I’ll never forget my first tax season at a local CPA firm, one customer meeting in particular. We were sitting across the table from a nice young couple expecting their first child. They had started a small construction company that year and did quite well. The purpose of our meeting was to deliver the tax return, tell them the balance due for taxes, and answer any questions they might have about the Federal and state tax returns and future estimated tax payments.

When I shared with them that they owed just shy of $10,000 in income taxes, the young lady burst out in tears! They didn’t have the money. They had profits–but no cash. No one had ever explained the difference to them, and they were not expecting a balance due of that magnitude.

This meeting changed their lives and the course of my career. I never again wanted to sit across the table to deliver unexpected news to a bright-eyed entrepreneur and his expecting wife.

Therein began my career of teaching small business owners the difference between profits and cash, along with many other nuances of business ownership that no one ever tells you (including the fact that approximately 40% of your profits will go to pay income taxes). It’s a harsh reality, and knowledge is power. These outflows of cash can be planned when you have advanced notice. This type of planning is usually called tax planning, business planning, revenue planning, and/or profit planning. But knowing the difference between profit and cash is a good place to start — let’s dive in.

Here is the short and sweet on the difference between profits and cash. Profit is revenue minus expenses. Cash is money in minus money out. There is a fancy, seldom understood financial report called a Statement of Cash Flows that reconciles your profit to your cash, and is part of a comprehensive financial statement package which will also include your Balance Sheet and Profit and Loss Statements.

Most small business owners only look at the profit and loss, pay little (if any) attention to the balance sheet, and have never heard of the Statement of Cash Flows.

However, I would argue that the Statement of Cash Flows is the single most important financial report. It will tell you how much profit you made, where the money went, and what’s left of your profit.

There are certain things that you spend money on that are not tax deductible: some are not deductible at all, and some not immediately. They use cash, deplete your bank account, and do not reduce profits.

Let’s discuss a few common examples:

Equipment – you buy a new piece of equipment for your business. This might look like a walk-in cooler for a restaurant, a forklift for a warehouse, a work van for a construction company, a new stitcher for a manufacturing facility, or a company truck for the business owner. These items are Assets with a useful life extending beyond a one-year operating cycle and are reported on the balance sheet. They affect cash and do not affect profit until they are depreciated. When you make an investment in a piece of equipment like this, it is not immediately deductible. You’re out the cash and do not have an expense deduction–yet.

Loan Payments – Let’s say you buy that forklift and take a loan for it because the interest rate is better than what you’re making on your savings, or you don’t actually have the cash to pay for it outright. While the interest paid on the loan will be tax deductible, the loan payments themselves are not. The principal portion of the loan payment reduces the loan Liability account on the balance sheet. It affects cash, but never profits.

It is important to reconcile profits to cash, to find out where the money came from and where the money went. You never want to be caught short at the end of the year without enough cash to pay the taxes on the profits generated by your business. And hey, those federal income taxes you pay? Those are not tax deductible either.

While New Business Directions doesn’t prepare tax returns, our clients can benefit from the types of planning we mentioned above. Having a CPA in your corner throughout the year can make or break you at tax time–we can consult with you on the best time to make a capital expenditure decision, keep you informed about the speed at which cash is entering and leaving your business, and more. If you’d like to discuss cash vs. profit within your company, complete our intake form to get started.

When building a team, classifying your workforce correctly is vital to your business’s success and legal compliance. Employees and independent contractors are not interchangeable terms, and it’s important that you can distinguish between the two in your organization.

While it may seem like a simple solution to classify members of your workforce as independent contractors, there are actually very specific criteria that determine whether a worker can be classified as an independent contractor. Workforce classification is not a grey area – the IRS has an independent contractor test, as do many states, and they do not always follow the same criteria. In this article, we’ll discuss the differences between an employee and an independent contractor so you can ensure you’re operating your business correctly.

When is a worker considered an Employee?

Employees work under your direct control – they follow your schedule, use your company tools, and often receive benefits such as training, healthcare and/or retirement. You withhold taxes from their paychecks and contribute your share of payroll and unemployment taxes, you pay workers’ compensation insurance on the wages, and you file quarterly and annual returns with the IRS, Social Security Administration, and state agencies.

When is a worker considered an Independent Contractor?

Independent contractors maintain autonomy – they work for themselves and have their own company, they set their own schedule, they provide their own tools, they have their own general and/or professional liability insurance, and they handle their own income and/or self-employment taxes and pay their own expenses. They are typically hired for a specific project and under contract and take the risk of whether or not they make a profit.

What can happen if a worker is misclassified as an Independent Contractor?

If the IRS determines that you have been misclassifying an employee as an independent contractor, the penalty can equal 20% of the wages paid; 100% of the employee FICA taxes that should have been withheld; 100% of the employer FICA taxes that should have been paid; 20-75% of the underpayment of taxes; 25% of the late payment of taxes; and a per-worker fine.

