As an accountant, I know that there is no such thing as bad debt on a cash basis tax return.

Accrual basis taxpayers recognize revenue when they invoice for the services and are allowed to write off a bad debt if it is not collected.

Cash basis taxpayers only recognize revenue when they receive the money. If you never receive the money, there is nothing to write off.

Yet, I’ve seen it; I’ve seen a bad debt expense account on a cash basis profit and loss report in QuickBooks. How does that happen? And how does it get reported on your income tax return?

How a Bad Debt Expense Account Gets on a Cash Basis Profit and Loss Report

Bad Debt can wind up on a Cash Basis Profit and Loss Report when you invoice a customer in one tax year and write it off in another. This is just one more reason to clean up your accounts receivable at year-end, before filing your income taxes.

Let’s look at an example –

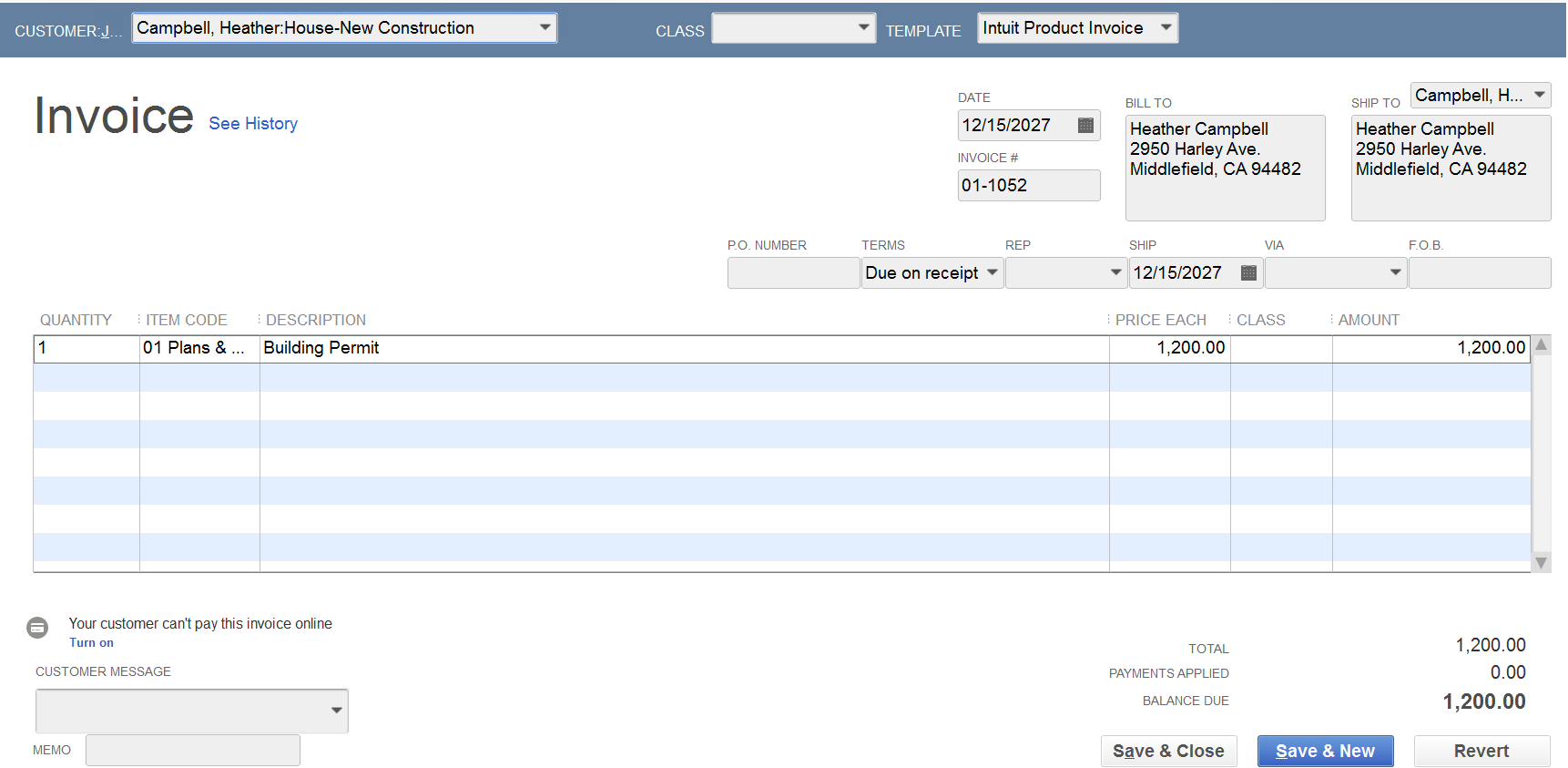

In a sample QuickBooks Enterprise data file, I have created an invoice dated 12/15/2027 to Heather Campbell for $1,200 for a building permit.

