As an accountant, I know that there is no such thing as bad debt on a cash basis tax return.

Accrual basis taxpayers recognize revenue when they invoice for the services and are allowed to write off a bad debt if it is not collected.

Cash basis taxpayers only recognize revenue when they receive the money. If you never receive the money, there is nothing to write off.

Yet, I’ve seen it; I’ve seen a bad debt expense account on a cash basis profit and loss report in QuickBooks. How does that happen? And how does it get reported on your income tax return?

How a Bad Debt Expense Account Gets on a Cash Basis Profit and Loss Report

Bad Debt can wind up on a Cash Basis Profit and Loss Report when you invoice a customer in one tax year and write it off in another. This is just one more reason to clean up your accounts receivable at year-end, before filing your income taxes.

Let’s look at an example –

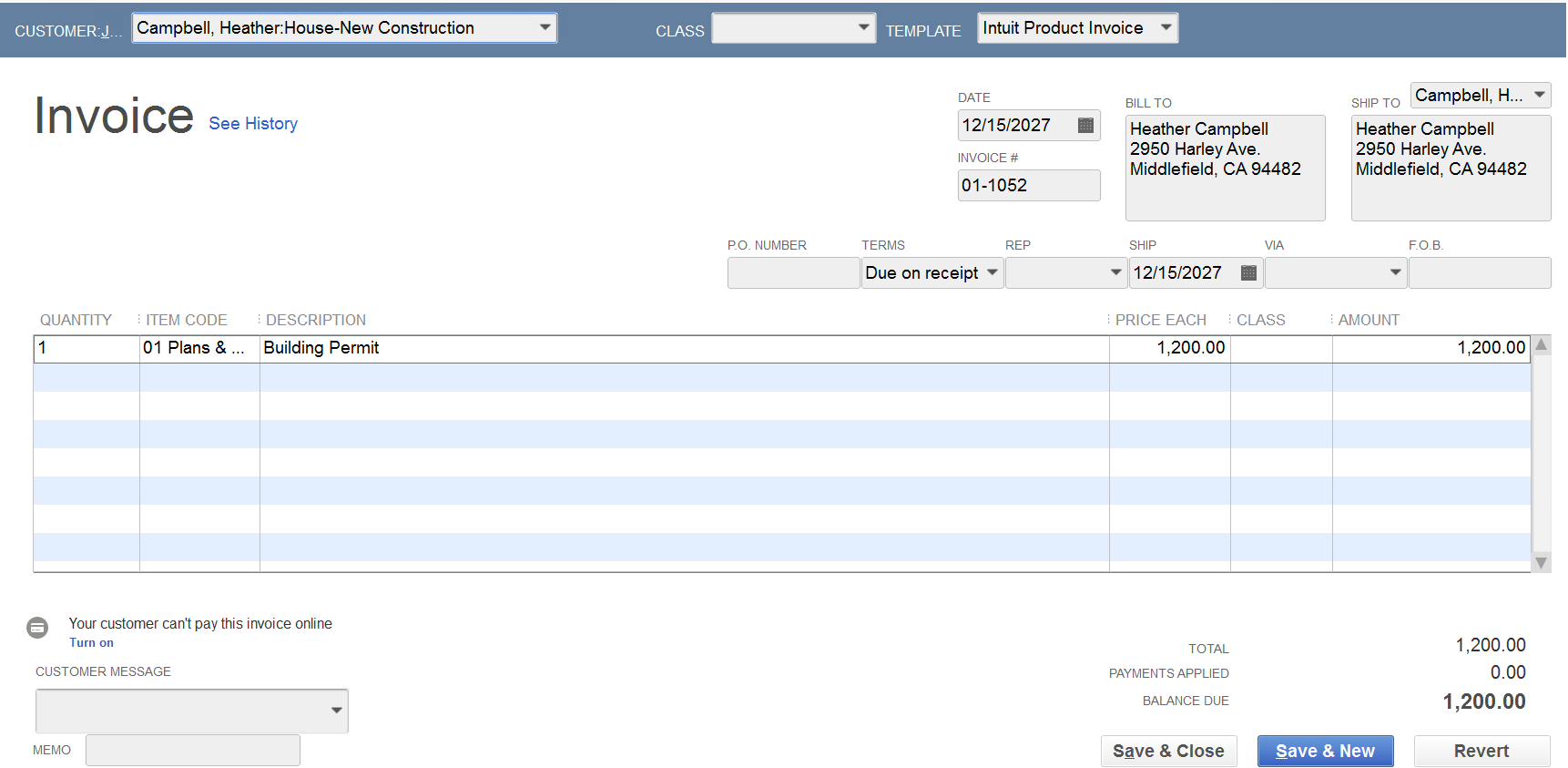

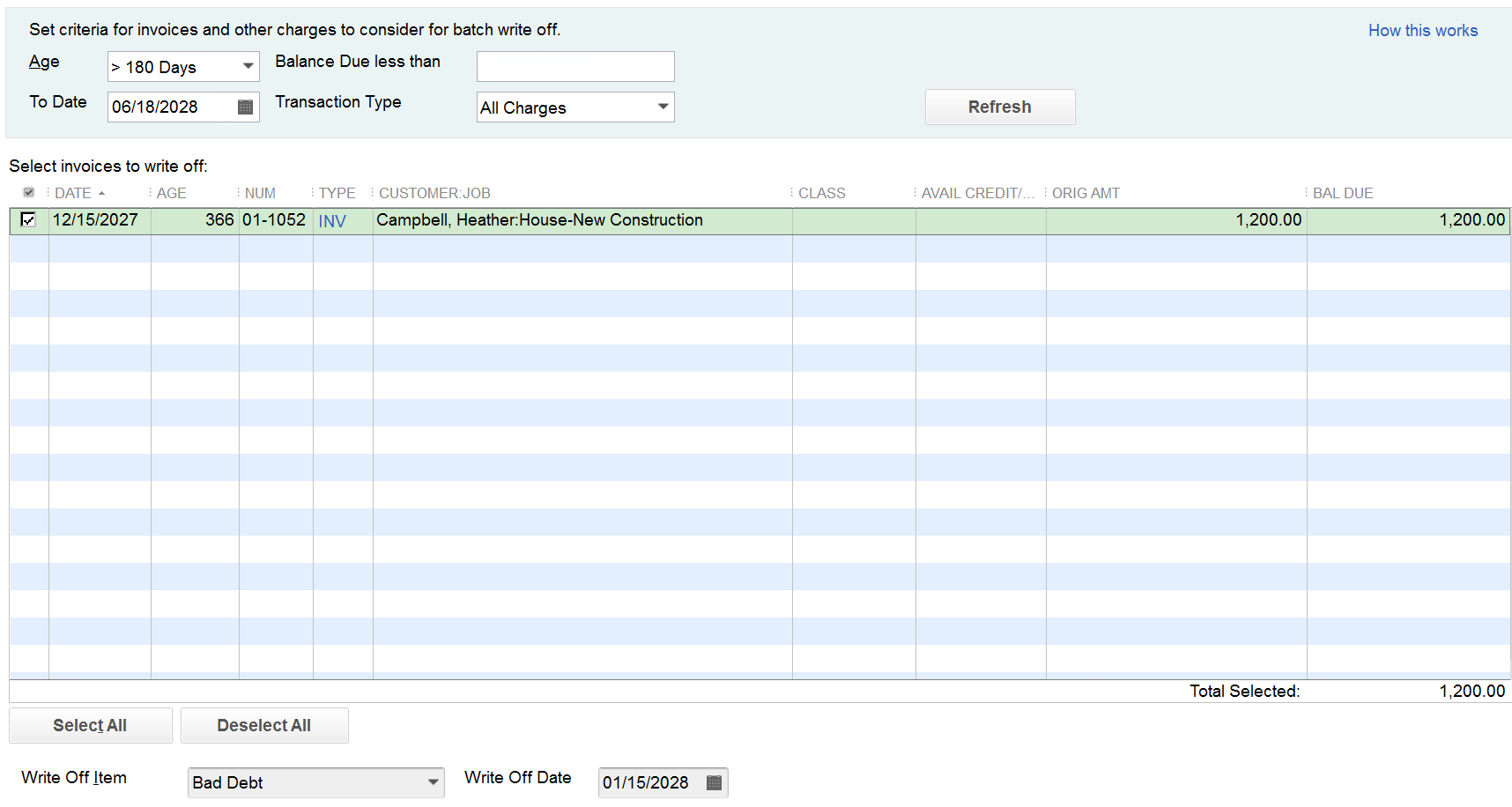

In a sample QuickBooks Enterprise data file, I have created an invoice dated 12/15/2027 to Heather Campbell for $1,200 for a building permit.

Behind the scenes, the transaction journal debits Accounts Receivable and credits Income.

