Our last two newsletters focused on what was new in QuickBooks Pro and Premier for 2015; first for Accountants and then for Clients. If you missed them, they are posted on our blog.

In the next two issues, we will cover what’s new in Intuit’s more robust software – Enterprise – in the recently released 2015 version.

![]() In my opinion, the most significant changes to Enterprise are in the Preferences that control what users can and cannot do within their company files.

In my opinion, the most significant changes to Enterprise are in the Preferences that control what users can and cannot do within their company files.

Disallow Negative Inventory

In the past, QuickBooks© has allowed you to sell products that you do not  have in stock – at least not according to QuickBooks. There was a preference that if set, would warn you that you were selling something that was not in stock, but it would not prevent you from doing so.

have in stock – at least not according to QuickBooks. There was a preference that if set, would warn you that you were selling something that was not in stock, but it would not prevent you from doing so.

This caused all sorts of problems – having negative quantities on hand threw off the Cost of Goods calculations, caused errors in reporting and in some cases lead to recurring data damage.

In the 2015 release, we now have an option in the Items and Inventory Preference that says “Don’t Allow Negative Quantity”. Selecting this option will prevent you from processing a transaction that causes negative inventory.

It only works to block transactions from going negative if they have a balance of zero or greater. If the quantity is already negative, it does not prevent it from becoming further negative.

This only works with Quantity on Hand. If you select the Preference to Disallow Negative Inventory, you will no longer be warned that a Sales Order or Inventory Assembly creates a negative Quantity Available.

If you decide to use this Preference, take the time to review the new report called Negative Item Listing under Reports – Inventory and correct ALL negative inventory quantities before enabling this Preference.

Disallow Sales to Overdue Customers

You will want to make sure that your Customer Terms as they relate to Due Dates and exactly what constitutes Overdue, are set up properly before selecting this option. There is no Admin user override and this is not a User or Role specific preference so it could become quite restrictive if not set up properly.

Hide Opening Balance Fields

The leading cause of postings to the Opening Balance Equity account is entering the Opening Value when setting up Customers, Vendors, Assets or Inventory accounts and items.

In 2015, we have the option to hide opening balance fields in Names and Items. It’s under the Accounting Preference tab. The field will be visible, but grayed out.

I only wish that Intuit had made the default preference to Hide this field; it would save us countless hours of reversing duplicate transactions.

These are only a few of the changes to Enterprise for 2015. Stay tuned for our next article and we will cover more of what you can expect to see for improvements.

Part 1 of our What’s New in Enterprise for 2015 focused on the changes to the Preferences. This issue will cover some of the other changes that were made to enhance this more powerful and robust version of QuickBooks.

Total Columns on Forms

In addition to being able to total the dollar amounts on transaction forms, we can now total Quantity and Custom Fields such as weights and counts specific to our industry.

This is available on Invoices, Sales Receipts, Sales Orders, Purchase Orders, Checks, Bills and Credit Card Charges. The Custom Field must be a numeric field and not text.

A section has been added to the Subtotal Item to allow you to edit and select which columns to total on forms.

This feature does not work well with Units of Measure. There is no way for the program to understand 2 each or 2 dozen and make the proper calculation. It’s also a little tricky for Group Items but it can be configured to work for this type of item.

Sort on Columns in Transactions

We now have the ability to sort columns on our transaction forms. This is available in Estimates, Sales Orders, Invoices, Assemblies, Checks, Credit Card Charges, Bills, Item Receipts, Credit Memos, Sales Receipts, Weekly Timesheets and Purchase Orders.

It behaves property with Subtotal Items by sorting those items above the Subtotal separately from the items below the subtotal. It does not do as well with Group Items.

Other than making the forms look neater, I don’t really understand it’s purpose here.

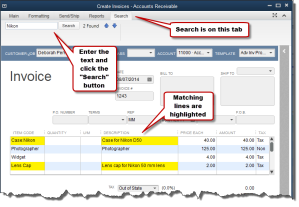

Search Within Transactions

This feature I like for when I am trying to find that needle in a haystack, like on lengthy purchase orders when I can’t remember if I added something to my order and I want to go back and look for it.