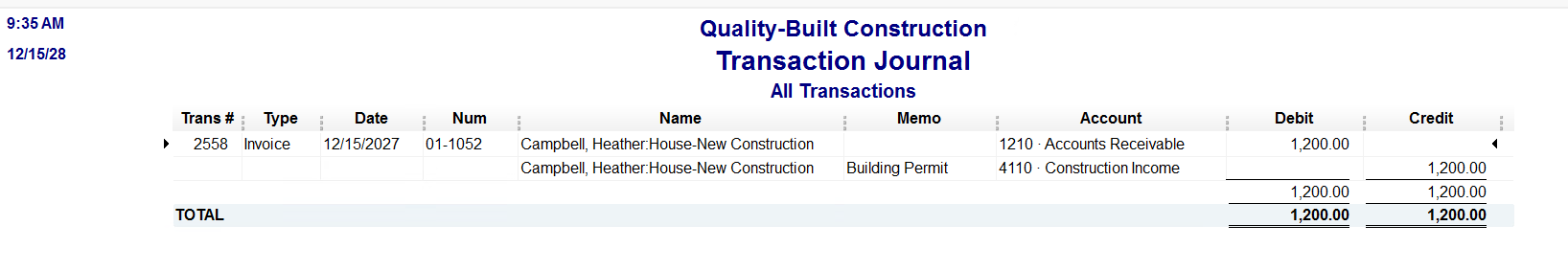

Behind the scenes, the transaction journal debits Accounts Receivable and credits Income.

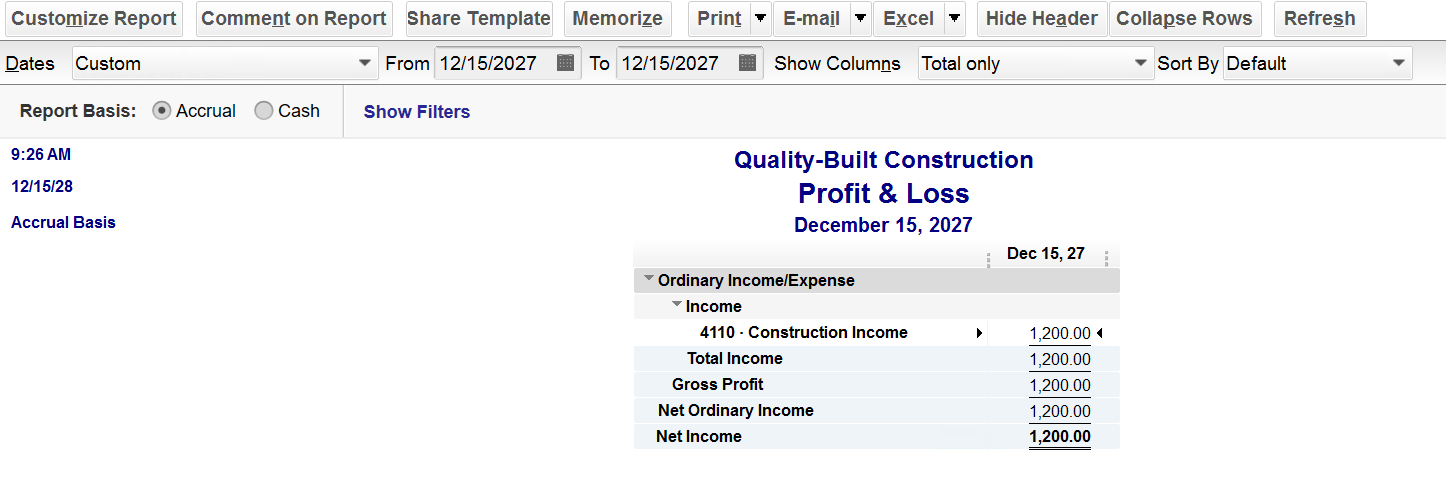

The accrual basis profit and loss will report this as Construction Income…

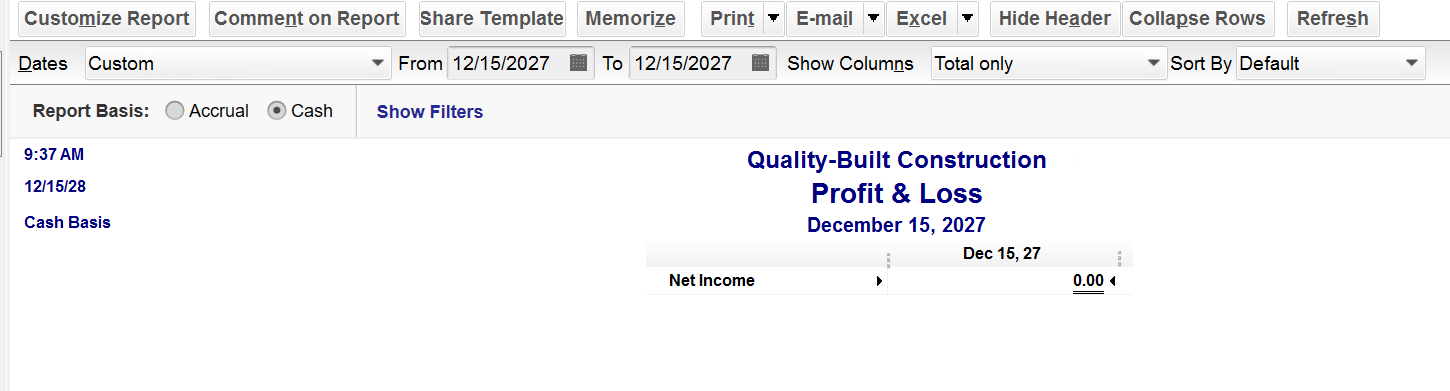

…but the cash basis profit and loss will not.

