It’s the little things that add up to make an exceptional experience for your customers. Here are five “little things” you can add to your services to create an exponentially memorable connection with your customers.

Generosity

Add a little extra something to the products or services you offer. It could be a piece of chocolate like Hershey’s® Kisses®. It might be a handwritten thank you note. It could be a coupon for their next visit. It could be a bottle of water.

These little additions pack a huge wallop for the customer experience. And none of them cost a lot to implement (unless you eat all the Hershey’s® candies yourself). Think of what you can add to your customer experience so that the customer sees you as generous and caring.

Speed

Many customers value their time, and adding speed to your service will be appreciated. When customers call in or email you for a service question, how fast do you respond?

Set response time goals for you and your employees to respond to customer issues and questions. You might choose one minute, four hours, or one day for response time, depending on your business. Make sure customer emails are answered first, and have someone monitoring the phone during business hours.

Track your results and reward your speediest employees.

Acknowledge and Apologize

Sometimes things go wrong, and an apology to the customer is in order. In most cases, customers simply want to be heard, so your listening skills are your best asset at that moment.

As an entrepreneur, the buck stops with you. Even though it might not have been your fault, it’s sometimes a good idea to simply apologize in the sincerest way possible. If there’s something that needs to be done to make it right, go overboard. Give the refund, take the loss, and let the customer win.

Positive Communications

How you word things can make all the difference. Which sounds nicer?

“That item is out of stock and won’t be in for six weeks.”

“We will have that item in stock in six weeks.”

The first sentence has two negatives (out of stock and won’t), while the second sentence is positive. It avoids the negative wording.

It’s a small but powerful change in the customer experience. Think about how you can word your communications so that there are more positive words and fewer negative words when speaking with customers.

Your Full Attention

Although you want to respond to customer issues with speed as mentioned above, while you are working with the customer, take time to slow down and really engage with the person. Our world is so fast, and some companies even reward multi-tasking, but no customer appreciates interruptions when being helped.

When you are with a customer, even on a phone call, be with the customer. Avoid interruptions and distractions, and give them your full attention. It’s the most powerful thing on this list. Treat them as a real person, not just another figure, and the customer will notice.

Try one or more of these five customer service boosts to take your customer service experience to the next level.

An after-action review (AAR) is a fantastic process to help you look back at a project or period of your business to see what, why, and how things occurred and how they can be improved for the future. Taking a profit-focused view will help you get the most out of the idea.

- What was supposed to happen?

- What did happen?

- What worked? What should we keep doing?

- What didn’t work? What are some improvements?

- What advice would you give yourself at the beginning of the year? (Or project?)

- What personal lessons did you learn?

- Technology changes / additions or training

- Staffing changes

- Hiring process changes

- Marketing changes / additions or training

- Operations changes / additions or training

- New service or product development / new niches

- Changes in your existing services or products

- Customer retention

- Sales cycle changes or development

- Pricing evaluations

- Client surveys / communications / service level changes

Online marketing is a large component of marketing for many small businesses. There are many aspects to online marketing that you’ll want to consider for your business. Here are just five for your consideration.

Content Marketing

Content marketing is huge, and it consists of generating articles, blog posts, social media updates, white papers, videos, and other educational materials about your company’s products and services. Content marketing provides your prospects with something to read, watch, or learn from.

You can offer your content via your website, social media pages, a special landing page, in a blog, in the description portion of your profiles, via paid ads, or almost anywhere online. Your content should promote your brand as well as show your prospect how to use your product or service.

Video

Video has become incredibly important. It’s no longer enough to generate text. Graphics are better than text, but video trumps them all when it comes to effectiveness, higher search rankings, engagement, and sales conversions.

The good news is you don’t have to hire an expensive video team anymore. A good video camera is less than $500, and you can also use your smartphone for some very decent footage.

Directories

It’s no longer enough to simply have a website. Being listed in online directories will help your business expand its visibility. Some common directories for small business include:

- Yelp

- Angie’s List

- Manta

- Better Business Bureau

- Yellow Pages (online version)

- Thumbtack

- Your local Chamber of Commerce

- Craigslist

- Google for Business (Google Places)

Some of these directories work best if you ask customers to post reviews. Be sure to also check out your industry-specific directories.

Social Media

Including social media in your digital marketing is a no-brainer today. Graphic and video posts are far more effective than text posts, so it’s important to make this content switch if you haven’t already.

