Accounting automation has come a long way in the last few years, and the process of handling invoices and receipts is included in those changes. No longer is there a mountain of paperwork to deal with. In this article, we’ll explain some of the changes in this area.

Vendor Invoices

Most invoices are now sent electronically, often through email or from accounting system to accounting system. Some accounting systems allow the invoice document, usually in PDF format, to be attached to the transaction in the accounting system. This feature makes it easy for vendor support questions as well as any audit that may come up.

Some systems are smart enough to “read” the invoice and prepare a check with little or no data entry. Others are able to automate three-way matching – this is when you match a purchase order, packing slip, and invoice together – so that time is saved in the accounts payable function.

Receipts

Today’s systems allow you or your bookkeeper to scan in or take cell phone photos of receipts – whether cash or credit card – and then “read” them and record the transaction. This type of system cuts way down on data entry and allows the accountants to focus on more consultative work rather than administrative work.

Some vendors will email you receipts so all you have to do is use a special email address where your accountant is copied or forward the receipt as you receive it.

The biggest challenge for business owners is getting into the habit of photographing the receipt and sending it to the accountant. The days of shoebox receipts are not completely over, but cloud-savvy business owners are definitely enjoying the alternative options of today’s paperless world.

Approvals

Some systems automate bill approval. This is especially handy for nonprofits or companies with a multi-person approval process. It cuts down on approval time and the time it takes to pay the bill.

New Systems

There are many 3rd party applications that automate a part of the vendor payment or receipt management system. All of them have different features, platforms, software requirements, integration options, and pricing. Many of them integrate with Quickbooks, some with the desktop version, some with Quickbooks online and some integrate with both platforms.

- BILL

- Hubdoc

- Receipt Bank

- Expensify

- SmartVault

- Doc.it

- Tallie

- Concur

- LedgerSync

- ShoeBoxed

- ShareFile

If you are interested in finding out more about automating your accounts payable invoices or receipts, please reach out anytime. We have partnerships with many of these 3rd parties for preferred pricing and in most cases we have certified in their products.

If you grant credit to customers, then you have a balance in accounts receivable. DSO stands for Days Sales Outstanding, and this helps you measure how fast your receivables are being converted to cash.

Here’s how to calculate it:

DSO = Accounts receivable balance / Annual net credit sales * 365.

DSO is measured in days and it represents how many days it takes to collect the customer invoice balance and convert it to cash.

Whether the DSO measure is “good” or not varies by industry as well as the terms you’ve set for your clients. If you’ve set your invoices to be due in 30 days and your DSO is 45 days or less, that’s pretty good. If you’ve set your invoices to be due in 10 days and your DSO is 60 days, then you might want to consider a more aggressive collection policy to speed up your cash flow.

Here are some tips to reduce DSO:

1. Invoice clarity.

Make sure your invoices are accurate and clear. Make it clear whom to make the check out to, where to mail it, the due date, and the amount due. All of these features should be easy to find on the invoice.

2. Consider discounts.

A common discount term is 2/10, net 30. This means the customer can take two percent off their invoice if they pay in 10 days; otherwise they owe the whole amount in 30 days. If you have customers from large companies, discounts are often required by policy to be taken and this can speed up your payments from them.

3. Consider electronic payments.

Going paperless with your invoicing as well as your payment process can speed up the entire billing cycle. Customers getting their bills earlier will also pay earlier.

What’s your DSO? If you need help calculating it, give us a call.

The best cakes have layers and layers of different delicious flavors to enjoy. Stacked on top of one another, each layer is baked separately and becomes part of the whole. Like a layer cake, your business expenses have layers of meaning to them. When you can understand how expenses play a part in profit, you can manage them better.

Here’s how to make a layer cake of your business expenses. Let’s start with the most direct expenses.

Direct Costs

If you have inventory you will have a balance in the Cost of Goods Sold account. It should represent how much you paid for product or inventory that you are selling. It is the most direct expense of all the expenses; if you don’t spend this money, you would not have a product.

If you sell services, you should not have a balance in Cost of Goods Sold, but you will have direct expenses that are tied to performing your services. These might include labor from wages of the employees who carry out the services for clients. Any supplies directly involved with delivering services should be included as well.

You may also have other direct costs related to selling specific products or to servicing specific accounts.

