would need to serve 12,000 meals per year, average 1,000 meals per month or 231 per week. If your restaurant is open five days/week, that’s 46 covers per day. If you have 20 seats in your restaurant, you will need to turn your tables 2.3 times.

Breakeven Revenue Formula

The breakeven point in terms of revenue is calculated as follows:

Breakeven Revenue = Fixed Costs / Contribution Margin

$300,000 / .5556 = $539,956

You will need to generate $539,956 in revenue to break even and anything beyond that is profit.

Here’s the breakeven analysis in graph format:

- The blue dashed line shows your fixed overhead.

- The red line is your total cost (fixed + variable).

- The green line is your revenue.

- The gray dashed line marks the breakeven point, which is $539,956 in revenue.

This chart helps visualize exactly how much you need to bring in before turning a profit.

Why This Matters

When you clearly define your fixed and variable expenses, you’re better positioned to:

- Adjust menu pricing intelligently

- Manage payroll strategically

- Negotiate purchasing

- Scale your business with intention

Breakeven analysis isn’t just a math exercise—it’s a decision-making compass. When you know your breakeven point, you know exactly what you need to sell, build, or serve each month just to stay afloat—and how much more to hit your profit targets.

Final Thought

Every dollar you bring in above your breakeven point contributes directly to your profit—but only if you manage your variable costs wisely. Understanding this relationship helps you shift from reactive to strategic business operations.

If you’re unsure how to calculate your breakeven point or how your cost structure stacks up, let’s talk. I help construction, retail, and restaurant owners like you take control of their numbers so they can focus on growth with confidence.

As a business coach and advisor, one of the most impactful conversations I have with customers revolves around understanding what it takes to make a profit by analyzing their cost structure—specifically, distinguishing between fixed and variable expenses—and how that affects their breakeven point. Whether you’re running a construction company, a retail shop, or a bustling restaurant, mastering this concept can be the difference between survival and sustainable success.

Let’s break this down with clarity and real-world examples.

What Are Fixed and Variable Expenses?

- Fixed Expenses are costs that remain constant regardless of your business activity level. They do not change with sales or production volume.

- Variable Expenses fluctuate in direct proportion to your revenue or output. More sales revenue or projects means more variable costs.

Understanding the balance between the two helps you:

- Plan more accurately

- Price your services and/or products effectively

- Make better hiring and investment decisions

- Know exactly what it takes to break even—that is, to cover your expenses without incurring a loss.

Construction Industry

Variable Expenses:

- Job materials (e.g., concrete, lumber, flooring)

- Subcontractor fees (e.g., electricians, plumbers)

- Equipment rental (e.g., excavators, lifts, scaffolding)

- Direct labor on job sites (typically paid hourly)

- Direct labor burden (payroll taxes, workers compensation, benefits)

- Fuel and transportation related to specific projects

Fixed Expenses:

- Office rent or warehouse lease

- Business insurance premiums

- Salaried administrative staff

- Utility bills for a permanent office location

Breakeven Example: Let’s say your annual fixed costs are $600,000 and that you markup your variable costs to arrive at an average 35% contribution margin, that’s how much your projects contribute to covering the overhead.

Breakeven Revenue Formula

The breakeven point in terms of revenue is calculated as follows:

Breakeven Revenue = Fixed Costs / Contribution Margin

$600,000 / .35 = $1,714,285.71

You will need to generate $1,714,286 in revenue to break even and anything beyond that is profit.

