While Net Profit and your cash balance are probably the first two numbers you look at on your monthly financial reports, those aren’t the only important factors you should be looking out for in your regularly scheduled reviews. You can glean a lot more gems by digging a little deeper and looking at your data through any of the following six perspectives.

Automation Opportunities

Look at your labor detail reports and professional and outsourced expenses to see where you could be automating specific tasks or work types. For example, adding more automation to your workflows could be as simple as automating your team’s calendars so that your admin professional(s) don’t have to spend as long coordinating between other team members. Additionally, if you find that duplicate data entry is driving up costs, reach out to us about integration solutions like Zapier that could free up more time to keep your employees working in their most profitable capacities.

Duplicate or Excessive Expenses

Have you noticed that you’re paying for things twice on your Profit and Loss Statement? Or, are there services, applications, or other expenses you could cut back on?

An area you might see duplicate spending, for example, is insurance coverage. Perhaps your liability and your business umbrella both cover worker’s compensation; see what you can do to reduce the overlap.

A significant example of excessive expense could be your rental. Especially in today’s environment, when many employees are working on a fully remote or hybrid basis, or your overall team is reduced, your office rental could be costing you more than it needs to. For example, if you rent 5,000 square feet but now only need 2,000, see if you can re-negotiate your lease, sublet that extra space, or move to a location that more suits your needs.

Lastly, retainer and recurring expenses should be scrutinized; are you getting what you’re paying for? These opportunities could lead to increased services for the same cost, or you might be able to negotiate for a lower fee.

Outsourcing Opportunities

Remember, all because you can do something doesn’t mean you should. Are there tasks or work that an outsource company could do cheaper and better than you? If so, outsourcing could be a profitable option to look into further.

Indications of Fraud, Theft, or Excessive Risk

As owners, we need to protect our business investment, and we should always be on the lookout for signs that our investment may be at risk. If your numbers look odd or unexpected, you should be skeptical and investigate further.

Tax Savings Situations

Investing in tax planning almost always yields the best results, especially this year with new tax relief available to qualifying businesses. Get help from a tax professional to see if you qualify or close to qualifying for tax deductions, credits, and savings.

Sales Growth

This list would be remiss without mentioning the obvious opportunities of finding ways to grow sales. Your sales results can give you an idea of where more growth can occur, where promotion opportunities exist, and where completely new revenue sources can be created.

So the next time you review your financial reports for your cash number and net profit, take a closer look through these six filters to extract insightful data on how to run your business better.

Did you forget your password again? Are you using the same password for multiple log-ins? Have you been locked out of your online banking? Again?

If you answered yes to even one of these questions, keep reading–we have some insight that might help!

At New Business Directions, we take data security very seriously–a compromise of our security system is, quite simply, not an option. That’s why we use LastPass, a game-changing application we think would improve the lives of all of our customers.

LastPass is a password management solution that uses strong encryption algorithms to store and protect your sensitive information while removing the stress of logging in. No more forgotten password runarounds, hacked Facebook accounts, or “this password is too weak” messages.

When you create an account with LastPass and install the app’s browser extension, your log-in credentials will always be current on every web-based platform you utilize. LastPass will auto-fill your credentials on a website, update your records when it sees your credentials have changed, and save your log-in information when it notices you’re signing in to a location that’s not saved in your Vault.

LastPass also makes sharing sensitive data with other people (like your accountant) easier. From the LastPass Vault, you can opt to share a password to another individual with or without their ability to view the password. By using the sharing feature, whenever your passwords are updated in your Vault, they’re also automatically updated for anyone else you’ve shared access to.

The functionality of LastPass extends even further, with options to add information to your password cards like a one-time password or security questions and answers. Plus, their secure password generator can help you create complex passwords that are more secure than the variations on a common theme you might be using. If you’re interested in learning more about LastPass or signing up for your small business, reach out to us. You can also learn more by visiting this link.

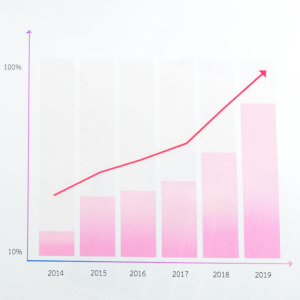

It can be hard for a business owner to know how to take their business to the next level of growth and profitability. If you’ve reached a revenue or profit level plateau, it could be that knowing how to scale your business is not a skill in your skillset — yet.

It can be hard for a business owner to know how to take their business to the next level of growth and profitability. If you’ve reached a revenue or profit level plateau, it could be that knowing how to scale your business is not a skill in your skillset — yet.

A classic management book on scaling has made a recent comeback and could be your ticket to leveling up your business. High Output Management, written by ex-chairman and CEO of Intel Andrew Grove was originally published back in 1983 but has resurfaced in popularity in Silicon Valley. While not widely known outside of the Bay Area, many readers claim it’s the best management book they have ever read; some even claim it’s life-changing. It is certainly a timeless and invaluable read for business owners and managers.

In the book, Grove applies the principles of engineering and manufacturing production to management. It’s all about process: developing processes and procedures so that you can track what’s going on and measure the results, or output, every step of the way. Only then can you improve the process so that it leads to high output.

Grove also delves into the ways managers can motivate their team members and affect production outputs. He focuses on the concept of leverage, which enables scaling both positively and negatively, and how it can affect employees’ output. An act of positive leverage might occur when a manager adds a “nudge” activity to enable their employees’ work, while a negative example might occur when a manager meddles with the progress an employee is making.

We’ve all been the victim of an ineffective meeting, and Grove breaks down the idea of holding purpose-driven meetings while touching on key meeting topics such as decision-making, planning, motivation, performance reviews, and values.