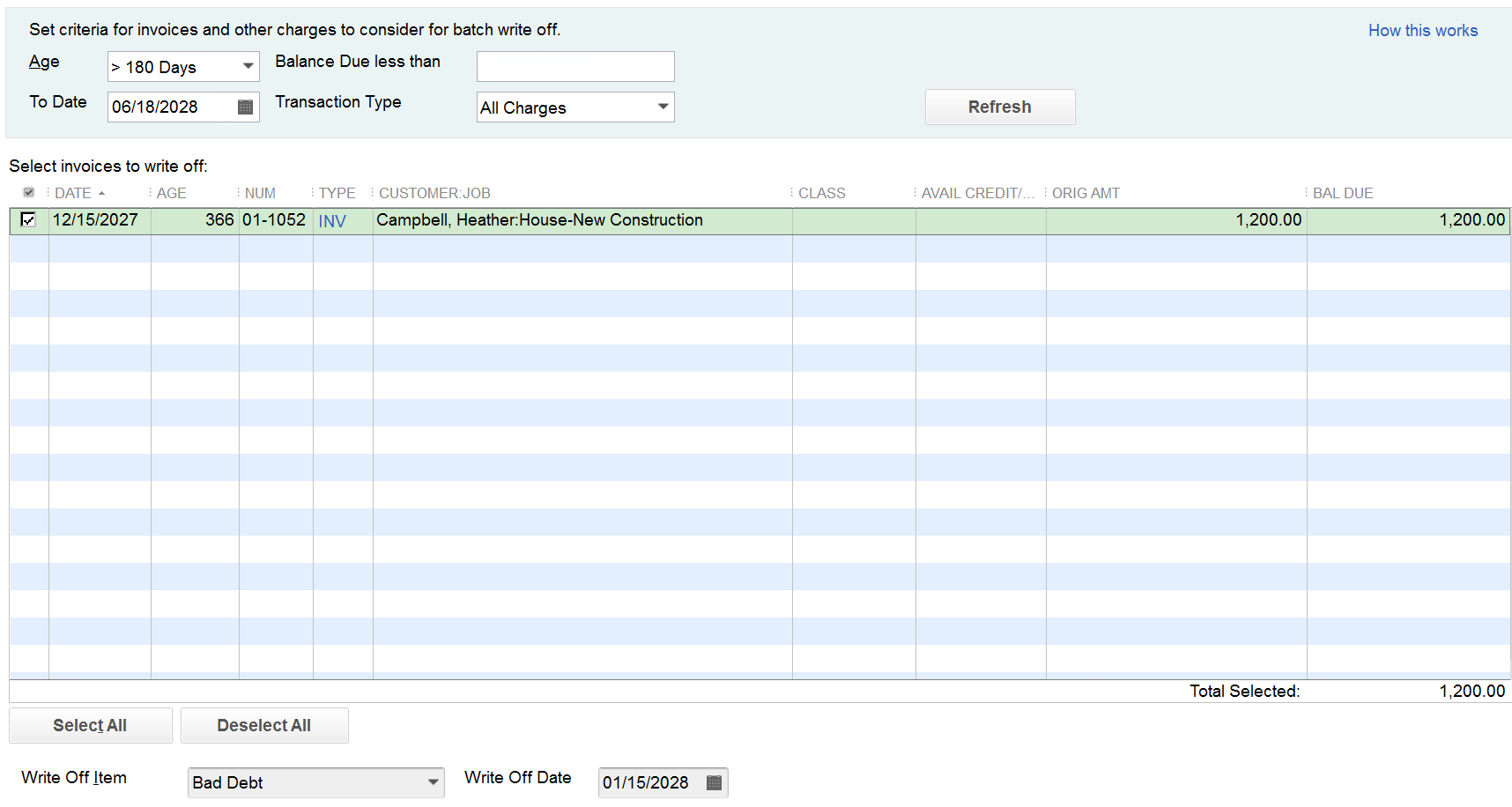

Now, let’s say I write off that invoice in the next tax year using the QuickBooks Enterprise tool –