Indirect Costs

The next layer includes indirect expenses. These expenses do not make up your product directly and might contribute to several different lines of products. Indirect costs might be attributable to a group of products or projects and can be apportioned accordingly.

Overhead

Although overhead is technically a form of indirect cost, it’s good to create a separate layer for it. It includes management salaries, rent, utilities, and other fixed costs that cannot be directly allocated to a product or service.

Assembling the Layers

A wonderful exercise is to classify each of your expense accounts in your Chart of Accounts as direct, indirect, or overhead. In that way, you can see how each account contributes to the costs of running your business. Some questions to ask yourself:

- What is my gross margin before indirect costs and overhead?

- What is my gross profit after indirect costs and before overhead costs?

- How can I cut down on any of these categories of expense?

- What is my breakeven volume in sales before overhead is factored in?

- Can my profit margin be changed if I spent less in a certain area?

This layered view is just another way to view the financial aspects of your business and can help you make better decisions down the road.

You can also break the layers down even further by classifying the expenses as critical and non-critical. This will help you determine where best to invest while maintaining the level of profit you desire.

You can’t manage what you don’t measure. Layering your expenses will help you have your cake and eat it too. And if we can help, just reach out as always.

Two very important skills for entrepreneurs to master are marketing and finances. Combine them by understanding the numbers behind marketing, and you have an even more powerful understanding of exactly what makes your business tick.

Key Numbers – Cost Per Client Acquisition

Do you know how much it costs your business to bring in one client? The technical term is “Cost per customer acquisition,” and it’s computed by adding the total marketing and sales costs excluding retention costs and dividing them by the total number of clients acquired during a period of time.

Cost per customer acquisition is important to know because then you can compute how long it takes before your business begins to make a profit on any one customer. In software application services with a monthly fee, the breakeven for a client can be around ten months.

It’s essential to understand this dynamic for pricing and volume planning purposes. If your services or products are priced too low so that your acquisition costs are not recouped in a reasonable period of time, it can play havoc with your cash flow as well as your profits. If you don’t have enough volume to cover overhead and acquisition costs, then your company will be in trouble in the long term.

Customer Lifetime Value

There is a simple and an academic formula for customer lifetime value. You can estimate it by multiplying the average sale of a customer by the average number of visits per year by the number of years they remain a customer. That’s the easy version.

The more difficult version of this formula takes into account retention rates and gross profit margins. The formula is: Average customer sales for life times the gross profit margin divided by the annual churn rate.

Once you know and track these numbers in your business, you’ll be better able to make smart decisions about your marketing investments and your pricing. And if we can help you, please reach out as always.

Outsmart your accountant and other financial friends with these accounting-related definitions:

Fiscal Year

Most companies report their results on a calendar year, from January 1 through December 31. Some companies use a different year for reporting, and that’s called a fiscal year. For example, Intuit’s fiscal year runs from August 1 to July 31. A nonprofit commonly runs from July 1 to June 30.

The word fiscal alone refers to government or public revenues and expenditures. A fiscal year can also be considered the period where companies report their financial results to the public.

Budget

Most companies sit down once a year and plan what they intend to spend. This set of numbers is a budget. It is prepared in income statement format which includes planned revenue and expenses. It can be done for a year, monthly or both.

A common report that compares budget to actual figures is the Income Statement Comparison to Budget which includes columns for month and year-to-date actual, budget, and variance (the difference).

Forecast

While a budget is a longer term plan, a forecast is an attempt to predict the short-term future. Forecasts can be made for cash flow, predicting your bank account balance, or can be focused on potential profit for a period. A forecast is created by enumerating current and expected short-term cash commitments.

General Ledger

A general ledger is a fancy word for your accounting books. It’s also a very specific report that lists each account within the chart of accounts, beginning balances, the activity of each account for a particular period of time, and ending balances. It includes both balance sheet accounts, such as cash, accounts receivable, and accounts payable, and income statement accounts, such as revenue and expenses.

Fixed Asset

A fixed asset is a special type of asset that includes items such as land, vehicles, furniture, buildings, office equipment, plants, and machinery. Fixed assets cannot easily be converted into cash (cash equivalents are termed current assets) and they must last longer than one year. They are physical or tangible (as opposed to intangibles such as patents and trademarks).