It’s located on a separate tab in the transaction menu ribbon. Just type in the box and it will search the displayed transaction for matches to your inquiry. It looks at the Item Code and the Description only – not custom fields.

It’s located on a separate tab in the transaction menu ribbon. Just type in the box and it will search the displayed transaction for matches to your inquiry. It looks at the Item Code and the Description only – not custom fields.

Shaded Lines on Forms and Reports

For me, this makes my forms and reports easier to read by alternating shaded lines. This option is available in the print window and is stored in the local printer preferences; it is saved per form and per user.

The option is available on Estimates, Sales Orders, Pick Ticket lists, Packing Slips, Invoices, Purchase Orders, Bills, Item Receipts, Sales Receipts, building Assemblies, the physical inventory worksheet and item price lists.

Show Cost on Sales Forms

This field is available for Sales/Work Orders, Invoices and Sales Receipts. It is only a screen option and will not print on the forms themselves. It allows you to see your cost as your making a sale and with the new Subtotal feature, you can compare your total cost to your total sale.

Keep in mind that this is Cost, not Average Cost. I can imagine that this would be useful in calculating customer discounts or mark-downs at the time of a sale to make sure that you’re not selling below cost.

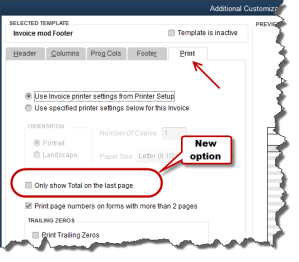

Print Footer on Last Page Only

I’ve been waiting for this one, unfortunately it’s only in Enterprise 2015 and not Pro and Premier 2015. The option is located in the additional customization settings of the form template on the last tab – Print – Only Show Total on the Last Page.

This avoids having that blank Total Box show on the first page of an invoice with multiple pages. It suppresses the entire footer with the exception of custom text boxes and page numbers.

This avoids having that blank Total Box show on the first page of an invoice with multiple pages. It suppresses the entire footer with the exception of custom text boxes and page numbers.

It affects Invoices, Sales Orders, Estimates and Purchase Orders. For some unknown reason it is not currently available on Credit Memos or Sales Receipts. Maybe they will add that later.

There are quite a few more changes in Enterprise 2015 – too lengthy to cover in this article – and I am sure that there will be more to follow. At the time of this writing, rumor has it that there will be a big announcement regarding the Enterprise platform at the QB Connect conference in San Jose next week – I’ll let you know what I find out.

QuickBooks 2015 Desktop has just been released and there are several new features and improvements to old ones that you will want to take a look at to see if it has something worth upgrading for.

Insights Dashboard – Insights is similar to the old Company Snapshot, which is still available. It’s a dashboard view of your financial position with a more up-to-date user interface. You can find it as a tab on the Home Page and configure the view using the gear icon in the upper right-hand corner of the screen. It’s customizable – you can add your logo, decide what you want to see and print the details of the entire screen. You can also click on the graphs to see a report with the supporting details.

Time and Expense on the Income Tracker – You can now view Unbilled Hours for Work in Progress by Dollars and sort the on-screen information in the Income Tracker. If you’re not familiar with the Income Tracker, that was a new feature in QuickBooks 2014.

Improved Reporting – This is great for those of us who are now having a difficult time with seeing our monitors without magnifiers. The on-screen reports have a more modern design with background shading, vertical and horizontal lines, increased line spacing, row alignment and indentation.

Improved Reporting – This is great for those of us who are now having a difficult time with seeing our monitors without magnifiers. The on-screen reports have a more modern design with background shading, vertical and horizontal lines, increased line spacing, row alignment and indentation.

Field Search Boxes – Finally! When customizing reports we can now search for the columns we want to add to our reports from the filter list that is now in alphabetical order and searchable, instead of scrolling up and down looking for a needle in a haystack.

Comments on Reports – In QuickBooks 2015, you will be able to add comments to reports, snapshot save them as Commented Reports and email them with the comments attached. The comments are numbered sequentially and will print as a separate page. Please keep in mind that emailing sensitive information is not secure.

