If you want 2016 to be better than 2015, you have to do something differently in 2016 than you did in 2015. It’s a simple but profound realization. Change brings the opportunity to make things better; it can be scary yet exciting at the same time.

Ask yourself what you are going to do differently to have your best year ever. Here are some questions and exercises to consider:

Clarify Your Vision

What does the world look like after it’s consumed your product or service? A vision statement for a company helps to keep everyone on track and seeing the bigger picture of what they’re accomplishing day after day. How is the world smarter, more beautiful, happier, healthier, or wealthier after they’ve left your business?

If you haven’t written your business vision and mission statement, consider this exercise for 2016.

Create New Habits

What habits are holding you back? Which ones are propelling you forward? Choose one habit that’s costing you the most and make a commitment to drop it from your 2016 repertoire. Conversely, identify the habit that is brining you happiness and wealth and multiply it.

Let Go

Sometimes we need to let go before we can move forward. What do you need to let go of? Are there customers or employees in your life that sap your energy or your bank account?

Build Your Support Structure

Are you short-staffed? The way you manage your time has everything to do with your success or the lack of it. If you are taking up your time with a lot of low-dollar tasks, it’s going to be hard to boost your income and get ahead. Surround yourself with support to do everything that can be delegated, including personal tasks such as grocery shopping, housekeeping, cooking, and lawn maintenance as well as tasks such as filing, bookkeeping, appointment scheduling, and routine customer service.

Make a list of areas where you could use support, and fill these gaps. In today’s world, you don’t need to hire full time people to fill these slots; you can simply get responsible contractors, other small businesses, and virtual assistants to build your support team.

Focus

What project or task would make a huge difference in 2016 if you could pull it off? Focus on the high payback projects and commit to one, even though it might be out of your comfort zone. Imagine the difference in your business once it’s completed, and get inspired to get started.

Choose just one of these areas to start your 2016 out with hope, intention, and excitement.

You may have heard that Google has rolled out a new search algorithm that ranks mobile-friendly websites higher than sites that are not mobile-friendly. You don’t need to worry too much about this unless you rely on website leads for new clients to build your business.

If you do rely on website leads for new business and your leads have dropped off over the summer, the reason could be that your site is not mobile-friendly and has been ranked lower because of it. Here are three steps you can go through to determine the status of your site.

Take a Free Mobile-Friendly Test

Go to this link and enter your domain name.

https://www.google.com/webmasters/tools/mobile-friendly/

It takes about a minute or two to find out whether your site is mobile-ready.

If your site passes, you’re done! You don’t need to do anything. If it doesn’t, then go to step 2.

Contact Your Webmaster

Ask your webmaster for an estimate to get your site mobile-ready.

Take Action

Google started making changes to the search algorithm the week of April 20, 2015 has now implemented it worldwide. To benefit from mobile traffic and a higher search ranking, make plans to get your site mobile-friendly sooner rather than later.

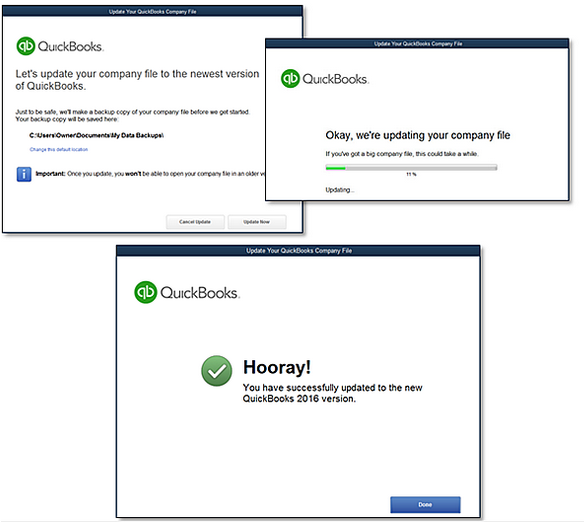

QuickBooks 2016 Desktop was recently released and there are a few new features that you will want to take a look at to see if it has something worth upgrading for.

Bill Tracker

The Bill Tracker is similar to the Income Tracker in the Customer Center that was released as a new feature in QuickBooks 2014 and improved with QuickBooks 2015. The Bill Tracker is located in the Vendor Center and allows a Snapshot View of Purchase Orders, Open Bills, Overdue Bills and Bills that have been paid in the last 30 days. Transactions can be managed from this area and batch actions can be taken to print or email and to close Purchase Orders and Pay Bills.

This Fiscal Year-to-Last Month

In the past, we had choices for date ranges on financial reports of This Fiscal Year or This Fiscal Year-to-Date as well as This Month or This Month-to-Date, none of which worked well for month-end reporting purposes. We now have This Fiscal Year-to-Last Month which allows us to print our financial reports as of the end of the Last Month, through which accounts are typically reconciled. This will allow us to Memorize Reports with the correct date instead of saving with a Custom Date that needs to be changed each time.