Depreciation

Most fixed assets except land depreciate in value over time. For example, when you drive a new car out of the lot, no one will give you what you just paid for it. This reduction in value over time is recognized on accounting books by recording depreciation. Since assets need to be recognized at market value, depreciation is an estimate of this adjustment. Depreciation becomes an expense and reduces the value of the fixed asset. Unlike most other transactions, cash is not affected when recording depreciation.

Accrual

There are two ways to keep books when it comes to the timing of how items are recorded: the cash method and the accrual method. Let’s invoke Popeye the Sailor Man’s friend Wimpy who always says, “I’ll gladly pay you Tuesday for a hamburger today.” Let’s say today is the Friday before this famous Tuesday.

If you are using the cash basis method, you would record the entire transaction on Tuesday, when you get the cold hard cash. If you are using the accrual basis, you would have two entries: one on Friday to record the sale to accounts receivable and one on Tuesday to zero out the receivable and increase cash. It’s the same net, effect; the only difference is in the timing.

Most small businesses that extend credit keep their books on an accrual basis so they can keep track of everything. Most taxes are paid on cash-basis books, requiring adjusting entries at year end that reverse at the beginning of the year.

Balance Sheet

A balance sheet is a very common report of all of the business’s account balances as of a specific date, such as December 31. These accounts include cash, receivables, fixed assets, liabilities, equity and others.

Journal Entry

A journal entry is usually an adjustment that is made to the accounting books. The result is that some accounts increase and others decrease. In theory, every transaction made to a company’s books is a journal entry. When you write a check and it’s cashed, cash goes down and an expense is increased. When you receive a payment, cash goes up and revenue goes up. Each of these transactions is a journal entry.

Do you feel a bit smarter? I’m not sure how exciting this is for cocktail table talk, but hopefully you feel smarter when it comes you’re your business’s accounting function.

QuickBooks 2016 offers some new features that we are excited to share with our fellow accounting professionals. Batch Delete/Void Transactions and enhanced Statement Writer Support are two of the latest features available to Accountants only. Sorting on Item Custom Fields and Auto Copy Ship to Addresses are features only available in Premier (including Accountant) and Enterprise versions of the software.