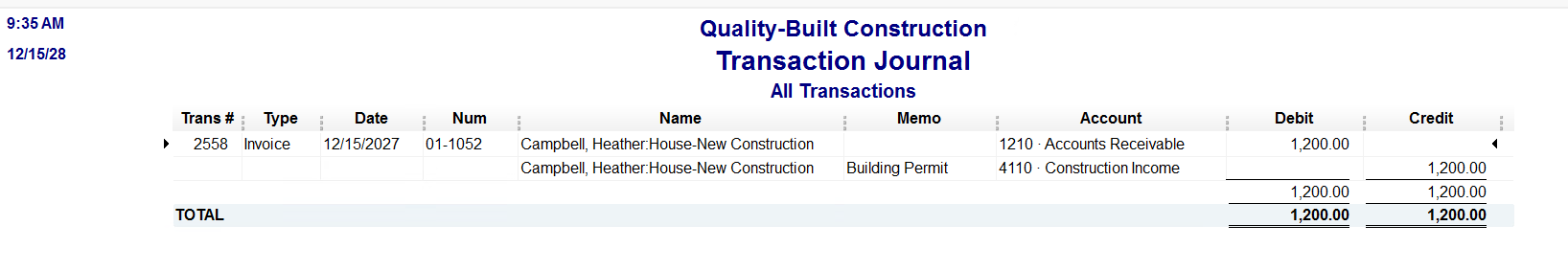

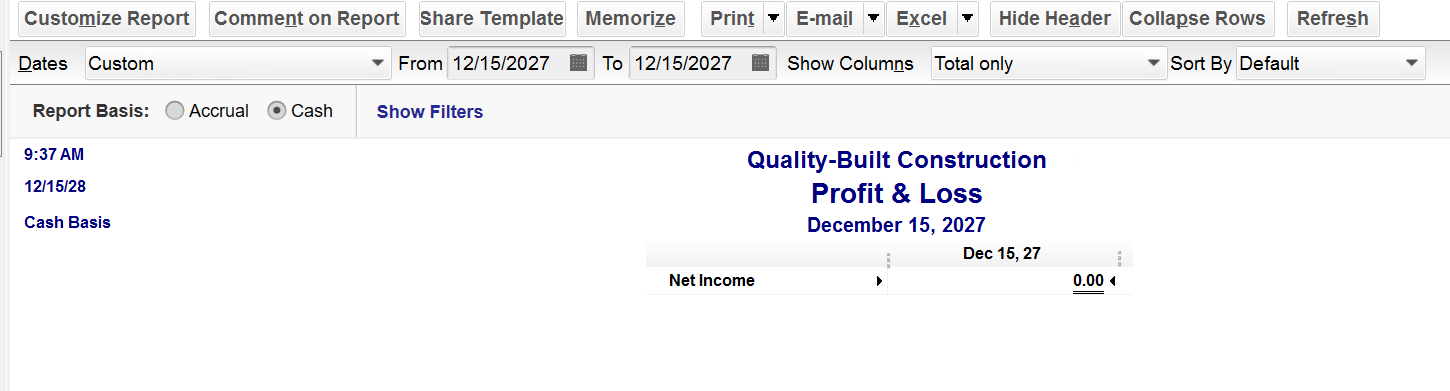

The accrual basis profit and loss will report this as Construction Income…

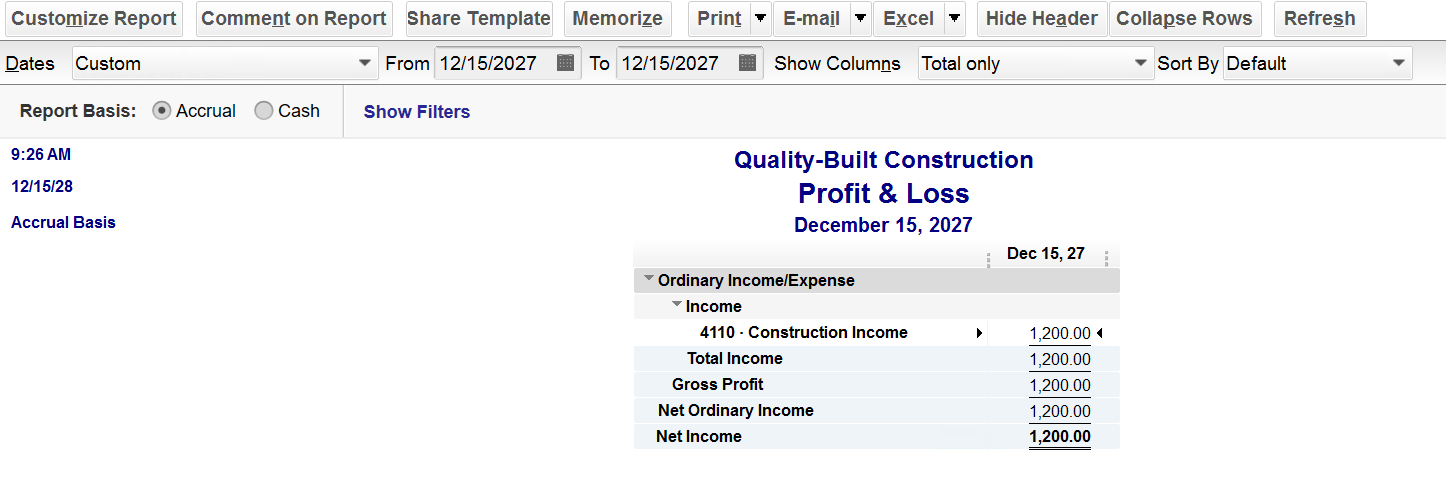

…but the cash basis profit and loss will not.

Now, let’s say I write off that invoice in the next tax year using the QuickBooks Enterprise tool –