In addition, there are Department of Labor and state penalties for misclassifying employees as contractors, which can equal any overtime that should have been paid. Plus, courts can award an additional 100% of unpaid overtime payments.

Penalties can also include severe criminal sanctions, including felony charges.

There’s a lot at stake when it comes to classifying your workforce correctly, and cutting corners here can be a costly decision for your business. Proper classification safeguards your company from legal issues and ensures compliance with labor laws, workers’ compensation laws, and Federal and state laws. If you have questions about the classification of your workforce or need support with payroll in your business, reach out to our team at newbusinessdirections.com/contact.

While you’ve likely heard of the term “goodwill,” are you aware of its application in accounting? Goodwill is an account on the balance sheet of certain businesses, and it falls into the category of assets. Specifically, it’s what’s known as an intangible asset, or one that isn’t physical. Examples of other intangible assets are copyrights, patents, and trademarks.

Understanding Goodwill in Accounting

Goodwill arises when one company purchases another. When a company pays more for the company that it is acquiring, the difference is booked as goodwill. Goodwill represents the extra value that the acquisition provides for the purchasing company.

When the purchase happens, the assets and liabilities of the acquired company are taken over by the purchasing company. They are recorded on the purchasing company’s books at their fair value. The balancing entry between the fair value of the assets and liabilities purchased and the purchase price is booked to the goodwill account.

What could lead a company to pay more for another company? Things that are not on the balance sheet but are valued could include a solid customer base, great employees, brand reputation, the company name and what it means, technology owned by the company, and a great reputation for customer service.

Normally, an intangible asset like goodwill would be amortized, but it is not. Amortization is when a portion of the asset is expensed each year. A patent, for example, is amortized over its useful life, not to exceed 20 years. If it sounds similar to depreciation, that’s because it is; some physical assets are depreciated, while some intangible assets are amortized.

Goodwill Impairment

Before 2001, goodwill was amortized for up to 40 years, but the accounting rules have changed to something less arbitrary. Now, goodwill must be checked each year for “impairment.”

Goodwill impairment happens when the value of the acquisition declines after it has been purchased. One famous example of impairment write-down occurred right after this new accounting rule was implemented. In 2002, $54.2 billion in impairment costs was reported for the AOL Time Warner, Inc. merger.

More recently, in 2020, a few of the largest impairment write-downs included companies, such as Baker Hughes, Berkshire Hathaway, and ATT, due to the latter’s acquisition of DirecTV in earlier years. In 2022, impairment write-downs included Teladoc Health and Comcast. Covid-19 was in part responsible for a large number of impairment write-downs in recent years.

If impairment is required to be booked, the journal entry will look like this:

Debit Impairment Expense (increases expenses and therefore reduces profits)

Credit Goodwill (reduces the asset amount)

If your company has acquired other companies and you have a goodwill account on your balance sheet, you can work with your accountant to determine how to check for impairment and if you are required to correct your books. While this process can be complex and time-consuming, it is crucial in ensuring that the financial statements are a true reflection of the company’s financial position. Goodwill is an important accounting concept that can have a significant impact on the financial statements of a business.

The IRS announced earlier this month that it has increased the optional #StandardMileageRate used to calculate the deductible costs of operating a vehicle for business. The new rate, effective January 1, 2023, will be 65.5 cents per mile driven, which is an increase of 3 cents from the unusual mid-year increase we saw in 2022.

For full information, including deductible amounts for miles driven in service of charitable organizations, medical, or moving purposes for members of the armed forces, read the full article from Journal of Accountancy linked here: https://www.journalofaccountancy.com/news/2023/jan/business-standard-mileage-rate-increases-2023.html

![]() The Critical Link Between Time Tracking and Labor Costs

The Critical Link Between Time Tracking and Labor Costs

Keeping track of how you and your workers spend time is one of the most important things you can do in your business. Labor costs can be a large portion of expenses, and understanding how time is spent can help you manage your business better in a multitude of ways. We touched on labor costs in our recent article, “Breaking Down Direct and Indirect Costs,” and wanted to share more on the topic. Keep reading to learn more.

Benefits of Time Tracking

There are plenty of reasons to track time, some of which we’ve listed below:

- When pricing by the hour, time tracking is mandatory; without it, you won’t be able to invoice your clients accurately.

- Documenting time spent on specific projects helps managers understand how long a task should take, when employees could benefit from training, and where processes and procedures may need improving.

- Project management systems allow users to import detailed time reports, which allows businesses to create more accurate fixed-fee pricing estimates on future jobs and customer proposals.

- For construction companies, time tracking feeds into job costing.

- For manufacturing businesses, time tracking feeds into labor reports.

- For hourly workers, time tracking is used in payroll systems so they can be paid accurately.

- Time tracking can increase accountability among team members as they become more aware of how they spend their working time.