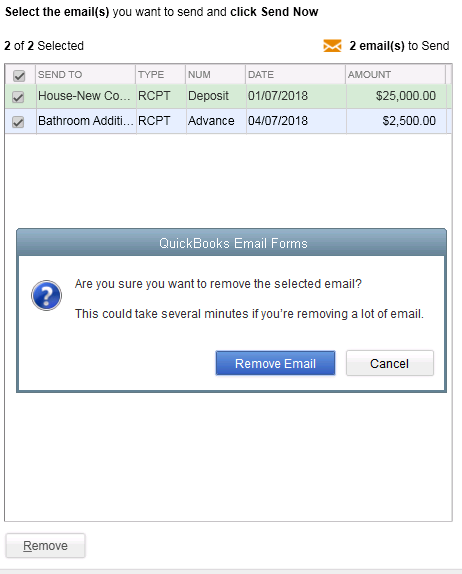

Bulk Clear “Send” Forms

Bulk Clear “Send” FormsSales Receipts, Invoices, Estimates and Purchase Orders all have an Email Later check box and it’s a “sticky” feature, meaning that once selected, it remembers for future transactions. In the past, we would accumulate many documents in the queue to be sent later and if we wished to clear the queue, it would have to be done individually. With this release, under the File menu, Send Forms, we can now Select All and click Remove.

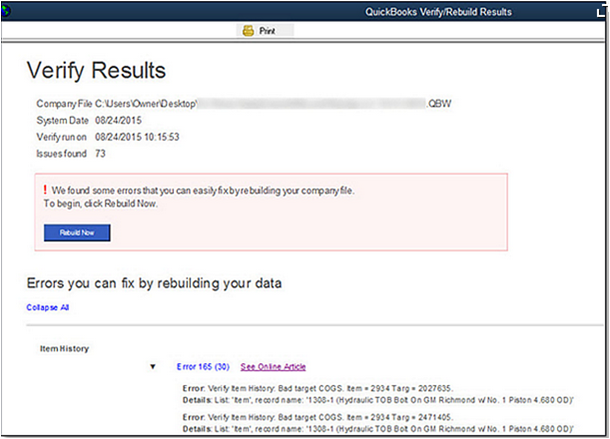

do a Backup!

Time is money as they say, and if you can save time, you’re also saving money. Since your time is limited to 24/7, both personal and business time saved is profitable. Here are eight ways to save time (and money) for your consideration. Go through all of them with an open mind, and see which one might work best for you.

1. The trip to the grocery store

If you’re making several trips to the grocery store throughout the week, this one is for you. Cut down on those trips by taking inventory of your kitchen and seeing what you’ll need for the week (or longer). Shopping once a week will save precious time throughout the week.

Better yet, have your groceries delivered. Some shops will also pick and bag your times so your selections are ready for pickup. Even better, hire an assistant to shop for you so that your refrigerator and pantry is stocked when you get home.

2. Appointment scheduling

Automate your appointment scheduling and you’ll free up weeks of admin time for either you or your staff. There are dozens of apps, many industry-specific that can help you save time making appointments. Once you’ve set it up, send the link to the people you’ll be meeting and voila, it will appear on your calendar.

Here are a few to check out:

- https://acuityscheduling.com/

- https://10to8.com/

- https://www.flexbooker.com/

- And so many more: Google “appointment scheduling” to find more

For field service companies in the home repair or maintenance industries that serve commercial and residential customers, Google “field service scheduling” to get the right software for your business.

3. Office supplies

Order your supplies online and have them delivered.

4. Email interruptions

Turn off automatic send and receive in your email software to get rid of that nasty interruption. Mark your calendar to check and answer your email three to four times a day. You’ll go home happier and feeling more in control of your work with this one change.

5. The commute

If you can manage it, working from home one to two days a week can save you commute time. You may also be able to avoid rush hour by altering your work hours if you have some flexibility. After all, it’s your business.

6. Those errands

Batching your errands all into one day will save precious start and stop time on your other work days. Better yet, choose one day a week for outside errands and personal appointments so that you can get into the habit of this for the long term.

7. Takeout

Do you go out for lunch every day? You may need the break or you may need to have that power lunch with a new business partner or client. But on days you don’t, have takeout delivered so you don’t have to waste time ordering and standing in line.

8. The bank

Are you going to the bank constantly? If so, you can avoid it in a number of ways:

• Take credit cards, and have clients pay online.

• Ask your bank about remote or mobile check deposit options.

• Hire a company to transport your cash deposits – Google “Cash logistics” to find companies with armored car services. It won’t hurt to find out how much it costs and you might be surprised.

