Did you ever want a secretary that could answer questions all day? While Amazon’s Echo product can’t fetch coffee, it can perform all sorts of digital tasks that come up in daily life at work and at home.

The Echo Dot looks like a small speaker that sits on your desk or table or in your car. It’s enabled with voice recognition and can be integrated with hundreds of apps. Its voice, named Alexa, can answer questions, spend money, play games, control components of your house, play music, and act as an alarm clock. And that’s just for starters.

Alexa listens to your voice and responds. A few of the questions that Alexa is capable of answering correctly include:

“Alexa, how old is Matt Damon?”

“Alexa, where is the closest sushi restaurant?”

“Alexa, could you order a stapler from Amazon?”

“Alexa, open Amex.”

“Alexa, set a timer for 20 minutes.”

“Alexa, order a pizza.”

“Alexa, play music by Lorde.”

“Alexa, what’s on my calendar?”

With additional integrations, Echo can control room temperature and turn on lights. Echo’s range is one room in the house, and the biggest Echo fans have more than one in their house and one for the car.

Echo can be used for business or personal needs. Where it comes in for business is to give you insight in how your business ranks in voice search results. Ask Echo about your business by asking it to find a business similar to yours. For example, if you run a hair salon, ask Echo to find a hair salon. Does it mention yours or your competitor?

Echo can save you time, amuse your employees, and help you gain marketing insights into your business.

What Sales Orders Are and When to Use Them

They’re not as commonly used as invoices. But if you need them, they’re there.

When you want to document sales that you can’t (or won’t) fulfill immediately, but you plan to do so in the future, you can’t create an invoice just yet. This is where sales orders come in.

You may never need to create a sales order for a customer. Perhaps you have a service-based business, or you never run out of inventory. Or you simply don’t enter an order unless you know you have the item(s) in stock.

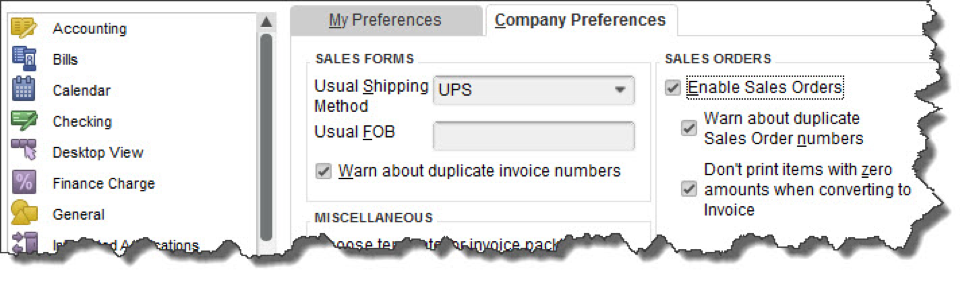

But if you plan to use sales orders, you must first make sure QuickBooks is set up to accommodate them. Open the Edit menu and select Preferences, then Sales & Customers. Click the Company Preferences tab to open that window.

Before you can use sales orders, you’ll need to make sure that QuickBooks is set up for them.

Sales Orders Are Required for Some Tasks

There are a few situations where you must use a sales order:

- If you have a customer who orders very frequently, you may not want to create an invoice for absolutely every item. You could use a sales order to keep track of these multiple orders, and then send an invoice at the end of the month.

- If you’re missing one or more items that a customer wanted, you can create a sales order that includes everything, but only note the in-stock items on an invoice. The sales order will keep track of the portion of the order that wasn’t fulfilled. Both forms will include the back-ordered quantity.

Warning: Working with back orders can be challenging. In fact, working with inventory-tracking itself may be problematic for you. If your business stocks enough of multiple types of items that you want to use those QuickBooks features, let us help you get started to ensure that you understand these rather complex concepts.