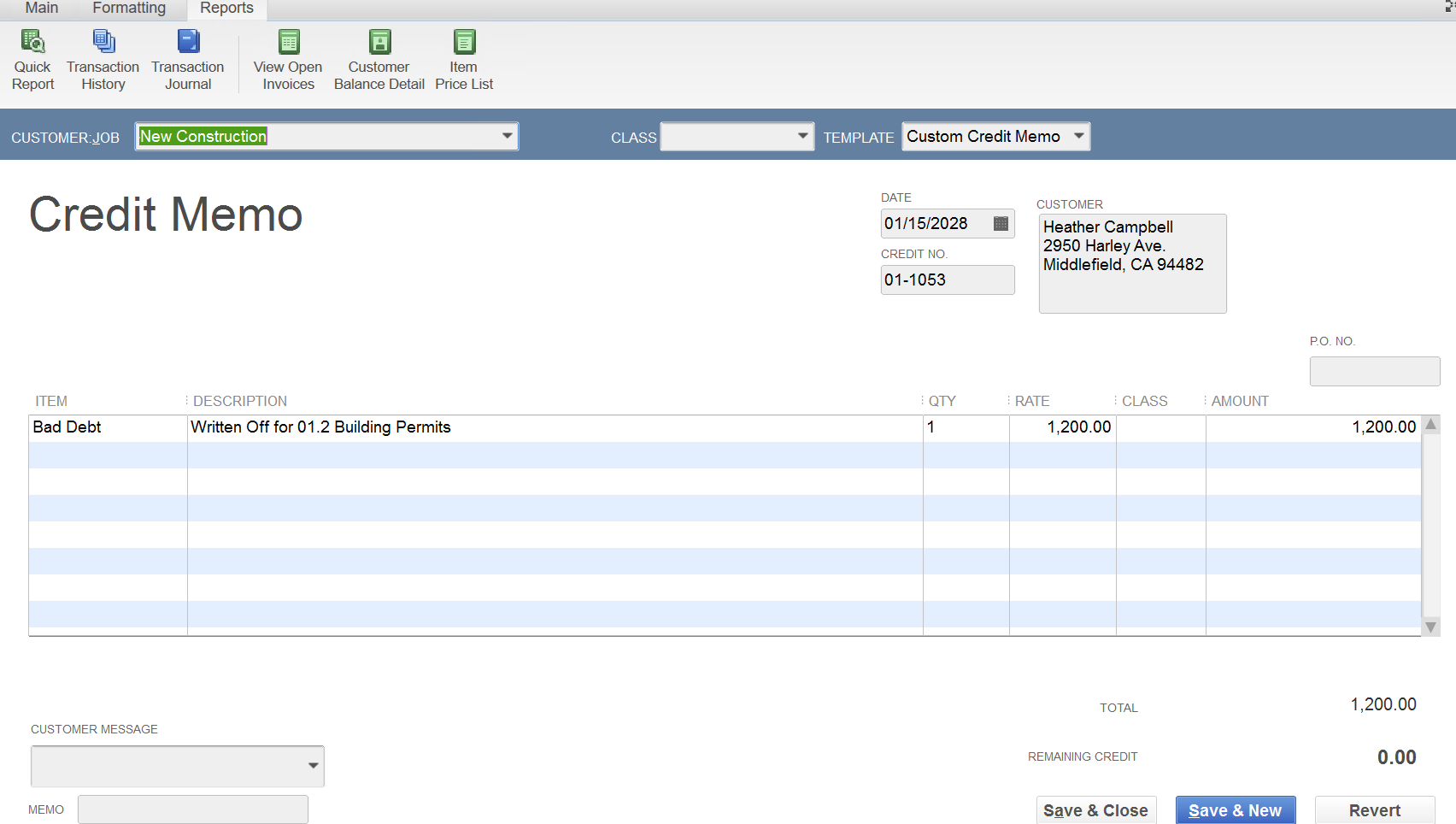

QuickBooks creates a credit memo for the write-off –

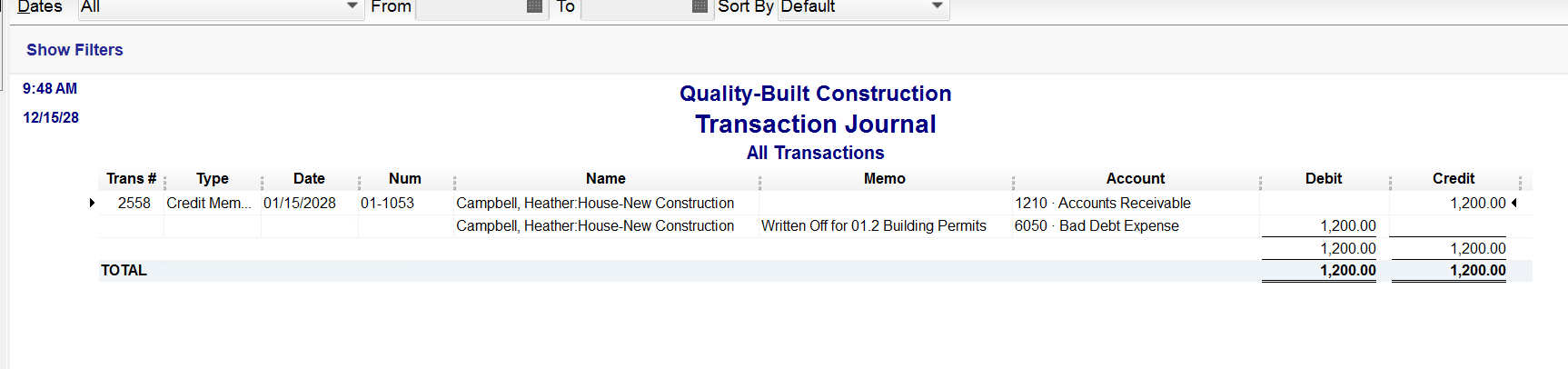

The transaction journal behind the scenes debits Bad Debt Expense and credits Accounts Receivable –

