When you run financial statements on a Cash Basis in QuickBooks®, the results may not be what you expect. For example, you may find balances for Accounts Receivable and/or Accounts Payable on Balance Sheets run on a Cash Basis. This often means that the client has assigned a Payable or a Receivable to a Balance Sheet account, rather than to an Expense or Income account. There are other reasons this happens too.

Reasons for Accounts Receivable on a Cash Basis Balance Sheet

- There may be open balances on Invoices that use Items linked to Balance Sheet accounts. An example would be a Customer Deposit linked to a Liability account.

- There may be a prorata cost of Inventory Items listed on open Invoices. For example, if an Invoice that includes Inventory Part Items is half paid, half the cost of the Inventory Part Items will remain in Accounts Receivable.

- There may be unapplied credits from Credit Memos or Payments. You can find these entries easily because they appear as negative numbers on the Open Invoices report.

- There may be Sales Tax due listed on an accrual basis. You can change the Sales Tax Preference to Cash Basis to eliminate this problem. CAUTION: Check with your State taxing agencies for rules regarding payment of Sales Tax – some States require the basis for Sales Tax accruals to match the basis for Income Tax filing.

Reasons for Accounts Payable on a Cash Basis Balance Sheet

- There may be Bills using Items linked to Balance Sheet accounts.

- There may be Bills entered for a Note Payable or to buy a Fixed Asset.

- You may find the cost of Inventory Part Items on open Bills.

- There may be unapplied Vendor Credits or Prepayments

To review balances in Accounts Receivable and/or Accounts Payable: Filter a transaction report with a paid status of Open transactions and date range of All to get a report showing the transactions that QuickBooks® did not reverse as part of the internal Cash Basis conversion.

- From the Reports menu, choose Company & Financial

- Choose Balance Sheet Standard from the submenu

- Click Customize Report

- Select Cash as the Report Basis

- Click OK

- Double-click the balance in the Accounts Receivable and/or Accounts Payable account

- Click Customize Report, and then click the Filters tab

- In the Filters list, select Paid Status and then select Open

- Click OK

To complete the Cash Basis conversion, use a Journal Entry to adjust away the Accounts Receivable and/or Accounts Payable balances. For the Journal Entry, create a Customer called ***A/R CPA Use Only*** and an Accounts Payable Vendor called ***A/P CPA Use Only***. Use these names to transfer the balances to whatever accounts you choose for the adjustments.

These Journal Entries are Reversing Entries as of the first day in the next fiscal period and you must apply the Journal Entry and the Reversing Entry against each other to offset them or you will have Unapplied Credits going forward.

Do not use Accounts Receivable and/or Accounts Payable as the first line of a journal entry in QuickBooks. See our next Accounting Professionals Only newsletter.

Many Retail stores sell inventory on consignment. It’s important to keep track and to know how much inventory you have in stock, who it belongs to and where it’s all located.

Let’s start our discussion of Accounting for Consignments in QuickBooks with a few basic definitions.

- Consignment – the act of consigning, which is placing any materials in the hands of another.

- Consigned Inventory – the goods shipped by the Consignor to the Consignee.

- Consignor – the owner of the inventory – the person who hands over the goods to be sold.

- Consignee – the seller of someone else’s goods – the person who receives the goods to sell.

There are two sides to the consignment equation – Consignor and Consignee. In this article, we will discuss the situation from the viewpoint of the Consignor. Note: We will also assume that you are using QuickBooks Premier and not Pro or Enterprise.

As the Consignor, you own the inventory – it’s your asset and your responsibility and if the product is damaged, it’s your loss. You are the party at risk and have an insurable asset. You’ve consigned it, or handed it over, to someone else who has agreed to sell it on your behalf in exchange for a pre-determined fee or percentage as well as reimbursable out-of-pocket expenses.

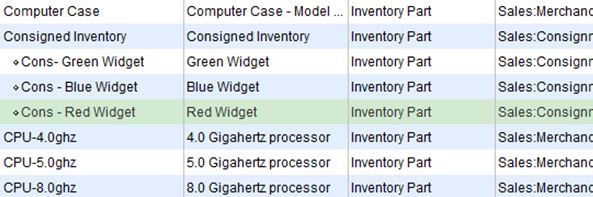

In QuickBooks, it’s as simple as creating a separate section in your Item List for Consigned Inventory and listing each Item as a Sub-Item with an identifier (Cons) that categorizes it as consigned. These are still Inventory Parts and are mapped to the same Cost of Goods Sold, Income and Inventory accounts as your other Inventory Items. Note: You may wish to create a separate Inventory Asset account for your Consigned Inventory, however this is optional.

To transfer the Items from your Regular Inventory to Consigned Inventory, it’s an Inventory Adjustment for Quantity only – the value of your inventory does not change, only the location of the Items for sale. Adjust Inventory/Quantity On Hand is located under the Vendor Menu.

