The Chart of Accounts is the foundation of your accounting system. It is a list of every account – bank, loan, asset, revenue, and expense – in your General Ledger, and it contains all of your accounting transactions.

The Chart of Accounts is the foundation of your accounting system. It is a list of every account – bank, loan, asset, revenue, and expense – in your General Ledger, and it contains all of your accounting transactions.

Think of your Chart of Accounts as a collection of buckets. These buckets need to be meaningful in their purpose because they’ll hold dollars of items relating to your business. For example, if you have three checking accounts, you need three buckets on your Chart of Accounts to hold the transactions for each bank account. It would not make any sense to have more or less than exactly one bucket for each checking account.

While it’s standard for most companies to have certain universal buckets (accounts) for assets, liabilities, and equity, the buckets you choose to categorize your business’s revenue and expenses will vary greatly in number and purpose because these are based on your business’s unique operations. It makes sense to create and design your accounts for your specific tax, accounting, and decision-making purposes needs.

Having certain expense accounts matched to the tax requirements can reduce extra work at tax time. For example, separating travel costs – hotel and airfare – from meals and entertainment is a common one.

The ultimate goal is to have a Chart of Accounts that works for you. If, when you first set up your accounting system, you accepted the default Chart of Accounts, it may be time to redesign and restructure the list so it serves your needs better. Below, you’ll find some questions to help guide this process:

- What revenue or expenses do you want to watch more carefully? Should they be broken out in more detail? You may want to use sub-accounts to group transactions.

- Is there cleanup work to do due to misspelling, duplication, or vague account names?

- Have you interviewed all the financial information users in your company to see how they need the data organized?

- What spreadsheets could be eliminated if the Chart of Accounts was better organized?

- Does your Chart of Accounts support your budgeting process? If two people are responsible for controlling spending from one account, would it be useful to break it out?

- Do you have too many accounts? Too few? (Most people have too many due to poor data entry hygiene.)

- Are you properly using other categorizing features in the accounting system, such as items, classes, and custom fields?

- What reports could produce better information for taking profit-focused actions in your business if the Chart of Accounts stored the transactions differently?

- How could key performance indicators be better linked to the Chart of Accounts?

These questions can help you begin thinking about how your Chart of Accounts can better serve you. After all, it’s your business, your accounting system, and your Chart of Accounts. If we can help you through the redesign process, let us know–and be sure to check out our YouTube video to learn more about the Chart of Accounts in QuickBooks with Rhonda Rosand, CPA.

All small businesses need cash to operate, and there are many ways to generate the required funds. Most commonly, owners will make an initial investment from their savings or other personal resources to get started. But what if that isn’t enough? In this article, we’ll explore a few ways to finance a business.

All small businesses need cash to operate, and there are many ways to generate the required funds. Most commonly, owners will make an initial investment from their savings or other personal resources to get started. But what if that isn’t enough? In this article, we’ll explore a few ways to finance a business.

Community banks

Most community banks are big supporters of small businesses, so this is a great place to start. Establish a relationship first by opening business checking and savings accounts. Then apply for a line of credit, which is a pre-approved loan that you can tap when you need it for working capital.

If you plan to purchase a building or equipment, you should be able to get a loan by using the asset as collateral. Business expansion loans are also an option; you may be able to borrow against your accounts receivables or other contracts with guaranteed income. Always match the term of the loan with the life of the asset being purchased. In other words, don’t use your line of credit for purchasing assets such as equipment.

Beyond community banks, you might also consider applying for a loan with an online lending agency, bank, credit union, or community development financial institutions (CDFIs).

When applying for a loan, keep in mind that you’ll likely need a good personal credit rating and either a strong business plan or financial statements to show the financial condition of your business.

Partners and investors

Investors such as angel investors or venture capitalists can provide cash in exchange for a position of debt or equity in your business. Obtaining financing in this manner is a significant decision since you are no longer the sole owner of the company once you give away some of your equity (think: Shark Tank).