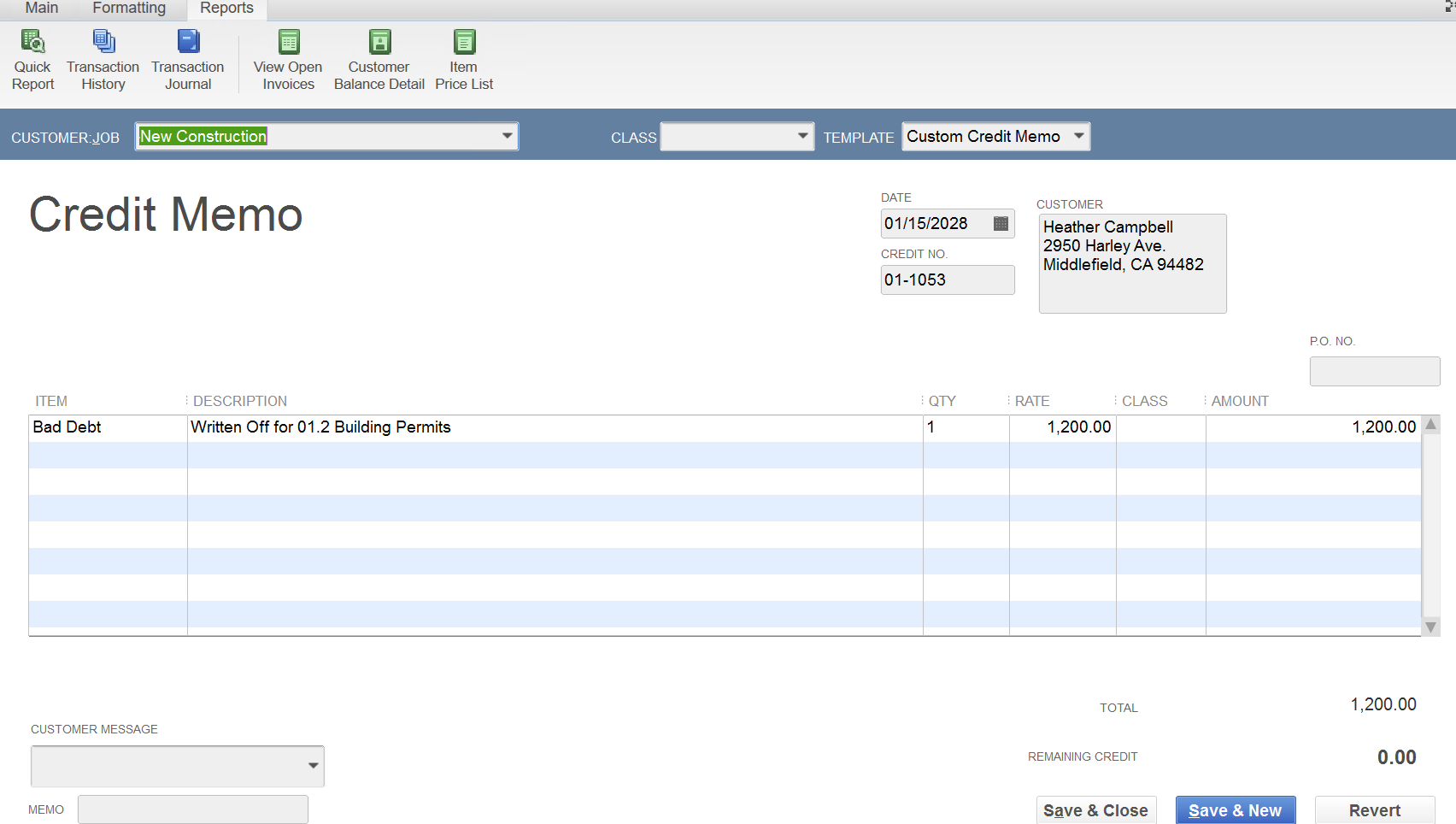

QuickBooks creates a credit memo for the write-off –

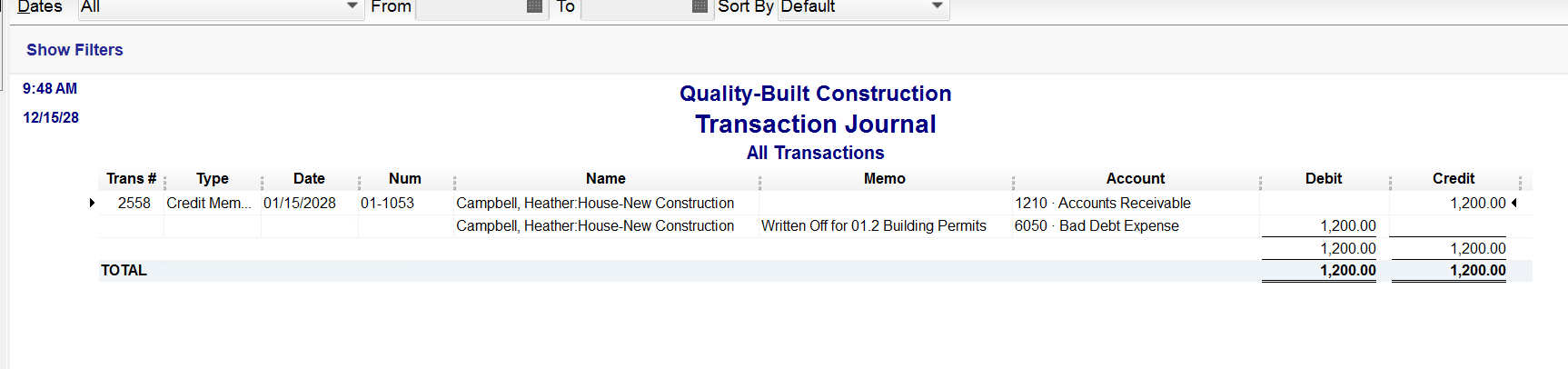

The transaction journal behind the scenes debits Bad Debt Expense and credits Accounts Receivable –