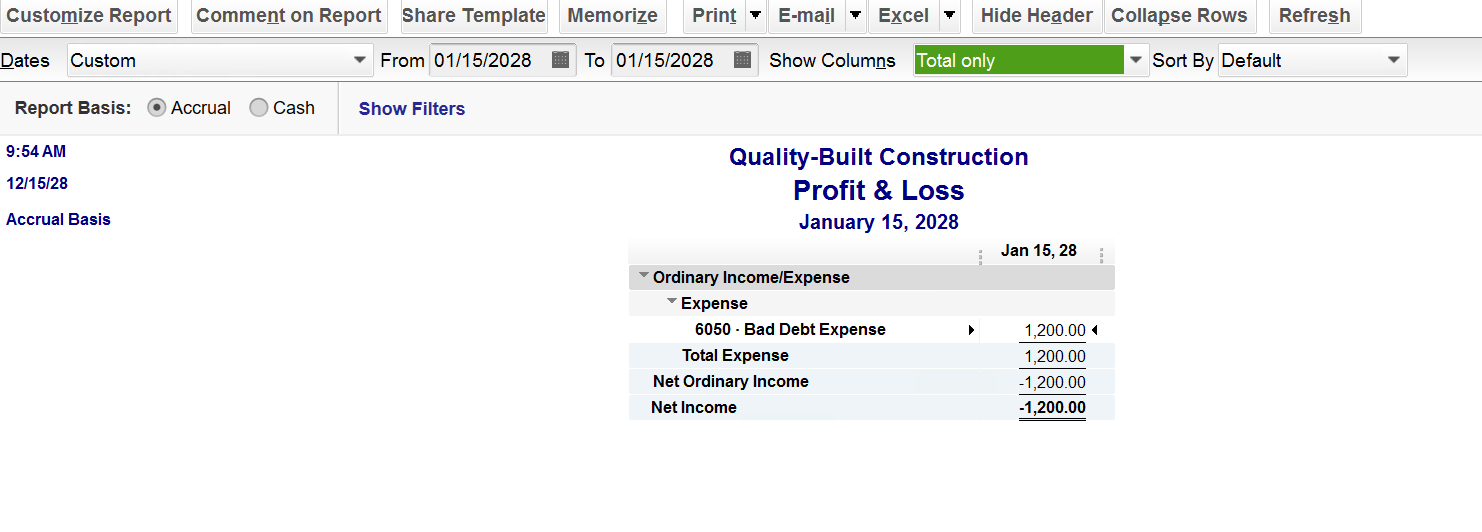

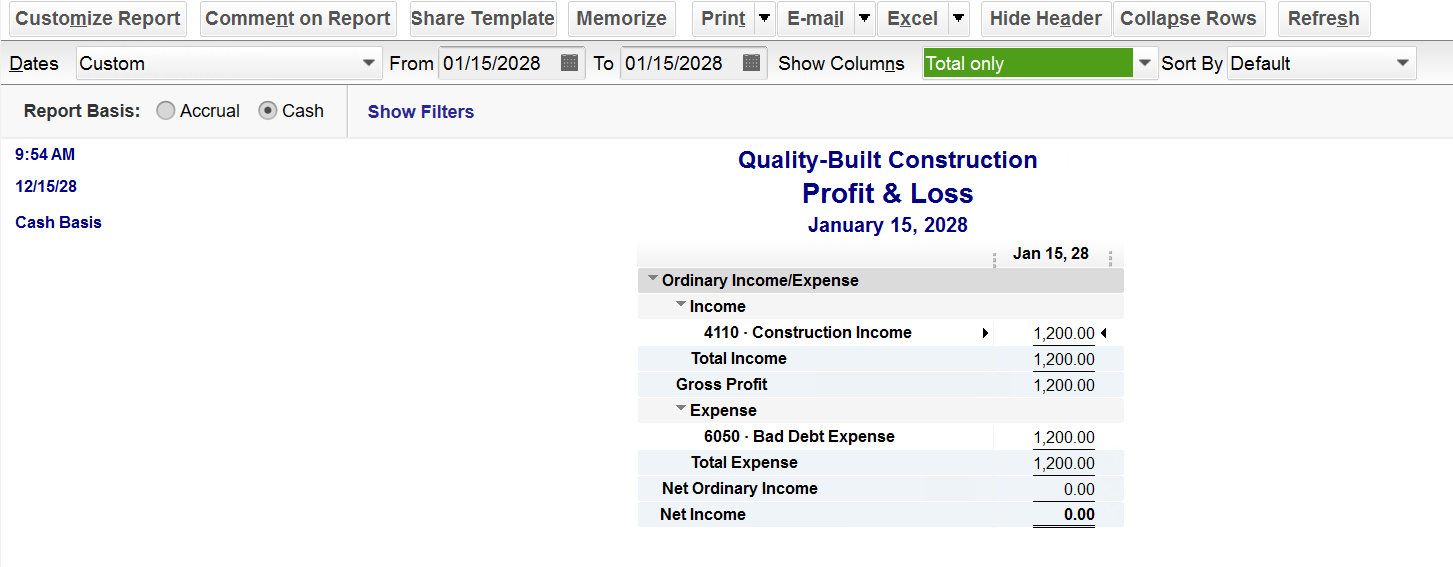

On the accrual basis profit and loss, we see Bad Debt Expense – this is correct – it’s writing off the income that was reported in the prior year.

