As we move into the fall season and the final quarter of the year, it’s a perfect time to commit to a project in your business that will help you reach the year’s end in better shape. Here are five ideas:

1. Back-to-School Time

If payroll expenses are one of the higher costs in your business, then it makes sense to boost your team’s productivity and maybe also your own. Fall is back-to-school time anyway, so it’s a natural time of the year to take on a course, read a business book, or hire an organizer to help you get more from your workspace.

If you spend a lot of time doing email, consider taking a course on Microsoft Outlook® or even Windows; learning a few new keystrokes could save you tons of time. If you need more time, look for a book or course on time management. Look for classes at your local community college or adult education center.

2. A Garage Sale for Your Business

Do you have inventory in your business? If so, take a look at which items are slower-moving and clear them out in a big sale. We can help you figure out what’s moving slowly, and you might even save on taxes too.

3. Celebrate Your Results

Take a checkpoint to see how your revenue and income are running compared to last year at this time. Is it time for a celebration, or is it time to hunker down and bring in some more sales before winter? With one more quarter to go, you have time to make any strategy corrections you need to at this time. Let us know if we can pull a report that shows your year-on-year financial comparison.

4. Get Ready for Year’s End

Avoid the time pressure of year’s end by getting ready early. Review your balance sheet to make sure your account balances are correct for all transactions entered to date. You will be ahead of the game by getting the bulk of the year reviewed and out of the way early.

Also make sure you have the required documentation you need from vendors and customers. One example is contract labor that you will need to issue a 1099 for; make sure you have a W-9 on file for them. If we can help you get ready for year-end, let us know.

5. Margin Mastery

If your business has multiple products and services, there may be some that are far more profitable than others. Breaking these numbers out to calculate your profit margins or contribution margins by product or service line can help you see the areas that are adding the most income to your bottom line. Correspondingly, you can determine if you have any items that are losing money; knowing will help you take the right action in your business. Refresh your financials this fall with your favorite idea of these five, or come up with your own fall project to rejuvenate your business.

contribution margins by product or service line can help you see the areas that are adding the most income to your bottom line. Correspondingly, you can determine if you have any items that are losing money; knowing will help you take the right action in your business. Refresh your financials this fall with your favorite idea of these five, or come up with your own fall project to rejuvenate your business.

If you need cash fast, there’s nothing like having a sale to increase your bank account quickly. Here are ten excuses you can use to tell your customers you’re having a sale.

1. It’s Your Birthday (or Your Business’s Birthday)

We all feel generous on our birthday, so why not have a sale on your special day. You can even tie to discount amount to your day of birth. For example, if you were born on the 14th, then you can offer customers 14% off.

Similarly, you can hold an anniversary sale on your business’s anniversary date. It’s a good way to let customers know how long you’ve been in business.

2. Your Partner Is on Vacation

If you have a business partner, you can use the excuse, “When the cat’s away, the mice will play.” You can pretend that your partner knows nothing about the sale, but has left you in charge and you’re going to have this sale. The customers will enjoy the reason and feel like they are getting away with something fun.

3. Holidays

Most stores have holiday sales, and you can too. There are so many unusual holidays that you can tap into just in case the holidays are at an inconvenient time. Here’s a website that will give you a list of special days, weeks, and holidays: http://www.holidayinsights.com/moreholidays/

4. The Full Moon

Why not? It might be the best sale you’ve ever had. The next full moon is June 2, 2015, and July has a blue moon (when two full moons occur in one month) on July 31, 2015.

5. Small Business Saturday

November 28, 2015 is Small Business Saturday. It’s one day after Black Friday and the Saturday before Cyber Monday. Small Business Saturday is relatively new, but has been gaining momentum in the past few years.