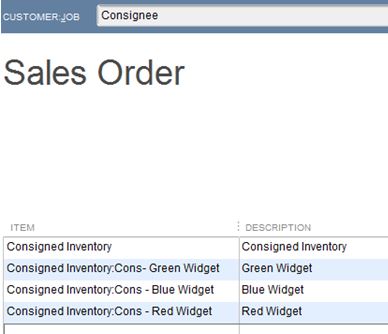

In addition to creating an Inventory Adjustment, you will need to create a Sales Order to the Consignee for the Consigned Inventory. Create Sales Order is located under the Customer Menu. This is a non-posting entry in QuickBooks and will show the Inventory as committed to the Consignee and not available for sale to others on an Inventory Stock Status Report.

As you receive reports of Sales of your Consigned Inventory from the Consignee, or better yet, as you conduct a physical inventory of your Consigned goods at the Retail location, you will create an Invoice in QuickBooks from the Sales Order to the Consignee to bill for your pre-determined percentage of the sale, less reimbursable expenses.

These are the steps to account for Consignments from the perspective of the Consignor.

There are many more steps involved in accounting for Consignments from the angle of the Consignee. We’ll cover these in a later edition of our newsletter – stay tuned.

As always, if you have any questions on any of the procedures for recording Consignments in QuickBooks, please contact us. We’re happy to help.

Accurate, thorough item records inform your customers and help you track inventory levels correctly.

Whether you’re selling one-of-a-kind items or stocking dozens of the same kinds of products, you need to create records for each. When it comes time to create invoices or sales receipts, your careful work defining each type of item will:

- Ensure that your customers receive correct descriptions and pricing,

- Provide the information you must know about your inventory levels, and,

- Help you make smart decisions about reordering.

You’ll start this process by making sure that your QuickBooks file is set up to track inventory. Open the Edit menu and select Preferences, then Items & Inventory. Click the Company Preferences tab and click in the box in front of Inventory and purchase orders are activated if there isn’t a check in the box already. Here, too, you can ask that QuickBooks warn you when there isn’t enough inventory to sell. Click OK when you’re finished.

Figure 1: You need to be sure that QuickBooks knows you’ll be tracking inventory before you start making sales.

To create your first item, open the Lists menu and select Item List. Click the down arrow next to Item in the lower left corner of the window that opens and select New. The New Item window opens.

Warning: You must be very precise when you’re creating item records in order to avoid confusing your customers and creating problems with your accounting down the road. Please call us if you want us to walk you through the first few items.

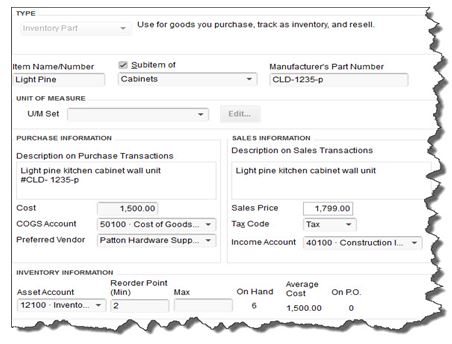

QuickBooks should display the list of options below TYPE. Since you’re going to be tracking inventory that you buy and sell, select Inventory Part. Enter a name and/or item number in the next field. This is not the text that will appear on transactions; it’s simply for you to be able to recognize each item in your own bookkeeping.

Figure 2: Let us work with you if you have any doubts about the data that needs to be entered in the New Item window. It must be 100 percent accurate.

In the example above, the box next to Subitem of has a check mark in it because “Light Pine” is only one of the cabinet types you sell (you can check this box and select <Add New> if you want to create a new “parent” item on the fly). Leave the next field blank if your item doesn’t have a Part Number, and disregard UNIT OF MEASURE unless you’re using QuickBooks Premier or above.

Fill in the PURCHASE INFORMATION and SALES INFORMATION fields (or select from the lists of options). Keep in mind that the descriptive text you enter here will appear on transaction forms, though customers will never see what you’ve actually paid for items, of course (your Cost, as opposed to the Sales Price).

QuickBooks should have automatically selected the COGS Account (Cost of Goods Sold), but you’ll need to specify an Income Account. Please ask us if you’re not sure, as this is a critical designation. The Preferred Vendor and Tax Code fields will display lists if you’ve already set these up.

QuickBooks should have pre-selected your Asset Account. If you want to be alerted when your inventory level for this item has fallen to a specific number (Min) so you can reorder up to the point you specify in the Max field, enter those numbers there (the Inventory to Reorder option must be turned on in Edit | Preferences | Reminders).

If you already have this item in stock, enter the number under On Hand. QuickBooks will automatically calculate Average Cost and On P.O. (Purchase Order).

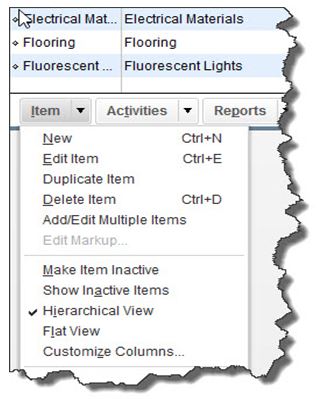

Click OK when you’ve completed all of the fields. This item will now appear in your Item List, and will be available to use in transactions. When you want to create, edit, delete, etc. any of your items, simply open the same menu you opened in the first step here (Lists | Item List | Item).

