Congratulations, you’ve landed a new customer! Or, perhaps you prefer the term “client.” Either way, you should be excited; in this particular climate, sparking fresh interest in any kind of business can be challenging. Yet, you did it, and now comes the next part: What to do after you have officially landed that customer/client.

Congratulations, you’ve landed a new customer! Or, perhaps you prefer the term “client.” Either way, you should be excited; in this particular climate, sparking fresh interest in any kind of business can be challenging. Yet, you did it, and now comes the next part: What to do after you have officially landed that customer/client.

The following essential list of to-do’s will help ensure you not only keep your customer happy but that you KEEP them—period! Take a look; you will discover the list can apply to everyone and anyone.

- Welcome Your New Customer

A simple “thank you” goes a long way. Remember, with today’s competition, it is more important than ever to stand out. Nothing will help you stand out more than by showing appreciation to any new customers. Make sure to welcome them and thank them for choosing you/your business. This can be done in person, via card, or even email. Though, written form will likely make a lasting impression. Reinforce all of the benefits of choosing YOU!

- Make a Smooth Handoff

If you think about it, this new customer has joined your family—let them know that! Introduce them to your team (i.e. their new family and friends). Specifically, make sure they are acquainted with their person of contact and ensure it is a good fit by all involved parties.

- Get Them Onboarded in a Fun Way

During the initial meeting—orientation, if you will—give your customer all of the vital information they will need to easily navigate your business and get the most from your services. This information could include passwords to access certain areas, emails, phone numbers, a glossary of keywords, etc. If you could present this information in the form of a video, even better! Videos are much easier to understand and leave a lasting effect!

- Be Their New Best Resource (Goodies Added)

Do you have a new client kit? You should! This kit can include anything pertinent to the relationship with your new customer (i.e. relevant paperwork, files, contact information, etc.). Spice up this kit with some goodies, though! Everyone loves goodies. Make sure to properly read your customer to get a better understanding of their likes, but in general, these goodies could include candy and sweets, candles . . . You get the idea.

- Connect with Them on Social Media

Whether it is Facebook, Twitter, or Instagram, almost everyone is on at least one social media platform. Connecting on social media will not only allow you to know your customer/client better but is also a great way to network with “friends” of your customer.

- Meeting with the Customer for the First Time

There will come a point when you have that first review meeting with your customer. Be sure to deliver value and explain the service you’ve performed so far. The most essential take away from this step is that your customer feels comfortable and knowledgeable. This is a perfect time to verify any information that may seem unclear or complicated; encourage questions during this meeting.

- Ask for a Referral or a Review

The best way to drum up more business is word of mouth. You can ask immediately or want until your relationship has blossomed and become strong. Asking for a referral or a review (or both!) is completely acceptable and a good business practice.

Incorporating these seven items into your new customer onboarding process will get your relationship off to a great start. By showing your customer they are important, you stand a better chance of securing their future business and attracting even more potential customers.

Here Rhonda’s latest video on how to add multiple users in you QuickBooks Desktop file:

Here is how to add users in your QuickBooks Online file:

Custom fields in your accounting software are data fields that you can define yourself. They are typically associated with customers, vendors, employees, and items, and they can help you store and categorize additional information about these stakeholders and your products and services in your business.

Custom fields in your accounting software are data fields that you can define yourself. They are typically associated with customers, vendors, employees, and items, and they can help you store and categorize additional information about these stakeholders and your products and services in your business.

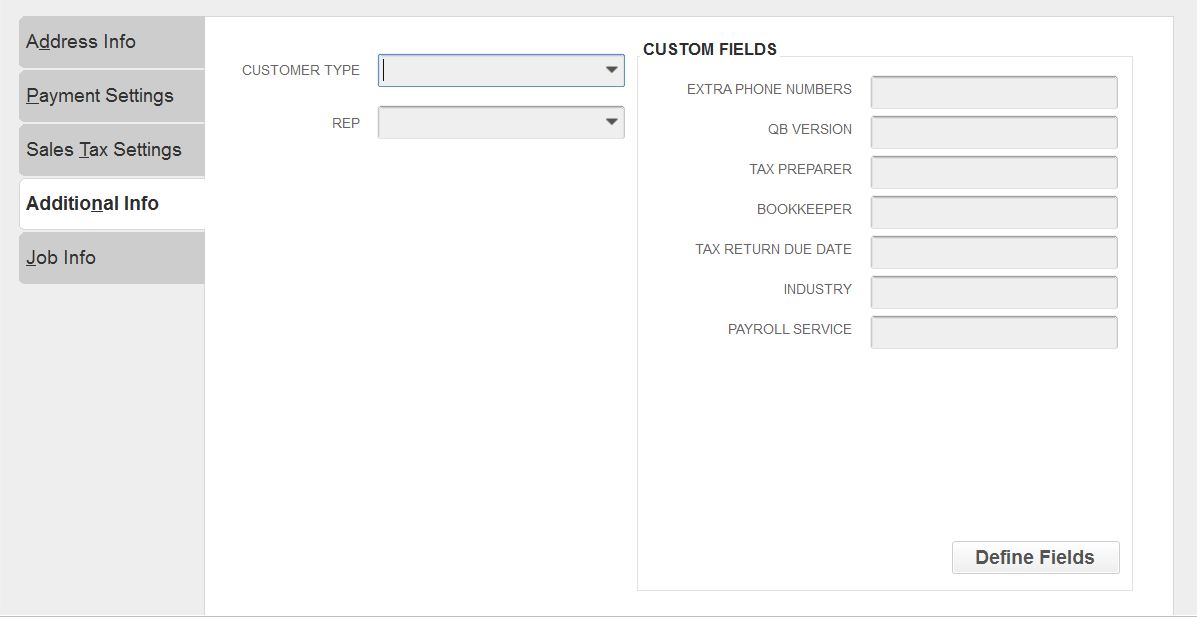

Custom Fields in QuickBooks Desktop

An example custom field that can be associated with customers is their anniversary date with you. You could also decide to store their birthday, their spouse’s name, their favorite color, or their shoe size.