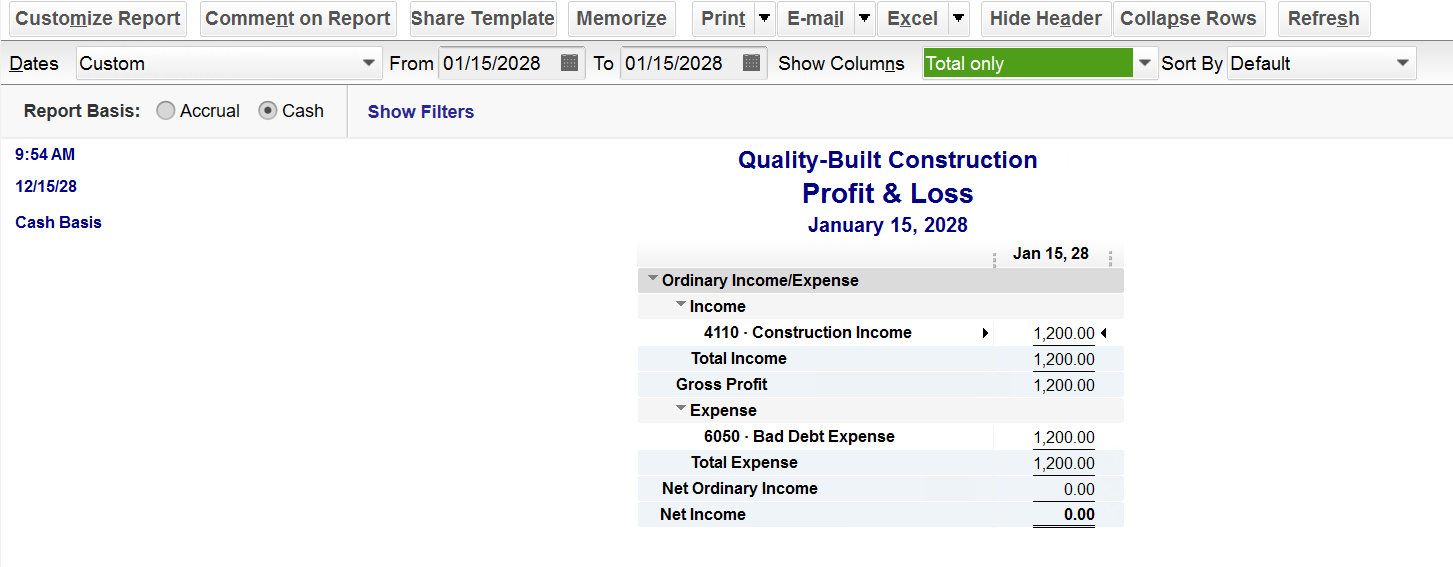

On the accrual basis profit and loss, we see Bad Debt Expense – this is correct – it’s writing off the income that was reported in the prior year.