On the cash basis profit and loss report, we see both Construction Income and Bad Debt Expense – this is also correct – it’s a wash – since it reports the income and writes off the bad debt.

How a Bad Debt Expense Gets Reported on Your Income Tax Return

Now, let’s discuss what’s supposed to happen on your cash basis tax return. Nothing; technically, it’s a wash, as the Bad Debt Expense on a cash basis profit and loss is simply a reduction of revenue. If I were preparing your income tax return*, I would reduce the Construction Income by the Bad Debt Expense and report the net revenue. For more information on this topic, check out this helpful tutorial our team prepared: https://newbusinessdirections.com/how-to-write-off-a-bad-debt-in-quickbooks-3/

*Note: New Business Directions does not prepare income tax returns.

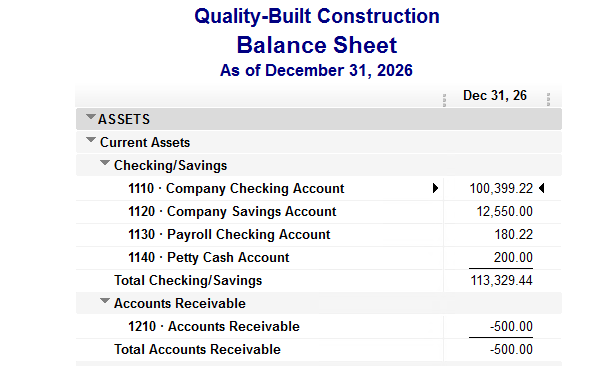

There are a few scenarios that will cause a negative accounts receivable on a cash basis balance sheet in QuickBooks. Let’s focus on the two most common: unapplied payments and timing differences.

Unapplied Payments –

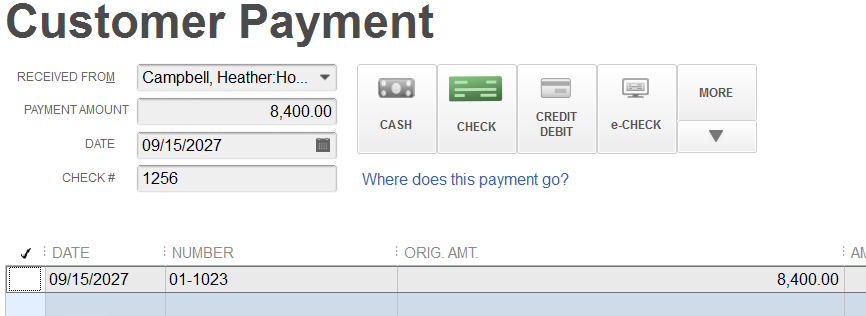

This occurs when a customer has paid you, you’ve received the payment, but you have not applied it to the invoice yet. As pictured below, a simple checkmark next to the invoice will resolve the negative accounts receivable on your balance sheet.

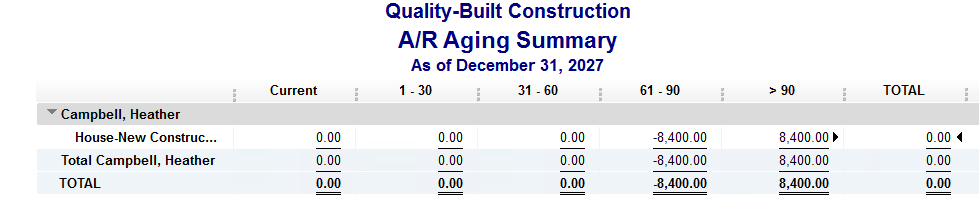

If you look at your accounts receivable aging report, you will see both the invoice and the payment for the customer – one positive, one negative and they wash to zero.

It’s important to clean up your accounts receivable aging summary report and fix unapplied payments by linking them before monthly reports are issued or year-end taxes are filed.

There are no journal entries required to correct this transaction; simply apply the payment to the invoice and re-run your reports.

