Did you forget your password again? Are you using the same password for multiple log-ins? Have you been locked out of your online banking? Again?

If you answered yes to even one of these questions, keep reading–we have some insight that might help!

At New Business Directions, we take data security very seriously–a compromise of our security system is, quite simply, not an option. That’s why we use LastPass, a game-changing application we think would improve the lives of all of our customers.

LastPass is a password management solution that uses strong encryption algorithms to store and protect your sensitive information while removing the stress of logging in. No more forgotten password runarounds, hacked Facebook accounts, or “this password is too weak” messages.

When you create an account with LastPass and install the app’s browser extension, your log-in credentials will always be current on every web-based platform you utilize. LastPass will auto-fill your credentials on a website, update your records when it sees your credentials have changed, and save your log-in information when it notices you’re signing in to a location that’s not saved in your Vault.

LastPass also makes sharing sensitive data with other people (like your accountant) easier. From the LastPass Vault, you can opt to share a password to another individual with or without their ability to view the password. By using the sharing feature, whenever your passwords are updated in your Vault, they’re also automatically updated for anyone else you’ve shared access to.

The functionality of LastPass extends even further, with options to add information to your password cards like a one-time password or security questions and answers. Plus, their secure password generator can help you create complex passwords that are more secure than the variations on a common theme you might be using. If you’re interested in learning more about LastPass or signing up for your small business, reach out to us. You can also learn more by visiting this link.

Our “Comprehensive COVID-19 Sick Pay and Paid Leave” YouTube tutorial has helped thousands of people since it was released last year, teaching QuickBooks Desktop users how to set up COVID-19 Sick Pay, FMLA, and Health Premiums under the Families First Coronavirus Response Act (FFCRA).

Recently, the tutorial received some updates. Below, you’ll find helpful screen grabs and instructions with the most up-to-date information about the processes explained in this video. The times mentioned below are all hyperlinked to the video and will route you directly to the timestamp being mentioned for ease of access. For additional helpful information, make sure to view the comments section of the video.

The video can be viewed in its entirety here: https://www.youtube.com/watch?v=D8zIiPk3eNI&t=2s

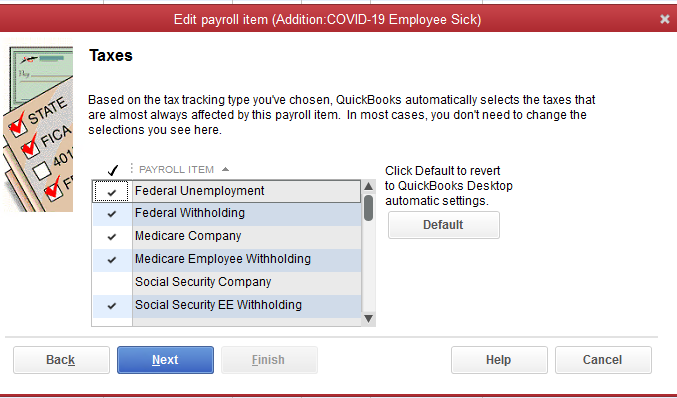

1. At 6:03, we discuss creating a COVID-19 employee sick pay item. The video shows that the social security company tax is checked, which is no longer correct. To revert back to the correct tax settings, select the “default” button. The screenshot below demonstrates the correct tax settings:

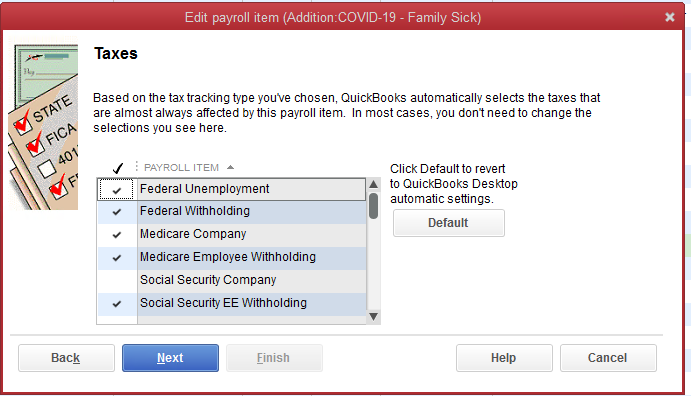

2. At 7:17, we discuss creating a family sick pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

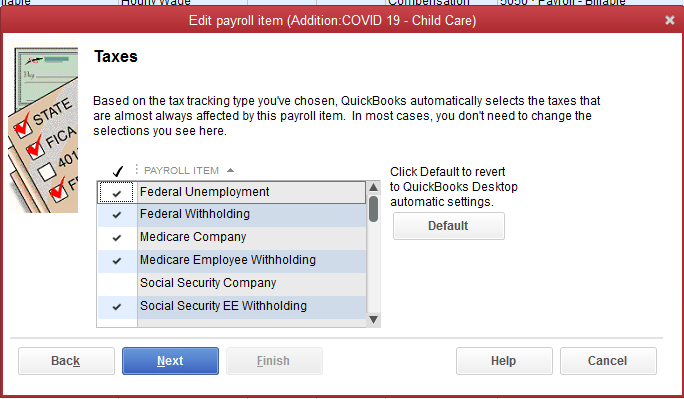

3. At 8:30, we discuss creating a child care pay item. To revert to the correct tax settings, select the “default” button. The correct settings are reflected in the screenshot below:

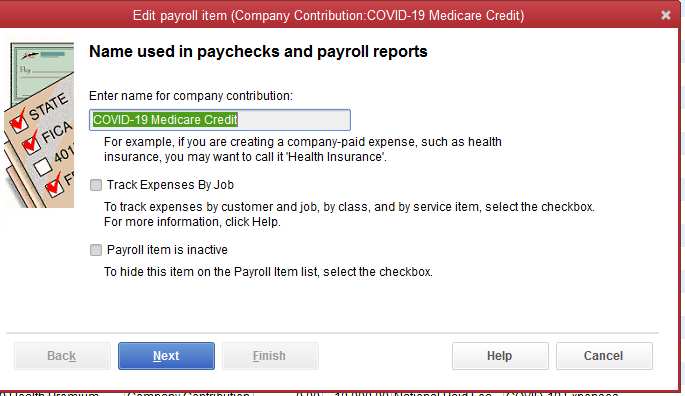

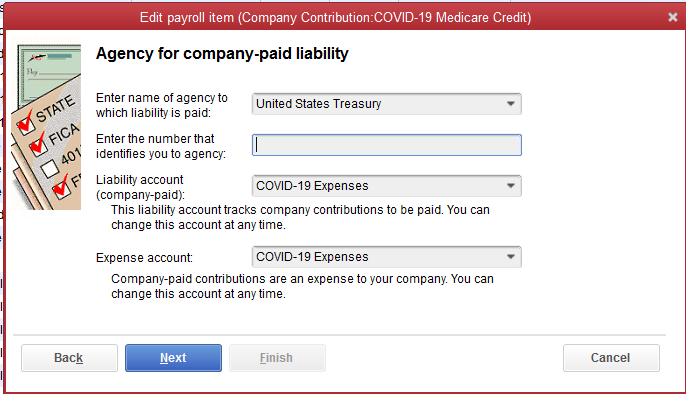

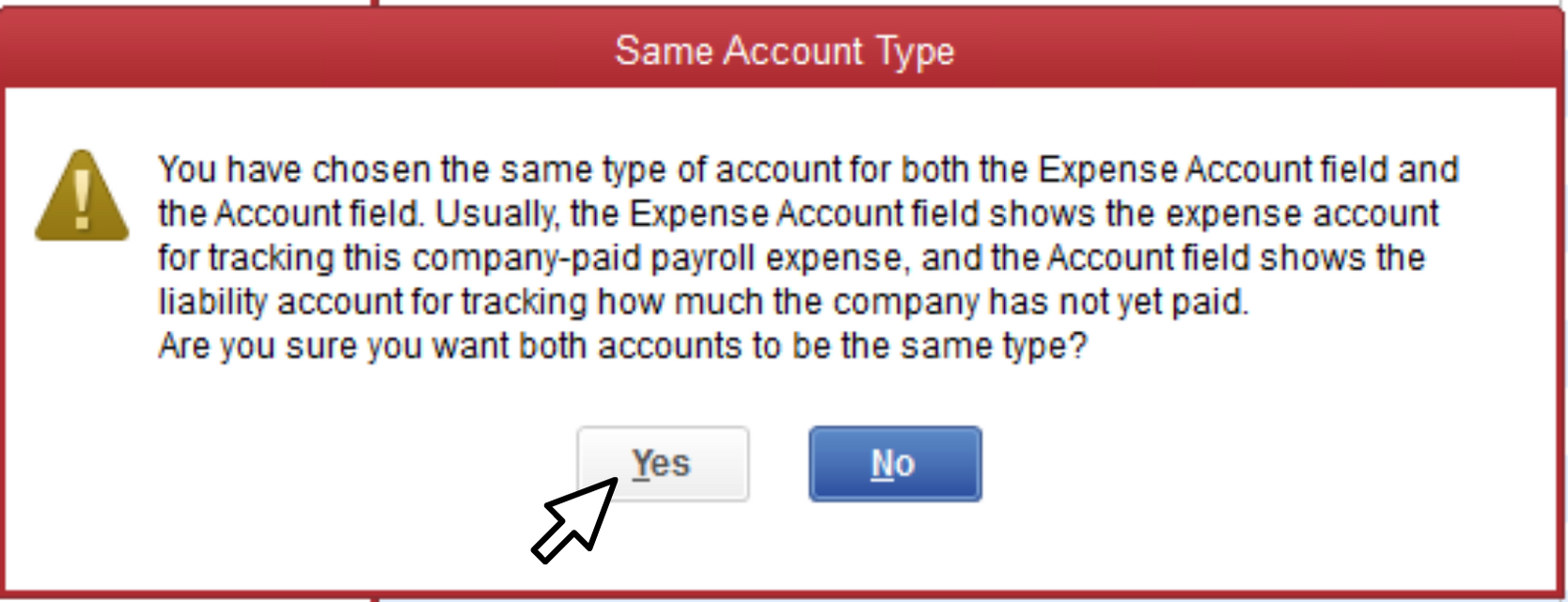

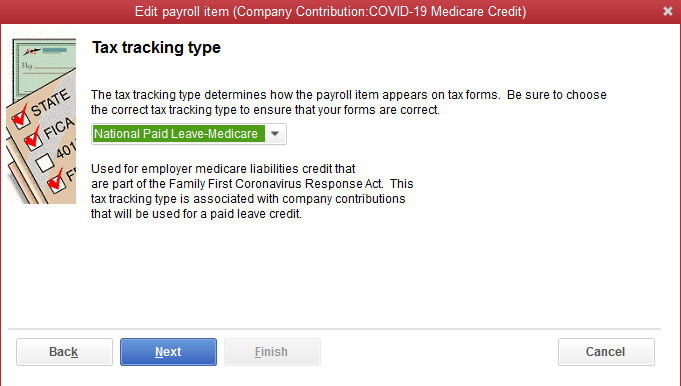

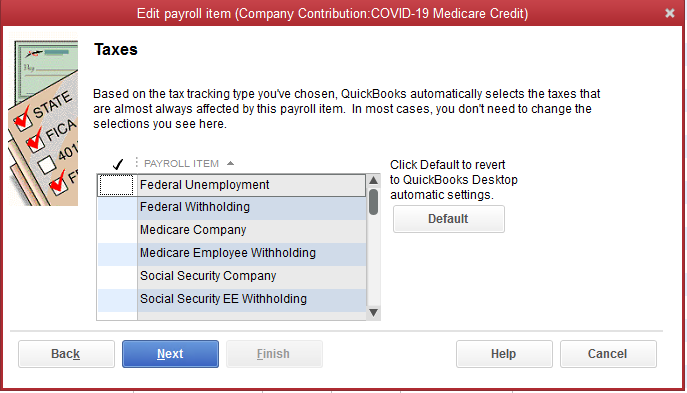

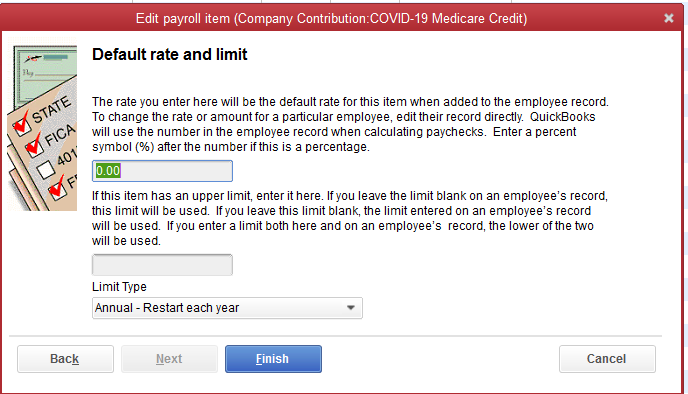

4. At 11:48, we discuss setting up a national paid leave credit. A second company contribution for the COVID-19 Medicare credit should have been created; Intuit later released information on this, and while the comments in the video contain this update, we wanted to ensure this information was easily accessible. The seven consecutive screenshots present the correct steps to take.

6. At 17:51, we discuss payroll liabilities. The video shows that the Medicare employee additional tax is checked, however, it should not be. Instead, the following items sh0uld be checked off:

- the federal withholding

- the Medicare company

- the Medicare employee withholding

- the social security company (this should be zero for COVID pay)

- social security employee withholding

Independence is a key concept in accounting, especially in the assurance or auditing area of accounting. Assurance services are services where a licensed CPA reviews an organization’s financial statements and accounting records and provides an opinion about them. This opinion takes the form of a report that can be shared with third parties such as banks and shareholders. Auditing services are one of many forms of assurance services.

Independence is a key concept in accounting, especially in the assurance or auditing area of accounting. Assurance services are services where a licensed CPA reviews an organization’s financial statements and accounting records and provides an opinion about them. This opinion takes the form of a report that can be shared with third parties such as banks and shareholders. Auditing services are one of many forms of assurance services.

Only a licensed CPA can provide assurance services; this is regulated by the states. A CPA who provides certain assurance services must be independent of the business that it is writing an opinion for. Essentially, independence means that the auditor must be able to do their work objectively and with integrity. And it goes further. The auditor must not be perceived as having any kind of bias or connection with the business it is auditing. There must be no perception of any impropriety.

To this end, the auditor must not have a relationship with the company’s executives. A CPA cannot, for example, audit her brother’s company. A CPA cannot be an investor in the company and also be the auditor because of the financial relationship. The audit opinion must not be influenced in any way by a relationship between the auditor and anyone in the company. The CPA must be able to provide an honest, professional, and unbiased opinion when auditing financial statements.

