The security breach at Equifax a few months ago left many people thinking once again about identity theft. The best thing is to do everything you can to prevent it from happening to you. Here are a few tips to help you reduce your risk of being a victim of identity theft as well as how to reduce the damage from security breaches of your personal data from sources you can’t control.

Discontinue paper statements that are mailed.

Paper bank, brokerage, and credit card statements that are mailed can be misboxed, intercepted, lost, or stolen, and the information can fall into dishonest hands. Instead, discontinue paper statements, and access them via your online account where you can review, print, or save them each month for your records.

Rent a private mailbox.

If you have trouble with mail theft in your area and can’t check your mailbox as soon as the mail is delivered, consider renting a post office box or a private mailbox. These are especially handy if you travel a lot or have many packages delivered and no one is home to sign for them. They cost up to $300 per year, and you can find them at places like The UPS Store, Mailboxes Etc., Postal Annex, or your local post office.

Shred your trash.

If you throw out junk mail offers for new credit cards or bank accounts, be sure to shred that paper and anything else that might contain private information.

Don’t email secure data.

Credit card numbers, social security numbers, and passwords should not be sent via email unless the email is encrypted or secure. The odds of something happening are low but could happen.

Use different passwords for different account groups.

Even the most secure-minded person uses the same password for many different accounts. You can too, but be smart about it. Use a unique password for your bank that you don’t use anywhere else. You might use the same password for all of your social media accounts because it’s just easier. Or another one for all of your free accounts; just don’t use those for any banking or credit card activity. Be smart about your password use, and make your password difficult based on the level of information that is at risk.

Choose hard passwords.

It’s painful, but choosing long, hard passwords can help throw off thieves. Include at least one capital letter, one special character, and one number in your password. Make it nice and long. And don’t use common words, your birthday, parts of your social security, or your phone number in your password. When it’s provided, use a random password generator. And don’t let your browser automatically save your banking passwords for you.

Close inactive accounts.

If you no longer use an account you signed up for, close it rather than let it linger. It will reduce your risk. Be mindful, though; if you close some credit card accounts, your credit score could be adversely affected even if there has been no activity for a while.

Consider freezing your credit.

If you don’t need a new credit card or loan or are not planning a large purchase soon, consider freezing your credit. When your credit is frozen or secure, no one can run checks against it. Any identity thieves would not be able to take a loan out in your name.

Avoid unsecured wifi.

Although the ambiance is nice at a Starbucks, the wifi is not secure, and connecting and doing your work all day long there is a big security risk.

Monitor all account activity.

Check your bank and credit card accounts frequently, and turn on all alerts and fraud notifications. You can turn on alerts for when transactions exceed a dollar amount and when your bank balance goes below a certain amount. Getting emails or text messages on your activity can help you stay on top of things.

Consider identity theft insurance.

Identity theft insurance is now common, and you can get it and fraud protection for your business as well as for individuals. If you are a victim, it reimburses you for the cost of restoring your credit. Check with your local insurance agent for more information.

We hope it never happens to you. Try these tips to reduce your risk of identity theft.

Abandoned Property – What Is It? How Do We Account For It?

How many times have you written a check to someone, who either loses it or forgets to cash the check? After a certain amount of time, that check is considered stale and can no longer be presented to be cashed. It sits in your QuickBooks file uncleared on the bank statement reconciliation, now what?

You call the person, ask them to cash it. You may even re-issue the check so they have another chance to get paid, but then you find out they moved away and you don’t have their address, now what?

Uncashed checks to vendors, payroll checks to employees, contractors, dividends, and distributions to stockholders all are potential unclaimed or abandoned property. Every state has their own escheatment laws that require businesses and organizations to hand over to the state, the abandoned property that has been in their possession for a certain period of time. If a check goes uncashed, that does not mean the property no longer belongs to that individual and the obligation that the employer has to compensate the employee does not go away.

In the state of New Hampshire, you are required to notify the owner of the abandoned property. No more than 120 days prior to filing, all holders must send a written notice to the owner of the property having a value of $50.00 or more. In this notice you must verify the nature of the property and how to retrieve it and avoid abandonment to the state. If this attempt at notifying the owner is unsuccessful, you will then move forward to reporting the abandoned property to the state.