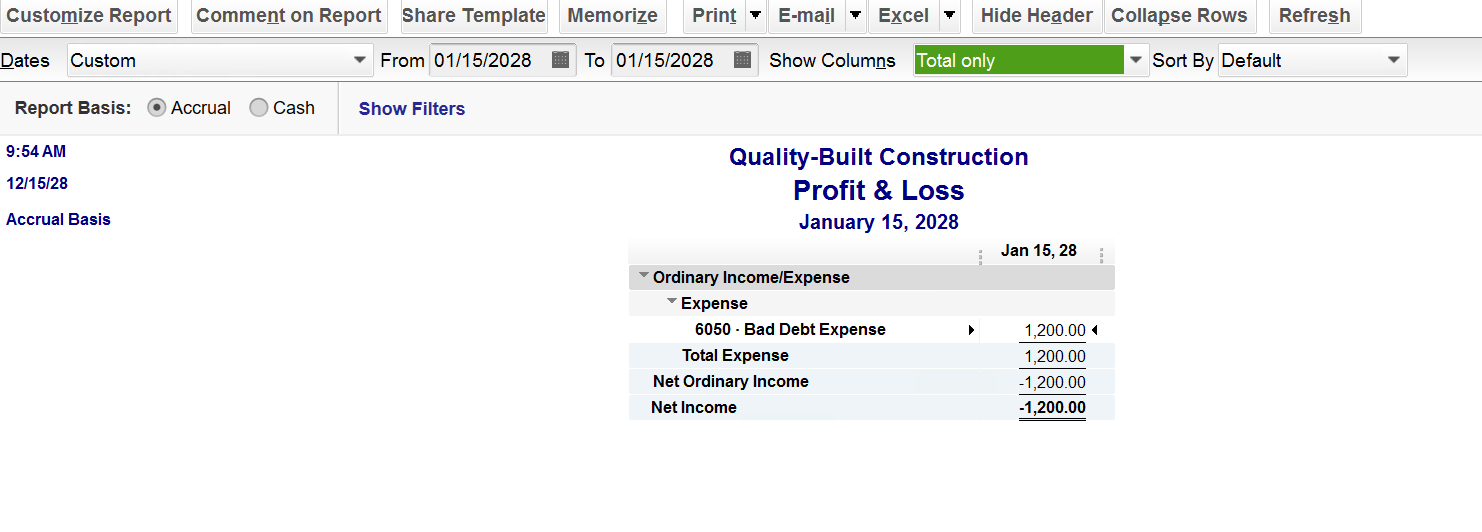

On the cash basis profit and loss report, we see both Construction Income and Bad Debt Expense – this is also correct – it’s a wash – since it reports the income and writes off the bad debt.

How a Bad Debt Expense Gets Reported on Your Income Tax Return

Now, let’s discuss what’s supposed to happen on your cash basis tax return. Nothing; technically, it’s a wash, as the Bad Debt Expense on a cash basis profit and loss is simply a reduction of revenue. If I were preparing your income tax return*, I would reduce the Construction Income by the Bad Debt Expense and report the net revenue. For more information on this topic, check out this helpful tutorial our team prepared: https://newbusinessdirections.com/how-to-write-off-a-bad-debt-in-quickbooks-3/

*Note: New Business Directions does not prepare income tax returns.

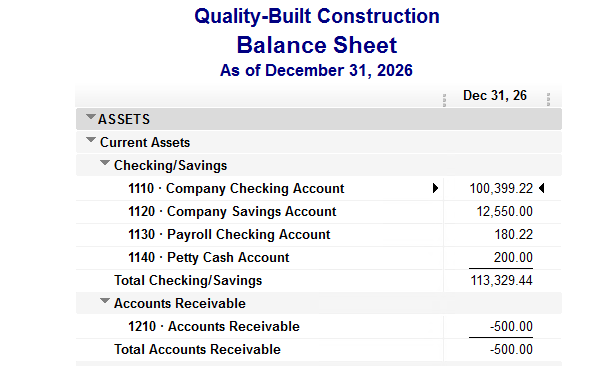

There are a few scenarios that will cause a negative accounts receivable on a cash basis balance sheet in QuickBooks. Let’s focus on the two most common: unapplied payments and timing differences.

Unapplied Payments –

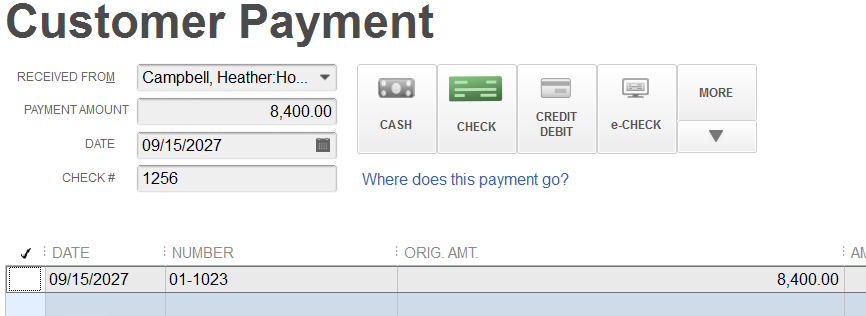

This occurs when a customer has paid you, you’ve received the payment, but you have not applied it to the invoice yet. As pictured below, a simple checkmark next to the invoice will resolve the negative accounts receivable on your balance sheet.