Another option is to bring a partner into your business. Typically, the partner will provide cash as well as management or other professional skills that complement yours, and they’ll be actively engaged in the process of running the business.

Government support

Plenty of government programs exist to help small businesses obtain financing, especially as we continue to navigate the pandemic. The Small Business Administration has loans and programs available to small businesses on a consistent basis. This year, they are also overseeing the forgivable Paycheck Protection Program (PPP) loans, economic disaster funding, shuttered venue operator loans, and restaurant relief grants, to name a few.

You should also research what’s available to you locally, as your county, city, and community governments may be offering grants or loans. Last but not least, organizations like the Small Business Development Council (SBDC) can provide space, funds, and training to small businesses in their area.

Nonprofits and educational institutions

Some nonprofits and educational institutions also provide grants, scholarships, and other funding opportunities to local businesses and even business owners who are part of a special interest group, like veterans, women in STEM, etc.

Factoring

Factoring is an option for businesses with accounts receivable balances. It is a transaction in which a business sells its accounts receivable as collateral to a third party at a discount in exchange for a cash advance to meet its immediate needs. This type of loan is common in the retail fashion industry where items are ordered months in advance of when they are sold, causing a cashflow gap.

Crowdfunding

Crowdfunding has been made popular in the last decade by popular platforms such as Kickstarter. A business can apply on these platforms for funding, and individuals can make contributions. Sometimes the business will promise goods or services in exchange for funding. This type of funding requires a strategic marketing campaign and in some cases, a sales funnel. It’s a popular method of funding for start-ups that intend to sell goods but needs assistance in production costs.

Credit card advances

It’s common for owners to charge startup expenses and use cash advances from their personal credit cards. Convenience comes at a cost, however, as this is one of the most expensive ways to fund a business and should only be used as a last resort.

The fine print

All financing options come with fine print. Terms and interest rates vary significantly. Sometimes, there is a balloon where you have to pay everything back all at once. Be sure to carefully read any agreements you sign and review them with your lawyer. Some agreements prohibit certain business decisions, which could leave you in a dire position financially. For example, businesses that obtained a PPP loan may not be able to accept a buyout offer because the loan agreement prohibits them from doing so. If they don’t read the fine print and sell the company anyway, they are now personally liable to pay back the PPP loan proceeds.

If you have questions or want to discuss the best financing options for your business, please feel free to contact us anytime.

Our “Comprehensive COVID-19 Sick Pay and Paid Leave” YouTube tutorial has helped thousands of people since it was released last year, teaching QuickBooks Desktop users how to set up COVID-19 Sick Pay, FMLA, and Health Premiums under the Families First Coronavirus Response Act (FFCRA).

Recently, the tutorial received some updates. Below, you’ll find helpful screen grabs and instructions with the most up-to-date information about the processes explained in this video. The times mentioned below are all hyperlinked to the video and will route you directly to the timestamp being mentioned for ease of access. For additional helpful information, make sure to view the comments section of the video.

The video can be viewed in its entirety here: https://www.youtube.com/watch?v=D8zIiPk3eNI&t=2s

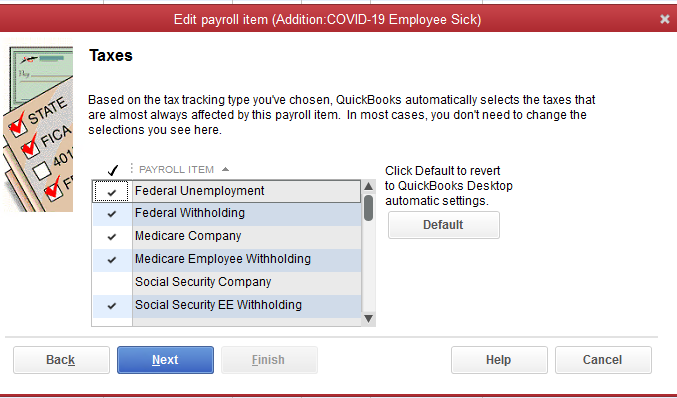

1. At 6:03, we discuss creating a COVID-19 employee sick pay item. The video shows that the social security company tax is checked, which is no longer correct. To revert back to the correct tax settings, select the “default” button. The screenshot below demonstrates the correct tax settings:

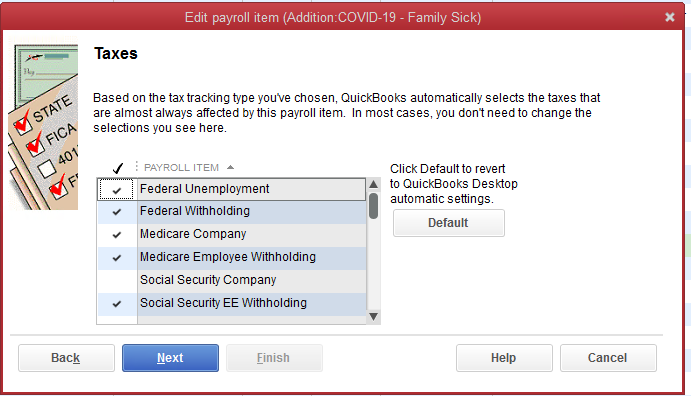

2. At 7:17, we discuss creating a family sick pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

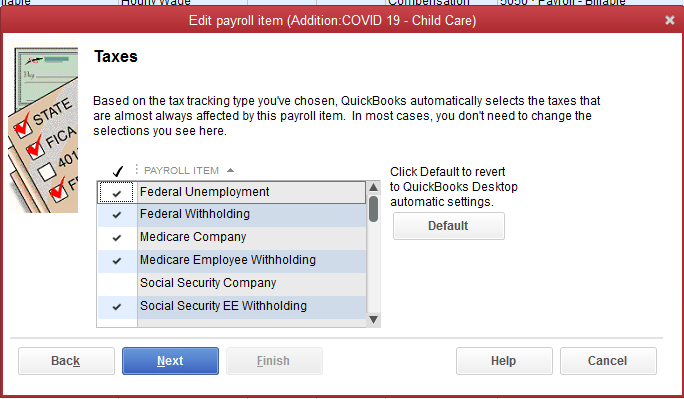

3. At 8:30, we discuss creating a child care pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

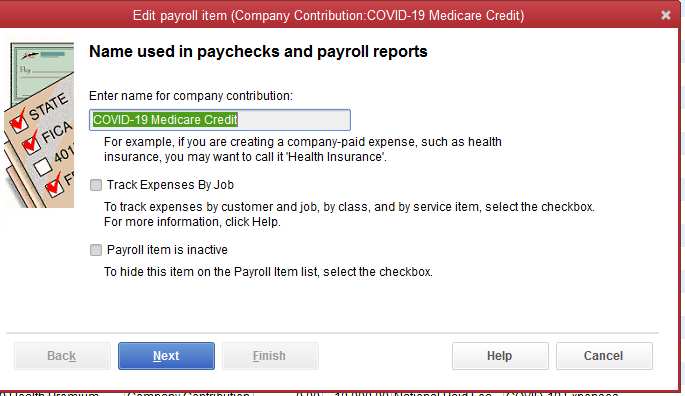

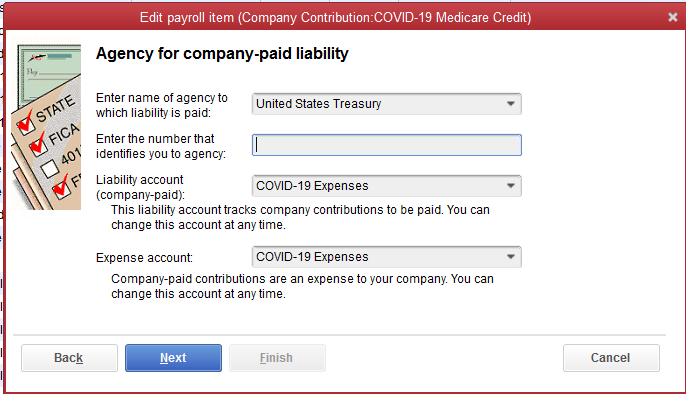

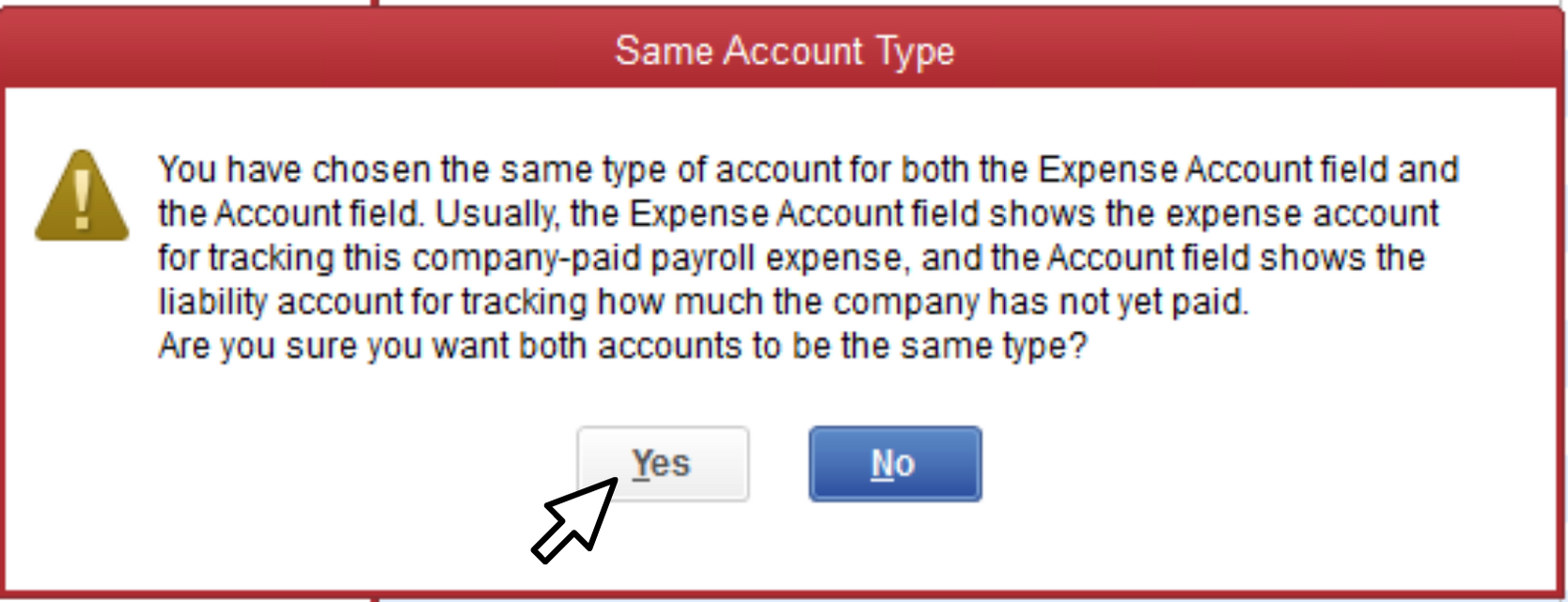

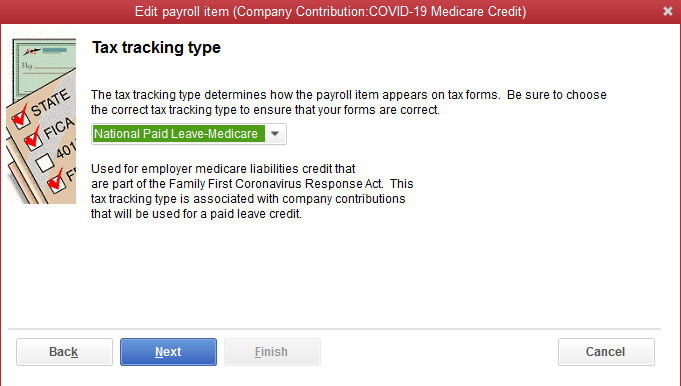

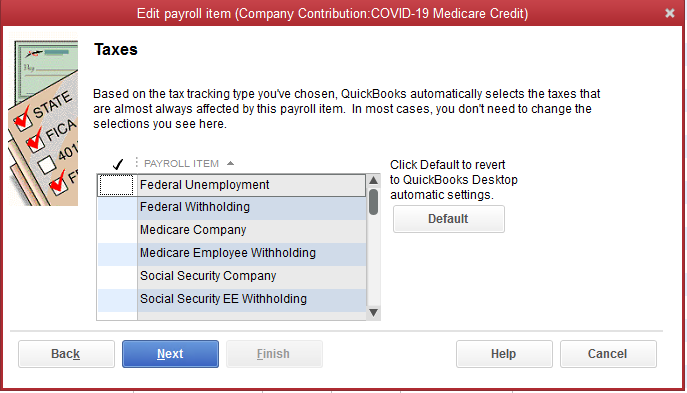

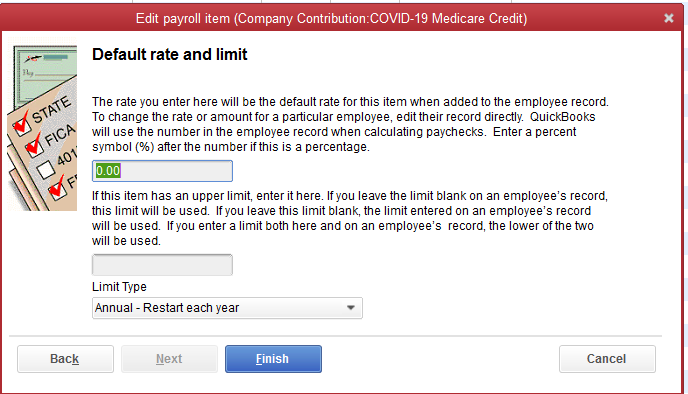

4. At 11:48, we discuss setting up a national paid leave credit. A second company contribution for the COVID-19 Medicare credit should have been created; Intuit later released information on this, and while the comments in the video contain this update, we