How to Report Abandoned Property in New Hampshire

To begin the process of reporting abandoned property, you must fill out the State of New Hampshire form for abandoned property which is Form T-1. Below is a link for your convenience to click on and review this form and/or print it.

https://www.nh.gov/treasury/documents/abandonded-propert-t1-form.pdf

For detailed instructions on how to fill out this form, we have also provided you the necessary link that will walk you through, step-by-step for filling out NH Form T-1.

https://www.nh.gov/treasury/documents/abandonded-property-t1-instructions.pdf

The first column on the form asks for the correct code for the property type. Here is a link that will show you which code is appropriate for your abandoned property.

https://www.nh.gov/treasury/documents/property-type-codes-t1-a.pdf

How to handle Abandoned Property in QuickBooks

It is important to remember that abandoned property does not belong to the company. That property is either owed to the state or owner. Uncashed checks should never be voided. Making sure your bank accounts are reconciled on a monthly basis will help you monitor uncashed checks. Once that property amount is sent to the state or given to the property owner, it can then be cleared from your bank reconciliation.

One of the many online marketing options available for businesses is blogging. A blog can act as a company’s daily newspaper, letting customers and followers know the latest news about what’s happening. It can also be a wonderful revenue-generator.

As long as the content of your blog is relevant to your readers, you can post on a wide variety of topics. You might want to let clients know about an upcoming sale, a new employee, or a tip related to a product or service of yours.

Some businesses make a separate revenue stream out of blogging. The most profitable blog today is the Huffington Post. Revenue from blogging can be earned in many ways:

- By selling ad space to people who want to get their products in front of people who read your blog

- From sponsors

- By holding events your readers attend

- From commissions from the sale of products on your site

- By creating products and services such as membership sites which allow paid access to your resources

Making money from blogging through one of these revenue streams takes work. Not only do you have to find or create content, you’ll need to attract readers too.

You can also simply use your blog to generate a following for your products and services. The right content can improve customer service, educate customers on your products which leads to better client retention, or inform them of the benefits of your products during your sales cycle.

If you’re not a writer, there are plenty of freelance writers available that you can hire to create your blog posts. You can also curate articles, meaning you can find existing articles and ask the author if you can re-publish theirs.

Creating a blog is easy with software like WordPress or apps like Blogger.com WordPress.com, and Wix.com, and all of these solutions are free.

Think about how a blog can impact your business for the better.

As business owners, we want to remain optimistic about our business’s future. But life can happen, and we need to be prepared. A good business owner thinks about all the risks to their business and has a plan in place to reduce or eliminate them. In 2017, we’ve already had floods in the Midwest and California, a healthy dose of tornadoes, and an ice storm earlier in the year. And those are just the weather disasters. Are you ready?

In 2015, Nationwide ran a survey that revealed that three out of four small business do not have a disaster plan. The same survey noted that 52 percent of small business owners thought it would take three months to recover from a disaster.

The most common solution is to create two plans:

- A disaster recovery plan, which details the steps needed to recover the business from a catastrophic loss

- A business continuity plan, which details the steps needed to keep the business running in case of a major loss, such as a loss of electricity, location, or key personnel

There’s a lot of help online to help you create your plan. A few of the major items that should be covered include:

- Employee safety: you’ll need an evacuation plan in case of a disaster that is life- or health-threatening.

- Communication plan: how will you reach employees in an emergency?

- Electricity contingency: will you need to access a generator?

- Internet contingency: can your business survive without the internet for long periods of time, or will you need to find a way to get connected?

- Location contingency: if your worksite is inoperable, do employees have another place to report to?

- Employee roles: who will carry out the plan?

- Private data: how will you safeguard private company and customer data?

- Systems: do you have an inventory of hardware and software, including vendor technical support contacts? How will you prioritize which system to get back up first? Do you have agreements with vendors who can come to your aid quickly?

Creating a disaster recovery plan can be the lowest priority item on your to-do list as a business owner – until it isn’t. If you have a lot to lose, then consider spending some time on a plan to give you peace of mind.

One of the hottest buzzwords in marketing this year is influencer marketing. Influencer marketing uses key people in thought leadership positions to spread the word about your brand. These people may be paid or unpaid spokespersons for your brands, products, and services.