- When time is budgeted in advance, actual hours worked can be compared to see how the budget is used and whether it was too much or too little.

- Time tracking allows managers and business owners to determine when they need to hire additional staff because the backlog has become too large.

What Is Time Tracking?

Time tracking is the recording of how you spend your time. You can use paper, a spreadsheet, or time tracking software like QuickBooks Time (formerly TSheets) to log the task you are working on and the length of time you worked on it. For example, here’s a simplistic example of a spreadsheet time log, aka timesheet, for one day:

Employees may be required to complete timesheets on a daily or weekly basis, which are then turned into their managers and payroll administrators.

Managers can take time tracking to the next level by adding hourly payroll costs as well as the employee’s hourly billing rate to gain insight into further time-tracking financial metrics.

Time Tracking Software

There are many different types of time-tracking software:

- A time clock allows employees to “punch in” when they arrive for work and “punch out” when they leave. This type of machine is mostly used for payroll in a manufacturing setting.

- Time tracking applications like QuickBooks Time allow workers with computers and smartphones to enter their time via the application. Features like biometric time clocks (i.e., requiring a thumbprint to verify the correct individual is clocking in) and geofencing (allowing employees to only clock in from certain locations) can reduce employee time theft.

- Some companies will have their time tracking function embedded into their project management, job costing, or billing system. Employees would then enter their time via those applications.

Getting Employees on Board with Time Tracking

Reporting your hours in a time-tracking system is one of the least favorite tasks of employees and requires managers to spend more time shaping their mindsets and attitudes than any software training. It’s important that employees feel that your policies don’t resemble “Big Brother” when using their time data.

For best results, let employees know how the timesheet data will be used. Allay their fears that they will not get fired or in trouble if they feel something “took too long,” which can often translate into an employee “fudging” their hours on a task where they might have made a mistake. Make sure they know they won’t be penalized in any way for what they report. In other words, remove the risk of penalty for recording their time data accurately.

Communication is key in getting employees to report their time accurately so that managers and owners can receive meaningful information. Have managers tie time tracking to an employee’s personal career goals to increase adoption and reduce resistance.

Personal Time Tracking

Time is our most precious commodity, and tracking your personal time can give you insights into how you are investing in yourself. Some really interesting questions can be considered when you have some time data for yourself.

- How much “downtime” do you need each day in order to live a productive and healthy life?

- How much time are you spending on your goals?

- Are you spending time on what you consider to be important?

Getting Started with Time Tracking

If you’re considering time tracking or would like to take your current time-tracking function to the next level, please contact us [here]. We may be able to help with integration, implementation, the accounting aspect of time-tracking, and financial metrics and reports.

We’ve heard more than a few horror stories in the past few months of business owners falling for phishing scams that compromise their company, cost them thousands of dollars, and put their customers and contacts at risk. Hackers are getting more sophisticated by the day, and it’s becoming harder to tell a malicious threat from an ordinary email.

We share this insight to empower, not scare. The good news is that most threats are avoidable with a vigilant eye. In 2021, think of a phisher as more of a vampire than a heister: you have to invite them in before they can cause any harm. Below, we’ve pinpointed a few common threats for 2021 and 2022, along with best ways to avoid them. These suggestions should help keep your sensitive data secure from current phishing trends.

Common Threat 1: QuickBooksⓇ Impersonation

One common trend we’re seeing involves solicitations from QuickBooksⓇ impersonators falsely notifying you that your QuickBooksⓇ file is corrupt, your automatic payment is about to expire, or your version of QuickBooksⓇ needs to be updated. These phishers will try to get you to pay for a phony upgrade over the phone or grant them access to your desktop to “fix” your accounting software. Here’s the thing: if you work with an accounting company like New Business Directions, we’ll probably be the first ones to know if something is wrong with your QuickBooksⓇ file. And if you’re a New Business Directions customer, QuickBooksⓇ knows you’re working with a QuickBooksⓇ Solution Provider and will often notify us of any issues your account may be experiencing, too.

How to dodge the threat: If an email appears to come from QuickBooksⓇ, check the email addresses for the correct website. If it doesn’t end in “@Intuit.com” or “@QuickBooks.com” the sender is fraudulent (even if the name before the @ symbol looks convincing). Always contact your accountant before engaging with a solicitation like this and never provide payment information or authorize remote access to your computer or QuickBooksⓇ file to anyone besides your accountant or IT solutions provider.

Common Threat 2: Download this Attachment

Another major threat to watch out for involves an email from an address you recognize (say, a customer, vendor, or team member), but asks you to enter your Microsoft credentials to view the attachment. This scam comes from a person you know, and their email address matches the one you have on file. The MicrosoftⓇ log-in screen looks legit, but the web address is not. Do not enter your Microsoft credentials. As soon as you do, the hackers have access to your email and all sensitive information you have ever sent or received via email. The phishers will then send the exact same email that you fell for to every contact in your address book.