wanted to ensure this information was easily accessible. The seven consecutive screenshots present the correct steps to take.

6. At 17:51, we discuss payroll liabilities. The video shows that the Medicare employee additional tax is checked, however, it should not be. Instead, the following items sh0uld be checked off:

- the federal withholding

- the Medicare company

- the Medicare employee withholding

- the social security company (this should be zero for COVID pay)

- social security employee withholding

The American Rescue Plan Act of 2021 (ARPA) signed into law on March 11, 2021 by President Biden contains numerous tax provisions which may affect your taxes in 2020 and 2021. We’ll provide a general recap of some of the major changes in this article.

Recovery Rebate

The biggest news for taxpayers is a stimulus payment of $1,400 per person including dependents for taxpayers who meet income limits. The income will be measured based on the 2020 tax return if filed, and the 2019 tax return if 2020 has not yet been filed.

Individuals with adjusted gross incomes (AGI) of less than $75,000 qualify for the full amount, while individuals with AGIs between $75,000 and $80,000 will qualify for a partial rebate. Joint filers with adjusted gross incomes below $150,000 qualify for the full amount, while joint filers with AGIs between $150,000 and $160,000 qualify for a partial rebate.

The Recovery Rebate stimulus payment is a fully refundable tax credit against 2021 taxes which will start paying out the weekend of March 13, 2021. The stimulus payments are tax-free.