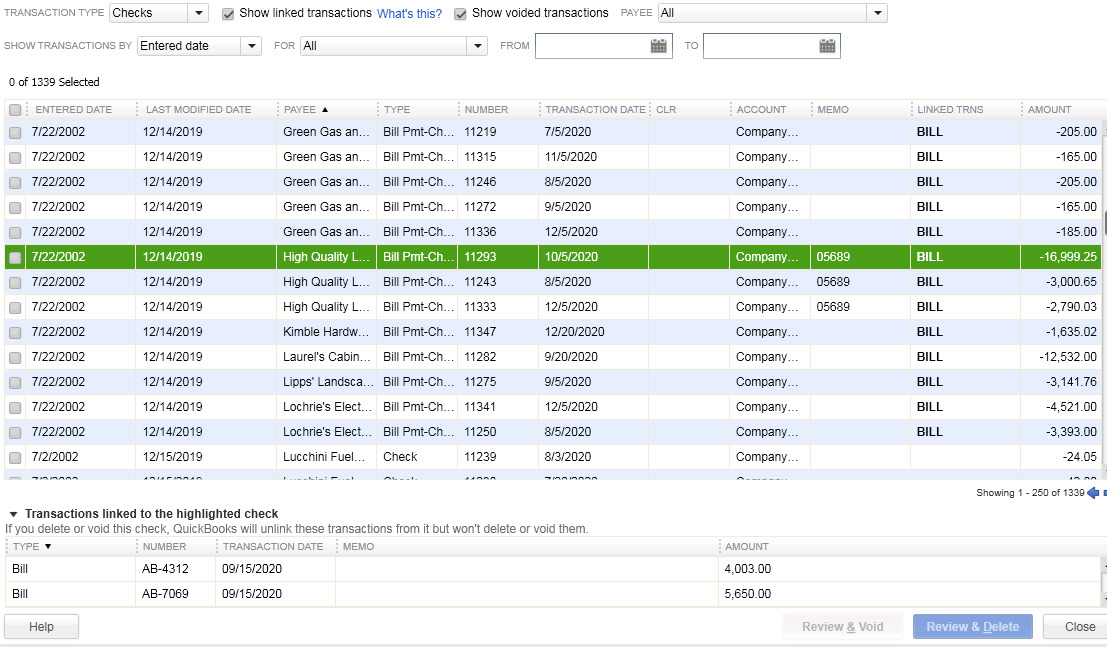

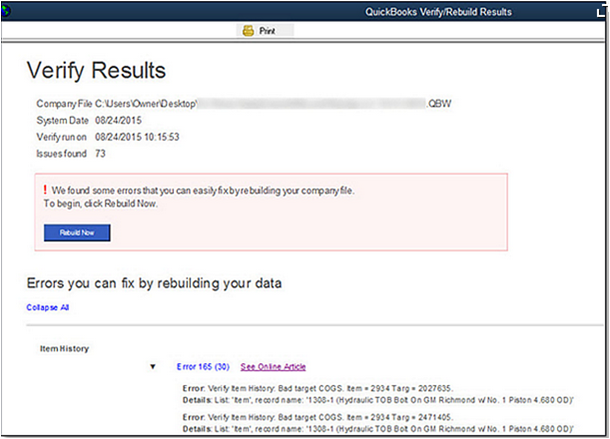

Batch Delete/Void Transactions

We are cautiously excited about this new feature as it could prove to be quite dangerous in the wrong hands. Fortunately, Intuit realized that and only made the tool available in the Accountant and Enterprise versions of the software and in the Accountant Toolbox in the Pro and Premier versions.

It works for Invoices, Bill and Check transactions, but not for Credit Cards Charges or Deposits, at this time. It is also not available for Payroll or Sales Tax Transactions. The columns can be sorted by Entered Date, Modified Date or Transaction Date as well as by Payee, Type, Number, Account or Amount.

Any other transactions that are linked to the transaction to be voided/deleted are highlighted for you to be aware and to address them as well, if need be. For example, voiding a Bill-Check does not void the related Bill.

I am hopeful that Intuit will improve this feature and add the ability to work with Credit Card Charges, as I have seen many occasions where these were imported to the wrong account or even twice to the same account. As with any tool of this nature, we recommend a backup before and to Void instead of Delete.

Statement Writer Support for Microsoft Office

I do not prepare financial statements, but for those who do and for those who use the QuickBooks Statement Writer, it is essential to have the integration with Microsoft Word and Excel. With QuickBooks 2016, we have this integration with the Accountant and Enterprise versions of the software. However, we still do not have support for the cloud-based Microsoft Office 365.

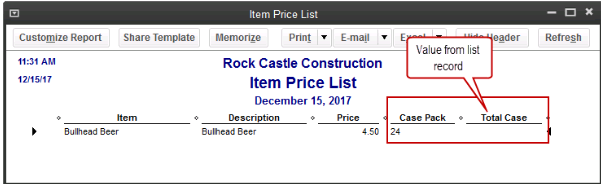

Sorting on Item Custom Fields

In prior versions, we had the ability to sort on the Customer and Vendor Custom Fields, but not on the Items Custom Fields – those fields were mostly notational and not very reportable.

In QuickBooks 2016 Premier, Accountant, and Enterprise, Intuit introduced this feature which will allow sorting on Inventory Valuation and Inventory Stock Status reports as well as the Inventory Price List. This will save countless hours of exporting to Excel and creating Pivot Tables to gather the required information.

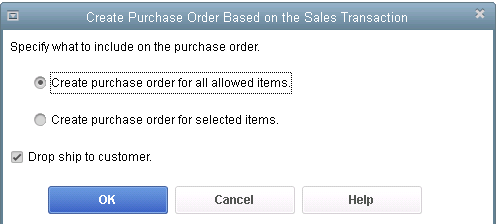

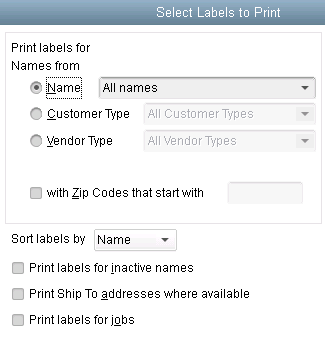

Auto Copy Ship to Addresses

For Contractors and Retailers who order materials or goods to be shipped directly to the job site or customer, QuickBooks 2016 – Premier, Accountant and Enterprise, has the ability to populate the Customer address in the Ship To Address directly from an Estimate or Sales Order, simply by selecting the Drop Ship to Customer checkbox when creating a Purchase Order.

It’s good to know some basic accounting terms, and here are ten terms with friendly definitions for your review.