Multiple Reports in Single Email – instead of sending one email per report or creating PDF’s of multiple reports, storing them in a folder and then emailing them, you can now process and email multiple memorized or commented reports from the multiple reports menu. Again, emailing is not the preferred method of sending sensitive financial information as it is not secure. We recommend using a secure portal for transmitting data.

Manufacturer’s Part Numbers – in QuickBooks 2015, we can add the Manufacturer’s Part Number to our forms without using up a valuable custom field. This is available on Invoices, Sales Receipts and Sales Orders, but not Credit Memos. Be careful, this is an editable field and can be copied back to your Item List.

Pin Notes – the Notes section of Customers and Vendors has been re-designed and we can now pin important notes to the top of the view screen so that it always shows and is the default note on reports.

Reminders Dashboard – The Reminders now show up as a dashboard with To Do Notes. It’s easier to understand and work with than previous versions.

Terminate QB on Workstation – This new feature is dangerous at best. In a multi-user QuickBooks file, the Administrator can now switch to single-user mode without the permission of the other users who may be logged in. It closes even if the other users have unsaved data. I am recommending that all Admins forget that I told you about this feature.

Invoice for Selected Items on Sales Orders – We can now select which items we want to Invoice from a Sales Order.

Unless you see something in these changes that has been an issue for you, there is no real reason to upgrade. If Intuit stays true to form, the 2012 version of QuickBooks will be sunsetted in May of 2015 at which time those users will be required to update if they wish to continue using online banking, payroll and email features from within the program.

New Business Directions offers QuickBooks consulting, outsourced accounting, business and CFO services to small and mid-sized organizations. If we can help you in anyway, please contact us.

QuickBooks 2015 offers some new features that we are excited to share with our fellow accounting professionals. The Accountant Toolbox, Client Collaborator and Report Comments are a few of the latest features available to accountants that we will explore in this newsletter.

Accountant Toolbox

In Pro and Premier versions of QuickBooks 2015, when you log into your clients’ QuickBooks file as the External Accountant, you will have an Accountant Toolbox available to you.

Instead of taking the file back to your office and restoring it to work on it with your tools while the client waits patiently and cannot use the file, you will be able to perform tasks right at their office on the live data file.

You will either need to be a ProAdvisor or have purchased the QuickBooks Accountant Plus subscription in order to use this Accountant Toolbox. From the Toolbox, you will be able to:

- Batch enter and/or reclassify transactions

- Preview the status of reconciliations

- See a list of your memorized reports

- Access the Client Data Review Tools

- All other features previously only available in the Accountant Center.

With Client Data Review, you will be able to track changes made by the client; changes to lists, anything that was merged or deleted, you will be able to correct client data errors, record review notes, troubleshoot beginning balances, write off small Accounts Receivable balances, apply open credits, troubleshoot Inventory and correct Sales Tax and Payroll Tax errors.

Comments on Reports

With QuickBooks 2015 for Accountants, you will be able to add comments directly onto the Reports that you generate for your clients. You can save these reports as Commented Reports, similar to Memorized Reports, and you will be able to batch print and batch email these reports to your clients. Now you can avoid drafting lengthy emails outside of QuickBooks with this handy feature.

|

Figure 1: This screenshot captures the process of adding comments to reports. |

Send Portable Company File

The Portable Company File feature has been streamlined. It’s a one-time setup and you can decide whether to send a Portable Company File or an Accountants’ Copy.

Client Collaborator

This was new in 2014, however it has been a best kept secret. This tool allows you to associate questions with specific transactions and track conversations between you and your client. Interactions between the accountant and the client are stored on a secure server and accessed online ensuring that nothing is lost.

This feature is located in the Accountant Menu under Ask Client about Transaction. Sign in to your Intuit account with your user ID and password and follow the onscreen prompts to create and send your questions to the client. The client will receive a secure email, log in to their QuickBooks file and view the conversation list, answer your questions and then you will be notified to review and close the conversations.

|

Figure 2: Here you can see the conversation trail of several transactions. No need for emailing your client with transaction details and questions, as you can do that now directly from QuickBooks. |

New Business Directions helps small business owners streamline the process of making money with QuickBooks consulting and training services and provides outsourced accounting, business and CFO services. If we can help you in anyway, please contact us.

