Working with Checks in QuickBooks

Online banking may get all the headlines, but many small businesses still insist on paper checks. QuickBooks can accommodate them.

“I don’t write checks anymore,” you hear a lot of people say these days. Debit cards, smartphone payment apps, and online banking have replaced the old paper checkbook for a lot of consumers.

That’s fine if you’re at Starbucks or the grocery store, but many small businesses still prefer to issue paper checks to pay bills, cover expenses, and make product and service purchases. QuickBooks provides tools that help you create, print, and track checks.

But you don’t just head to the Write Checks window every time something needs to be paid. There are numerous times when you would record a payment in a different area of the program. For example, if you’ve already created a bill in Enter Bills, you’d go to the Pay Bills screen to dispatch a check.

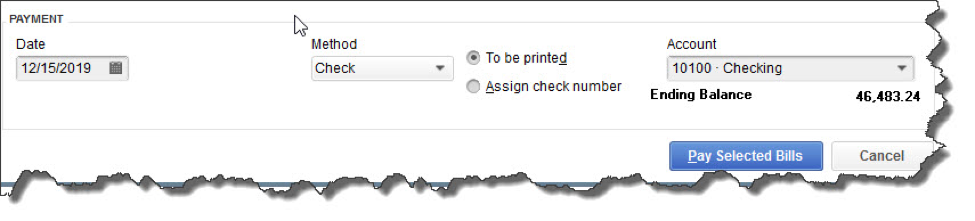

Once you’ve recorded a bill in Enter Bills, you need to visit the Pay Bills screen to dispatch a check. The image above shows the bottom of that screen.

Other examples here include:

- Issuing paychecks (click the Pay Employees icon),

- Submitting payroll taxes and liabilities (Pay Liabilities icon), and

- Paying sales taxes (Manage sales tax icon).

Simple Steps

Let’s say you asked an employee to go to an office supply store to pick up some copy paper because you ran short before your normal shipment came in. If you knew the exact amount it would cost, you could write a check directly to the shop. But the employee agrees to pay for it and be reimbursed.

Click the Write Checks icon on the home page. If the BANK ACCOUNT that’s showing isn’t the correct one, click the arrow to the right of that field and select the right one. Unless you’ve written a check to that employee before, he won’t be in the Vendor list that opens when you click the arrow to the right of PAY TO THE ORDER OF. Enter his name in that field.

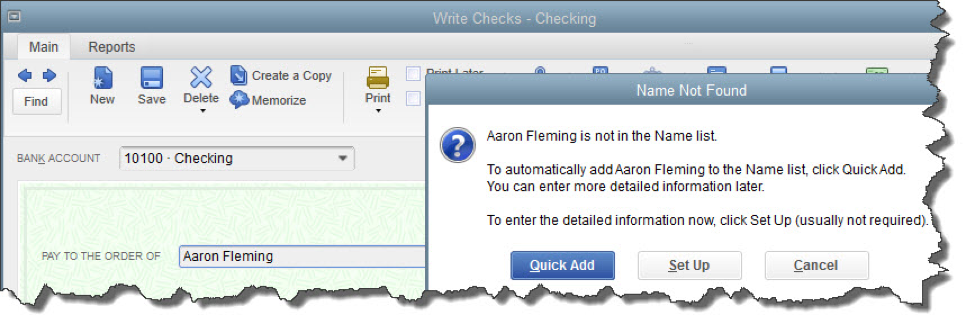

The Name Not Found window opens. If this was a new vendor that you would be working with again, you’d click Set Up and follow the instructions in the step-by-step wizard that opened. Since this isn’t the case, click Quick Add. In the window that opens, click the button next to Vendor.

Note: If you’re using a payroll application, you already have an employee record for that individual, which would have filled in automatically when you started typing the name. Since this is a Non-Payroll Transaction, it won’t get mixed up with his payroll records as long as you assign the correct account.

If you don’t want to create an entire record for the payee of a check, you can just click Quick Add.