6. Tax Holidays

In some states the sales tax authority provides exemptions for a few days on selected categories of items. For example, in August, Texas allows one weekend where sales tax does not have to be paid or collected on school supplies. You may not even have to mark down your items to generate a crowd for sales tax holidays. Unfortunately, this does not apply here in New Hampshire. For more information, here’s a Wikipedia page on it: http://en.wikipedia.org/wiki/Tax_holiday

7. Old Inventory Items or Overstock Condition

A great reason to have a sale is when you have old inventory items you need to clear out. Similarly, if you’re overstocked on certain items, a sale will help them move.

8. Your Kid’s College Tuition Is Due

You can have a lot of fun by advertising that you simply need to make your tuition payments. Customers will get a smile out of helping you out and relating to a familiar need.

9. The Stock Market

If the stock market goes up or down, you can have a sale based on its performance.

10. Seasonal Dates

Dates such as the first day of summer, Spring Equinox, or even April 15th, tax day (in the U.S.) can be potential sales days for your business. Think about seasonal dates related to your industry.

Try these ten ideas to get your sale noticed.

The Mount Washington Valley Economic Council will be hosting a three-part QuickBooks® Boot Camp series, led by Rhonda Rosand, CPA:

Session #1: Introduction to QuickBooks® Products – What’s Right for Me?

Tuesday, February 24, 2015 – 8:30 AM – 11:00 AM

Whether you are keeping the books for your own business or for others, you need to be using the right tools. We will cover a multitude of options under the Intuit umbrella.

- Desktop Pro and Premier

- Enterprise Solutions and Point of Sale

- Desktop Hosted and Online Solutions

- Payroll – Full Service, Basic, Enhanced, and Assisted

- Third Party Applications

Session #2: QuickBooks® Navigation Workflow and Basic Set Up

Tuesday, March 17, 2015 – 8:30 AM – 11:00 AM

Learn how to navigate your way around the Quickbooks Desktop and online versions, how to begin setting up your own company file and avoid some of the common pitfalls.

- Navigation and Workflow

- Common Pitfalls

- Basic Set Up

Session #3: QuickBooks® Reports and Customizing Forms and Templates

Tuesday, April 7, 2015 – 8:30 AM – 11:00 AM

Learn how to customize forms and templates and create Quickbooks reports that are useful management tools for your business. Understand the difference between profits and cash.

- Customize forms and templates

- Revenue Planning

- Quickbooks Reports

- Cash Flow Management

Courses are $35.00 and are held from 8:30am-11am at:

Many Retail stores sell inventory on consignment. It’s important to keep track and to know how much inventory you have in stock, who it belongs to and where it’s all located.

Let’s start our discussion of Accounting for Consignments in QuickBooks with a few basic definitions.

- Consignment – the act of consigning, which is placing any materials in the hands of another.

- Consigned Inventory – the goods shipped by the Consignor to the Consignee.

- Consignor – the owner of the inventory – the person who hands over the goods to be sold.

- Consignee – the seller of someone else’s goods – the person who receives the goods to sell.

There are two sides to the consignment equation – Consignor and Consignee. In this article, we will discuss the situation from the viewpoint of the Consignor. Note: We will also assume that you are using QuickBooks Premier and not Pro or Enterprise.

As the Consignor, you own the inventory – it’s your asset and your responsibility and if the product is damaged, it’s your loss. You are the party at risk and have an insurable asset. You’ve consigned it, or handed it over, to someone else who has agreed to sell it on your behalf in exchange for a pre-determined fee or percentage as well as reimbursable out-of-pocket expenses.

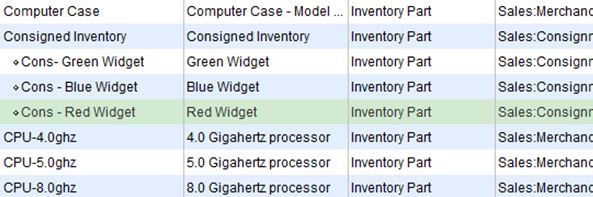

In QuickBooks, it’s as simple as creating a separate section in your Item List for Consigned Inventory and listing each Item as a Sub-Item with an identifier (Cons) that categorizes it as consigned. These are still Inventory Parts and are mapped to the same Cost of Goods Sold, Income and Inventory accounts as your other Inventory Items. Note: You may wish to create a separate Inventory Asset account for your Consigned Inventory, however this is optional.