Unemployment Income

While unemployment income (UI) is normally taxable, the first $10,200 of 2020 UI for households making less than $150,000 is now tax-free. However, if you pay state income tax, the UI may still be taxable. It remains to be seen how many states will follow federal tax treatment of UI.

The $300 unemployment income payments that were set to expire in March are now extended through September 6, 2021 for eligible individuals. The Pandemic Unemployment Assistance for the self-employed, part-time workers and gig workers is also extended.

Expanded Credits

The Child Tax Credit (CTC) increases for 2021 only from $2,000 to $3,600 for each child under 6 and $3,000 for each child older than 6 and younger than 18 (up from age 16). Single filers earning up to $75,000 and joint filers earning up to $150,000 receive the full credit, while single filers making from $75,000 to $200,000 and joint filers making from $150,000 to $400,000 will receive a portion of the credit.

The payout for the CTC is different as well. Half of the credit will be disbursed in monthly payments from July to December 2021 while the remaining half can be claimed on the 2021 tax return.

The Child and Dependent Care Credit amounts have been increased as well. This credit helps defray the costs paid to a caretaker or child care agency for caring for a child or dependent with disabilities. For 2021 alone, the credit is increased from $3,000 to $8,000 for one child or dependent, and from $6,000 to $16,000 for more than one child or dependent.

COBRA

Many people who have been laid off have also lost their health insurance. COBRA is the program that allows unemployed individuals to continue paying for insurance after they’ve lost their job or had hours reduced. The government will pay COBRA premiums from April through September 2021 for qualified taxpayers.

Student Debt

While ARPA did not forgive student debt outright, it provided for the tax treatment of forgiven student debt that occurs between January 1, 2020 and December 31, 2025. Any debt forgiven during these dates is non-taxable.

The American Rescue Plan Act of 2021 (ARPA) signed into law on March 11, 2021 by President Biden contains numerous tax provisions which may affect the tax situation for your business in 2020 and 2021. We’ll provide a general recap of some of the major changes impacting businesses in this article.

Employee Retention Credit

The Employee Retention Credit (ERC) has been extended through the end of 2021, which adds the third and fourth quarters to the mix. It also allows the credit to be claimed against the 1.45% Medicare or Hospital Insurance (HI) taxes.

The ERC can be a significant windfall for businesses that have had a drop in gross receipts or have been shuttered by a government order.

Paycheck Protection Program

While the current March 31, 2021 application deadline for First and Second Draw PPP loans has not been extended as of this posting, the ARPA did add more funds to the program, made COBRA eligible for forgiveness, and expanded eligibility to additional entities, including additional covered nonprofit entities, newspapers, and certain nonprofits.

The Paycheck Protection Program was designed to save jobs by providing forgivable funds to employers and self-employed individuals so they can make payroll and support their ongoing operations during the economic uncertainty of the pandemic.

Shuttered Venue Operators

Additional monies have been allocated to this program which was initiated by the Consolidated Appropriations Act signed in December 2020. Entities that are eligible for the Shuttered Venue Operators program, which has not opened as of this writing, can now apply for Paycheck Protection Program loans.

Paid Sick Leave

ARPA extended the sick and family leave benefits that began with the Families First Coronavirus Response Act (FFCRA) to September 30, 2021. It adds the employer’s share of Medicare and Social Security taxes on qualifying leave wages to the credit calculation and increases the per employee limit from $10,000 to $12,000.

The changes also include time for the employee to receive the COVID-19 vaccine and recover from it if needed. Self-employed sick days limit is expanded from 50 to 60.

Restaurant Revitalization Grant

Certain restaurants, food businesses, and shops located in an airport can apply for a restaurant revitalization grant that will be offered through the Small Business Association. The grant is for $10 million, up to $5 million per location, and can be spent on expenses necessary to keep the business open. A total of $28.6 billion has been allocated.

Businesses cannot have more than 20 locations, cannot be operated by a state or local government, and cannot apply if they received or have pending applications for Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act.

New Business Direction LLC

New Business Direction LLC