Timing Differences –

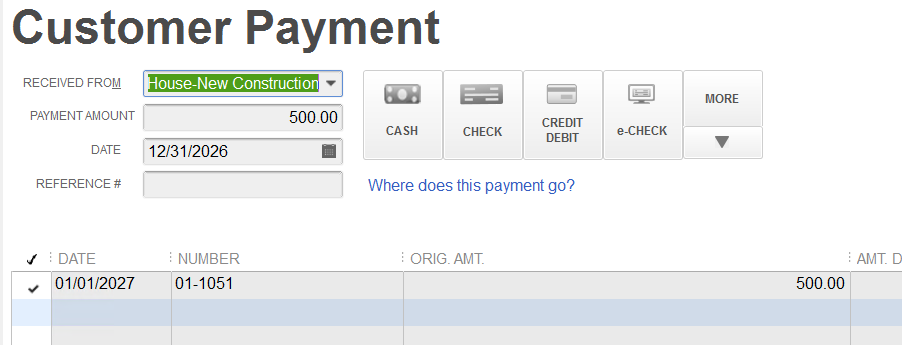

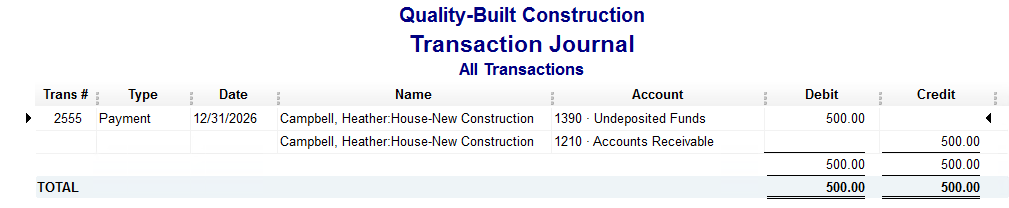

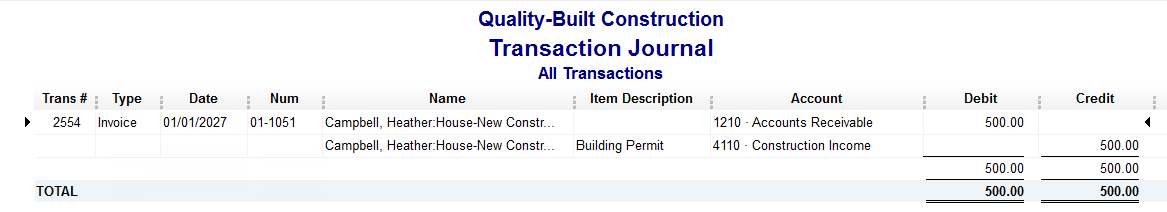

This occurs when a customer has paid you in advance; you’ve received the payment and applied it to an invoice that is dated in the future.

In the image above, you’ll notice that the date of the payment receipt is the day before the date of the invoice. This is an advance payment from the customer on a future invoice resulting in a negative accounts receivable on the balance sheet dated as of the date of the payment. It will not wash to zero on the accounts receivable aging report until the next day–in this case, it will be in the next calendar year.

Please note that you will have a negative accounts receivable on both the cash and the accrual basis balance sheets for this transaction. Below is the transaction detail for the payment dated 12/31/2026 and the invoice dated 1/1/2027, behind the scenes in QuickBooks.

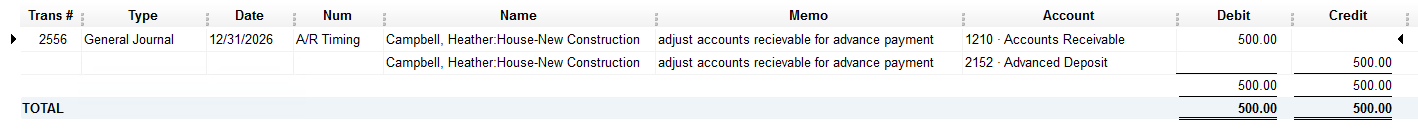

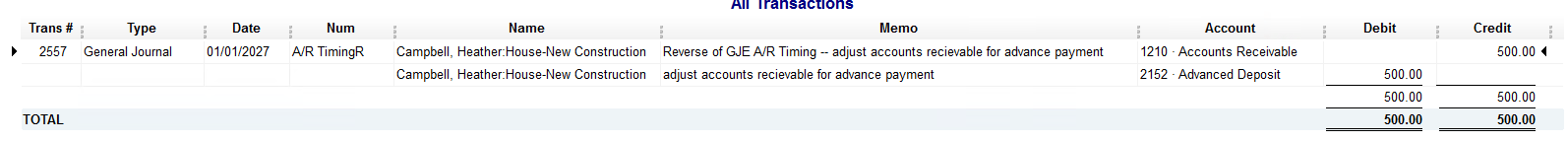

If you find yourself in a situation where you have negative accounts receivable due to a timing difference at a month-end reporting period (or at year-end for tax filing), you will need to make two journal entries – one regular and one reversing, to move the negative accounts receivable to an other current liability account for advanced deposits, as follows:

These are the two most common reasons why you would see a negative accounts receivable on a cash basis balance sheet in QuickBooks.

This holds true for negative accounts payable on a cash basis balance sheet as well and the process to fix/link or adjust is the same.

We’re pleased to announce that Britney Schaub, our dedicated Office Manager and Certified QuickBooks ProAdvisor, has recently earned her QuickBooks Desktop Enterprise ProAdvisor Certification, QuickBooks Online ProAdvisor Certification, and Fathom Advisor Certification!

Britney’s achievements highlight her dedication to professional growth and outstanding service to our customers. They also strengthen our entire team’s capabilities here at New Business Directions.

It is no small feat to attain these certifications, let alone in such a short time. We are so proud of you, Britney!

Regards,

Rhonda Rosand, CPA

CEO, New Business Directions

Did you know? While New Business Directions works primarily with QuickBooks Desktop, we maintain ProAdvisor certifications in QuickBooks Online as well so that we can effectively navigate both platforms—all in the name of better serving our customers.