To transfer the Items from your Regular Inventory to Consigned Inventory, it’s an Inventory Adjustment for Quantity only – the value of your inventory does not change, only the location of the Items for sale. Adjust Inventory/Quantity On Hand is located under the Vendor Menu.

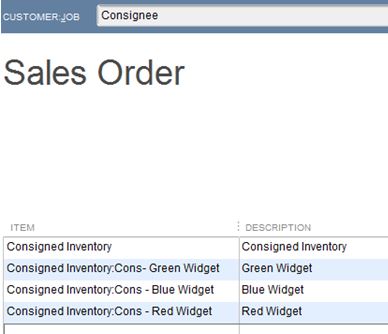

In addition to creating an Inventory Adjustment, you will need to create a Sales Order to the Consignee for the Consigned Inventory. Create Sales Order is located under the Customer Menu. This is a non-posting entry in QuickBooks and will show the Inventory as committed to the Consignee and not available for sale to others on an Inventory Stock Status Report.

As you receive reports of Sales of your Consigned Inventory from the Consignee, or better yet, as you conduct a physical inventory of your Consigned goods at the Retail location, you will create an Invoice in QuickBooks from the Sales Order to the Consignee to bill for your pre-determined percentage of the sale, less reimbursable expenses.

These are the steps to account for Consignments from the perspective of the Consignor.

There are many more steps involved in accounting for Consignments from the angle of the Consignee. We’ll cover these in a later edition of our newsletter – stay tuned.

As always, if you have any questions on any of the procedures for recording Consignments in QuickBooks, please contact us. We’re happy to help.

If you‘re new to QuickBooks Point of Sale, get ready to expand your vocabulary.

When you first start using QuickBooks, even if you’ve been doing manual accounting for your business, there’s a learning curve. You recognize some things, like check blanks and invoice forms, but you have to take on an unfamiliar workflow, deal with new words and phrases, and learn more about double-entry accounting concepts than you perhaps knew before.

The same is true as a novice QuickBooks Point of Sale user. Whether you’re opening your first retail location or you’ve been selling auto parts or craft supplies or bakery goods for a decade, there will undoubtedly be some new terminology for you to learn.

Here’s a sampling of some of this new lingo that comes with the territory. You may look at the definition of a word or phrase and still be confused, but that’s where we come in. Seasoned shopkeeper or first-time seller, you will likely need our help when you first start using this complex piece of software.

Here’s a sampling of some of this new lingo that comes with the territory. You may look at the definition of a word or phrase and still be confused, but that’s where we come in. Seasoned shopkeeper or first-time seller, you will likely need our help when you first start using this complex piece of software.

- Address Verification Service (AVS): In transactions where a credit or debit card is not physically present, AVS adds an extra layer of security

- Assembly: Multiple products pre-assembled in a unit

- Average Unit Cost: The average (not actual) cost of the items on hand in your inventory

- Chargeback: A credit card charge disputed by a customer

- Class: A categorization method used in creating reports; for example, run Profit and Loss reports by store

- Committed Quantities: The number of inventory items that have been included on active customer orders

- Financial Exchange: QuickBooks POS tool that helps you share data with QuickBooks

Figure 1: QuickBooks Point of Sale’s Financial Exchange establishes an ongoing connection to QuickBooks for data-sharing.