Being independent also means the CPA must have a healthy dose of skepticism. A common phrase in the accounting profession is “Trust, but verify.”

Numerous rules abound to protect auditor independence. For example, an auditor cannot be paid on a contingent or commission basis. All practicing CPAs must complete ethics courses every few years, and these almost always include independence scenarios and case studies.

If you have any questions about independence or assurance, please feel free to reach out any time.

August 18, 2020, North Conway, NH. New Business Directions, LLC is pleased to announce that Rhonda Rosand, CPA has been named a 2020 Top 100 ProAdvisor by Insightful Accountant, an independent news and information source written specifically for the small business advisor to keep up with current technology, trends in the industry and continuing their education.

August 18, 2020, North Conway, NH. New Business Directions, LLC is pleased to announce that Rhonda Rosand, CPA has been named a 2020 Top 100 ProAdvisor by Insightful Accountant, an independent news and information source written specifically for the small business advisor to keep up with current technology, trends in the industry and continuing their education.

This list recognizes the leading consultants who have embraced the ProAdvisor program and have leveraged it in order to better serve their clients and grow their own business. “We’d like to congratulate everyone who made this year’s list,” said Insightful Accountant Senior Technical Editor, William “Murph” Murphy.

“This is the seventh year of our ProAdvisor awards,” said Insightful Accountant Publisher and Managing Partner, Gary DeHart. “The ProAdvisors who make this list are the best in the business. Any small business would be well-served working with any one of the winners on this list.

About Insightful Accountant: Insightful Accountant is an independent news and information source written specifically for the small business advisor who needs to stay current on the latest news and offerings in accounting technology; including updates from Intuit, Xero, Sage and the hundreds of add-on products serving the small business ecosystem. With news and insight specifically written to help the advisor better serve their clients while building their firm, Insightful Accountant is unlike any other news source serving this space.

Britney Schaub, Office Assistant and Bookkeeper of New Business Directions, LLC, recently obtained her Associate’s of Science from Granite State College, majoring in Business. She is now pursuing her Bachelor’s degree.