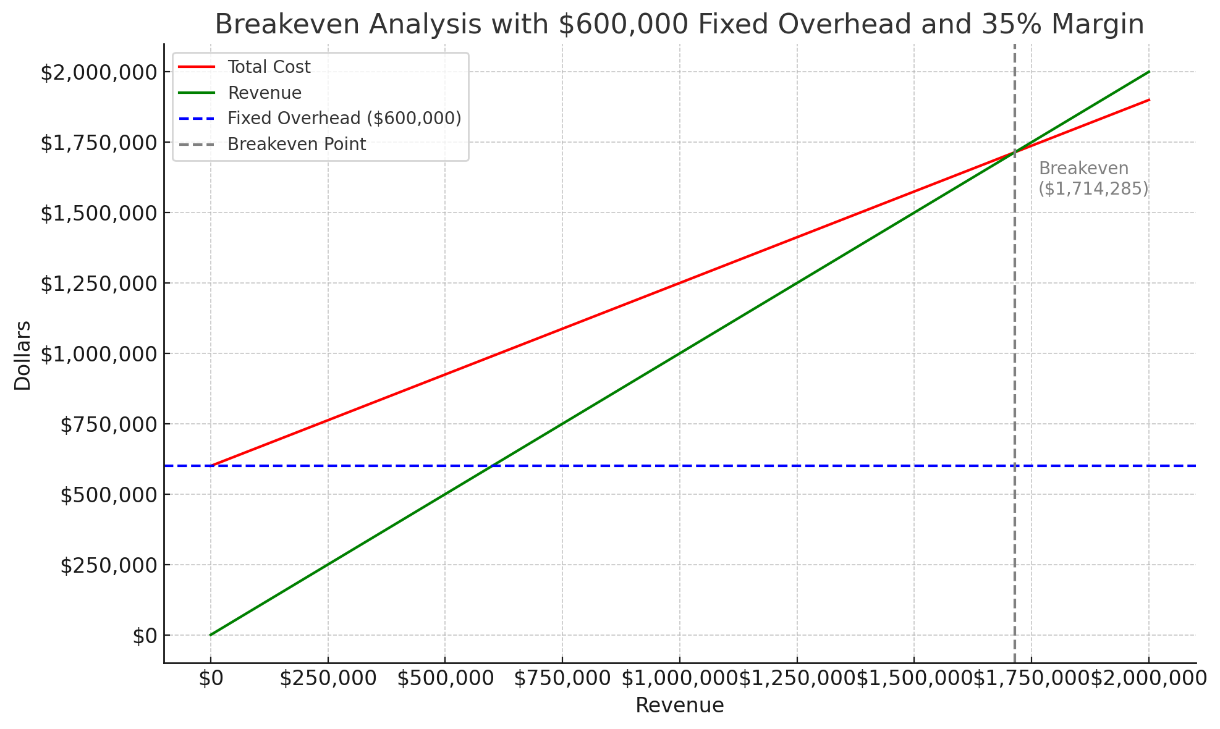

Here’s the breakeven analysis in graph format:

- The blue dashed line shows your fixed overhead.

- The red line is your total cost (fixed + variable).

- The green line is your revenue.

- The gray dashed line marks the breakeven point, which is $1,714,286 in revenue.

This chart helps visualize exactly how much you need to bring in before turning a profit.

Why This Matters

When you clearly define your fixed and variable expenses, you’re better positioned to:

- Adjust pricing intelligently

- Manage payroll strategically during slow seasons

- Negotiate vendor contracts

- Scale your business with intention

Breakeven analysis isn’t just a math exercise—it’s a decision-making compass. When you know your breakeven point, you know exactly what you need to sell, build, or serve just to stay afloat—and how much more to hit your profit targets.

Final Thought

Every dollar you bring in above your breakeven point contributes directly to your profit—but only if you manage your variable costs wisely. Understanding this relationship helps you shift from reactive to strategic business operations.

If you’re unsure how to calculate your breakeven point or how your cost structure stacks up, let’s talk. We help construction, retail, and restaurant owners like you take control of their numbers so they can focus on growth with confidence.

Stay tuned for our next issue of Fun With Finance where we break this down for the retail and restaurant industries.

New Business Directions, LLC just wrapped up another unforgettable team retreat at Ocean Park in San Juan, Puerto Rico! As a fully remote team, opportunities to connect face-to-face, in real life, not just on a computer screen, are rare, which makes our annual retreat even more special.

New Business Directions, LLC just wrapped up another unforgettable team retreat at Ocean Park in San Juan, Puerto Rico! As a fully remote team, opportunities to connect face-to-face, in real life, not just on a computer screen, are rare, which makes our annual retreat even more special.

This extended weekend was the perfect blend of relaxation, collaboration, and strategy. With the warm Puerto Rican sun as our backdrop, we stepped away from our daily routines to focus on strengthening our team dynamic and setting the course for another year of growth.

This extended weekend was the perfect blend of relaxation, collaboration, and strategy. With the warm Puerto Rican sun as our backdrop, we stepped away from our daily routines to focus on strengthening our team dynamic and setting the course for another year of growth.

Beyond the work, we enjoyed the incredible energy of Ocean Park—morning beach walks, kayaking in the lagoon, local cuisine, and plenty of laughter. These moments reminded us why we do what we do: to support our customers, grow as professionals, and create a work environment that feels both fulfilling and fun.

Beyond the work, we enjoyed the incredible energy of Ocean Park—morning beach walks, kayaking in the lagoon, local cuisine, and plenty of laughter. These moments reminded us why we do what we do: to support our customers, grow as professionals, and create a work environment that feels both fulfilling and fun.

We returned refreshed, inspired, and ready to tackle the year ahead with a renewed sense of purpose. Until next time, Puerto Rico!

Looking to plan your own company retreat for a fully-remote team? See our guide on retreats for team building.

QuickBooks® Desktop 2022 software will be discontinued after May 31, 2025. This affects all 2022 versions. Starting from June 1, 2025, you will not have access to technical support and will not receive the latest security patches.

In addition, certain features will no longer be available in your QuickBooks® 2022 after May 31st – QuickBooks® payroll processing, workers’ comp payment service, QuickBooks® workforce, payment processing, merchant service deposit (reconciliation), recurring payments, eInvoice, accountant copy transfer service, contributed reports, multi-currency/exchange rate, online banking, emailing reports from within the software.

Intuit is encouraging all Desktop 2022 users to upgrade to QuickBooks® Enterprise 24.0 or QuickBooks® Online. However, a version of QuickBooks Desktop Plus 2024 is also available at no

additional charge to existing QuickBooks Desktop Plus subscribers.

New Business Directions recommends that if you have an existing QuickBooks® Desktop Plus subscription that you upgrade to the 2024 version. If you do not have an existing subscription, we recommend upgrading to QuickBooks® Desktop Enterprise Solutions 24.0.

This is a friendly reminder that all eligible entities registered in the state of New Hampshire are required to file their annual report with the Secretary of State by April 1st of each year.

Entities that are required to file include:

- Corporations

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- Limited Liability Partnerships (LLPs)

Filing your annual report is crucial for maintaining your entity’s good standing. Failure to file can result in penalties, loss of privileges, and even dissolution of your business entity. You will have received an email with your business registration number and/or a paper mailing from the state with details regarding filing of this annual report.

Please ensure timely submission to avoid any complications. For assistance or more information, feel free to reach out to us or visit the Secretary of State’s website at https://sos.nh.gov

New Business Direction LLC

New Business Direction LLC