The profitable thing about influencer marketing is the leverage. Instead of marketing or selling to one person at a time, you are marketing to key leaders with followings who can influence many people at once.

Influencer marketing varies by industry; here are some common examples:

- Locating photos of your product already on social media and reaching out to those people to do more

- Hiring a social media expert with a large following to talk about your clothing line

- Having a prominent lifestyle blogger post a photograph containing your juice product

- Starting a referral program for a makeup company so “regular” women will spread the word

The common theme to all of the above examples is finding people who have a huge number of followers that just happen to be your ideal customers.

To take advantage of this marketing method, ask yourself who is influential in your industry that has the ear and respect of your customer base. How could you partner with them so it’s a win for you, them, and their following? You may or may not need to compensate them, depending on their revenue model.

There are plenty of apps to help you locate influencers relevant to you. A favorite is Ninja Outreach at ninjaoutreach.com.

Try reaching out to influencers to leverage your existing marketing and make your marketing dollars go farther.

Before we get too far into 2017, let’s take a look back at 2016 results and five meaningful numbers you may want to discover about your business’s performance. To start, grab your 2016 income statement, or better yet, give us a call to help you compute and interpret your results.

Revenue per Employee

This number measures a company’s productivity with regard to its employees and is relevant and meaningful for all industries. If you have part-time employees, compute a full time equivalent total and use that as your denominator.

Compare this number to prior years to see if your company is getting more or less productive. Also compare this number to businesses in your same industry to see how your company compares to peer companies.

You may also want to compute other revenue calculations, such as revenue by geography, revenue by product line, or average sale: revenue by customer, if you feel these may be meaningful to your business.

Customer Acquisition Cost (CAC)

How much does it cost your business to acquire a new customer? That is the customer acquisition cost and is made up of marketing and selling costs, including marketing and selling labor. You’ll need the number of new customers acquired during 2016 in order to calculate this number.

Compare this number to prior years as well as industry peers. You can potentially do a lot to lower this number by boosting your marketing skills and implementing lower cost marketing channels.

Overhead Costs

Overhead costs are costs that are not directly attributable to producing or selling your products and services. They include items such as rent, telephone, insurance, legal expenses, and executive salaries. Although it’s not standard practice to break out overhead expenses from other expenses on an income statement, it’s valuable to know the numbers for performance purposes.

Compare your overhead costs to prior years and industry averages. You can actively manage your overhead cost by re-negotiating with vendors on a regular basis and trimming where it makes sense.

Profit Margins

Your profit margin can help you determine which division of your business is most profitable. If you sell more than one product or service, you can compute a gross or net margin by product or service. You can also compute margins by geography, sales rep, employee, customer, or any other meaningful segment of your business.

Your accounting system may be able to generate an income statement by division if everything has been coded correctly and overhead has been allocated appropriately. Reach out if you’d like us to help you with this.

Seeing which service or product is most profitable can help you decide if you want to try to refocus marketing efforts, change prices, discontinue items, fire employees, attract a different type of customer, or any number of other important decisions for your business.

Breakeven Point

Do you know how many units you need to sell in order to start generating a profit? If not, the breakeven calculation can help you learn this information. The formula is Fixed Costs / (Sales Price per Unit – Variable Costs per Unit) which results in the number of units you need to sell in order to “break even” or cover your overhead costs.

The breakeven point helps you plan the amount of volume you need in order to ensure that you have healthy profits and plenty of cash flow in your business.

These five numbers can help you interpret your business performance on a deeper level so you can make better decisions that will lead to increased success in your business. If we can help with any of them, please give us a call any time.

If there is a period of time between when your customers receive your goods or services and when they pay for them, then several things are true:

- You have a balance in Accounts Receivable on your balance sheet that represents how much customers owe you

- You have an invoice process that you follow

- You have granted credit to customers

- You may have some that don’t pay as quickly as you’d like them to

Each invoice you send should have payment terms listed. A payment term is the period of time you expect the invoice to be paid by the customer. Your payment terms should be set by you, not your customers!

Payment terms are always measured from the invoice date and define when the payment should be received. Here are some common payment terms in accounting terminology, and then in English.

Net 30

Payment is due 30 days from the invoice date.