Custom fields add functionality to your accounting system. Here are a few examples of practical uses for custom fields:

- Contact for customer – if customers are assigned a particular team member, you can add their name in a custom field

- Frequency of service – daily, weekly, monthly

- Warehouse location

- Type of customer; for example, non-profit, construction, retail, restaurant

- Referral Source

- Preferred method of contact: email, phone, fax, text, chat

- License number

Our customer custom fields track which version of QuickBooks you use, what payroll service is active, who your tax preparer is, etc. Then we can sort on any one of these fields.

Some software allows you to choose the type of custom field you want to add. In some cases, this allows for cleaner data as the data can be limited to a certain type or certain values upon entry. Here are the most common types:

- Free form text – this is the default type; it can come as a single line or paragraph

- Check box – choose one or more values from a limited number of choices

- Radio button – choose only one value from a limited number of choices

- Drop down – choose a value from a dropdown list

- File upload – add an attachment

- Image upload – upload an image that will be displayed

- Date/time – enter a date or time

- Number – enter a number; it can be currency, integer, or another mathematical type of number

Custom fields allow you to meet your company’s unique needs over and above what the software provides by default. It’s a great way to make your data more meaningful. If you have some ideas for custom fields in your accounting software and want help setting them up, feel free to give us a call anytime.

Nobody likes, them, but sometimes it happens. This is how you record it in QuickBooks if this happens to you.

Learn How to Record a Bounced Check From a Customer in QuickBooks® with Rhonda Rosand, CPA and QuickBooks® ProAdvisor from New Business Directions, LLC

As we welcome in a new year (and maybe a new decade depending on how you count them), it’s a perfect time to reflect on the trends that will impact us and our businesses. Here’s a list for your consideration and reflection.

As we welcome in a new year (and maybe a new decade depending on how you count them), it’s a perfect time to reflect on the trends that will impact us and our businesses. Here’s a list for your consideration and reflection.

Trend #1: Sustainability

Concern for the environment has made the list of many companies’ core values. The way  businesses are run can have a huge impact on the environment. While we hear a lot of stories about large companies impacting sustainability, we can also do our part as small businesses. In the accounting profession, many firms have gone paperless, transitioning from staplers, paper clips, and filing cabinets to digital storage which greatly reduces their footprint.

businesses are run can have a huge impact on the environment. While we hear a lot of stories about large companies impacting sustainability, we can also do our part as small businesses. In the accounting profession, many firms have gone paperless, transitioning from staplers, paper clips, and filing cabinets to digital storage which greatly reduces their footprint.

Trend #2: The Gig Economy

Young workers often have multiple jobs instead of the 9 to 5 jobs of their parents. This means there is more flexibility than ever before when it comes to hiring and retaining young workers. They can be employees, contractors, outsourced solutions, remote, local, part-time, full time, temporary, or permanent. Sub-trends in this area include more virtual workers and many more opportunities for veterans.

Trend #3: AI – Automated Intelligence

This trend is impacting the accounting profession in a big way via smart data entry, smart document fetching, and even smart bookkeeping. Marketing has also been impacted in a big way through online ads, customer service solutions, and marketing technology. In email, Google is finishing our sentences for us, and chat and other technologies are having fairly effective conversations via bots.

Trend #4: Stories

Storytelling is huge everywhere. People want to know:

- The story behind your business and why you do what you do

- The stories about your customers and the experience they have with you and your services

- The stories from your employees and how it is to work at your organization

Digital communication has moved from text to graphics to video as bandwidth improves. Video makes stories even easier to share. Smart companies will leverage both stories and video to get their message out.

Trend #5: Diversity Expanded

The conversation is no longer about race, gender, and even sexual preference. It’s now about authenticity and being the same person at work and at home. No one is “normal.” But it takes courage to reveal our differences, especially if they are outside the “standard.” Your courage is more likely to be honored in 2020 than it has in prior years.

Trend #6: A WOW Customer Experience

We’ve moved way past the time of “infotainment,” yet the concept is parallel. As businesses, the challenge is how we can deliver an entertaining, positive, and memorable experience while producing the outcomes the client desires.

Trends #7: Drones

So far, drones have made appearances in photography, special effects at conferences, as toys, in movies, and of course, in war. I see them in use for safety reasons, going where people shouldn’t or can’t. They will become more pervasive in 2020 and there will be more rules, protocols, and court cases on their use.

Trend #8: User Interface

The move from desktop to mobile is nearly complete, with only the laggard portion of the population remaining. The move to voice is still a work in progress, and it will steadily continue to gain traction in 2020.

Trend #9: Actionable Analytics

Capturing information digitally gives businesses a huge amount of data to utilize but small businesses have barely scratched the surface of this profitable information. It’s time they started catching up, and that’s something our firm can help you with.

Trend #10: Pace of Transformation

New business models in companies like Tesla, Uber, Google, and Facebook will continue to show up at a rapid rate. The business that’s most nimble will be the one that changes the game or at least stays in it without folding.

Which trends impact your business the most? Which ones speak to you? Feel free to reach out to discuss any of these ideas with us.

New Business Direction LLC

New Business Direction LLC