QuickBooks will then return you to the check-writing screen, where you can verify the check number and date, and enter the amount. Fill in the MEMO field so you’ll remember the reason for the payment.

At the bottom of the screen, you’ll see a tabbed register. The Expenses tab should be highlighted and the amount of your check entered. Click the down arrow in the field under ACCOUNT to open the list, and select Office Supplies. The AMOUNT should fill in automatically. Not sure which account to select, and what the remaining three columns mean? Ask us.

Note: You would only enter the expense under the Items tab if you were buying inventory items or paying job-related costs.

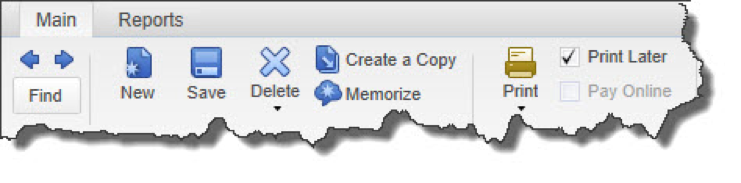

Warning: If you’re planning to print the check, be sure to check the Print Later box in the horizontal toolbar at the top of the screen.

When you’re finished, save the transaction. Since you want to pay the employee right away, click the Print Checks icon and click in the field in front of the correct check to select it, then click OK.

Easy, But Tricky

QuickBooks makes the mechanics of writing checks easy. Simple as it is, though, a lot can go wrong if you, for example:

- Issue a check from the wrong screen,

- Classify a check incorrectly, or,

- Skip a step.

We encourage you to set up a learning session with us if you’re new to check-writing in QuickBooks or are confused about any of its attributes. We’ll be happy to help ensure that your accounts payable activities will result in accurate record keeping.

If you spend a lot of time online using a web browser to view web sites or to work in online applications, then you may benefit from knowing these wonderful features about your browser software.

Bookmarks

All browsers support bookmarks, and hopefully you are already using this powerful feature. Which web pages do you need to visit on a daily basis? Those should be ones that have a place on your browser’s bookmark bar. Look for your browser menu to find the bookmark commands you can use to set them up.

Avoid bookmarking your bank, brokerage, and credit card web pages for security reasons, but most everything else is fair game and will save you a lot of time.

Browse Incognito

Need to browse privately? Many browsers offer incognito browsing which disables browsing history and the web cache. Find this command in your browser menu.

People

Roughly two-thirds of the population use Google Chrome as their browser, and the People feature is unique to Chrome. If you have a situation where you have multiple accounts with one software provider, Chrome allows you to have an entirely separate browser session going on for each person.

Let’s say you’re a social media consultant and manage the Facebook accounts for ten clients. You can set up a “person” in Chrome, one for each client. You then can have ten browser sessions going for each of your clients without having to log out and log back in to each Facebook account.

Do you volunteer at a nonprofit where you manage accounts for them? Set them up as a new person, and you can log in to all of their accounts without impacting yours.

Pretend that different departments of your business are separate people. Set up Accounting as a person in Chrome and log in to all of your accounting apps. Or set up Marketing as a person and log in to all your marketing and social media apps using this person.

Set up a different bookmark bar for each person, pouring rocket fuel on your time savings and decluttering you bookmark bars at the same time.

Set up a new person using the Manage People section in Settings. Toggle between People by using the button on the tab bar at the top right of your screen just to the left of the Minimize command.

Extensions

Many browsers have extensions or plug-ins which expand the functionality of the browser. Here are couple of favorites.

- Gmail Offline – allows Gmail users to view their email when they don’t have an Internet connection.

- AdBlock Plus – tired of ads popping up? Get this extension to thwart them.

- Momentum – provides a customized, motivational dashboard with weather, time, and daily to-do items.

- Pocket – allows you to save articles and other content to read later or on your other devices.

Many of the software apps you use every day also have Chrome extensions you can use. Pinterest, Evernote, your anti-virus software, Hootsuite, and others have extensions you can check out and install.

Try these tips to learn your browser software better and become more productive while navigating the web.