If you‘re new to QuickBooks Point of Sale, get ready to expand your vocabulary.

When you first start using QuickBooks, even if you’ve been doing manual accounting for your business, there’s a learning curve. You recognize some things, like check blanks and invoice forms, but you have to take on an unfamiliar workflow, deal with new words and phrases, and learn more about double-entry accounting concepts than you perhaps knew before.

The same is true as a novice QuickBooks Point of Sale user. Whether you’re opening your first retail location or you’ve been selling auto parts or craft supplies or bakery goods for a decade, there will undoubtedly be some new terminology for you to learn.

Here’s a sampling of some of this new lingo that comes with the territory. You may look at the definition of a word or phrase and still be confused, but that’s where we come in. Seasoned shopkeeper or first-time seller, you will likely need our help when you first start using this complex piece of software.

Here’s a sampling of some of this new lingo that comes with the territory. You may look at the definition of a word or phrase and still be confused, but that’s where we come in. Seasoned shopkeeper or first-time seller, you will likely need our help when you first start using this complex piece of software.

- Address Verification Service (AVS): In transactions where a credit or debit card is not physically present, AVS adds an extra layer of security

- Assembly: Multiple products pre-assembled in a unit

- Average Unit Cost: The average (not actual) cost of the items on hand in your inventory

- Chargeback: A credit card charge disputed by a customer

- Class: A categorization method used in creating reports; for example, run Profit and Loss reports by store

- Committed Quantities: The number of inventory items that have been included on active customer orders

- Financial Exchange: QuickBooks POS tool that helps you share data with QuickBooks

Figure 1: QuickBooks Point of Sale’s Financial Exchange establishes an ongoing connection to QuickBooks for data-sharing.

Figure 1: QuickBooks Point of Sale’s Financial Exchange establishes an ongoing connection to QuickBooks for data-sharing. - Merchant Service Center: An Intuit website dedicated to helping you manage your merchant account

- Non-Inventory Item: An item for which you do not keep track of on-hand quantities, like shipping or delivery fees

- Payout: Funds taken from the cash drawer for any of a number of reasons, like a bank deposit, office party, or to make a necessary purchase

- Physical Inventory (PI): The process of tallying the number of items physically present in inventory; used to correct quantities recorded in QuickBooks

- Price Level: Price charged for items that differs from the regular price; can define up to four additional reduced prices in QuickBooks POS (employee cost, promotions, etc.)

- Quick Add Item: Process by which you can quickly create a new inventory item while completing a transaction with a customer; doesn’t require as much immediate detail

-

Quick Find: Found on the QuickBooks POS Navigator; functions as a search tool for locating customers, items, receipts, etc.

Figure 2: You can enter a search word or phrase in the Quick Find box at the top of the Navigator page. - Quick Pick: A user-defined group of selected items that can be easily accessed during checkout

- Quick Zoom: Lets you “drill down”on a line or value within a report; can see the origin of the selected item

- Remote Store: Refers to every store other than Headquarters in a multi-store QuickBooks POS configuration

- Simple View: An abbreviated version of a sales receipt that may be viewed via touchscreens and virtual keyboards

- Split-Payment Sale: A transaction that is completed using two or more payment methods

- Store Exchange: Data shared between Headquarters and remote stores via:

- Desktop email

- Web-based email

- Removable media, or

- Network file exchange

- Transfer Slip: Documents transfer of merchandise between stores

- X-Out Shift Report: Available throughout the sales day, monitors recent sales activity

- Z-Out Drawer Count: End-of-shift or end-of-day cash drawer reconciliation

- Z-Out Store Close Report: End-of-day sales and cash flow summary; assists in readying a bank deposit

You can see that there are a lot of new terms to understand when you begin managing your retail transactions using QuickBooks Point of Sale. We can help further your knowledge by putting those words and phrases in context, so you can see where they fit in your workflow.

You can see that there are a lot of new terms to understand when you begin managing your retail transactions using QuickBooks Point of Sale. We can help further your knowledge by putting those words and phrases in context, so you can see where they fit in your workflow.

New Business Direction LLC

New Business Direction LLC