How to dodge the threat: never enter your log-in credentials to view an attachment. If an email includes a hyperlink, hover over the link with your mouse (don’t click) and watch for a link preview to appear in the corner of your screen. In Outlook, this will be the bottom left corner. You’ll be able to see a preview of the web address the hyperlink is trying to send you to, and if it’s different from the one typed out in the email. In this case, if the domain isn’t “office.com” the email is fraudulent. This is a fast and simple step you should always take before clicking a hyperlink in an email. And when it comes to sharing sensitive information like bank statements and government IDs, you should always use a secure, encrypted file sharing application like SmartVault instead of sending the document as an email attachment.

Common Threat 3: “You Have a Voicemail” emails

Are you surprised to be receiving an email notifying you about a new voicemail? Does it have an attachment? Is the sender posing as RingCentral or another VOIP phone system provider you use? Remember: if it seems suspicious, it probably is.

How to dodge the threat: don’t download the voicemail. If you want to be sure you’re caught up on your voice messages, navigate to your voice mailbox the way you usually do and avoid interacting with the email in question.

Common Threat #4: The QR Code Swap

QR codes have become so mainstream that we interact with them weekly, if not daily. From restaurant menus to sign up forms, they make accessing the information you need quick and simple. But there are emerging trends in which bad actors will replace a QR code with their own – by overlaying a sticker. They may also come in the form of seemingly-legit emails. But as soon as you scan these phony codes, you could be putting your sensitive data at risk or downloading malware.

How to dodge the threat: Review the preview of the web address when you scan the code, and before you click on the link that appears. Make sure it’s spelled correctly, and seems like it’s coming from the correct person or business. When dealing with QR codes that exist in a public space, take a second glance to make sure the QR code hasn’t been tampered with, such as replaced by a sticker. When in doubt: don’t scan that code!

Best Practices

There are so many ways to avoid phishing scams, but the most important thing to do is stay observant. If something seems off about an email, it probably is. Below, we’ve outlined a few specific best practices that should help you avoid scams:

- Set-up two factor authentication. Do this for all websites/applications you have log-in credentials for. It might seem inconvenient to go through one more step to access your online accounts, but this practice is still more convenient than dealing with a successful cyber security attack. Apps like LastPass Authenticator or Google Authenticator are an option. These apps provide a six-digit code for you to enter once you’ve logged in to your desired online account. Many other web-based companies offer the option to have an authentication code sent to your personal cell phone or the email associated with the account. How does two factor authentication help? Even if a phisher gets your credentials, they still need access to your email, text messages, or authenticator app to get the authentication code and hack your account, making it significantly less likely they’ll be successful in their attempted breach.

- Keep up with phishing scam trends. Check for updates from Forbes.com, PCMag.com, or your favorite trusted business news source for updates on phishing trends and recent cyber security threats.

-

- Don’t open the door for strangers. Never grant access to your computer to someone you don’t personally know, even if they look like a QuickBooksⓇ rep. Your accountant and your IT Support vendor/employee are the only people you should ever allow access to.

- Watch for inconsistencies and typos. Are there misspellings in a marketing email? Does the subject line have five exclamation points? Is your name or the name of your company spelled wrong? When it comes to emails, if it smells like a phish and looks like a phish…well, you know the rest.

- Double-check the sender. Always check the sender’s email address. If the name associated with the email address says “Rhonda Rosand” but the email address differs from the one you have on file for Rhonda Rosand, the sender is a fraud. In cases like this, you should check with the individual through another previously established method of communication, be it a phone call to a number or email you already have on file to confirm your contact actually sent the email you’re looking at. Don’t reply to the questionable email with, “Rhonda, is this really you?” If you were a hacker, how would you respond to that email? Red flags include a professional email that includes an @gmail.com (or similar) domain, a slightly misspelled name, or a domain that differs from that of their company’s website.

- Train your Team. If you received a sketchy email, chances are your team received it, too. Send out an all-company message about the threat and tell employees to notify you or your IT professional immediately if they interacted with the threat. Share trends in cyber security threats, and host frequent training on cyber security best practices.

- Trust your gut. Even if the sender looks familiar, if they’re asking for weird information or are trying to send you an attachment in an unusual way and it seems suspicious, trust your gut. Look for other clues that they might be an imposter: is a hyperlinked web address different from what it should be? Is their email address different from the one they typically use? Is their tone or communication style different than usual?

- Keep your passwords strong and secure. LastPass is a great solution for dual factor authentication, generating complex passwords, and storing sensitive information securely. You can read more about this helpful cyber security solution in a recent blog post of ours here.

- Don’t send sensitive information via email. Avoid sending credit card information, banking information, W-2s and 1099s, pictures of vital documents like drivers licenses, social security cards, etc. via email altogether. Instead, use a secure document management system both parties are already aware of.

