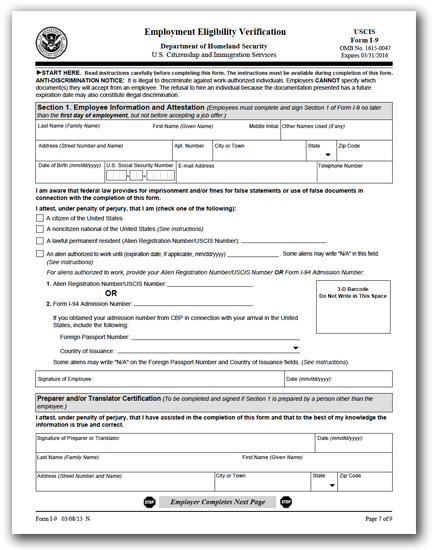

New I-9 Form Mandated After January 22, 2017

- Section 1 asks for “other last names used” rather than “other names used,” and streamlines certification for certain foreign nationals.

- The addition of prompts to ensure information is entered correctly.

- The ability to enter multiple preparers and translators.

- A dedicated area for including additional information rather than having to add it in the margins.

- A supplemental page for the preparer/translator.

Are you ready for next year to be even better than this year? If so, take a few minutes to reflect on the questions below and take action to set your profit plan for the next year.

Question 1: What were the three best business things about this year?

No need to re-invent the wheel. If you knocked it out of the park this year, can you wash, rinse and repeat these tasks in the next?

If you’re having trouble thinking of three things, here are some hints:

- What apps saved you time and money?

- Did you make some good hires?

- Did you let go of a bad hire or two?

- Was there a marketing campaign that really worked?

- Were there any events you went to that generated great ideas?

- Did you add or remove products and/or services?

- Did you buy new equipment or open a new location?

Summarize the three best things that happened in your business for the last year and think about how you can repeat them to enhance your next year in business.

Question 2: What were the three worst business things about this most recent year?

While we don’t want to dwell too much on our failures, we do want to learn from them. Think about the three things that are causing you to lose time, money or gain stress, and decide if you can make changes for the next 12 months.

Question 3: What vision do you have for your business in the coming year?

At the end of next year, what has to have happened in order for you to have a successful year? Think in terms of metrics as well as intangibles, such as peace of mind and happiness.

Once you know your destination, the fun is in creating a roadmap to get you there.

Your Profit Plan for Next Year

If your vision includes financial goals, then creating a profit plan is one way to measure your progress throughout the upcoming year. Start by deciding how much profit you want to make. From there, you can compute your revenue goal and make a plan. Then you can add expenses to complete the budget. Here’s an example:

Let’s say you want to make $50,000 in profit for next year. You can do that in a number of ways:

- Generate $500,000 in revenue and $450,000 in expenses.

- Generate $2 million in revenue and $1,950,000 in expenses.

- Generate $150,000 in revenue and $100,000 in expenses.

- And so forth.

From your profit number, you can create a revenue plan. A revenue should include how many items you need to sell. Like this:

| No. of units | Price | Revenue | |

| Widget A | 3,000 | $200 | $600,000 |

| Part B | 100 | $2,000 | $200,000 |

| Service C | 700 | $1,000 | $700,000 |

| Total | $1,500,000 |

Once you have your revenue plan, you can fill in your estimated expenses.

You might be thinking that this sure sounds a lot like making a budget. And it is. But it’s far more fun to work on something called a profit plan than it is a budget. And if you need us to do the number-crunching part, please feel free to reach out any time.

Here’s to a very happy and prosperous next year in business for you.

Wishing you the Happiest of Holidays

and all the Best in the New Year!

From all of us at New Business Directions

Rhonda, Wayne, Suzy, Kendra, Britney, Trudi, Kristen, and Freckles

New Business Direction LLC

New Business Direction LLC