Figure 1: QuickBooks Point of Sale’s Financial Exchange establishes an ongoing connection to QuickBooks for data-sharing. - Merchant Service Center: An Intuit website dedicated to helping you manage your merchant account

- Non-Inventory Item: An item for which you do not keep track of on-hand quantities, like shipping or delivery fees

- Payout: Funds taken from the cash drawer for any of a number of reasons, like a bank deposit, office party, or to make a necessary purchase

- Physical Inventory (PI): The process of tallying the number of items physically present in inventory; used to correct quantities recorded in QuickBooks

- Price Level: Price charged for items that differs from the regular price; can define up to four additional reduced prices in QuickBooks POS (employee cost, promotions, etc.)

- Quick Add Item: Process by which you can quickly create a new inventory item while completing a transaction with a customer; doesn’t require as much immediate detail

-

Quick Find: Found on the QuickBooks POS Navigator; functions as a search tool for locating customers, items, receipts, etc.

Figure 2: You can enter a search word or phrase in the Quick Find box at the top of the Navigator page. - Quick Pick: A user-defined group of selected items that can be easily accessed during checkout

- Quick Zoom: Lets you “drill down”on a line or value within a report; can see the origin of the selected item

- Remote Store: Refers to every store other than Headquarters in a multi-store QuickBooks POS configuration

- Simple View: An abbreviated version of a sales receipt that may be viewed via touchscreens and virtual keyboards

- Split-Payment Sale: A transaction that is completed using two or more payment methods

- Store Exchange: Data shared between Headquarters and remote stores via:

- Desktop email

- Web-based email

- Removable media, or

- Network file exchange

- Transfer Slip: Documents transfer of merchandise between stores

- X-Out Shift Report: Available throughout the sales day, monitors recent sales activity

- Z-Out Drawer Count: End-of-shift or end-of-day cash drawer reconciliation

- Z-Out Store Close Report: End-of-day sales and cash flow summary; assists in readying a bank deposit

You can see that there are a lot of new terms to understand when you begin managing your retail transactions using QuickBooks Point of Sale. We can help further your knowledge by putting those words and phrases in context, so you can see where they fit in your workflow.

You can see that there are a lot of new terms to understand when you begin managing your retail transactions using QuickBooks Point of Sale. We can help further your knowledge by putting those words and phrases in context, so you can see where they fit in your workflow.

Have you ever stayed at a hotel and then returned, finding that they have stocked your room with everything you asked for the last time you were here? Your special allergenic pillow was already waiting for you, you were asked if you would like a dinner reservation made just like you always do the first night, and there were even extra hangars because you always need extra hangars. None of this would be possible for the hotel if it didn’t have a CRM,

Have you ever stayed at a hotel and then returned, finding that they have stocked your room with everything you asked for the last time you were here? Your special allergenic pillow was already waiting for you, you were asked if you would like a dinner reservation made just like you always do the first night, and there were even extra hangars because you always need extra hangars. None of this would be possible for the hotel if it didn’t have a CRM,  customer relationship management, system in place.

customer relationship management, system in place.

Would your clients be impressed if you remembered all of the details about your last conversation, their last purchase, or their preferences? If so, your business might benefit from a CRM system.

Businesses that have more than 30 or so clients may benefit from a system that allows you and your employees to enter detailed information about each client interaction that they have. It can work for both current and future clients, i.e., prospects. A CRM is basically a great big customer database at its core. It contains master file information on a customer or client, such as name, company, address, contact info, and custom fields. It is also transaction-driven in that you can log activity such as calls, meetings, proposal dates, and more.

Businesses that have more than 30 or so clients may benefit from a system that allows you and your employees to enter detailed information about each client interaction that they have. It can work for both current and future clients, i.e., prospects. A CRM is basically a great big customer database at its core. It contains master file information on a customer or client, such as name, company, address, contact info, and custom fields. It is also transaction-driven in that you can log activity such as calls, meetings, proposal dates, and more.

A good CRM system is also integrated with your other internal systems, such as your accounting or POS system or both. In some CRM systems, you can see invoice and payment history, so that when a client calls in, you can also peek to see whether they owe you money or what goods they ordered that they may be calling about.