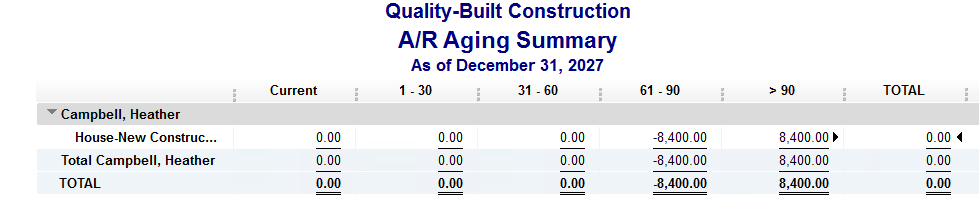

If you look at your accounts receivable aging report, you will see both the invoice and the payment for the customer – one positive, one negative and they wash to zero.

It’s important to clean up your accounts receivable aging summary report and fix unapplied payments by linking them before monthly reports are issued or year-end taxes are filed.

There are no journal entries required to correct this transaction; simply apply the payment to the invoice and re-run your reports.

Timing Differences –

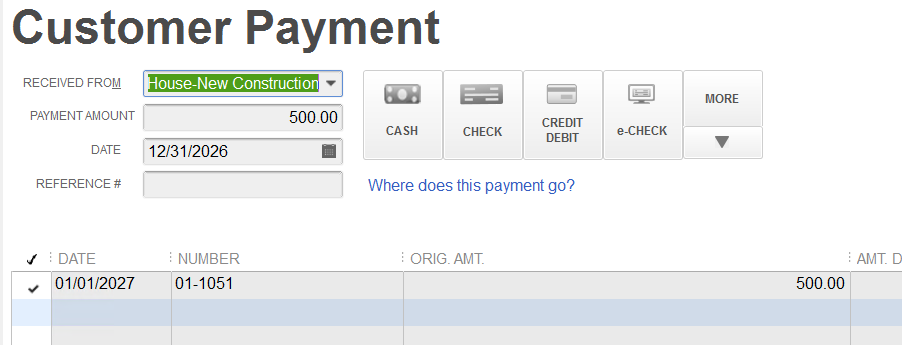

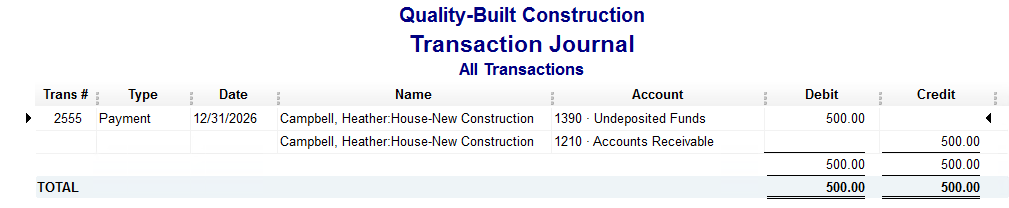

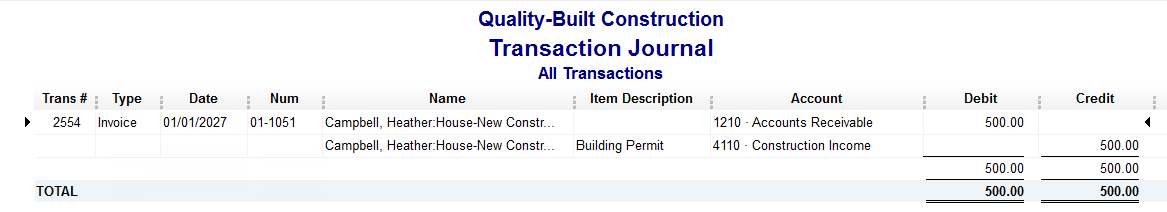

This occurs when a customer has paid you in advance; you’ve received the payment and applied it to an invoice that is dated in the future.

In the image above, you’ll notice that the date of the payment receipt is the day before the date of the invoice. This is an advance payment from the customer on a future invoice resulting in a negative accounts receivable on the balance sheet dated as of the date of the payment. It will not wash to zero on the accounts receivable aging report until the next day–in this case, it will be in the next calendar year.

Please note that you will have a negative accounts receivable on both the cash and the accrual basis balance sheets for this transaction. Below is the transaction detail for the payment dated 12/31/2026 and the invoice dated 1/1/2027, behind the scenes in QuickBooks.

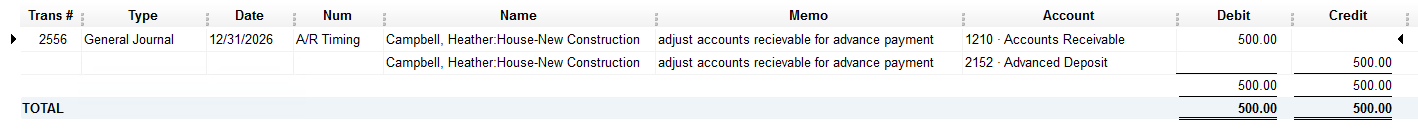

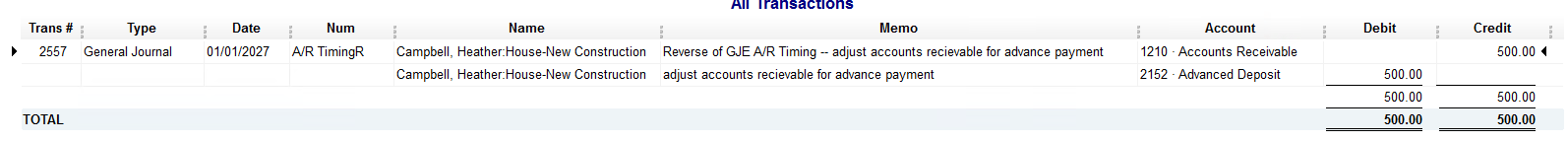

If you find yourself in a situation where you have negative accounts receivable due to a timing difference at a month-end reporting period (or at year-end for tax filing), you will need to make two journal entries – one regular and one reversing, to move the negative accounts receivable to an other current liability account for advanced deposits, as follows:

These are the two most common reasons why you would see a negative accounts receivable on a cash basis balance sheet in QuickBooks.