Video Tutorial: Part 2 of Paying Employees under the Families First Coronavirus Response Act.

An addition to our previous video, “How To Track COVID19 Paid Leave in QuickBooks Desktop”. We make a quick adjustment to the last account set up. Part 2 of Paying Employees under the Families First Coronavirus Response Act.

With Rhonda Rosand, CPA of New Business Directions

For more information on what you need to know about the Families First Coronavirus Response Act: https://quickbooks.intuit.com/learn-support/en-us/help-articles/ffcra/00/517349

Pay employees under the Family First Coronavirus Response Act: Learn to to track COVID19 sick pay and paid leave in QuickBooks Desktop, with QuickBooks ProAdvisor Rhonda Rosand, CPA of New Business Directions.

For QuickBooks Online, visit Intuit’s guide here: https://quickbooks.intuit.com/learn-support/en-us/help-articles/pay-employees-under-the-family-first-coronavirus-response-act/00/523401

For information on what you need to know about the Families First Coronavirus Response Act: https://quickbooks.intuit.com/learn-support/en-us/help-articles/ffcra/00/517349

April 3, 2020

Both the CARES Act and the Families First Act include a variety of relief measures for small businesses, individuals and certain nonprofit organizations. There are tax benefits, tax credits, direct payments, loan programs, grant programs, expanded unemployment benefits and other resources meant to incentivize businesses and nonprofits and encourage employee retention.

We’re sorting this out as fast as possible and we’ll do everything we can to keep you up to date. This is a moving target – forms and links change as new information becomes available.

You can also check https://home.treasury.gov/cares for the latest information as updates are happening on a daily basis.

Payroll processing companies are working hard to figure out all of the mechanics of the Families First Act and how to report what employers pay for sick time to their employees that would qualify for the payroll tax credits. We’ll keep you updated as we learn more.

Below is a partial list of resources for you to review and consider:

Economic Injury Disaster Advance Loan

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application. This loan advance will not have to be repaid.

Apply for the Loan Advance https://covid19relief.sba.gov/#/

Read the US Chamber Guide https://www.uschamber.com/report/guide-sbas-economic-injury-disaster-loans

Small Business Emergency Loan Guide – Updated

The U.S. Chamber’s Coronavirus Small Business Emergency Loan Guide, first issued last week, outlines the steps small businesses need to take to access much-needed Payroll Protection Program (PPP) funds.

The guide now includes important information including key dates as the government moves toward implementation. Recently, the Treasury Department issued more details on this paycheck protection program and a loan application available for download.

Starting April 3, small businesses and sole proprietorships can apply for loans.

Starting April 10, independent contractors and self-employed individuals can apply for loans.

There is a funding cap, so the Treasury Department recommends applying as soon as possible.

Be sure to send data using secure methods – these forms include personal and confidential information

Read the US Chamber Guide https://uschamber.com/sbloans

Download the Application https://www.sba.gov/document/sba-form–paycheck-protection-program-borrower-application-form

Employee Retention Tax Credit Guide

The CARES Act created a new employee retention tax credit for employers who are closed, partially closed, or experiencing significant revenue losses as a result of the coronavirus. Employers who receive a Paycheck Protection Program (PPP) loan are not eligible for this tax credit.

Read the US Chamber Guide https://uschamber.com/ertc

Families First Coronavirus Response Act: Employer Paid Leave Requirements

The Families First Coronavirus Response Act (FFCRA or Act) requires certain employers to provide their employees with paid sick leave or expanded family and medical leave for specified reasons related to COVID-19.[1] The Department of Labor’s (Department) Wage and Hour Division (WHD) administers and enforces the new law’s paid leave requirements. These provisions will apply from the effective date through December 31, 2020.

https://www.dol.gov/agencies/whd/pandemic/ffcra-employer-paid-leave

Stay Safe – Stay Healthy,

Rhonda Rosand, CPA

See Rhonda’s tutorial on how and why to track COVID-19 expenses in QuickBooks:

Insightful Accountant has announced their “Top 100 ProAdvisors for 2019”

Insightful Accountant has announced their “Top 100 ProAdvisors for 2019”

New Business Direction LLC

New Business Direction LLC