When in doubt, don’t click that sh!t

When it comes to Cyber Security, It’s always better to be safe than sorry. Be suspicious of communication that seems a little off. Avoid unusual emails and contact your IT security provider (or accountant, if it’s related to accounting) to ask for their insight right away, especially if you’ve already accidentally interacted with the phishing attempt. New Business Directions is well versed in phishing scams, and we have a keen eye for malicious emails. If you’re a current customer and feel unsure about an email or solicitation you recently received involving your accounting software, reach out to us.

A lot of times, new business owners ask us one question: How much will it cost for you to do my accounting or taxes? And, we’re happy to answer that question as soon as we find out more about your business and whether we can help you with what you need.

However, you might want to ask us more questions than simply inquiring about our fees. Here are some to consider. And yes, feel free to grill us. We appreciate your interest and want you to know us better. Setting expectations at the beginning contributes toward a healthy long-term relationship between a business owner and their accountant.

- How long have you been in business?

- What experience do you have with companies in my industry?

- What experience do you have with companies at my revenue level?

- What professional bookkeeping, accounting, and/or tax credentials do you have?

- How skilled are you with technology?

- What accounting software do you support?

- Have you earned any accounting software credentials?

- Do you partner with any accounting software vendors, and what benefits do your clients receive from your partnership?

- What accounting and tax services do you offer? Do you have a specialty or favorite service or niche?

- What services are inhouse and what is outsourced by you to other vendors? (example: payroll)

- Are your employees US-based or overseas?

- What size is your team, and who would support my business?

- How do you bill for services: flat-rate or hourly?

- How long is my initial rate locked in for?

- How often do you raise prices on clients?

- What price would you charge to perform the services I need?

- Do you offer a guarantee or warranty on your work?

- How do you protect and secure my financial data?

- Who in your company and supply chain will see my financial data?

- How secure is the accounting software you use?

- Do you require me to sign a contract or engagement letter?

- What is your cancellation policy?

- If I pay for software through you and decide to cancel, what happens to my software and data inside the accounting system?

- Is your firm environmentally-friendly?

- Does your firm support diversity and inclusion?

Our “Comprehensive COVID-19 Sick Pay and Paid Leave” YouTube tutorial has helped thousands of people since it was released last year, teaching QuickBooks Desktop users how to set up COVID-19 Sick Pay, FMLA, and Health Premiums under the Families First Coronavirus Response Act (FFCRA).

Recently, the tutorial received some updates. Below, you’ll find helpful screen grabs and instructions with the most up-to-date information about the processes explained in this video. The times mentioned below are all hyperlinked to the video and will route you directly to the timestamp being mentioned for ease of access. For additional helpful information, make sure to view the comments section of the video.

The video can be viewed in its entirety here: https://www.youtube.com/watch?v=D8zIiPk3eNI&t=2s

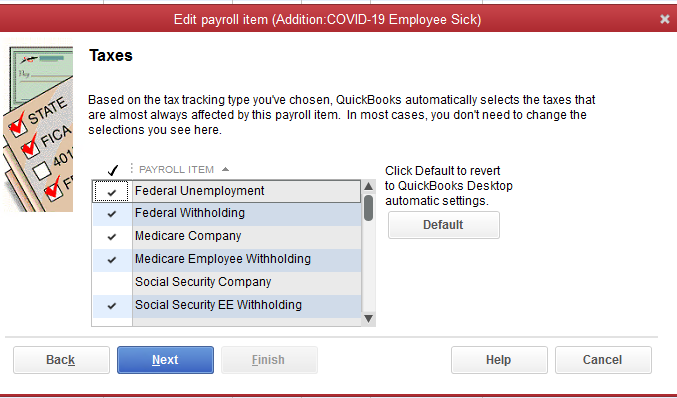

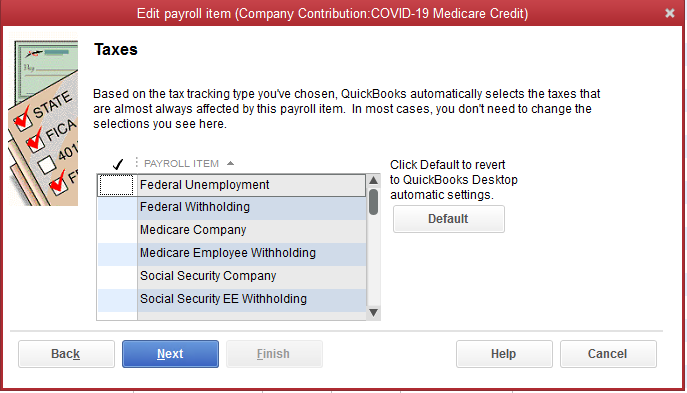

1. At 6:03, we discuss creating a COVID-19 employee sick pay item. The video shows that the social security company tax is checked, which is no longer correct. To revert back to the correct tax settings, select the “default” button. The screenshot below demonstrates the correct tax settings:

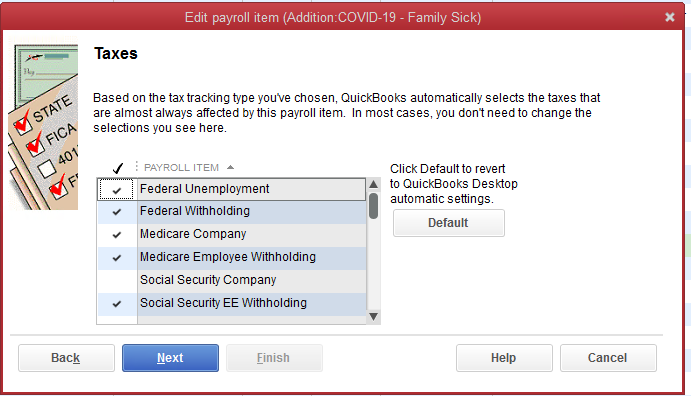

2. At 7:17, we discuss creating a family sick pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

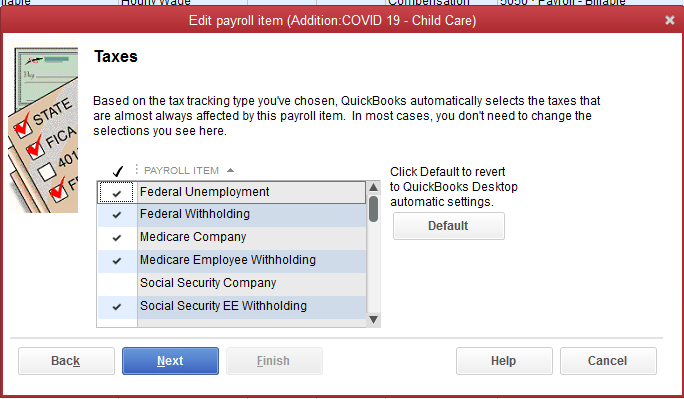

3. At 8:30, we discuss creating a child care pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

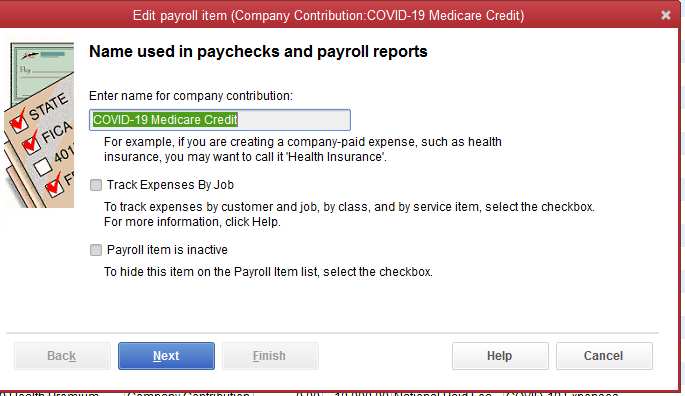

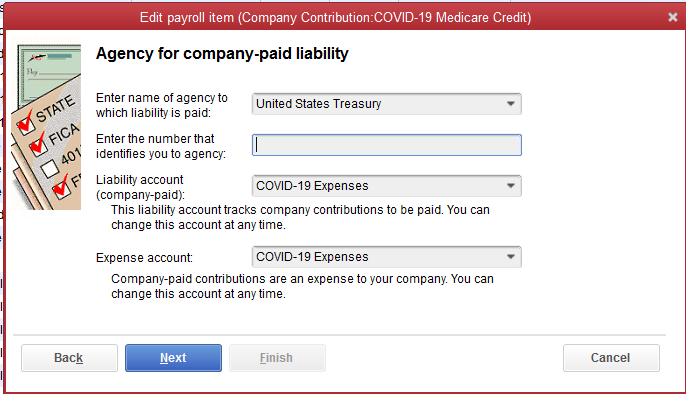

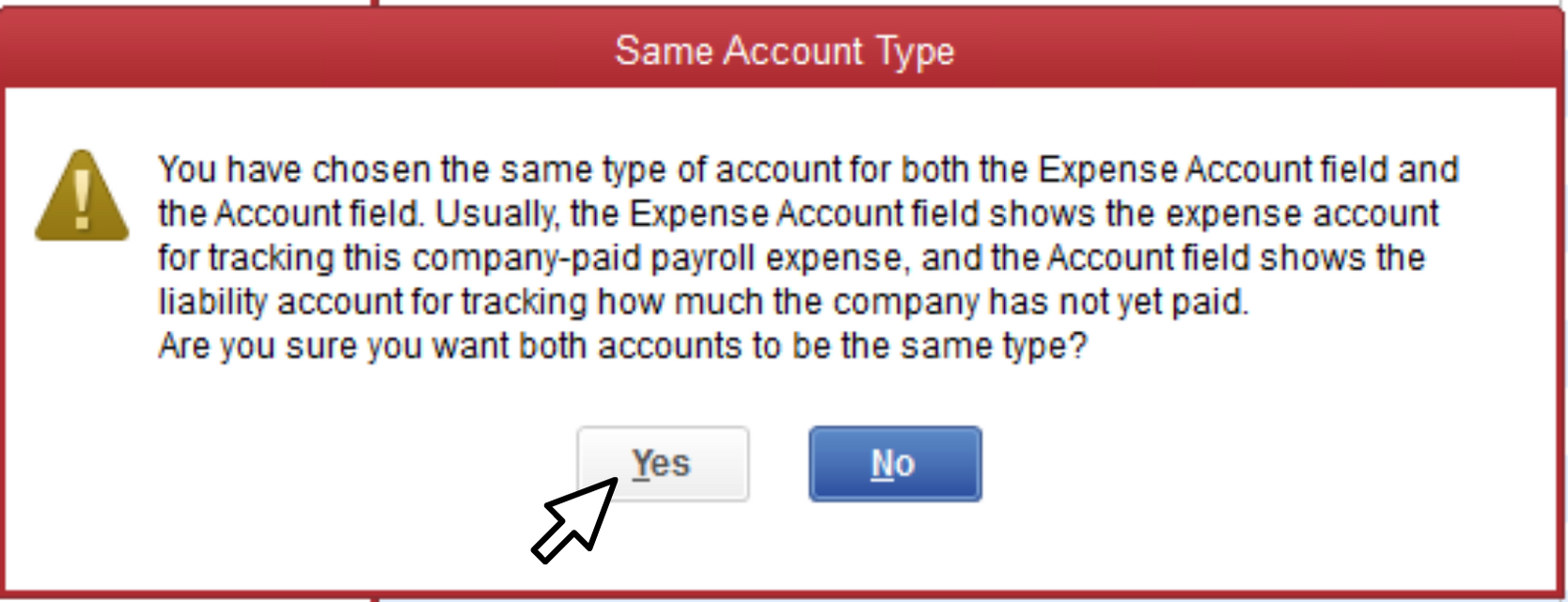

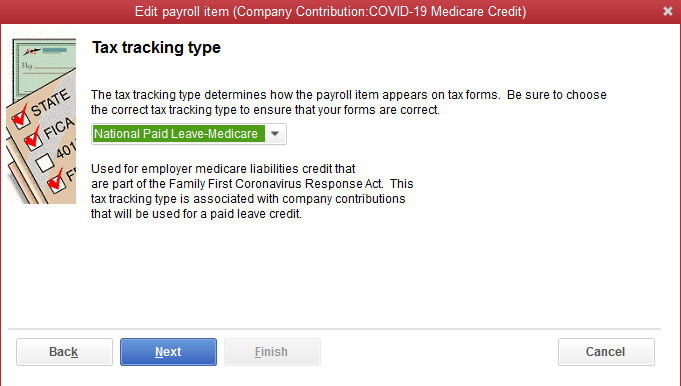

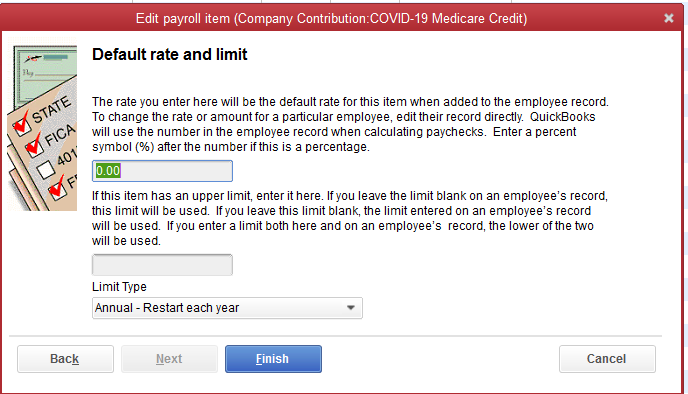

4. At 11:48, we discuss setting up a national paid leave credit. A second company contribution for the COVID-19 Medicare credit should have been created; Intuit later released information on this, and while the comments in the video contain this update, we wanted to ensure this information was easily accessible. The seven consecutive screenshots present the correct steps to take.

6. At 17:51, we discuss payroll liabilities. The video shows that the Medicare employee additional tax is checked, however, it should not be. Instead, the following items sh0uld be checked off:

- the federal withholding

- the Medicare company

- the Medicare employee withholding

- the social security company (this should be zero for COVID pay)

- social security employee withholding

The American Rescue Plan Act of 2021 (ARPA) signed into law on March 11, 2021 by President Biden contains numerous tax provisions which may affect your taxes in 2020 and 2021. We’ll provide a general recap of some of the major changes in this article.