Creating a Sales Order

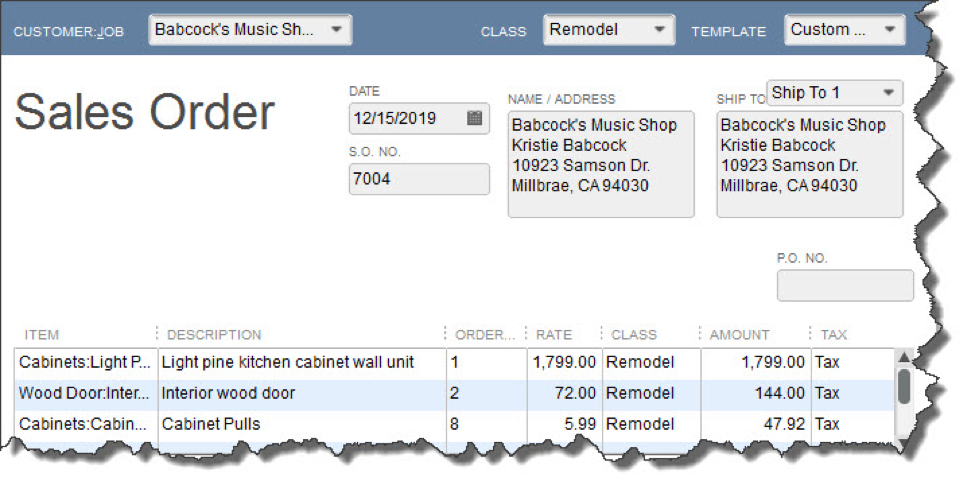

Creating sales orders in QuickBooks is actually quite simple and similar to filling out an invoice. Click the Sales Orders icon on the home page, or open the Customers menu and select Create Sales Orders.

A sales order in QuickBooks looks much like an invoice.

Click the down arrow in the field next to Customer: Job and choose the correct one. If you use Classes, select the correct one from the list that drops down, and change the Template if you’ve created another you’d like to use.

Tip: Templates and Classes are totally optional in QuickBooks. Templates provide alternate views of forms containing different fields and perhaps a different layout. Classes are like categories. You create your own that work for your business; they can be very helpful in reports. Talk to us if you don’t understand these concepts.

If the shipping address is different from the customer’s main address, click the down arrow in the field next to Ship To, and either select an alternate you’ve created or click <Add New>. Make sure the Date is correct, and enter a purchase order number (P.O. No.) if appropriate.

The rest of the sales order is easy. Click in the fields in the table to make your selections from drop-down lists, and enter data when needed. Pay special attention to the Tax status. Let us know if you haven’t set up sales tax and need to.

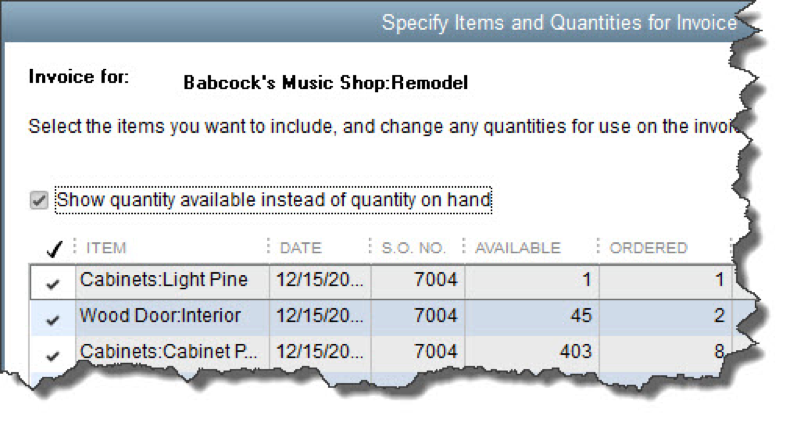

When everything is correct, save the sales order. When you’re ready to convert it to an invoice, open it and click the Create Invoice icon in the toolbar. QuickBooks will ask whether you want to create an invoice for all the items or just the ones you select. You’ll be able to specify quantities, too, in the window that opens.

When you create an invoice from a sales order, you can select all the items ordered or a subset.

As we’ve said, sales orders are easy to fill out in QuickBooks. But they involve some complex tracking, and you may want to schedule a session with us before you attempt them. Better to understand them ahead of time than to try to troubleshoot problems later.

As business owners, we want to remain optimistic about our business’s future. But life can happen, and we need to be prepared. A good business owner thinks about all the risks to their business and has a plan in place to reduce or eliminate them. In 2017, we’ve already had floods in the Midwest and California, a healthy dose of tornadoes, and an ice storm earlier in the year. And those are just the weather disasters. Are you ready?