2/10 Net 30

Payment is due 30 days from the invoice date. If you pay the invoice in 10 days, you can take a 2% discount off the total amount of the invoice as an early pay discount incentive.

Due Upon Receipt

Payment is due immediately

If you use Net 30 or Due Upon Receipt, then you may want to change your terms to get paid faster. When people see Due Upon Receipt, sometimes they translate it into “I can take my time.” A more specific term spelled out such as Net 7 or Net 10 will actually get you your money faster than Due Upon Receipt.

Do you have issues with people paying you late? If so, you might want to set consequences. Consider adding a line on your invoice that provides interest charges if the payment is late. Utility companies do it, and so do many businesses. A common percentage to charge is 1% – 2%, however, some states have laws that limit you to 10% or another percentage.

The wording would be something like this:

“Accounts not paid within __ days of the date of the invoice are subject to a __% monthly finance charge.”

You will also need to make sure your accounting system can automatically compute these fees.

If you have questions about payment terms, your invoicing process, or your accounts receivable, please reach out.

Positive Pay is a service offered by banks that is designed to reduce fraudulent check-cashing against your account. If you are writing checks on your bank account (as opposed to using ACH transactions), then the positive pay service, which usually has an extra charge, may be beneficial.

When you activate positive pay, you must send a file of checks that you have written to the bank. The bank will not cash those checks against your account unless they match by check number, dollar amount, and account number. Your file may also include the date of the check and sometimes the payee. Some banks are also able to match payee, but not all of them, so be sure to ask about this.

If there is a mismatch among checks presented for payment, the check will be treated as an exception item and your company will be notified. A representative of your company will let the bank know whether to pay or exclude the exception check.

Positive pay helps to deter a couple of types of fraud:

- Checks where someone has changed the amount

- Stolen blank check stock, even if you don’t know about it being stolen

Positive pay is not designed to prevent the type of fraud that occurs when checks are written to a ghost vendor and erroneously approved by management.

If you use positive pay, you should separate the file creation process from the person who actually writes and/or signs the checks. This will give you better internal control.

The main challenge with positive pay is making sure the bank receives the file of checks before they are presented for payment, including any manual checks written. Another issue is the extra cost, although some banks offer this service at no extra charge.

For companies worried about check fraud, consider looking into positive pay with your local bank.

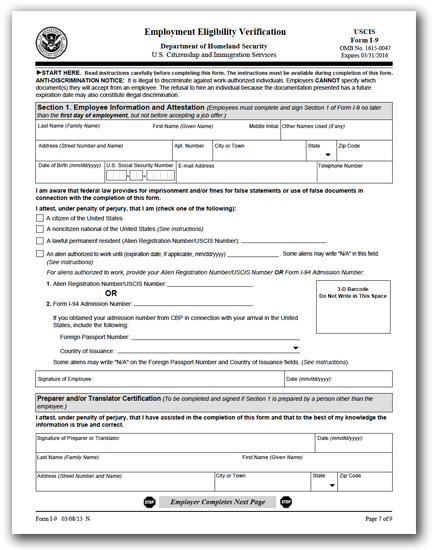

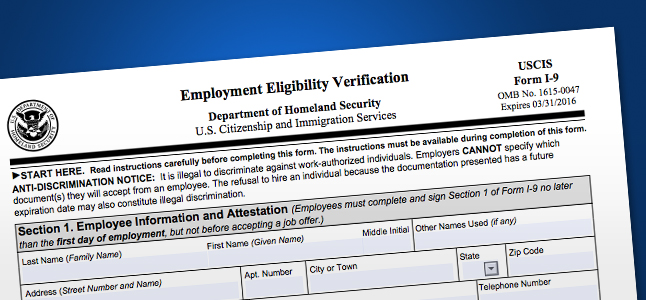

New I-9 Form Mandated After January 22, 2017

- Section 1 asks for “other last names used” rather than “other names used,” and streamlines certification for certain foreign nationals.

- The addition of prompts to ensure information is entered correctly.

- The ability to enter multiple preparers and translators.

- A dedicated area for including additional information rather than having to add it in the margins.

- A supplemental page for the preparer/translator.

New Business Direction LLC

New Business Direction LLC