Recovery Rebate

The biggest news for taxpayers is a stimulus payment of $1,400 per person including dependents for taxpayers who meet income limits. The income will be measured based on the 2020 tax return if filed, and the 2019 tax return if 2020 has not yet been filed.

Individuals with adjusted gross incomes (AGI) of less than $75,000 qualify for the full amount, while individuals with AGIs between $75,000 and $80,000 will qualify for a partial rebate. Joint filers with adjusted gross incomes below $150,000 qualify for the full amount, while joint filers with AGIs between $150,000 and $160,000 qualify for a partial rebate.

The Recovery Rebate stimulus payment is a fully refundable tax credit against 2021 taxes which will start paying out the weekend of March 13, 2021. The stimulus payments are tax-free.

Unemployment Income

While unemployment income (UI) is normally taxable, the first $10,200 of 2020 UI for households making less than $150,000 is now tax-free. However, if you pay state income tax, the UI may still be taxable. It remains to be seen how many states will follow federal tax treatment of UI.

The $300 unemployment income payments that were set to expire in March are now extended through September 6, 2021 for eligible individuals. The Pandemic Unemployment Assistance for the self-employed, part-time workers and gig workers is also extended.

Expanded Credits

The Child Tax Credit (CTC) increases for 2021 only from $2,000 to $3,600 for each child under 6 and $3,000 for each child older than 6 and younger than 18 (up from age 16). Single filers earning up to $75,000 and joint filers earning up to $150,000 receive the full credit, while single filers making from $75,000 to $200,000 and joint filers making from $150,000 to $400,000 will receive a portion of the credit.

The payout for the CTC is different as well. Half of the credit will be disbursed in monthly payments from July to December 2021 while the remaining half can be claimed on the 2021 tax return.

The Child and Dependent Care Credit amounts have been increased as well. This credit helps defray the costs paid to a caretaker or child care agency for caring for a child or dependent with disabilities. For 2021 alone, the credit is increased from $3,000 to $8,000 for one child or dependent, and from $6,000 to $16,000 for more than one child or dependent.

COBRA

Many people who have been laid off have also lost their health insurance. COBRA is the program that allows unemployed individuals to continue paying for insurance after they’ve lost their job or had hours reduced. The government will pay COBRA premiums from April through September 2021 for qualified taxpayers.

Student Debt

While ARPA did not forgive student debt outright, it provided for the tax treatment of forgiven student debt that occurs between January 1, 2020 and December 31, 2025. Any debt forgiven during these dates is non-taxable.

The American Rescue Plan Act of 2021 (ARPA) signed into law on March 11, 2021 by President Biden contains numerous tax provisions which may affect the tax situation for your business in 2020 and 2021. We’ll provide a general recap of some of the major changes impacting businesses in this article.

Employee Retention Credit

The Employee Retention Credit (ERC) has been extended through the end of 2021, which adds the third and fourth quarters to the mix. It also allows the credit to be claimed against the 1.45% Medicare or Hospital Insurance (HI) taxes.

The ERC can be a significant windfall for businesses that have had a drop in gross receipts or have been shuttered by a government order.

Paycheck Protection Program

While the current March 31, 2021 application deadline for First and Second Draw PPP loans has not been extended as of this posting, the ARPA did add more funds to the program, made COBRA eligible for forgiveness, and expanded eligibility to additional entities, including additional covered nonprofit entities, newspapers, and certain nonprofits.

The Paycheck Protection Program was designed to save jobs by providing forgivable funds to employers and self-employed individuals so they can make payroll and support their ongoing operations during the economic uncertainty of the pandemic.

Shuttered Venue Operators

Additional monies have been allocated to this program which was initiated by the Consolidated Appropriations Act signed in December 2020. Entities that are eligible for the Shuttered Venue Operators program, which has not opened as of this writing, can now apply for Paycheck Protection Program loans.

Paid Sick Leave

ARPA extended the sick and family leave benefits that began with the Families First Coronavirus Response Act (FFCRA) to September 30, 2021. It adds the employer’s share of Medicare and Social Security taxes on qualifying leave wages to the credit calculation and increases the per employee limit from $10,000 to $12,000.

The changes also include time for the employee to receive the COVID-19 vaccine and recover from it if needed. Self-employed sick days limit is expanded from 50 to 60.

Restaurant Revitalization Grant

Certain restaurants, food businesses, and shops located in an airport can apply for a restaurant revitalization grant that will be offered through the Small Business Association. The grant is for $10 million, up to $5 million per location, and can be spent on expenses necessary to keep the business open. A total of $28.6 billion has been allocated.

Businesses cannot have more than 20 locations, cannot be operated by a state or local government, and cannot apply if they received or have pending applications for Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act.

New Business Direction LLC

New Business Direction LLC