This holds true for negative accounts payable on a cash basis balance sheet as well and the process to fix/link or adjust is the same.

You may have heard reports over the past couple of years regarding the demise of QuickBooks Desktop.

Actually, if you search the web to purchase QuickBooks Desktop, you’ll be hard-pressed to find it.

Now that we’ve passed the May 31st, 2024 sunset date of the 2021 versions of QuickBooks Desktop – Pro, Premier, Mac and Enterprise Solutions v21, there is no more Intuit support for those 2021 versions and any integrations for connected services such as payroll and merchant services will no longer link.

There is a New Date on the Horizon

Intuit will stop selling new subscriptions of Desktop Pro, Premier and Mac as well as Enhanced Payroll to new US users on September 30, 2024. This is not a sunset or discontinuation; it’s a stop-sell.

If you don’t have a current subscription of the 2024 QuickBooks Desktop Pro, Premier or Mac or Enhanced Payroll on or before July 31, 2024 – you will not be able to purchase it.

Existing customers with 2024 Pro, Premier, Mac or Enhanced Payroll will not be affected and they will still be able to renew their software annually – this is only for new customers. Existing customers will be able to add seats, additional licenses, to their existing licenses.

QuickBooks Enterprise Solutions is Alive and Well

This stop-sell order does not affect QuickBooks Enterprise Solutions. Think of the Enterprise version of QuickBooks as the Pro/Premier software on steroids. It’s the same product, just more robust, with increased capacity and additional features.

Next Steps – What You Need to Do

Confirm that you have the 2024 version of QuickBooks Desktop and that your payment method on file with Intuit is current with the correct card number and expiration date. Do not let your subscription for Desktop Pro, Premier, Mac or Enhanced Payroll lapse.

If you need assistance with the renewal process or upgrading the file from an older version, please reach out.

We’ve heard more than a few horror stories in the past few months of business owners falling for phishing scams that compromise their company, cost them thousands of dollars, and put their customers and contacts at risk. Hackers are getting more sophisticated by the day, and it’s becoming harder to tell a malicious threat from an ordinary email.

We share this insight to empower, not scare. The good news is that most threats are avoidable with a vigilant eye. In 2021, think of a phisher as more of a vampire than a heister: you have to invite them in before they can cause any harm. Below, we’ve pinpointed a few common threats for 2021 and 2022, along with best ways to avoid them. These suggestions should help keep your sensitive data secure from current phishing trends.

Common Threat 1: QuickBooksⓇ Impersonation

One common trend we’re seeing involves solicitations from QuickBooksⓇ impersonators falsely notifying you that your QuickBooksⓇ file is corrupt, your automatic payment is about to expire, or your version of QuickBooksⓇ needs to be updated. These phishers will try to get you to pay for a phony upgrade over the phone or grant them access to your desktop to “fix” your accounting software. Here’s the thing: if you work with an accounting company like New Business Directions, we’ll probably be the first ones to know if something is wrong with your QuickBooksⓇ file. And if you’re a New Business Directions customer, QuickBooksⓇ knows you’re working with a QuickBooksⓇ Solution Provider and will often notify us of any issues your account may be experiencing, too.

How to dodge the threat: If an email appears to come from QuickBooksⓇ, check the email addresses for the correct website. If it doesn’t end in “@Intuit.com” or “@QuickBooks.com” the sender is fraudulent (even if the name before the @ symbol looks convincing). Always contact your accountant before engaging with a solicitation like this and never provide payment information or authorize remote access to your computer or QuickBooksⓇ file to anyone besides your accountant or IT solutions provider.

Common Threat 2: Download this Attachment

Another major threat to watch out for involves an email from an address you recognize (say, a customer, vendor, or team member), but asks you to enter your Microsoft credentials to view the attachment. This scam comes from a person you know, and their email address matches the one you have on file. The MicrosoftⓇ log-in screen looks legit, but the web address is not. Do not enter your Microsoft credentials. As soon as you do, the hackers have access to your email and all sensitive information you have ever sent or received via email. The phishers will then send the exact same email that you fell for to every contact in your address book.

How to dodge the threat: never enter your log-in credentials to view an attachment. If an email includes a hyperlink, hover over the link with your mouse (don’t click) and watch for a link preview to appear in the corner of your screen. In Outlook, this will be the bottom left corner. You’ll be able to see a preview of the web address the hyperlink is trying to send you to, and if it’s different from the one typed out in the email. In this case, if the domain isn’t “office.com” the email is fraudulent. This is a fast and simple step you should always take before clicking a hyperlink in an email. And when it comes to sharing sensitive information like bank statements and government IDs, you should always use a secure, encrypted file sharing application like SmartVault instead of sending the document as an email attachment.

Common Threat 3: “You Have a Voicemail” emails

Are you surprised to be receiving an email notifying you about a new voicemail? Does it have an attachment? Is the sender posing as RingCentral or another VOIP phone system provider you use? Remember: if it seems suspicious, it probably is.

How to dodge the threat: don’t download the voicemail. If you want to be sure you’re caught up on your voice messages, navigate to your voice mailbox the way you usually do and avoid interacting with the email in question.

Common Threat #4: The QR Code Swap

QR codes have become so mainstream that we interact with them weekly, if not daily. From restaurant menus to sign up forms, they make accessing the information you need quick and simple. But there are emerging trends in which bad actors will replace a QR code with their own – by overlaying a sticker. They may also come in the form of seemingly-legit emails. But as soon as you scan these phony codes, you could be putting your sensitive data at risk or downloading malware.