Asset: Essentially, assets are what you own. These include your bank accounts, business equipment, and even the amounts that customers owe you.

Revenue: Revenue is what you make. Another word for it is Sales. You generate revenue in your business when you make a sale to a customer. The amount of the sale is included in revenue.

Expense: An expense is what you spend in your business on items that are not expected to benefit you in the long term. Expenses include credit card fees, office supplies, insurance, rent, payroll expense, and similar items that you need to incur to keep your business running.

COGS: COGS stands for Cost of Goods Sold. It’s a form of expense that directly relates to the product or service being sold. For example, if shoes are being sold, the cost of purchasing those shoes are consider COGS, while something like rent or insurance is simply an expense. COGS is more important in manufacturing, retail, and distribution companies.

Net Income: Another word for net income is profit. It’s calculated by subtracting expenses from revenue. If what’s left over is a positive number, it’s net income and if it’s negative, it’s a net loss. Besides your salary, it’s the amount of money you can either keep or re-invest into your business.

Debit: A debit is a term that tells you whether money is being increased or decreased. The hard part is that it’s opposite depending on the account and the company. Here are some examples:

- A debit to cash increases it, so that’s good.

- A debit to a loan you owe decreases it, so that’s good too because you are paying it off.

- When you talk to a bank teller and they want to debit your account, it means they are taking money away, because your account is a liability to them. So it’s opposite.

Credit: A credit is a term that tells you whether money is being increased or decreased. The hard part is that it’s opposite depending on the account and the company. Here are some examples:

- A credit to cash decreases it, as in writing a check to someone.

- A credit to a loan you owe increases it, so you owe more money.

- When you talk to a bank teller and they want to credit your account, it means they are putting money in, because your account is a liability to them. So it’s opposite.

GAAP: GAAP stands for Generally Accepted Accounting Principles. It refers to the set of standards that must be followed by accountants when creating accounting reports for people like bankers and investors who rely on them.

Liabilities: Liabilities are what you owe. If you have loans taken out for your business or owe vendors money for invoices of purchases they sent you, those are liabilities. Common liabilities include sales tax that you’ve collected but not paid, unpaid vendors’ invoices, credit cards that are not paid off each month, mortgages on buildings, and any bank loans you’ve taken out.

Equity: In mathematical terms, equity is the net of your assets less your liabilities. In more philosophical terms, it’s the net amount you and your fellow business owners have invested in your business adjusted by the years of net income you’ve made less what you’ve taken out of the business.

How many terms did you already know? Do you feel smarter already? Knowing accounting terms will help you understand this aspect of your business a bit better.

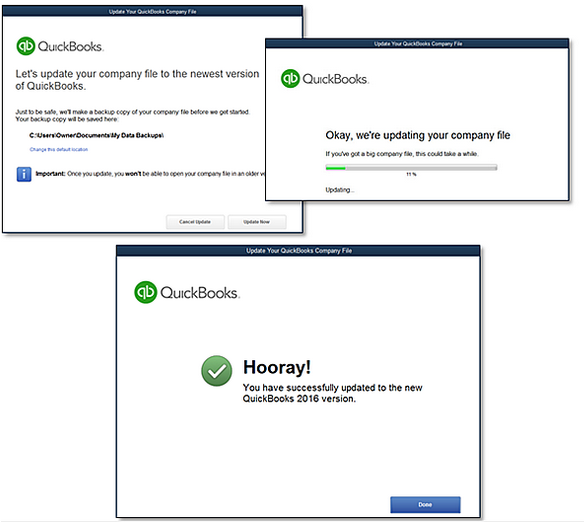

QuickBooks 2016 Desktop was recently released and there are a few new features that you will want to take a look at to see if it has something worth upgrading for.

Bill Tracker

The Bill Tracker is similar to the Income Tracker in the Customer Center that was released as a new feature in QuickBooks 2014 and improved with QuickBooks 2015. The Bill Tracker is located in the Vendor Center and allows a Snapshot View of Purchase Orders, Open Bills, Overdue Bills and Bills that have been paid in the last 30 days. Transactions can be managed from this area and batch actions can be taken to print or email and to close Purchase Orders and Pay Bills.