Did you get an idea on how to save time? If so, it’s your turn to implement and reap the benefits.

Small business owners have a lot on their plates, and time simply does not allow you to become an expert in all the areas required for running a business. Here are a couple of common mistakes that we see all the time. Correcting them will help you be more productive and profitable in your business.

1. Mismanaging receipts

Maintaining receipts are challenging for everyone, but the IRS requires that you have proof of business expenditures. Periodically, we come across people who feel that keeping the credit card statements are enough; unfortunately, they’re not. You’ll want to create a process to keep your receipts all in one place so they don’t get lost.

Receipts printed on thermal paper (think gas station receipts and many more) will fade within a year or two, and the bad news is the IRS could audit several years back if they come calling. Correct this by scanning them in or taking a clear picture of them using your smartphone.

Some accounting systems and/or document management applications allow you to upload the receipt and attach it to the transaction in your accounting system. This is a great solution, and if you’re interested in this, please ask us about it.

2. Ignoring the accounting reports

There are gold nuggets in your accounting reports, but some business owners don’t take the time to review them or are uncertain about how to interpret them. Your accountant can help you understand the reports and find the gold nuggets that can help you take action toward profitability.

Some of the things you can do with your reports include:

- Identifying your highest selling services or products

- Projecting cash flow so you’re not caught short at payroll time

- Getting clear on your top customers or your demographic of top customers

- Evaluating your marketing or business development spend

- Pointing out trends compared to prior years, budget, or seasonality effects

- Checking up on profit margins per product or service to make sure you are priced correctly

- Managing aging receivables or speeding up collections

- Measuring employee profitability, if relevant

- And so much more

Being proactive with your accounting will help you spot opportunities in your business that you can act on, as well as spot and correct problems long before they manifest into trouble.

3. Mixing business and pleasure

In your bank accounts and on your credit cards, mixing business and pleasure is to be avoided when possible. All businesses should have a separate bank account, and all business transactions should go through there. It takes an accountant much longer to correctly book a business deposit that was deposited into a personal account.

Taking out a separate credit card and putting all your business transactions on it will save your bookkeeper a ton of time. The credit card doesn’t even have to be a business credit card. It can just be a personal credit card that’s solely used for business. If you have employees making credit card charges, sometimes a separate card for them helps you control fraud.

The hardest area in which to separate business from pleasure is cash transactions. Be sure your accountant knows about these. The accountant can either set up a petty cash account or a reimbursement process so that you can get credit for cash expenditures that are for the business.

How did you rate on these three mistakes? Avoid these three and your accounting department as well as your business will run a lot smoother.

As a business owner, you’re likely torn in a hundred different directions every day. It can take up most of the work day just fighting fires, serving your customers, and answering employee questions – never mind the time spent on email. It’s super-easy to lose sight of what you can be doing to move your business forward the most.

That’s when “the one question” can come in handy. It’s something you can ask yourself at the very beginning of each day, even before you check your email. Make your question about you and your goals for your company.

That’s when “the one question” can come in handy. It’s something you can ask yourself at the very beginning of each day, even before you check your email. Make your question about you and your goals for your company.

The one question is, “What’s the highest payback thing I can do today?”

If your goal is to boost profits, then ask “What’s the highest payback thing I can do today that will boost my profits?” If your goal is to empower your employees, then ask “What’s the highest payback thing I can do today that will empower my employees?” If your goal is to make a difference in your community, then ask “What’s the highest payback thing I can do today to make a difference in my community?” If your goal is something else, tailor your one question to that specific goal.

It’s not about fighting fires or answering routine employee questions or even serving current  customers. Although those tasks are all important and essential, none of them will take your business to the next level.

customers. Although those tasks are all important and essential, none of them will take your business to the next level.

It could be meeting with a power partner or referral source that sends you a lot of business, designing the next campaign that will bring in a higher level customer, meeting with your employees for lunch, or researching new products to sell. It’s going to be a task that gets you working “on” your business instead of “in” your business.

If you like this idea, consider writing the question on a sticky note and posting it to your bulletin board so that you can see it  every day. I write my question and my intentions each morning on a colorful piece of paper that I carry with me all day. I do this while having my coffee and long before I check an email, text or telephone message.

every day. I write my question and my intentions each morning on a colorful piece of paper that I carry with me all day. I do this while having my coffee and long before I check an email, text or telephone message.

Try asking yourself this one question each day: “What’s the highest payback thing I can do today?” Then do it, and watch your business grow.

Holding your own event is a great way to meet new people and allow them to sample your business in a low-risk setting. A face-to-face event allows you to build trust quicker than many other marketing methods, and trust is almost always required before a sale can be made.

Types of Events

Some of the more popular types of events you can hold include:

- A seminar or class

- An open house

- A neighborhood sale

- A networking meeting

- A reception or party or celebration or festival

- A conference

If you’re new to holding events, start small and/or join with another business so that you’ll have a larger number of people to invite.