A good CRM system is also integrated with your other internal systems, such as your accounting or POS system or both. In some CRM systems, you can see invoice and payment history, so that when a client calls in, you can also peek to see whether they owe you money or what goods they ordered that they may be calling about.

There are literally hundreds of CRM systems to choose from. The gold standard for large companies is SalesForce.com; however, some small businesses use it as well. SugarCRM is the largest open source CRM, meaning its programming code is available to the public. ZohoCRM is one of the largest small business CRMs and offers a suite of products for small businesses. And Act! is also very popular and plays well with social media.

Before choosing a CRM, decide what you want it to do and how you will be using it. One of the most important aspects of profiting from a CRM is to make sure it gets used, and that takes some habit-changing from you and your staff. Once you have your requirements, you can evaluate the software options available, and choose the one that works best for you.

When your clients start talking about how great your service is and how much attention you pay to the details they care about, you’ll know your CRM is paying off for you.

One of the side effects of our last economic slowdown was in state government budgets; states are estimating $25.8 Billion in uncollected sales tax and have made deep cuts to higher education to fill the budget gaps. New Hampshire has cut its higher education funding by 36.6% making it the 7th highest in the nation. Many states are finding additional revenue by cracking down on sales tax collections. Please don’t believe that just because you’re in New Hampshire that you’re exempt from sales tax.

|

The Hot Buzzword: Nexus.

|

|

Nexus means a connection, link or tie that a business has with a state, and it has to do with a form of presence. If you have presence, the state has jurisdiction to collect sales tax. In the sales tax world, you owe sales tax to a state if you have nexus in that state and you are selling taxable items. The scary part for small businesses is what makes up nexus. |

|

A Small World

|

Globalization and technology together have produced dramatic shifts in the way businesses can look today. Not only can we access a pool of local talent to staff and grow our businesses, we can employ almost anyone around the world to work for us. Hiring employees or contractors located in other states can stretch our nexus to include that state. Globalization and technology together have produced dramatic shifts in the way businesses can look today. Not only can we access a pool of local talent to staff and grow our businesses, we can employ almost anyone around the world to work for us. Hiring employees or contractors located in other states can stretch our nexus to include that state.

As an example, if your company is located in New Hampshire and you hire an employee who works from her home in Florida, you might have nexus in Florida and New Hampshire, and you might owe sales tax in Florida (you could owe in both states if New Hampshire had a sales tax). Sales tax nexus is not the same as state income tax nexus, but the presence of a worker in another state is a possible trigger for sales tax nexus. |

|

Taxable in One State, Not in Another

|

|

The taxability of services has grown rapidly as states look to balance their budgets after Federal cuts and other shortfalls. Not all services are taxed equally across states. For example, web design services are taxable in Texas, but not California. Accounting services are taxable in Hawaii and South Dakota.Some states have smaller jurisdictions such as counties and municipalities, making for over 11,000 jurisdictions in the U.S., not just 50. Alabama, Colorado and Arizona, for example, have statewide rules as well as taxability rules for localities within the states. |

|

NOMAD

|

|

There are only five (5) states that currently have no sales tax; New Hampshire, Oregon, Montana, Alaska and Delaware. Again, this does not mean that if you’re business is located in one of these states, that you will not have to pay sales tax. It just means that these states do not colllect a sales tax. There may be other taxes; e.g. Meals and Rentals taxes, etc. |

|

Innocuous Survey Can Trigger Audit

|

|

You might receive a form that looks like a survey and asks innocent-looking questions such as how many employees do you have and what state do they work in and where do they live. The surveys don’t look like they are from a state government but they might be. It’s their way of getting you to admit nexus. Please do not let just anyone fill these out; it could expose you to a huge liability. Hint: If you receive a nexus questionnaire, the requesting agency already suspects an issue. |