This Fiscal Year-to-Last Month

In the past, we had choices for date ranges on financial reports of This Fiscal Year or This Fiscal Year-to-Date as well as This Month or This Month-to-Date, none of which worked well for month-end reporting purposes. We now have This Fiscal Year-to-Last Month which allows us to print our financial reports as of the end of the Last Month, through which accounts are typically reconciled. This will allow us to Memorize Reports with the correct date instead of saving with a Custom Date that needs to be changed each time.

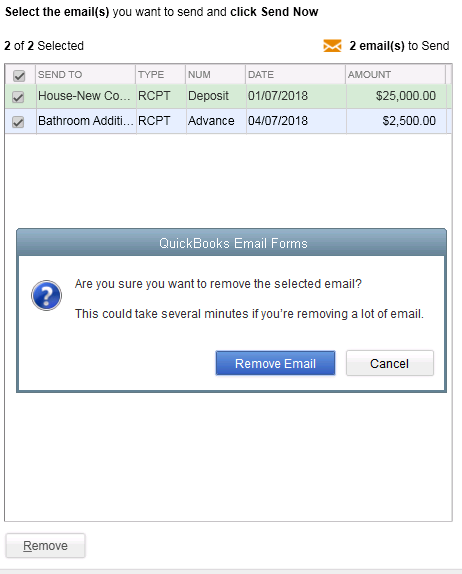

Bulk Clear “Send” Forms

Bulk Clear “Send” FormsSales Receipts, Invoices, Estimates and Purchase Orders all have an Email Later check box and it’s a “sticky” feature, meaning that once selected, it remembers for future transactions. In the past, we would accumulate many documents in the queue to be sent later and if we wished to clear the queue, it would have to be done individually. With this release, under the File menu, Send Forms, we can now Select All and click Remove.

do a Backup!

We are pleased to announce that on November 18th, 2015, Rhonda Rosand, CPA/Owner of New Business Directions, will be conducting the QuickBooks 2016 Expanded workshop sponsored by the New Hampshire Society of Accountants at the Executive Court in Manchester, NH.

Rhonda will touch on What’s New in QuickBooks 2016, how to fully utilize QuickBooks, which software program works best for you and your clients, and an accountants only section leaving plenty of time for questions.

Registration fee is $89 for NHSA members and $109 for non-members and allows participants to earn 4 CPE credits. To sign up for this event, please call (603)228-1231 or email info@cornerstoneam.com

On November 2nd– 4th, Intuit will be hosting the 2nd annual QuickBooks Connect Conference in San Jose. The conference brings together thousands of entrepreneurs, small business owners, accounting professionals and developers  under one roof.

under one roof.

There are three different tracks on the agenda as follows:

Accountant – QuickBooks Connect will help your firm get future ready by challenging you to go further, think differently, and embrace the cloud to properly value the services you provide, grow your firm, and better support your clients. *

Small Business – Whether you’re a company of one or one hundred, come to make your business dream a reality: network with fellow small business owners, entrepreneurs, self employed individuals, startup founders, and Venture Capital leaders to receive personalized advice on maximizing your success. *

Developer – Engage Intuit Developer experts to speed your QuickBooks app integration and successful launch to the QuickBooks ecosystem. Take advantage of the unique opportunity to meet and network with other developers, accountants and small business owners. *

The mission is to connect, learn and grow throughout a dynamic agenda of main stage and intimate sessions. Key speakers  include Oprah Winfrey, Jessica Alba, Brian Lee and Robert Herjavec. Sessions topics include: Here to There: The Accountant’s Journey toward Professional Greatness, Work/Life Harmony, 10 Barriers to Service Excellence and How to Overcome Them, and Cash is King: Tips to Increase Your Cash Flow Today. There will also be speed mentoring sessions and an entire series of QuickBooks Online training topics.

include Oprah Winfrey, Jessica Alba, Brian Lee and Robert Herjavec. Sessions topics include: Here to There: The Accountant’s Journey toward Professional Greatness, Work/Life Harmony, 10 Barriers to Service Excellence and How to Overcome Them, and Cash is King: Tips to Increase Your Cash Flow Today. There will also be speed mentoring sessions and an entire series of QuickBooks Online training topics.

Rhonda Rosand states, “This will be my second year attending the Intuit conference and I look forward to seeing many familiar faces at the event and I invite you to join me in California for this spectacular training opportunity.”

* – content is taken directly from the QuickBooks Connect Website

New Business Direction LLC

New Business Direction LLC