If you’ve focused on the “big 3” platforms – LinkedIn, Twitter, and Facebook – it might be time to try some new ones. Pinterest and Instagram lend themselves to graphic representation of your product. Google Plus is often overlooked but can help search engine rankings. And YouTube is a must because of the importance of video.

Public Relations

Digital public relations has been around for a while as well. If you don’t already have a Press page on your website, consider this addition. It can list contact information for reporters as well as a list of articles that your product, company, or employees have been featured in. You can also post press releases to this page.

Distributing press releases is less expensive than ever with options such as PRWeb and PRNewswire.

Make sure your digital marketing campaign has all the components above and that you have updated your content for these latest trends. Having an up-to-date digital campaign will help you generate more revenue and grow your business.

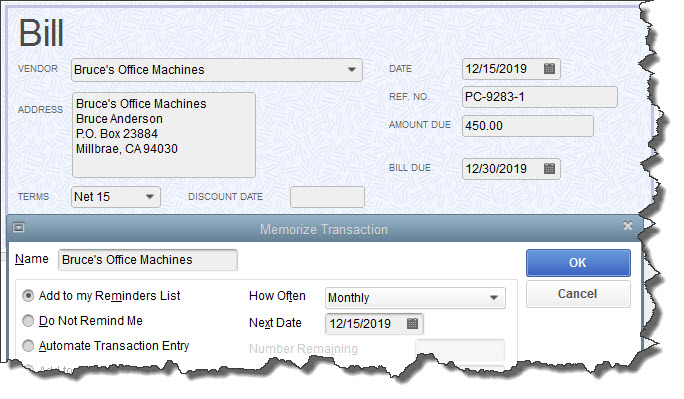

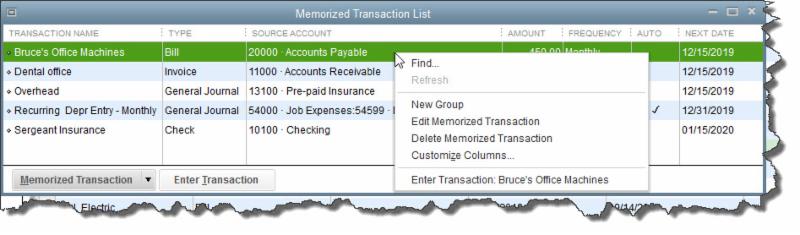

- Add to my Reminders List. If you click the button in front of this option, the current transaction will appear on your Reminders List every time it’s due. You might request this for transactions that will change some every time they’re processed, like a utility bill that’s always expected on the same day, but which has a different amount every month.

- Do Not Remind Me. Obviously, QuickBooks will not post a reminder if you click this button. This is best used for transactions that don’t recur on a regular basis. Maybe you have a snow-shoveling service that you pay only when there’s a storm. So the date is always different, but everything else is the same.

- Automate Transaction Entry. Be very careful with this one. It’s reserved for transactions that are identical except for the issue date. They don’t need your approval – they’re just created and dispatched.

Social media is an awesome marketing tool, but it can also be a huge time drain. If you post regularly, or want to post regularly, and use multiple social media platforms, such as Twitter, LinkedIn, Facebook, and Google+, then an app like Hootsuite can save you a tremendous amount of time.

Hootsuite allows you to schedule social media updates or posts across multiple platforms. If you are posting in real time, logging on several times a day, then Hootsuite can save you a lot of time. You can enter tweets, posts, or updates ahead of time and tell Hootsuite when to post them. You can also enter one post to be posted on multiple platforms all at once.

All you need to do is write your posts ahead of time. Once you have a week’s worth, you can log in to Hootsuite, enter them, and let Hootsuite know when and where to post them.

One of the biggest benefits of Hootsuite is that it allows you to become far more consistent with social media, rather than posting when you feel like it. You can decide ahead of time if you want to post once a day, three times a day, or ten times a day. Then, you can write your posts all at once. If you want to post three times a day, then you’ll need to write 15 posts a week. Plan to write them on Friday morning, and schedule them for the coming week. You’ll be all set with your social media until next Friday.

Writing a post and using it on multiple platforms can also save time. There is little need to create separate posts for each platform, and with Hootsuite, you can enter your post and have it update your LinkedIn, Twitter, Facebook, and Google+ account all at the same time. In addition to those four, Hootsuite integrates with WordPress, YouTube, and Instagram.

Even if you still log into your social media platforms every day to increase your interactivity and engagement, you can still automate your posts to save time. Hootsuite is free for customers who have three or fewer social media platforms connected. Look for it at Hootsuite.com.

New Business Direction LLC

New Business Direction LLC