|

Minimizing Sales Tax Audit Risk

|

|

A sales tax audit could expose you to an average of 6% of customer revenues back seven to ten years plus up to 60% in penalties and interest. Because of the high dollar impact on the profitability of your business, it’s best to get a sales tax professional involved in helping you determine the taxability of your items as well as interpreting nexus. Many states are hiring auditors, sharing information and aggressively pursuing businesses, so due diligence in this area is prudent. |

| Sales Tax Tools Are Available |

|

|

|

Marketplace Fairness Act

|

|

If we can help in any way, please reach out and let us know. |

As an entrepreneur, you are responsible for shaping your business success. Any habits that sabotage your success in your personal life can often carry over to your business. Becoming aware of these is the first step to success. Here are seven success-boosting habits to double-check against your own.

|

1. Being Able to Say “No.”

|

|

You may need to re-evaluate the value of your time and your priorities. Practice making smart decisions by having a structure and a higher purpose that helps you decide what you should and shouldn’t do with your time, money, and life. And if you tend to be one of those who says “yes” to everything, you may need to practice saying “no” in front of the mirror to break your habit. |

|

2. Hiring Fast and Early

|

|

|

|

3. Strategizing Proactively

|

|

How much time do you spend in reactive mode versus proactive mode in your business? Reactive mode includes answering emails, fighting fires, serving clients, and managing employees. Proactive mode includes developing new products and services, creating and implementing your revenue plan, and training employees.

Sometimes we have to really push ourselves to look beyond the daily fires. One way to do that is to plan time every day for proactive activities and be ruthless about keeping that time slot on the calendar. |

|

4. Setting a Tight Scope and Polite Boundaries with Customers

|

|

Successful entrepreneurs set clear boundaries when it comes to delivering their products and services to customers. Especially in service companies, it’s not always clear to the client what’s included in a fixed fee contract unless it’s clearly spelled out. If you are asked to do something that’s not included in the contract, you now have a choice. Do you give it away for free, or do you have a change order process where you can easily provide an estimate for that extra work? |

|

5. Measuring Results

|

Only what can be measured can be improved, and smart entrepreneurs know this. Track — in real time, not a year later — what’s important to you. New customers, new leads, closed sales, revenue per day, sales per day, monthly net income, certain costs, profit margins, profit per customer, profit per job, and profit per location are just a few of the many metrics you can choose to track for your business. Only what can be measured can be improved, and smart entrepreneurs know this. Track — in real time, not a year later — what’s important to you. New customers, new leads, closed sales, revenue per day, sales per day, monthly net income, certain costs, profit margins, profit per customer, profit per job, and profit per location are just a few of the many metrics you can choose to track for your business.Once you measure it, you can now set goals to improve it. |

|

6. Curbing Irrational Spending

|

|

Invest in things that will last, such as your own education, great systems, team training, and assets that you really need. Avoid spending on items that are used up quickly, such as elaborate entertainment expenses that don’t generate significant revenue, excessive utilities, and stopgap equipment.

This area can be a tough one to evaluate objectively because there can be emotion and attachment involved in the spending. Let us know if you need help in this area; we can help you look at your spending with fresh eyes and provide a new perspective. |

|

7. Maintaining Focus

|

|

|

|

Seven Habits

|

|

Which of the seven habits are you best at? Celebrate your natural gifts while keeping an eye on the habits you need to work on. That will move you to the success you deserve. |

The two major ways entrepreneurs can take money from their business is through draws or by receiving a paycheck. The type of entity in which their business is set up will determine which method can be used. In either case, entrepreneurs need to be careful not to shortchange themselves.

The two major ways entrepreneurs can take money from their business is through draws or by receiving a paycheck. The type of entity in which their business is set up will determine which method can be used. In either case, entrepreneurs need to be careful not to shortchange themselves.