Participants

Once you’ve decided on the type of event you want to hold, you’ll want to determine who you will invite. Will it be clients only? Will you join with other businesses and combine your lists? You’ll want to invite a larger number of people than you might think. If the event is free, there may be several no-shows, even if they have RSVP’d. The more formal the event, the fewer the no-shows.

Topic or Purpose

For the best turnout, choose a topic that’s interesting to your clients as well as relevant to the services you offer. Provide education that the customer needs, a new money-making strategy, a new product or service roll-out, or something that will affect your customers’ well-being, and you’ll experience the best turnout.

Spread the Word

Now that you’re ready to hold your event, it’s time to get the word out. Plan on sending multiple emails (more than you might be comfortable with) to let people know about your event. Email is a good way to notify people, but if you have the budget, mail invitations. Call the most important people and let them know you want them at your event.

Have Fun and Make Money

Be sure to have a high ratio of staff to guests so that more than one of your staff can meet each person. Enjoy your event, and hopefully, you’ll be able to get to know many future customers there as well.

As we move into the fall season and the final quarter of the year, it’s a perfect time to commit to a project in your business that will help you reach the year’s end in better shape. Here are five ideas:

1. Back-to-School Time

If payroll expenses are one of the higher costs in your business, then it makes sense to boost your team’s productivity and maybe also your own. Fall is back-to-school time anyway, so it’s a natural time of the year to take on a course, read a business book, or hire an organizer to help you get more from your workspace.

If you spend a lot of time doing email, consider taking a course on Microsoft Outlook® or even Windows; learning a few new keystrokes could save you tons of time. If you need more time, look for a book or course on time management. Look for classes at your local community college or adult education center.

2. A Garage Sale for Your Business

Do you have inventory in your business? If so, take a look at which items are slower-moving and clear them out in a big sale. We can help you figure out what’s moving slowly, and you might even save on taxes too.

3. Celebrate Your Results

Take a checkpoint to see how your revenue and income are running compared to last year at this time. Is it time for a celebration, or is it time to hunker down and bring in some more sales before winter? With one more quarter to go, you have time to make any strategy corrections you need to at this time. Let us know if we can pull a report that shows your year-on-year financial comparison.

4. Get Ready for Year’s End

Avoid the time pressure of year’s end by getting ready early. Review your balance sheet to make sure your account balances are correct for all transactions entered to date. You will be ahead of the game by getting the bulk of the year reviewed and out of the way early.

Also make sure you have the required documentation you need from vendors and customers. One example is contract labor that you will need to issue a 1099 for; make sure you have a W-9 on file for them. If we can help you get ready for year-end, let us know.

5. Margin Mastery

If your business has multiple products and services, there may be some that are far more profitable than others. Breaking these numbers out to calculate your profit margins or contribution margins by product or service line can help you see the areas that are adding the most income to your bottom line. Correspondingly, you can determine if you have any items that are losing money; knowing will help you take the right action in your business. Refresh your financials this fall with your favorite idea of these five, or come up with your own fall project to rejuvenate your business.

contribution margins by product or service line can help you see the areas that are adding the most income to your bottom line. Correspondingly, you can determine if you have any items that are losing money; knowing will help you take the right action in your business. Refresh your financials this fall with your favorite idea of these five, or come up with your own fall project to rejuvenate your business.

Have you ever been in a situation where there’s no internet and you needed it? Or perhaps you’re at a hotel and don’t want to pay the extra $15 per day for wireless internet. If so, you’re not alone, and luckily, there’s a gadget for just about everything. This time, it’s a gadget you probably already have: all you need to do is whip out your cell phone.

iPhone

Your cell phone can act as your wireless modem. Plug the iPhone into your PC using your USB connection. Go to Settings on your iPhone and one of your settings will be labeled Personal Hotspot. Tap it and toggle it to “on.” Set a password.

On your PC, view your wireless internet connections, and the name you’ve given your phone will show up. Click to connect and enter the password you set on your phone.

Voila, internet!

Android

If you have an Android, tap More… and select Wireless and Networks, then Tethering and Portable Hotspot. Check Portable Wi-Fi hotspot. Tap Portable Wi-Fi hotspot settings and you can edit the Wi-Fi network name, and choose a password.

On your PC, view your wireless internet connections, and the name you’ve given the Wi-Fi network will show up. Click to connect and enter the password you set on your phone.

Fees

Ask your cell phone network provider if this hotspot feature is included in your package or is an extra charge. You may also have to call then to enable this feature.

Once you’ve used this once, you’ll be hooked. You now have a new internet access alternative anywhere you have cell phone coverage.

New Business Direction LLC

New Business Direction LLC