Abandoned Property – What Is It? How Do We Account For It?

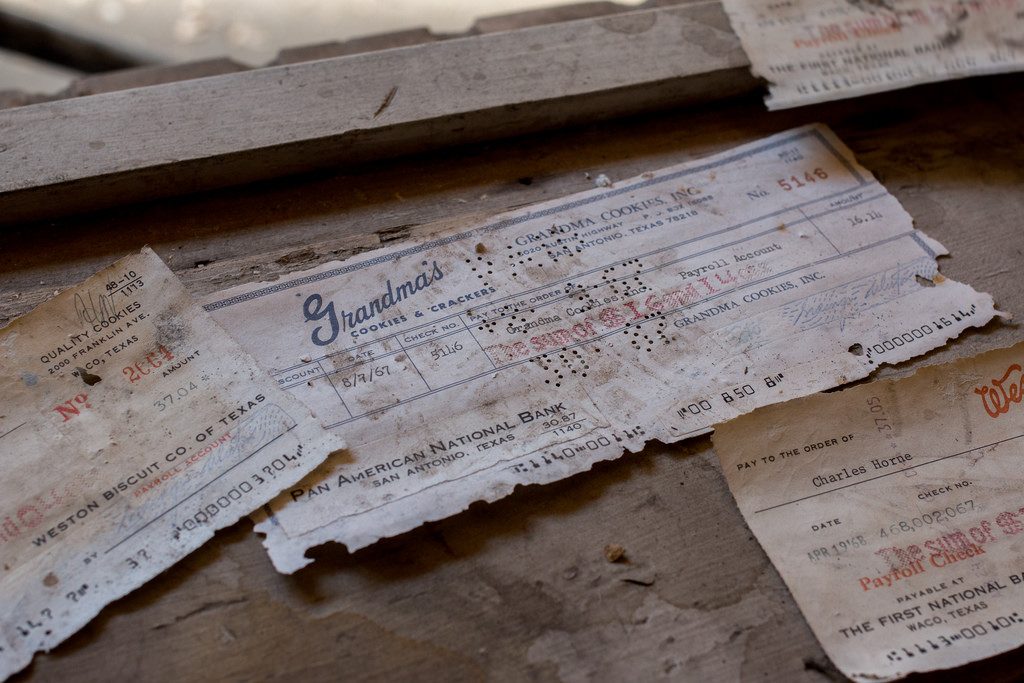

How many times have you written a check to someone, who either loses it or forgets to cash the check? After a certain amount of time, that check is considered stale and can no longer be presented to be cashed. It sits in your QuickBooks file uncleared on the bank statement reconciliation, now what?

You call the person, ask them to cash it. You may even re-issue the check so they have another chance to get paid, but then you find out they moved away and you don’t have their address, now what?

Uncashed checks to vendors, payroll checks to employees, contractors, dividends, and distributions to stockholders all are potential unclaimed or abandoned property. Every state has their own escheatment laws that require businesses and organizations to hand over to the state, the abandoned property that has been in their possession for a certain period of time. If a check goes uncashed, that does not mean the property no longer belongs to that individual and the obligation that the employer has to compensate the employee does not go away.

In the state of New Hampshire, you are required to notify the owner of the abandoned property. No more than 120 days prior to filing, all holders must send a written notice to the owner of the property having a value of $50.00 or more. In this notice you must verify the nature of the property and how to retrieve it and avoid abandonment to the state. If this attempt at notifying the owner is unsuccessful, you will then move forward to reporting the abandoned property to the state.