Figure 3: The Item menu, found in the lower left corner of the Item List.

Precisely created Inventory Part records are critical to accurate sales and purchase transactions. So use exceptional care in building them.

The technology side of the accounting industry is rapidly changing and expanding. Literally hundreds, if not thousands of new companies and new software applications have sprung up to help small businesses automate their processes and save time and money.

The best way to profit from all of this innovation is to first identify where you can best use the technology in your business. Here are three places to look:

What business tasks are you still using pen and paper for? Look what’s on your desk or in your filing cabinet in the form of paper, and that will be your next opportunity for automation. For example, are you still hand-writing checks? There’s an app (or two) for that.

What business tasks are you still using pen and paper for? Look what’s on your desk or in your filing cabinet in the form of paper, and that will be your next opportunity for automation. For example, are you still hand-writing checks? There’s an app (or two) for that.

Sticky notes and to do lists have been replaced with Evernote. Business cards you collect can go in a CRM (customer relationship manager). All of your accounting invoices and bills can be digitized and stored online.

Make a list of all the manual and paper processes you do every day and look for an app that can make the task faster for you.

Take stock of what systems you already have in place. The opportunity to fill the gap is where you might have systems that should talk to each other but don’t. If you need to enter data into two different places, there may be a chance to automate and/or integrate the systems or data. For example, your point of sale or billing system should integrate well with your accounting system. A few other examples include accounting and payroll, CRM and accounting, inventory and accounting, project management and time tracking, and time tracking and payroll.

Take stock of what systems you already have in place. The opportunity to fill the gap is where you might have systems that should talk to each other but don’t. If you need to enter data into two different places, there may be a chance to automate and/or integrate the systems or data. For example, your point of sale or billing system should integrate well with your accounting system. A few other examples include accounting and payroll, CRM and accounting, inventory and accounting, project management and time tracking, and time tracking and payroll.

The more your systems integrate and work as a suite, the better.

It could be you have your systems automated, but the systems are not the best choice for your business requirements. If your systems don’t meet many of your business requirements, it may be time to look for an upgrade or a replacement.

It could be you have your systems automated, but the systems are not the best choice for your business requirements. If your systems don’t meet many of your business requirements, it may be time to look for an upgrade or a replacement.

If you are performing a lot of data manipulation in Excel or Access, this might also signal that your systems are falling short of your current needs. Look where that’s happening, and you will have identified an opportunity for improvement.

Look in these three areas in your business, and I bet you’ll not only find an app for that, you’ll also find some freed up time and money once you automate.

New Business Directions – Rhonda Rosand, CPA announced today that it has been selected as an Intuit® Solution Provider. New Business Directions offers a full range of value-added consulting services for Intuit business and financial management solutions. Intuit Inc., the maker of QuickBooks®, is the leading provider of business and financial management solutions for small and mid-sized businesses, consumers and accounting professionals.

New Business Directions – Rhonda Rosand, CPA announced today that it has been selected as an Intuit® Solution Provider. New Business Directions offers a full range of value-added consulting services for Intuit business and financial management solutions. Intuit Inc., the maker of QuickBooks®, is the leading provider of business and financial management solutions for small and mid-sized businesses, consumers and accounting professionals.

The Intuit Solution Provider Program will enable New Business Directions to better serve small and mid-market businesses through the sale, implementation and service of Intuit solutions that help businesses save and make money.

“We are very excited to have New Business Directions – Rhonda Rosand, CPA as an Intuit Solution Provider,” said Simon Pass, sales leader of the Intuit Solution Provider Channel. “Their expertise in reselling and supporting small to mid-market business software solutions and their track record for customer satisfaction make them a valuable addition to our Solution Provider network.”

At New Business Directions, we help small business owners streamline the process of making money. We create order out of chaos. We do this with QuickBooks. We set up, clean up, train and maintain accounting systems. We believe in small business owners and we absolutely LOVE what we do. We are proud to be partners in the success of our clients.

At New Business Directions, we help small business owners streamline the process of making money. We create order out of chaos. We do this with QuickBooks. We set up, clean up, train and maintain accounting systems. We believe in small business owners and we absolutely LOVE what we do. We are proud to be partners in the success of our clients.

About Intuit Inc.

To learn more about New Business Directions and QuickBooks, or to schedule an appointment, please call (603)356-2914, email rhonda@newbusinessdirections.com or visit the website at www.newbusinessdirections.com.

To learn more about New Business Directions and QuickBooks, or to schedule an appointment, please call (603)356-2914, email rhonda@newbusinessdirections.com or visit the website at www.newbusinessdirections.com.All products mentioned in this release are trademarks or registered trademarks of their respective holders

New Business Direction LLC

New Business Direction LLC