Especially if you’re running a service business, it’s easy to initially think you can do well with a similar hourly rate that you earned as an employee. Here’s a quick list of five elements that should be included in the compensation of every entrepreneur:

|

1. Competitive Pay

|

|

|

|

2. Profit

|

|

|

|

3. Benefits

|

|

Employees get vacations, health insurance, and bonuses; and you should too. This should be part of your compensation package as an entrepreneur. |

|

4. Taxes

|

|

|

|

5. Retirement Plan

|

|

|

|

Complete Compensation

|

|

Your compensation should include all of these components. If it doesn’t and you feel like you can’t afford to pay yourself that much, then your pricing might not be reflecting all of these items correctly, you might have a volume problem, or your business model may need some adjusting.

It’s normal to take a smaller paycheck the first few years as we’re building our businesses, but if you’re still doing it after several years or constantly having cash flow issues, then something may be wrong.

If you’d like our help in this area of your business, please reach out and let us know.

Make sure your future is bright and financially secure by including all five components in your entrepreneur compensation. |

Watching the cash balance is one of the most frequent activities of a small business owner. Besides making sure you have enough cash for payroll and bills, there is another huge opportunity you can benefit from: lowering the cost of processing your bills. It can be expensive and time-consuming to process bills and handle the paperwork involved. We’ll take a look at a couple of the many ways you can streamline your accounts payable processing costs in this article.

Watching the cash balance is one of the most frequent activities of a small business owner. Besides making sure you have enough cash for payroll and bills, there is another huge opportunity you can benefit from: lowering the cost of processing your bills. It can be expensive and time-consuming to process bills and handle the paperwork involved. We’ll take a look at a couple of the many ways you can streamline your accounts payable processing costs in this article.

|

Opportunity #1: Go Digital

|

|

The Intuit Payment Network (IPN) is a best-kept secret when it comes to sending and receiving money. It’s free to set up your account, and it’s also free for your receiver to set up an account. All you do is add your bank account, and you can easily transfer funds between the two accounts just by knowing the receiver’s email address.

Another way to go digital is via PayPal. Fees vary, and are usually paid by the receiver. |

|

Opportunity #2: Get Control

|

|

When it comes to finances, it’s never a good idea to mix business and personal, especially when it’s coming out of the same bank account. Keep separate accounts for business and personal, and your bookkeeping costs will go way down. Do the same thing for credit cards as well.

|

|

Opportunity #3: Automate

|

|

|

|

Opportunity #4: Verify

|

|

We hope you never pay bills that aren’t yours, but it can happen. To avoid it as much as possible, implement a three-way matching process on all your payables, especially those related to inventory. The three-way part refers to the three documents involved in accounts payable:

Before any invoice is paid, these three documents should be matched line by line – for quantity, price, and description — to ensure you ordered and received what you paid for. Only then should your bill be approved. This will ensure that you don’t pay a fraudulent bill, you don’t pay for out-of-stock that didn’t ship and that you paid the correct price you agreed to in the first place.

Please feel free to reach out and ask us about this if you’d like to know more. |

|

Opportunity #5: Tell Yourself a Little White Lie

|

|

Reduce all that by telling yourself a little white lie about your bank balance. If your bank balance is $10,000, tell yourself it’s only $5,000 (or whatever amount makes sense for you). That way, you’ll always have a cushion in your account that will help you reduce transfers. There are several ways to set this “little white lie” up in your books. |

|

More A/P Ideas

|

|

These are only five of many ways you can reduce your processing costs and save time on accounts payable processing. Give these five accounts payable ideas a try, and if you’d like to know more, please reach out and let us know. |

New Business Direction LLC

New Business Direction LLC

There are tools that integrate with QuickBooks and other small business software products, including online shopping carts. These tools will help you to calculate the taxes and file the required state sales tax forms.

There are tools that integrate with QuickBooks and other small business software products, including online shopping carts. These tools will help you to calculate the taxes and file the required state sales tax forms. The Marketplace Fairness Act, which is slated to tax internet sales for companies with revenues in excess of $1 million, even in New Hampshire, has passed the Senate and will be voted on in the House shortly. This will change everything.