In 2015, Nationwide ran a survey that revealed that three out of four small business do not have a disaster plan. The same survey noted that 52 percent of small business owners thought it would take three months to recover from a disaster.

The most common solution is to create two plans:

- A disaster recovery plan, which details the steps needed to recover the business from a catastrophic loss

- A business continuity plan, which details the steps needed to keep the business running in case of a major loss, such as a loss of electricity, location, or key personnel

There’s a lot of help online to help you create your plan. A few of the major items that should be covered include:

- Employee safety: you’ll need an evacuation plan in case of a disaster that is life- or health-threatening.

- Communication plan: how will you reach employees in an emergency?

- Electricity contingency: will you need to access a generator?

- Internet contingency: can your business survive without the internet for long periods of time, or will you need to find a way to get connected?

- Location contingency: if your worksite is inoperable, do employees have another place to report to?

- Employee roles: who will carry out the plan?

- Private data: how will you safeguard private company and customer data?

- Systems: do you have an inventory of hardware and software, including vendor technical support contacts? How will you prioritize which system to get back up first? Do you have agreements with vendors who can come to your aid quickly?

Creating a disaster recovery plan can be the lowest priority item on your to-do list as a business owner – until it isn’t. If you have a lot to lose, then consider spending some time on a plan to give you peace of mind.

One of the hottest buzzwords in marketing this year is influencer marketing. Influencer marketing uses key people in thought leadership positions to spread the word about your brand. These people may be paid or unpaid spokespersons for your brands, products, and services.

The profitable thing about influencer marketing is the leverage. Instead of marketing or selling to one person at a time, you are marketing to key leaders with followings who can influence many people at once.

Influencer marketing varies by industry; here are some common examples:

- Locating photos of your product already on social media and reaching out to those people to do more

- Hiring a social media expert with a large following to talk about your clothing line

- Having a prominent lifestyle blogger post a photograph containing your juice product

- Starting a referral program for a makeup company so “regular” women will spread the word

The common theme to all of the above examples is finding people who have a huge number of followers that just happen to be your ideal customers.

To take advantage of this marketing method, ask yourself who is influential in your industry that has the ear and respect of your customer base. How could you partner with them so it’s a win for you, them, and their following? You may or may not need to compensate them, depending on their revenue model.

There are plenty of apps to help you locate influencers relevant to you. A favorite is Ninja Outreach at ninjaoutreach.com.

Try reaching out to influencers to leverage your existing marketing and make your marketing dollars go farther.

For business owners with employers, payroll is a necessary task that can slow your day and tie you down if you let it. If you’re looking for a way to make payroll less time-consuming, here are five ideas you can put to good use:

- Employee Onboarding

If you hire a lot, empower your new hires by letting them do their paperwork for you. A good payroll system allows employees to “onboard” themselves, completing the I-9, W-4, and direct deposit authorizations electronically, even before they show up for their first day. You’ll still need to ask for ID on their first working day, but at least you won’t have to do their paperwork for them.

- Integrate Employee Benefits

Rather than hire several separate companies to handle benefits, some payroll systems allow you to integrate benefits solutions right in their dashboard. That way, you won’t have to re-enter employee data in multiple systems, which often gets out of sync. Deductions and payments can also be integrated to save accounting time.

- Delegate Timesheet Entry

Require non-exempt employees to enter their own time; all you should have to do is approve it. The right timesheet application can take care of that, and a great timesheet application will allow employees to enter time from multiple options, including timecard, cell phone, and others.

- Eliminate the Annual Worker’s Compensation Audit

Tie your worker’s compensation vendor to your accounting system, and you’ll be able to avoid that time-consuming annual reconciliation report required by your worker’s compensation insurance company. You can also avoid the large annual payment because the insurance will be taken out each payroll cycle.

- Reduce the Frequency of Payroll

It’s not always possible, but if you can pay employees less frequently, you might be able to cut your payroll time in half. Pay weekly employees every two weeks or pay bi-weekly employees monthly. Reducing payroll frequency boosts cash flow as well.

Try one of these five ideas to streamline your payroll time and costs in your business. And as always, let us know if we can help.

New Business Direction LLC

New Business Direction LLC