One of the most significant highlights from the book, however, drives home a message we’ve all heard before: change starts from within. If you’re a business owner who’s motivated to improve the output of your organization, the first, most important step is to train yourself. Only then will you be able to rally the troops and push past your profit plateau.

In accounting, “internal control” is a key term to know. Internal control is the series of processes and procedures that are performed within the organization to ensure the integrity and accuracy of the financial information and reporting of that organization. It is an important means of protecting the business owners, employees, vendors, investors, and stakeholders.

In a small business, maintaining good internal control is often a challenge since team size is smaller and resources are limited. Yet, it is essential to understand so that owners understand what risks they are taking every day in their businesses. A good system of internal controls can help the organization reduce the risk of fraud, safeguard against loss, and demonstrate good business practices.

In this article, we’ll discuss the three key concepts of internal control–segregation of duties, delegation of authority, and system access–and optimizing business operations.

Key Concepts

Segregation of duties is the first key concept of internal control. It dictates that tasks be assigned to different people when there is a risk of hidden errors or theft as a result of having all responsibilities assigned to one individual. For example, the employee who opens the mail and receives checks should not also be the individual responsible for applying the check to the correct customer in Accounts Receivable.

Delegation of authority is the second key concept of internal control. While the owner has ultimate control, they cannot accomplish everything that needs to be done. They must delegate assignments to their team, who are then responsible for maintaining internal controls in their area of work.

System access is the third concept of internal control. Access to documents, rooms, computers, applications, and other items should be on a need-to-know basis to reduce risk. While one person might have system access to enter a transaction, they should not also be the one to have system access to review or approve that same transaction. We’ve made two YouTube tutorials to help you add users to QuickBooks. For QuickBooks Online, click here. For QuickBooks Desktop, click here.

Business Operations

Every aspect of the business should be considered while setting up the company’s policies and procedures. In a small business, an easy way to develop internal controls is to review each major transaction flow and implement the controls needed.

On the customer side, this includes receiving the customer order, sales contracts, shipping, invoicing, managing accounts receivables, collections, bank deposits or merchant reconciliations, and cash management. It can also include customer service, pricing, and promotional activity.

On the vendor side, the process includes adding controls for vendor selection, purchase orders, receiving, bill pay, managing accounts payable, payments, managing travel and expense accounts, and company credit cards.

Depending on the company, additional areas that need to be reviewed for internal control include inventory and supply chain management and government contracts, if any.

When hiring, the process of hiring, onboarding, training, evaluating performance, and payroll should be considered. Safety is also an important consideration.

A very large part of internal control development should focus on the information technology operations of the company. Areas include user access and controls, password management, naming conventions, physical security, disaster recovery, and network and applications development, updates, and change control. Data entry should also be considered and is best included when developing controls for the customer, vendor, and employee functions.

Additional functions that need internal control processes include treasury and financing; financial reporting, budgeting, and planning; records storage, access, retention, and destruction; asset management; and insurance.

Internal controls can be applied to small businesses as well as large organizations. It’s all about being able to feel confident that your business is operating with financial integrity, accuracy, efficiency, and a reduced risk of failure. If you have questions about how internal control applies to your business, be sure to reach out to us at any time.

It seems like we’ve been in “pandemic mode” for an indefinite amount of time. Has it been a year, or five? Some days, it’s hard to tell. Many people are finding themselves feeling a heightened level of restlessness surrounding the 1-year anniversary of the shutdown of the world.

It seems like we’ve been in “pandemic mode” for an indefinite amount of time. Has it been a year, or five? Some days, it’s hard to tell. Many people are finding themselves feeling a heightened level of restlessness surrounding the 1-year anniversary of the shutdown of the world.

While working from home certainly has its benefits (especially during a global health crisis) if you’re someone who enjoys going to the office every day, chatting with co-workers in person, attending meetings that aren’t all virtual, and having a little spontaneity each week, then we’re here to help you tap back into that magic without risking your health. Here are five tips to improve upon your WFH (working from home) environment.

- Take Short Breaks often

Taking regular breaks throughout the day will help improve mood as well as productivity and quality of output. These breaks don’t need to be—and shouldn’t be—long or strenuous. Just a quick 5 or 10 minutes every hour can have a positive effect.

Walk the dog. Stand up and do some light stretches. Run (or walk) up and down your stairs. Sit on your balcony or out in a backyard. Put on a pump-up song and dance. Do a quick chore, like emptying or loading the dishwasher. The goal is to get the blood flowing and the fog cleared from your mind, and encourage you to establish some healthy boundaries around work and home.

- Switch Up Locations

If you can, get creative and switch up your location or refresh your home office. If the weather allows it and you have a yard or patio of some sort try taking your work outside for an hour or two. If not, working from a new spot, even if it’s just the dining room versus the couch, can help foster a sense of newness and shake up your routine.

- Treat Yourself with Lunch

Everyone needs something to look forward to, and lunch at a socially distant restaurant or delivery from your favorite comfort food spot can be the mood booster you need. Not only will this be fun for you, but you will also be supporting small, local businesses. Win-win!

- Dress for Success

We can probably all agree on one thing: sweatpants are comfortable! As such, it can be difficult to trade in the sweats for more restrictive, but professional, options like jeans or a dress shirt. But wearing your “zoom shirt,” styling your hair, or accessorizing for the first time in 6 months can give you a burst of inspiration to get through the day

- Create a New Playlist

Does music motivate you? Are you able to work and listen to music at the same time? If so, create different playlists to listen to throughout your day. You might find an Elton John playlist to be the driving force that gets you through a sluggish afternoon, or a Lo-Fi Hip Hop station to keep you cool while you prepare for a big meeting.

New Business Direction LLC

New Business Direction LLC