How to dodge the threat: Review the preview of the web address when you scan the code, and before you click on the link that appears. Make sure it’s spelled correctly, and seems like it’s coming from the correct person or business. When dealing with QR codes that exist in a public space, take a second glance to make sure the QR code hasn’t been tampered with, such as replaced by a sticker. When in doubt: don’t scan that code!

Best Practices

There are so many ways to avoid phishing scams, but the most important thing to do is stay observant. If something seems off about an email, it probably is. Below, we’ve outlined a few specific best practices that should help you avoid scams:

- Set-up two factor authentication. Do this for all websites/applications you have log-in credentials for. It might seem inconvenient to go through one more step to access your online accounts, but this practice is still more convenient than dealing with a successful cyber security attack. Apps like LastPass Authenticator or Google Authenticator are an option. These apps provide a six-digit code for you to enter once you’ve logged in to your desired online account. Many other web-based companies offer the option to have an authentication code sent to your personal cell phone or the email associated with the account. How does two factor authentication help? Even if a phisher gets your credentials, they still need access to your email, text messages, or authenticator app to get the authentication code and hack your account, making it significantly less likely they’ll be successful in their attempted breach.

- Keep up with phishing scam trends. Check for updates from Forbes.com, PCMag.com, or your favorite trusted business news source for updates on phishing trends and recent cyber security threats.

-

- Don’t open the door for strangers. Never grant access to your computer to someone you don’t personally know, even if they look like a QuickBooksⓇ rep. Your accountant and your IT Support vendor/employee are the only people you should ever allow access to.

- Watch for inconsistencies and typos. Are there misspellings in a marketing email? Does the subject line have five exclamation points? Is your name or the name of your company spelled wrong? When it comes to emails, if it smells like a phish and looks like a phish…well, you know the rest.

- Double-check the sender. Always check the sender’s email address. If the name associated with the email address says “Rhonda Rosand” but the email address differs from the one you have on file for Rhonda Rosand, the sender is a fraud. In cases like this, you should check with the individual through another previously established method of communication, be it a phone call to a number or email you already have on file to confirm your contact actually sent the email you’re looking at. Don’t reply to the questionable email with, “Rhonda, is this really you?” If you were a hacker, how would you respond to that email? Red flags include a professional email that includes an @gmail.com (or similar) domain, a slightly misspelled name, or a domain that differs from that of their company’s website.

- Train your Team. If you received a sketchy email, chances are your team received it, too. Send out an all-company message about the threat and tell employees to notify you or your IT professional immediately if they interacted with the threat. Share trends in cyber security threats, and host frequent training on cyber security best practices.

- Trust your gut. Even if the sender looks familiar, if they’re asking for weird information or are trying to send you an attachment in an unusual way and it seems suspicious, trust your gut. Look for other clues that they might be an imposter: is a hyperlinked web address different from what it should be? Is their email address different from the one they typically use? Is their tone or communication style different than usual?

- Keep your passwords strong and secure. LastPass is a great solution for dual factor authentication, generating complex passwords, and storing sensitive information securely. You can read more about this helpful cyber security solution in a recent blog post of ours here.

- Don’t send sensitive information via email. Avoid sending credit card information, banking information, W-2s and 1099s, pictures of vital documents like drivers licenses, social security cards, etc. via email altogether. Instead, use a secure document management system both parties are already aware of.

When in doubt, don’t click that sh!t

When it comes to Cyber Security, It’s always better to be safe than sorry. Be suspicious of communication that seems a little off. Avoid unusual emails and contact your IT security provider (or accountant, if it’s related to accounting) to ask for their insight right away, especially if you’ve already accidentally interacted with the phishing attempt. New Business Directions is well versed in phishing scams, and we have a keen eye for malicious emails. If you’re a current customer and feel unsure about an email or solicitation you recently received involving your accounting software, reach out to us.

Learn about the Audit Trail Feature in QuickBooks Desktop and Online from Rhonda Rosand, CPA from New Business Directions, LLC.

The Audit Trail tracks the who did what when: it tracks the history of a transaction, where it started, what changes were made and what it looks like now. This tool can be especially useful to accountants.

Join Rhonda Rosand, CPA and Advanced Certified QuickBooks ProAdvisor of New Business Directions, LLC, and learn how to Record PPP or EID Loans in QuickBooks Desktop and QuickBooks Online:

Join Rhonda Rosand, CPA and Advanced Certified QuickBooks ProAdvisor of New Business Directions LLC, to set up your COVID-19 Expense account, payroll liabilities account, payroll items and tax credit in QuickBooks Desktop. See what it looks like when you process a payroll and where to go to find the remaining balance of your tax credit.

Pay employees under the Family First Coronavirus Response Act: Learn to to track COVID19 sick pay and paid leave in QuickBooks Desktop, with QuickBooks ProAdvisor Rhonda Rosand, CPA of New Business Directions.

For QuickBooks Online, visit Intuit’s guide here: https://quickbooks.intuit.com/learn-support/en-us/help-articles/pay-employees-under-the-family-first-coronavirus-response-act/00/523401

For information on what you need to know about the Families First Coronavirus Response Act: https://quickbooks.intuit.com/learn-support/en-us/help-articles/ffcra/00/517349

Here Rhonda’s latest video on how to add multiple users in you QuickBooks Desktop file:

Here is how to add users in your QuickBooks Online file:

Nobody likes, them, but sometimes it happens. This is how you record it in QuickBooks if this happens to you.

Learn How to Record a Bounced Check From a Customer in QuickBooks® with Rhonda Rosand, CPA and QuickBooks® ProAdvisor from New Business Directions, LLC

New Business Direction LLC

New Business Direction LLC