How to Report Abandoned Property in New Hampshire

To begin the process of reporting abandoned property, you must fill out the State of New Hampshire form for abandoned property which is Form T-1. Below is a link for your convenience to click on and review this form and/or print it.

https://www.nh.gov/treasury/documents/abandonded-propert-t1-form.pdf

For detailed instructions on how to fill out this form, we have also provided you the necessary link that will walk you through, step-by-step for filling out NH Form T-1.

https://www.nh.gov/treasury/documents/abandonded-property-t1-instructions.pdf

The first column on the form asks for the correct code for the property type. Here is a link that will show you which code is appropriate for your abandoned property.

https://www.nh.gov/treasury/documents/property-type-codes-t1-a.pdf

How to handle Abandoned Property in QuickBooks

It is important to remember that abandoned property does not belong to the company. That property is either owed to the state or owner. Uncashed checks should never be voided. Making sure your bank accounts are reconciled on a monthly basis will help you monitor uncashed checks. Once that property amount is sent to the state or given to the property owner, it can then be cleared from your bank reconciliation.

Would you call yourself a procrastinator? If so, you’re not alone, and with our to-do-lists growing daily, the percentage of people who procrastinate chronically has increased over the last few decades.

There’s a difference between procrastinating and prioritizing. Great entrepreneurs know how to put the most important tasks first. There’s also a difference between procrastinating and being overloaded with tasks; that’s another problem called delegation (or lack of it), and that’s a topic for a later article.

If you need a little motivation getting things done that you are procrastinating, here are five quick tips. Even if you aren’t a procrastinator, these tips may boost your productivity.

- Check your willpower.

Think of your willpower like a tank of gas that you use up every day. By the end of the day, it’s gone. If you leave tasks that you procrastinate until the end of the day when you have no willpower left, chances are they won’t get done. Instead, re-arrange your schedule so that the tasks you are procrastinating on get done on a full tank of willpower, usually in the morning.

- Set an internal deadline.

You might respond well to external deadlines when everyone is watching or there are consequences for missing them. If so, then make your internal deadlines external ones by announcing them to the world. Having friends ask you about the deadline will incent you to keep your promise.

- Treat your success.

If you completed the task you have been procrastinating, then stop and reward yourself. Your reward should be personal, something you enjoy. Perhaps it’s a spa day, a movie during the week, a long lunch with friends, or just a leisurely walk.

Hopefully, you will want more rewards, so you can set a new one for the next tasks you complete.

- Break it down.

Sometimes procrastination is the result of feeling like the project is just too big. If you have a large project looming ahead, break it down into smaller pieces that you feel are more manageable.

- Find your power hour.

Everyone has a time of day where they perform the best. For early risers, it’s the crack of dawn. For late night owls, it’s past sunset. Find the time of day where you have the most energy and motivation, and plan your difficult tasks accordingly.

Almost everyone procrastinates on their least favorite tasks. Let these tips help you boost your productivity and reduce your procrastination.

If you need guidance on how to stop procrastinating read “Eat that Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less Time” by Brian Tracy.

One of the many online marketing options available for businesses is blogging. A blog can act as a company’s daily newspaper, letting customers and followers know the latest news about what’s happening. It can also be a wonderful revenue-generator.

As long as the content of your blog is relevant to your readers, you can post on a wide variety of topics. You might want to let clients know about an upcoming sale, a new employee, or a tip related to a product or service of yours.

Some businesses make a separate revenue stream out of blogging. The most profitable blog today is the Huffington Post. Revenue from blogging can be earned in many ways:

- By selling ad space to people who want to get their products in front of people who read your blog

- From sponsors

- By holding events your readers attend

- From commissions from the sale of products on your site

- By creating products and services such as membership sites which allow paid access to your resources

Making money from blogging through one of these revenue streams takes work. Not only do you have to find or create content, you’ll need to attract readers too.

You can also simply use your blog to generate a following for your products and services. The right content can improve customer service, educate customers on your products which leads to better client retention, or inform them of the benefits of your products during your sales cycle.

If you’re not a writer, there are plenty of freelance writers available that you can hire to create your blog posts. You can also curate articles, meaning you can find existing articles and ask the author if you can re-publish theirs.

Creating a blog is easy with software like WordPress or apps like Blogger.com WordPress.com, and Wix.com, and all of these solutions are free.

Think about how a blog can impact your business for the better.

New Business Direction LLC

New Business Direction LLC