The Marketplace Fairness Act, which is slated to tax internet sales for companies with revenues in excess of $1 million, even in New Hampshire, has passed the Senate and will be voted on in the House shortly. This will change everything. Do you say “yes” to too many things that don’t serve your life purpose, help your family, or move your business forward? If so, you’re not alone. Saying “yes” in a weak moment when you feel like you can do it all can be a downfall for many entrepreneurs. It can also distract you from success if you are not working on the right things for you.

Do you say “yes” to too many things that don’t serve your life purpose, help your family, or move your business forward? If so, you’re not alone. Saying “yes” in a weak moment when you feel like you can do it all can be a downfall for many entrepreneurs. It can also distract you from success if you are not working on the right things for you.  The best time to hire is just before you need your new team member. It can be easy to put off hiring if you fill with dread when you think about large stacks of resumes and endless phone calls. Not hiring soon enough can cost your business in reduced service and sales. The smartest entrepreneurs stay ahead of the game in this area.

The best time to hire is just before you need your new team member. It can be easy to put off hiring if you fill with dread when you think about large stacks of resumes and endless phone calls. Not hiring soon enough can cost your business in reduced service and sales. The smartest entrepreneurs stay ahead of the game in this area.

Great entrepreneurs have clear focus. If you have too many projects going on at once, you end up delaying all of your project completion dates, and nothing gets finished. Ask yourself, what’s the most important thing I can do today? And work on that until it’s done. Then ask yourself the same question again, and wash, rinse, repeat your way to success.

Great entrepreneurs have clear focus. If you have too many projects going on at once, you end up delaying all of your project completion dates, and nothing gets finished. Ask yourself, what’s the most important thing I can do today? And work on that until it’s done. Then ask yourself the same question again, and wash, rinse, repeat your way to success.  If you were doing the same work for a company that hired you, what would your pay be? Are you making at least market equivalent or better? A lot of times, as entrepreneurs, we tend to focus only on this piece of our compensation when we set our pricing, and that’s a big mistake. It’s only 75 percent of what our total pay needs to be.

If you were doing the same work for a company that hired you, what would your pay be? Are you making at least market equivalent or better? A lot of times, as entrepreneurs, we tend to focus only on this piece of our compensation when we set our pricing, and that’s a big mistake. It’s only 75 percent of what our total pay needs to be. As an entrepreneur, you take extra risk when you own your own company, and you should be compensated accordingly. Your capital is tied up in your business and should be earning a good return in addition to your reasonable compensation.

As an entrepreneur, you take extra risk when you own your own company, and you should be compensated accordingly. Your capital is tied up in your business and should be earning a good return in addition to your reasonable compensation.  Although our individual taxes are not deductible as business expenses, we need to compensate for them so that we’ll have enough cash for our living expenses. It’s a huge chunk too. We work about three and a half months every year, just to pay for our taxes.

Although our individual taxes are not deductible as business expenses, we need to compensate for them so that we’ll have enough cash for our living expenses. It’s a huge chunk too. We work about three and a half months every year, just to pay for our taxes.  When you work for yourself, no one is going to fund your retirement for you. Although the Social Security program helps a lot of seniors, it’s up to you to set additional money aside for a comfortable future.

When you work for yourself, no one is going to fund your retirement for you. Although the Social Security program helps a lot of seniors, it’s up to you to set additional money aside for a comfortable future.

There’s an old saying: “robbing Peter to pay Paul.” If you’re always moving money around from one checking account to another to cover bills and payroll, you’re not the only small business owner who juggles funds. It takes up valuable time to make all these transactions, and then it costs to record them and track them.

There’s an old saying: “robbing Peter to pay Paul.” If you’re always moving money around from one checking account to another to cover bills and payroll, you’re not the only small business owner who juggles funds. It takes up valuable time to make all these transactions, and then it costs to record them and track them.