As a business coach, I’ve often witnessed the power of familial bonds in the world of entrepreneurship. One strategy that has shown immense potential for both the business and the family is hiring children within the business. While some may raise eyebrows at the idea, there are numerous benefits to be reaped from such a decision, ranging from financial advantages to fostering a sense of responsibility and entrepreneurship in the younger generation.

As a business coach, I’ve often witnessed the power of familial bonds in the world of entrepreneurship. One strategy that has shown immense potential for both the business and the family is hiring children within the business. While some may raise eyebrows at the idea, there are numerous benefits to be reaped from such a decision, ranging from financial advantages to fostering a sense of responsibility and entrepreneurship in the younger generation.

Two Financial Benefits of Hiring Your Children in Your Business

Hiring your children and offering them a salary can be a mutually beneficial scenario, financially speaking:

- Salary Expenses: Instead of handing out allowances, you can pay them a reasonable wage for the work they do. The IRS allows business owners to deduct reasonable wages paid to their children as a business expense.

- Tax Advantages: Hiring your children can also offer tax advantages for both parties. Children can earn up to a certain amount (subject to change, so consulting a tax professional is advisable) without paying federal income tax. For the business, wages paid to children are deductible as a business expense, reducing the overall taxable income.

Tax Exemptions and Retirement Benefits Associated with Hiring Your Children

As a business owner, it’s also important to understand the potential tax benefits of providing certain benefits to your employees, including family members. In particular, offering retirement planning as a benefit to your children can both introduce them to the concept of saving early on and yield tax advantages for your family. Let’s get into the details:

Tax Exemptions for Certain Benefits: Depending on the structure of your business and the tax laws in your jurisdiction, certain benefits provided to employees, including your children, may be tax-exempt. This could include health insurance premiums or contributions to retirement plans.

Retirement Planning as a Benefit: By hiring your children, you can also introduce them to the concept of retirement savings early on. You may establish retirement accounts, such as a Roth IRA, and contribute a portion of their earnings. This not only helps them start saving for their future but also reduces the family’s overall tax liability.

Three Final Benefits of Hiring Your Children within Your Small Business

Hiring your children can reap benefits beyond providing you and them financial and tax-savings benefits. This decision can also offer them a meaningful learning opportunity and set the stage for their future success, both professionally and financially. Here are three final benefits of hiring your children within your small business:

- Hiring your children provides them with a learning opportunity: Working in the family business provides invaluable real-world experience for children. They learn important skills such as communication, teamwork, problem-solving, and financial literacy, all of which are crucial for their future endeavors.

- Hiring your children creates an opportunity for family bonding: Working together can strengthen family bonds and create shared experiences. It provides an opportunity for open communication and mutual understanding between generations, fostering a sense of unity and purpose within the family.

- Hiring your children allows for proactive succession planning: Hiring children can be a strategic move for succession planning. It allows them to gain firsthand experience and knowledge of the business, preparing them to take on leadership roles in the future.

Ultimately, hiring your children in your business can be a win-win situation for both the family and the business. This business strategy offers financial benefits, tax advantages, and valuable learning opportunities while fostering a strong sense of family unity and preparing the next generation for future success.

However, it’s essential to approach this decision thoughtfully and in compliance with all legal and tax regulations. Consulting with a qualified tax advisor or financial planner is a great way to navigate the complexities–and maximize the benefits–of this arrangement.

You may have heard reports over the past couple of years regarding the demise of QuickBooks Desktop.

Actually, if you search the web to purchase QuickBooks Desktop, you’ll be hard-pressed to find it.

Now that we’ve passed the May 31st, 2024 sunset date of the 2021 versions of QuickBooks Desktop – Pro, Premier, Mac and Enterprise Solutions v21, there is no more Intuit support for those 2021 versions and any integrations for connected services such as payroll and merchant services will no longer link.

There is a New Date on the Horizon

Intuit will stop selling new subscriptions of Desktop Pro, Premier and Mac as well as Enhanced Payroll to new US users on September 30, 2024. This is not a sunset or discontinuation; it’s a stop-sell.

If you don’t have a current subscription of the 2024 QuickBooks Desktop Pro, Premier or Mac or Enhanced Payroll on or before July 31, 2024 – you will not be able to purchase it.

Existing customers with 2024 Pro, Premier, Mac or Enhanced Payroll will not be affected and they will still be able to renew their software annually – this is only for new customers. Existing customers will be able to add seats, additional licenses, to their existing licenses.

QuickBooks Enterprise Solutions is Alive and Well

This stop-sell order does not affect QuickBooks Enterprise Solutions. Think of the Enterprise version of QuickBooks as the Pro/Premier software on steroids. It’s the same product, just more robust, with increased capacity and additional features.

Next Steps – What You Need to Do

Confirm that you have the 2024 version of QuickBooks Desktop and that your payment method on file with Intuit is current with the correct card number and expiration date. Do not let your subscription for Desktop Pro, Premier, Mac or Enhanced Payroll lapse.

If you need assistance with the renewal process or upgrading the file from an older version, please reach out.

New Business Direction LLC

New Business Direction LLC